Now what?

Now what?

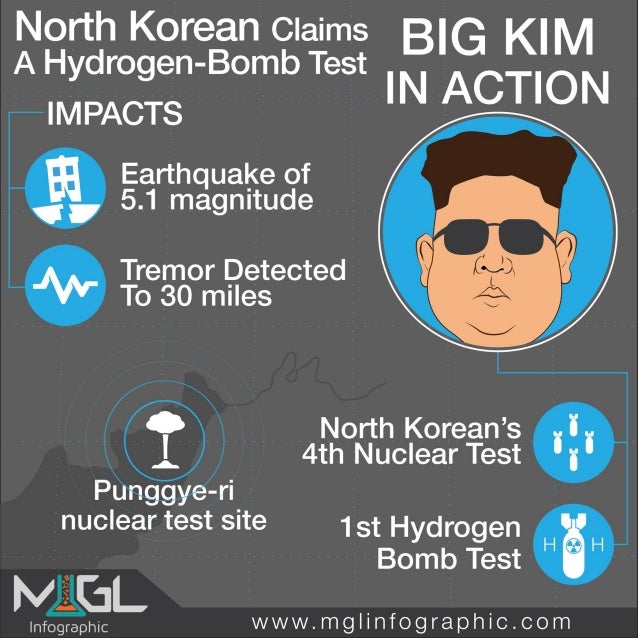

We made it through the Holiday that marks the end of the Summer of Trump (like the Summer of Love, but with a lot more Hate) and now we are stuck with the baby World we've made and it just spit up a hydrogen bomb. Daddy Trump promised "fire and fury the likes of which the World has never seen" if baby NoKo simply fired another missile, which they did over Japan last week but the weekend's HBomb was a move to a whole new level of telling Trump to F off.

Now Mr. Trump has to either put up or shut up but, of course, no one actually believes a word he says (including, obviously, Kim Jong Il), which makes him sort of totally ineffective as a figure of authority in this situation. That's the downside of constantly lying, I suppose, people don't believe you when it matters the most.

Of course, the President probably didn't read "The Boy Who Cried Wolf" as it's a book, with words and stuff – so how could he possibly know that losing all credibility might come back to bite him in the ass one day? After all the bluster about what he WOULD do if North Korea crossed the line they just leap-frogged over, all the Trump Administration has actually done as the Doomsday Clock ticks forward is to call for more sanctions – and China won't even let them do that!

Hopefully America won't come out of this looking like an impotent laughingstock in the World Community – not that we haven't already gone that way for the past 8 months… Of course, the damage Trump has inflicted on this country hasn't only been on the World stage – he's done a lot to destroy us domestically as well. The Guardian did a nice job this weekend of summarizing Trump's war on Labor, in honor of the holiday, and some of the highlights were:

As Donald Trump celebrates Labor Day by proposing to slash taxes for CEOs such as himself, it may come as a shock that a president who was previously best known for firing people on TV might not have been completely sincere in his promise to put “American workers first”.

A new report from the Institute for Policy Studies shows, the job growth rate for corporations that paid the least amount in taxes over the past eight years was negative 1%, compared to 6% for the private sector as a whole; businesses for the most part spent tax breaks not on job creation but on stock buybacks and executive pay.

It’s also beside the point whether Trump actually believes corporate tax cuts benefit workers. They benefit him, and the people he goes golfing with, and that’s all that matters. This is a president who embodies rent-seeking at its purest.

Consider the Department of Labor, an otherwise low-profile department targeted in Trump’s budget proposal for a 21% funding cut, the largest of any federal agency after the Environmental Protection Agency and State Department.

Under Puzder’s replacement, Alex Acosta, the Department of Labor has taken measures to ensure deadbeat employers will go unpunished. These include ending a policy holding businesses responsible for violations committed by subcontractors, rescinding disclosure requirements for law firms engaging in union busting, overturning rules to prevent companies from misclassifying employees as independent contractors (making them ineligible for overtime, unemployment insurance and workers compensation), and excluding many workers from overtime by lowering the disqualifying income threshold former president Barack Obama had raised from just over $23,000 to $47,000.

Nevertheless, under Trump, the Department of Labor has delayed rules protecting workers from lung disease caused by exposure to silica and beryllium, barred union representatives from certain health and safety inspections and, in a petty but symbolic move, erased a tally of deaths from workplace accidents from the Occupational Safety and Health Administration website.

It’s hard to imagine a more anti-worker agenda from any president, much less one claiming the mantle of champion of the American worker. Yet despite this record, Trump continues to show up at factories wearing a hardhat and taking credit for saving jobs that have already been shipped overseas.

That's right, Trump has, in just 8 months, undone 80 years of the rights American Workers have fought and even died for and it paves a very dangerous path for what's left of the middle class in this country. As our Top 1% Rich get much, much richer and the Middle Class becomes poorer, they are being hit with, aside from having their rights taken away, the lowest level of real wage compensation since the 1950s as real wages haven't come close to keeping up with inflation.

That's right, Trump has, in just 8 months, undone 80 years of the rights American Workers have fought and even died for and it paves a very dangerous path for what's left of the middle class in this country. As our Top 1% Rich get much, much richer and the Middle Class becomes poorer, they are being hit with, aside from having their rights taken away, the lowest level of real wage compensation since the 1950s as real wages haven't come close to keeping up with inflation.

In a study done by HowMuch.net, they plotted the federal minimum wage for every year since 1940 (the blue) and then adjusted for inflation to reflect how much purchasing power an hour’s work would be worth today (the green on the chart below). For example, workers earned $0.40 per hour in 1945, which doesn’t seem like much, but it gave you the ability to purchase the equivalent of $5.90 worth of stuff in 2017 dollars.

If you think about the minimum wage in terms of purchasing power, you can see how an hour’s labor was worth more in the 1960s. Low-wage workers could do the most with their paychecks in 1968, when they earned more than $10/hour in 2017 dollars. Congress passed a few adjustments in the 1990s and 2000s, but the wage is back to the same level it was in the 1980s.

This is why you hear so many idiots who are my around my age (54) spouting off that minimum wage is enough to live on – it actually was when we were working in the 70s. Since then, however, things have gotten considerably worse – 35% worse, in fact, yet most people don't understand the difference and, sadly, those people are in Congress, as well as in state-level Government and they bow to business interests who will do anything to keep wages as low as possible for as long as possible.

That's why there is such a dichotomy between the stock market, which reflects the sentiment of the Top 10% and the economy, which reflects the actual commerce of the bottom 90%. Even the economy is distorted because, with the Top 10% doing so well – their spending and their wages boost the averages and make it SEEM like the whole economy is broadly recovering but there is PLENTY of data that indicates that's not the case – including last week's radically adjusted Non-Farm Payroll Report.

That's why there is such a dichotomy between the stock market, which reflects the sentiment of the Top 10% and the economy, which reflects the actual commerce of the bottom 90%. Even the economy is distorted because, with the Top 10% doing so well – their spending and their wages boost the averages and make it SEEM like the whole economy is broadly recovering but there is PLENTY of data that indicates that's not the case – including last week's radically adjusted Non-Farm Payroll Report.

When America was "great" – our labor laws were strong and our mimimum wage was the highest in the World and new factories opened in our country every day. What this Administration is doing has nothing at all to do with making America Great Again – it's just dismantling all the things that made us great and whether it's a Russian plot or simply the greed of our local Oligarchs, who managed to put one of their own in power – the results are the same for the American workers and the Middle Class.

Contrary to Republican opinion, the destruction of the Middle Class is not good for America or even the stock market and Barron's this weekend has come to agree with us, stating:

MOVES THAT VERY RECENTLY might have been written off as a run-of-the mill market pause now raise questions about this bull’s durability. After all, the S&P 500 is up 265% since bottoming on March 9, 2009. Stock valuations have surged to extremes rarely seen except at market peaks. And expectations for market-friendly legislation seem to be as up in the air as ever.

Two conditions now exist that could increase the chances of a sharp selloff. The first is valuation. The S&P 500 is trading at 17.7 times 12-month forward estimated earnings, near the highest price/earnings ratio since the dot-com boom. As a short-term measure, such high valuations have almost no predictive value. But bear markets almost never begin when stocks are cheap.

At the same time, the Federal Reserve is normalizing interest rates. That, on its own, won’t precipitate a bear market, but it could be a catalyst for one if the central bank hikes too much, too fast. The interest-rate backdrop, combined with high valuations, suggests the risk to the bull market is higher now than at any time in the past eight years. “The two most important pieces are there,” says Antti Ilmanen, manager of the portfolio-solutions group at AQR Capital Management. He stresses, though, that neither means a bear market is imminent.

September is a month that will be fraught with peril, including:

- 8 Central Banks making rate decisions – most leaning towards a tightening

- The Debt Ceiling – Sept 29th is the deadline, so the debate could drag on all month

- A summit of BRIC leaders hosted by China just ended — days after tensions between the world’s second-largest economy and India caused a standoff in the Himalayas

- The Trump team will continue to renegotiate NAFTA

- Germany is having an election on the 24th – watch out for more populism/nationalism

- Noway has elections Sept 11th – watch out for more populism/nationalism

- New Zealand has electionss Sept 23rd – watch out for more populism/nationalism

- Brexit talks are scheduled to continue

- Initial jobless claims will give the earliest indication of Hurricane Harvey’s potential economic toll. Judging by past storms, the peak effect will occur three weeks after the disaster, according to economists at Morgan Stanley.

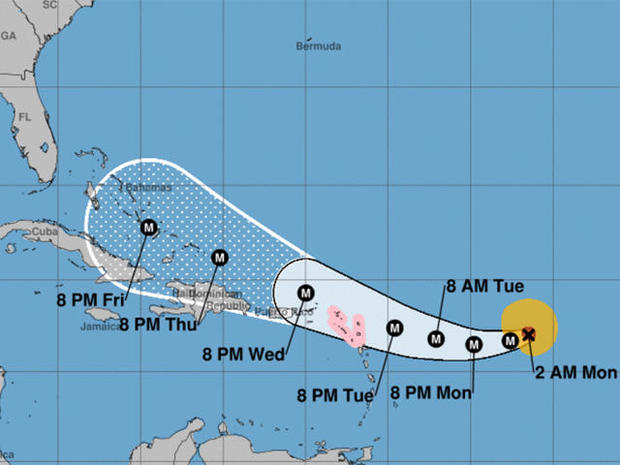

- A much worse hurricane is barreling down on us as we speak with more to possibly follow.

- @realDonaldTrump will surely tweet

.jpg) So let's be extra careful out there this month. We have our hedges in place and we'll keep our eyes open for short-term opportunities. Last Friday, we took full advantage of the Dow's pop to double down at the highs (during our Live Member Chat session) and yesterday we took full advantage of what turned into a nice $4,370 gain (up $437 per contract) as the Dow came back down and tested 21,900.

So let's be extra careful out there this month. We have our hedges in place and we'll keep our eyes open for short-term opportunities. Last Friday, we took full advantage of the Dow's pop to double down at the highs (during our Live Member Chat session) and yesterday we took full advantage of what turned into a nice $4,370 gain (up $437 per contract) as the Dow came back down and tested 21,900.

That bought our total gains in Futures trading to well over $20,000 last week (you're welcome!) and no, we don't expect to do that well every week – the hurricane and the holiday weekend conspired to make for some very obvious trading patterns we were able to take advantage of. The trick is not to force these trades – when there's a good set-up, we take it but, if not – best to just stand pat and wait for events to unfold.

Our favorite short at the moment is oil (/CL) below the $48.50 line with very tight stops above. We also like the Russell (/TF) below the 1,415 line – tight stops too.