Yes, I know no one cares, BUT:

Yes, I know no one cares, BUT:

On CNN yesterday, UN Ambassador Nikki Haley said the United Nations Security Council has just about reached the limit of its ability to economically punish North Korea. Responding to a question by CNN’s Dana Bash about whether President Donald Trump’s famous “fire and fury” remark was an empty threat, Haley insisted that the US has held back out of a sense of “responsibility.” But now that diplomatic solutions appear to be dwindling, she would be “perfectly happy” handing the situation off to Defense Secretary James Mattis, the source of some of the US’s harshest rhetoric against North Korea. Mattis, Haley said, would “take care of it.”

“What we’re doing is being responsible where North Korea is being irresponsible and reckless. We were being responsible by trying to use every diplomatic possibility that we could possibly do. We’ve pretty much exhausted all the things that we could do at the Security Council at this point.”

“I said yesterday I’m perfectly happy kicking this over to General Mattis because he has plenty of military options. So, I think that the fire and fury – while he said this is what we can do to North Korea – we want to be responsible and go through all diplomatic means to get their attention first. If that doesn’t work, General Mattis will take care of it.”

Former chief strategist Steve Bannon, has admitted that the White House doesn’t have a viable military strategy for North Korea where “ten million people in Seoul don’t die in the first 30 minutes from conventional weapons.” Wow – so happy Monday to you and Jimmy Crack Corn 'cause the markets don't care – hovering at their all-time highs this morning and even up a bit in the Futures at Dow 22,300 (we're short /YM), S&P 2,503, Nasdaq (100) 6,004 and Russell 1,435 (we're short /TF).

Oil, amazingly was still at $50 this morning and we're still shorting that too (/CL) – so lots to do on a Monday, even though the action on the first day of the week is usually low-volume BS. We could see a lot of action as Trump speaks to the UN this afternoon. After denouncing the organization throughout his campaign, he now has to get them to work with the US to contain North Korea.

Oil, amazingly was still at $50 this morning and we're still shorting that too (/CL) – so lots to do on a Monday, even though the action on the first day of the week is usually low-volume BS. We could see a lot of action as Trump speaks to the UN this afternoon. After denouncing the organization throughout his campaign, he now has to get them to work with the US to contain North Korea.

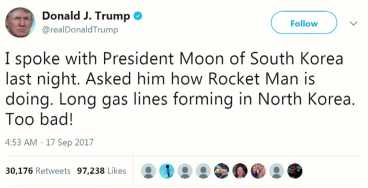

Trump's tweet early Sunday morning was considered so juvenile ahead of the UN Assembly (North Korea will be there too) that his advisors have removed it, but it's a bit late, as you can't get things really "off" the Internet and it was up all day yesterday. China, in fact, has REFUSED to cut oil exports off to North Korea, saying instead it was American leaders who needed to tone down their rhetoric and come to the negotiating table. China's ambassador said they will implement all United Nations Security Council resolutions, “no more, no less.”

So it is 100% up to President Donald Trumps diplomatic skill to avert a war that can quickly escalate to involve South Korea, China and Japan – in the very least. May God have mercy on our souls!

Speaking of mercy and the number 3, there are three more storms forming in the Atlantic with Hurricane Maria forcast to rapidly strenghten and follow the same awful path as Irma. Thank goodness Global Warming is a myth of we might have to do something about these storms.

Speaking of mercy and the number 3, there are three more storms forming in the Atlantic with Hurricane Maria forcast to rapidly strenghten and follow the same awful path as Irma. Thank goodness Global Warming is a myth of we might have to do something about these storms.

In fact, since the US abidicated it's leadership in Climate Control, the rest of the World is moving on without us and the EU is teaming up with China to pass rules, which will lead to US getting sanctioned and boycotted if we continue to recklessly pollute the planet.

Oil (/CL) is already back to $49.50 so we'll take that $500 per contract profit and we'll wait for the bounce and reload our shorts either back below the $49.50 line or at the $50 line – either way with tight stops. As I demonstrated in last week's Live Trading Webinar, we can keep our losses very low (risk) against a fairly high reward by simply combining good stop lines with disciplined position management techniques.

As of Friday's NYMEX close, there were still 132,600 fake, Fake, FAKE!!! open orders and those all have to be sold or rolled by Wednesday. Last Wednesday there were 308,000 fake orders and, if the sudden disappearance of more than half of them hasn't convinced you this whole thing is a scam – just watch it for 2 more days and watch the rest of the US's oil disappear to create an artificial shortage.

That's right, if the CRIMINAL traders at the NYMEX didn't cancel their LEGAL, BINDING CONTRACTS for delivery of 308M barrels of oil (1,000 per contract) to the US in October – there wouldn't be a shortage anywhere as we'd be swimming in oil and prices would come down and everyone would be happy. Everyone but their bosses – who pay them to create artificial shortages and jack up the price of oil and gasoline for consumers (See: "Goldman's $2.5 Trillion Global Oil Scam Discovered").

That's right, if the CRIMINAL traders at the NYMEX didn't cancel their LEGAL, BINDING CONTRACTS for delivery of 308M barrels of oil (1,000 per contract) to the US in October – there wouldn't be a shortage anywhere as we'd be swimming in oil and prices would come down and everyone would be happy. Everyone but their bosses – who pay them to create artificial shortages and jack up the price of oil and gasoline for consumers (See: "Goldman's $2.5 Trillion Global Oil Scam Discovered").

That's why we were able to make $500 per contract in just over an hour this morning, they make BILLIONS manipulating the price and we're able to pick up millions on our contrary trades. Speaking of Millions – if you followed my Friday Trade Idea to short all 169,159 remaining contracts at $50 – you would now be up 0.50 per barrel, which is up $84,579,500. That's pretty good for a Monday – you're welcome!

Since there are stil 132,000 contracts left, we can see they canceled 37,000 on Friday but now it's crunch time and they have to get rid of at least 40,000 per day, which is going to be very hard to do into expiration so I'm projecting $48.50, which would gain us another $169,159,000 if we held all those contracts through to the bitter end. But we don't do that, we take our quick profits, get out and wait for the next good set-up (see above).

Still, our Trade Idea of the Week for our Institutional Traders is shorting those 132,000 contracts below the $49.50 line with a target of $48.50 and $132,000,000 in profits by Wednesday. And don't complain just because you aren't an institution with $500M in margin to play with – last Monday, in our PSW Morning Report, we also said we liked Natural Gas (/NGZ7) long on the December contracts at $3.07 and those are now $3.32 – up 0.25 at $100 per penny, per contract for $2,500 gains in a week. Margins on those contracts are just $1,870 each!

Still, our Trade Idea of the Week for our Institutional Traders is shorting those 132,000 contracts below the $49.50 line with a target of $48.50 and $132,000,000 in profits by Wednesday. And don't complain just because you aren't an institution with $500M in margin to play with – last Monday, in our PSW Morning Report, we also said we liked Natural Gas (/NGZ7) long on the December contracts at $3.07 and those are now $3.32 – up 0.25 at $100 per penny, per contract for $2,500 gains in a week. Margins on those contracts are just $1,870 each!

Remember, I can only tell you what is likely to happen and how to profit from it – the rest is up to you!

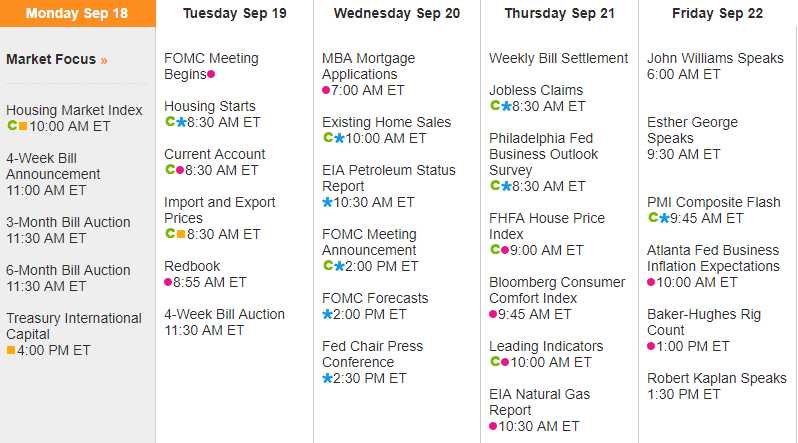

I'm sorry that we're still bearish but that's what the data tells us to be and we are Fundamental Traders so we don't play sentiment (except in that it's a fundamental factor) but we do play the economy and, very quietly, ahead of the Fed meeting on Wednesday (2pm), the Atlanta Fed has taken down their Q3 GDP forecats by just under 50%. That's right – remember when I told you there was no F'ing way we'd hit 3.5%, let alone 4% – well, now it's 2.2% and falling:

We already adjusted our portfolios and added to our hedges last week and, as noted above, we're shorting oil and the index futures too so we'll see how long it takes the market to catch on to the concept that, if the GDP growth has been revised down 50% since Aug 1st – maybe the market shouldn't be higher than it was on Aug 1st? Just a thought….