It's been very exciting.

Back on the 13th, I titled the morning Report: "Which Way Wednesday – S&P 2,500 or Bust!" and we've been teasing the line in the subsequent two weeks but now failing again as oil prices rise ($52 this morning, which is our new shorting line!) and Global tensions mount. Meanwhille, on the home front, the Republican agenda is failing in a most spectacular fashion as repealing Obamacare simply isn't going to happen (thank God!) and now they are far over-reaching on Tax Cuts, with a plan that will add Trillions of Dollars to the National Debt with no offsetting spending cuts – all just to benefit the Top 1% – it's not going to fly either.

The markets are still wildly underpricing the overhanging threat of war in North Korea. We are, in fact, still at war with North Korea – having never signed a peace treaty since that war started in 1950. Meanwhile, back in the middle east, Turkey's President and Trump Thunder Buddy, Erdogan has threatened to invade the Kurdish region of Iraq as he is enraged by their vote for independence (Turkey also has a larget Kurdish region so he considers it a bad example).

Key to this conflict is a major oil pipleline that runs from Kurdish Iraq through Turkey which Edrogan threatens to cut off (hence the jump in oil) as well as warning: "“Our military is not (at the border) for nothing. We could arrive suddenly one night." We need to take Edrogan seriously – this is the guy who had his security detail beat the crap out of protesters in Washington DC and again in New York – even after he was told what they did in DC was not acceptable.

Key to this conflict is a major oil pipleline that runs from Kurdish Iraq through Turkey which Edrogan threatens to cut off (hence the jump in oil) as well as warning: "“Our military is not (at the border) for nothing. We could arrive suddenly one night." We need to take Edrogan seriously – this is the guy who had his security detail beat the crap out of protesters in Washington DC and again in New York – even after he was told what they did in DC was not acceptable.

Janet Yellen will speak this afternoon at 12:45 and MIGHT seek to clarify Fed policy moving forward but is more likely to remain enigmatic – since that seems to be working. As I noted yesterday, we have a dozen Fed speakers this week and, last night Neel Kashkari came out on the dove side, saying he thought it was far too soon to raise rates. Nonetheless, the markets have flattened out in pre-market trading so far as we wait for Evans (very doveish) and Mester (neutral) to spreak at 9:30.

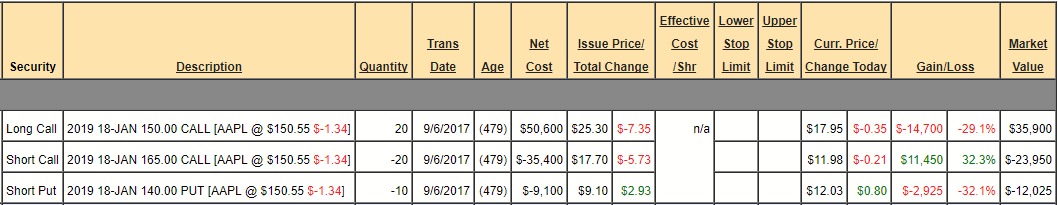

Apple (AAPL) tested the $150 line yesterday and that's 10% off the highs so, in the very least, we expect weak bounce back to $153 or a strong bounce to $156 according to our 5% Rule™. A 10% correction is exactly what I predicted on 9/6, when I was interviewed on Money Talk, so now is a great time to sell those 10 2019 $140 puts ($12) and to buy the 20 2019 $150 calls ($18) against the short 20 $165 calls ($12) for a net cost of $0 on the $30,000 spread. That's a better deal than we got back on the 6th – but I did say it would be better to wait!

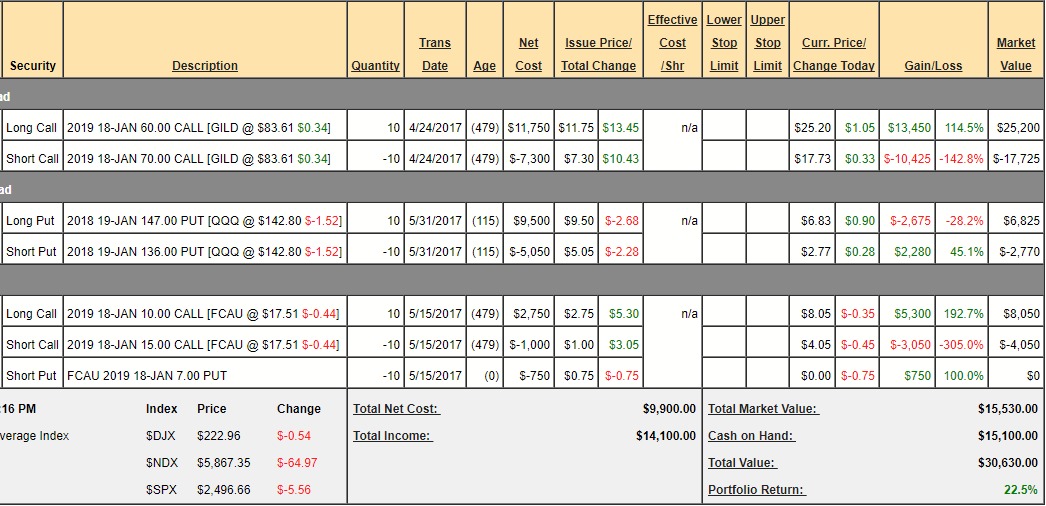

Despite the $6,175 current loss, the rest of the Money Talk Portfolio is up $11,612.50 so our net gain in less than a month is $5,437, which is 10% of the $50K portfolio. I'll be on TV this morning, live at the Nasdaq and that portfolio is up $22.5%, after starting with just $25,000 in April. You've got to love this market, it's just a money-printing machine.

Notice we have a hedge in the Nasdaq Portfolio and, so far, it's only a small loss – even though we took the insurance way back in late May. That means the Nasdaq hasn't gotten any stronger since that time – despite how you may FEEL it's doing. That should be a good enough warning sign to be very careful as the Nasdaq continues to struggle to get over the 6,000 line on the 100 Index (/NQ).

In our main portfolios, we've been using the Nasdaq Ultra-Short (SQQQ) as a primary hedge and recent weakness in the market-leaing "FAANG" stocks should be a concern to traders who are banking on the market continuing the 20% run we've had since November. I wish I were a believer but I'm too much of a Fundamentalist and the Fundamentals are telling us to stick to CASH!!! at the moment and our main portfolios are roughy 75% cash (but very leveraged in our upside plays).

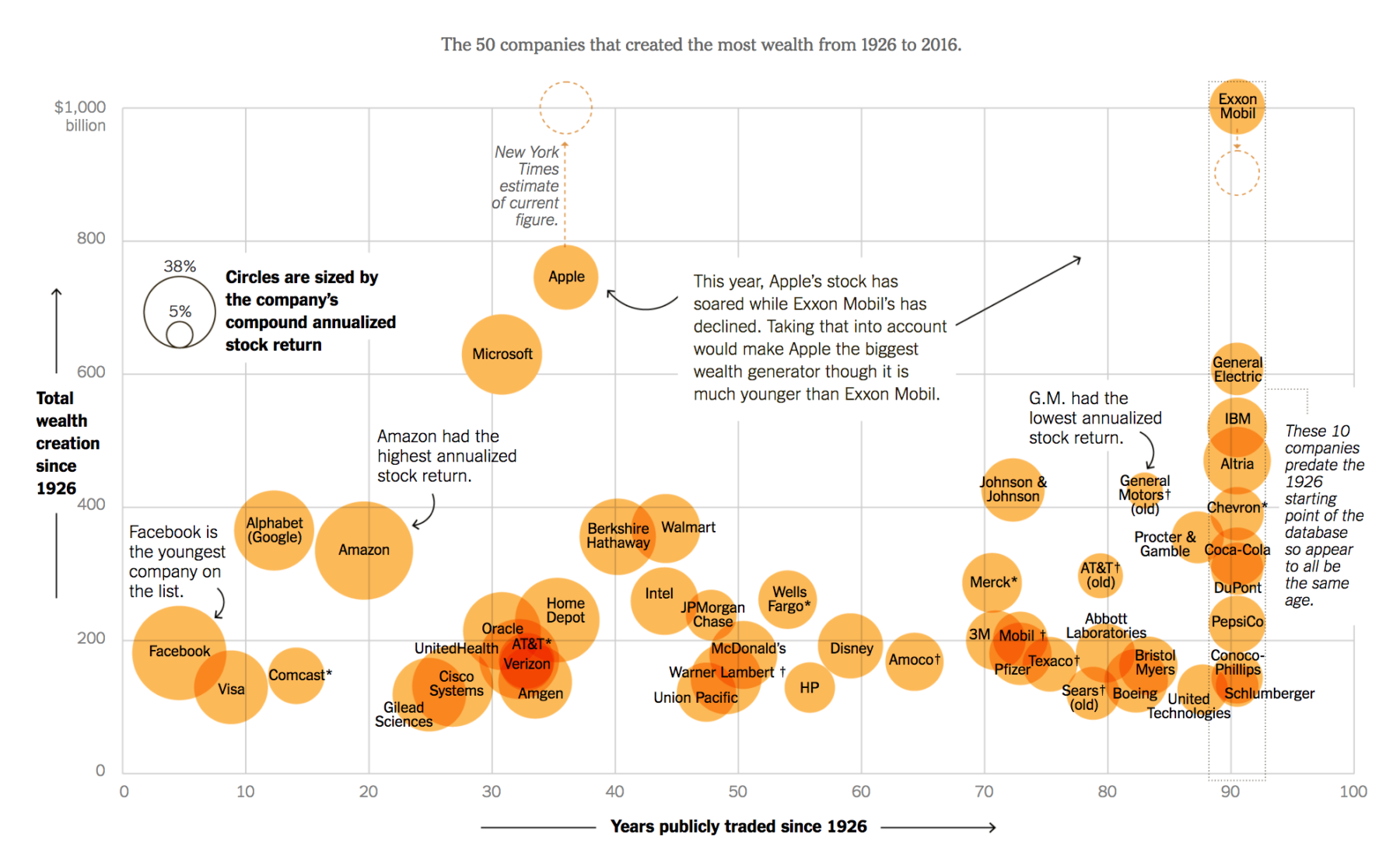

As you can see from this chart, the gains of the past 100 years have mostly come from 50 companies which make up the bulk of our portfolios – nice, steady blue-chip companies that build wealth for their shareholders with great consistency. Through good times and bad, these are the kind of stocks we look to buy whenever they go on sale.