Can we ignore more terrorism today?

Can we ignore more terrorism today?

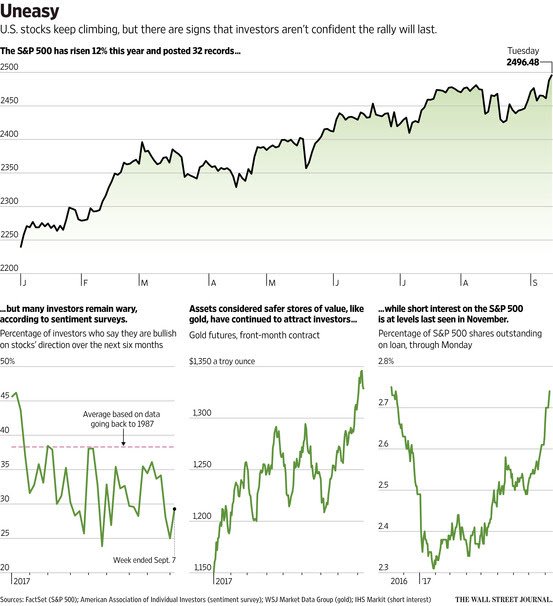

I don't see why not, "only" 22 people were injured this morning as a bomb went off on a London Subway and that's nothing to the relief Japan must have felt when the missile North Korea fired over their heads turned out NOT to have a nuclear warhead – isn't that great? Frankly, I don't know what it would take to spook this market anymore – it seems to only head up – no matter what happens. Our President, of course, handled the incident in London with his usual compassion:

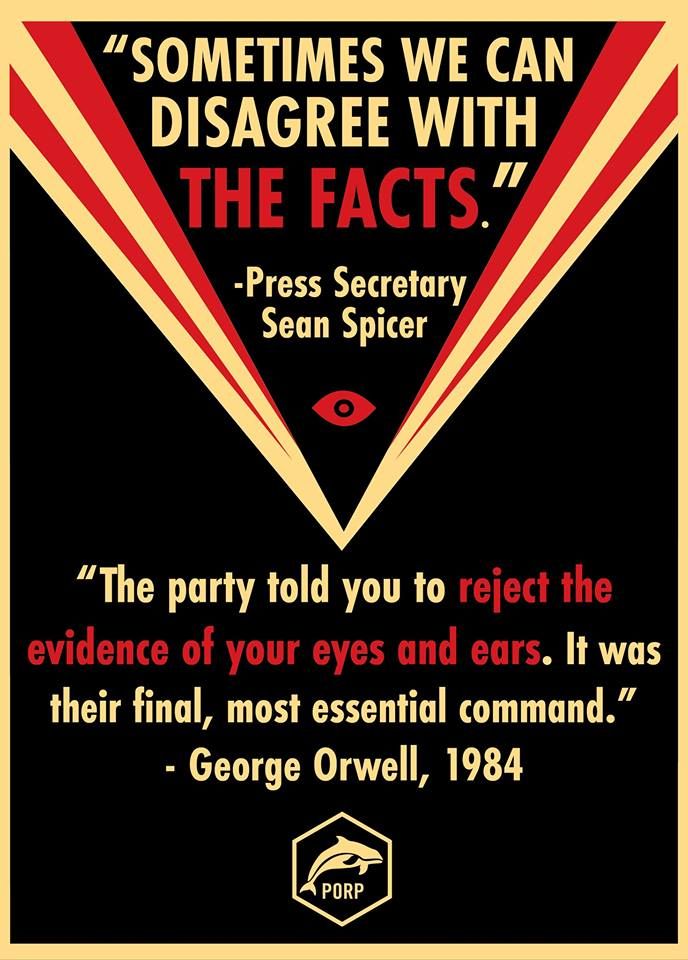

Loser terrorists must be dealt with in a much tougher manner.The internet is their main recruitment tool which we must cut off & use better!

And, of course, the UK's own right-wing leader also sent out a tweet:

Thoughts with those injured in Parsons Green terrorist incident, and thanks to police, ambulance staff and firefighters who are responding.

Wow, this guy just doesn't get how to be Presidential, does he? If he becomes Prime Minisister, what's he going to do in a time of crisis – HELP people? What an idiot! He should be blaming and grandstanding and using the incident as an excuse to call for Big Brother-like censorship.

Wow, this guy just doesn't get how to be Presidential, does he? If he becomes Prime Minisister, what's he going to do in a time of crisis – HELP people? What an idiot! He should be blaming and grandstanding and using the incident as an excuse to call for Big Brother-like censorship.

I mean, come on, Terrorists are people, people use the Internet, therefore – the Internet is the problem! We've got to look into this air and water thing too – I hear the Terrorist have been breathing and drinking and we're going to have to put tight controls on both. Wait, this just in, they were talking too! Who's in charge of talking? If we take away the bad words, then they can't be terrorists!

"Newspeak is the official language of Trumpmerica, scheduled for official adoption around 2030, and designed to make the ideological premises of Conservatism the only expressible doctrine. Newspeak is engineered to remove even the possibility of rebellious thoughts—the words by which such thoughts might be articulated have been eliminated from the language. Newspeak contains no negative terms. For example, the only way to express the meaning of “bad” is through the word “ungood.” Something extremely bad is called “doubleplus ungood.”

"The particularities of Newspeak make it impossible to translate most older English (oldspeak) texts into the language; the introduction of the Declaration of Independence, for instance, can be translated only into a single word: crimethink."

That is adopted from Orwell's 1984 with, sadly, little need for changes. In fact, NewSpeak is already being test-run on Fox News and a large portion of America is already engaged in NewThink. Just try talking to a Conservative about a women's right to choose, Universal Health Care or Global Warming and you'll see what I mean – there simply isn't room in their thoughts or volcabulary for contrary ideas and the funny part is – they don't even realize it!

And when memory failed and written records were falsified—when that happened, the claim of the Party to have improved the conditions of human life had got to be accepted, because there did not exist, and never again could exist, any standard against which it could be tested.

This quote from Orwell's Book One, Chapter VIII, emphasizes how one’s understanding of the past affects one’s attitude about the present. Winston has just had a frustrating conversation with an old man about life before the Revolution, and he realizes that the Party has deliberately set out to weaken people’s memories in order to render them unable to challenge what the Party claims about the present.

This quote from Orwell's Book One, Chapter VIII, emphasizes how one’s understanding of the past affects one’s attitude about the present. Winston has just had a frustrating conversation with an old man about life before the Revolution, and he realizes that the Party has deliberately set out to weaken people’s memories in order to render them unable to challenge what the Party claims about the present.

If no one remembers life before the Revolution, then no one can say that the Party has failed mankind by forcing people to live in conditions of poverty, filth, ignorance, and hunger. Rather, the Party uses rewritten history books and falsified records to prove its good deeds. In other words, the "alternate facts" are ultimately accepted.

1984 was not supposed to be an instruction manual, folks – we shouldn't be able to draw ANY comparisons between the way our country is now and the World Orwell was trying to warn us about, let alone having to try hard to spot the few differences that remain…

This morning, the markets are getting a nice Friday bump from the Dollar dropping 0.5%, back to 91.50, where we do like it long again but it did go lower than that (/DX), so be careful playing this volatile currency. Despite the Dollar down 0.5%, oil is only up 0.25% at $50.05 and we love oil short below $50 with tight stops above or at $50.50 we grabbed it yesterday and caught a nice run back to $49.50 overnight but still, on the whole, we're down $500 per contract for the week – as we started shorting oil too early.

We also shorted the Russell Futures too early and the trade from our Live Trading Webinar on Thursday is now 10 Russell (/TF) shorts at an average entry of 1,421.38 and it's down $940 at the moment (1,424) but we have faith there will be a sell-off – one day.

Maybe today as August Retail Sales were down 0.2% vs up 0.4% predicted by leading Economorons. That's only off by 150% so pretty good compared to most of their predictions and how can that possibly be bullish for oil since the whole rally is based on the IEA's BS projections of US demand growing 5%? Well, we'll see what happens but I'm loving my oil shorts – espcecially as there is still a clusterf*ck of open contracts at the NYMEX:

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Oct'17 | 49.72 | 50.11 | 49.41 | 49.99 |

07:48 Sep 15 |

– |

0.10 | 112712 | 49.89 | 169159 | Call Put |

| Nov'17 | 50.19 | 50.58 | 49.88 | 50.47 |

07:48 Sep 15 |

– |

0.12 | 88294 | 50.35 | 531653 | Call Put |

| Dec'17 | 50.51 | 50.91 | 50.21 | 50.81 |

07:48 Sep 15 |

– |

0.15 | 18024 | 50.66 | 348752 | Call Put |

| Jan'18 | 50.76 | 51.13 | 50.47 | 51.05 |

07:48 Sep 15 |

– |

0.16 | 5823 | 50.89 | 204715 | Call Put |

| Feb'18 | 50.93 | 51.28 | 50.69 | 51.23 |

07:48 Sep 15 |

– |

0.17 | 2576 | 51.06 | 83223 | Call Put |

| Mar'18 | 51.10 | 51.39 | 50.78 | 51.30 |

07:48 Sep 15 |

– |

0.13 | 4471 | 51.17 | 165056 | Call Put |

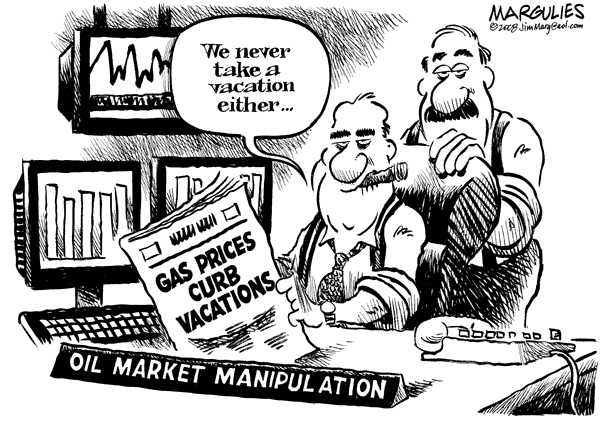

We showed you this chart in our Wednesday morning PSW Report and, at the time, there were 300,216 open Oct contracts, 417,234 in Nov, 337,816 in Dec and 195,537 in Jan for a total of 1,250,803 or 1.25 BILLION barrels worth of fake, Fake, FAKE!!! orders. At the time I told you:

Over at the NYMEX, there are 308Mb worth of fake, Fake, FAKE!!! orders for October delivery and they all have to be rolled to longer FAKE!!! orders by next Wednesday so that's just 6 trading days to move 308,000 open contract but there are already 419,000 FAKE!!! open orders for November delivery and another 339,000 stuffed into Dec and even January has 195,000 open contracts already and that's a whopping 1.26 BILLION barrels worth of order slated for delivery to Cushing, OK – a facility that can only handle 50Mb/month. Aside from that, consider that the US only imports a net of 5.5Mb/day so, even with 120 days to play with – that would only be 660Mb for the ENTIRE country – that's what I mean when I call those orders FAKE!!!

Yes, I was wrong about the total because I rounded but I wasn't wrong about the rest as today the total for the same 4 months is 1,254,279 so, in REALITY, not ONE SINGLE BARREL was actually sold – they were just shuffeled along to the forward months in order to pretend there is demand there – all in an effort to jack up the prices you suckers pay at the pumps. And Congress does NOTHING about it!

Yes, I was wrong about the total because I rounded but I wasn't wrong about the rest as today the total for the same 4 months is 1,254,279 so, in REALITY, not ONE SINGLE BARREL was actually sold – they were just shuffeled along to the forward months in order to pretend there is demand there – all in an effort to jack up the prices you suckers pay at the pumps. And Congress does NOTHING about it!

As citizens in a TrumpThink economy, the best we can do is make money off the manipulation and, while they have moved 131,057 contracts in two days, they only have until next Wednesday to move the rest and, don't forget, they had pulled all the stops out on Wednesday with the OPEC announcement and the IEA report and that took them from $48 Tuesday to $50.50 yesterday but only briefly as the 5% line at $50.40 was the non-spike failure and, according to our fantastic 5% Rule™, the $2.40 run gets an 0.48 weak pullback to $49.92 and a strong 0.96 pullback to $49.44 but oil gravitates to the 0.50 line, so we'll use $50 and $49.50, which is what we've been testing. A failure at $49.50 can take us very quickly back to $48 and that's why we love the short here at $50 on /CL (with tight stops above).

A good, bearish pattern would be for us to see that weak retrace ($50) fail and then a less than 0.20 bounce off $49.50, which would be an excellent sign we're consolidating for a good move down. If you short all 169,159 remaining contracts at $50, at $48 you can make $338,318,000 and, if you stop out at $50.05, you risk just $8,457,950 so that's my trade of the week for people who can afford to lose $8.5M!

Enjoy your weekend,

– Phil