No more death tax!

No more death tax!

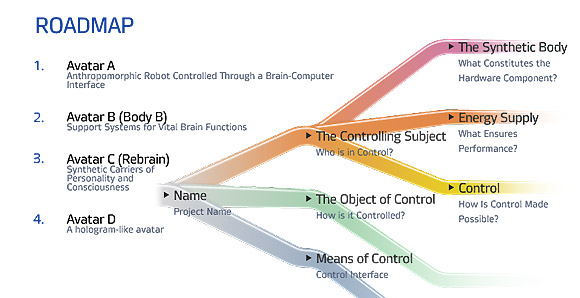

Very nice if you are rich enough to have it affect you (estates over $10M with poor tax planning) and it's very important to the GOP's Top 1% donors, who plan on living on through their clones and need to leave all their money to themselves. Think how annoying it would be if, every 60 years, when you are having you mind transferred to a new clone, you had to pay a tax to transfer your money. Of course the "death tax" needs to be elimintated but of course you can't tell your bible-thumping base the real reason or they might decide you are a Godless heritic.

We are supposedly 5 years away from Avatar B, where your brain can be transferred from your body and the goal is put you into a machine or a clone over the next few decades. Well, not you, unless you are one of the ones with millions of Dollars to spend on such nonsense but at least we know that the people who can afford it WILL be able to take it with them and build up such unimaginable wealth over multiple lifetimes that the efforts of you and generations of your mortal family will be like dust in the wind under their immortal gaze.

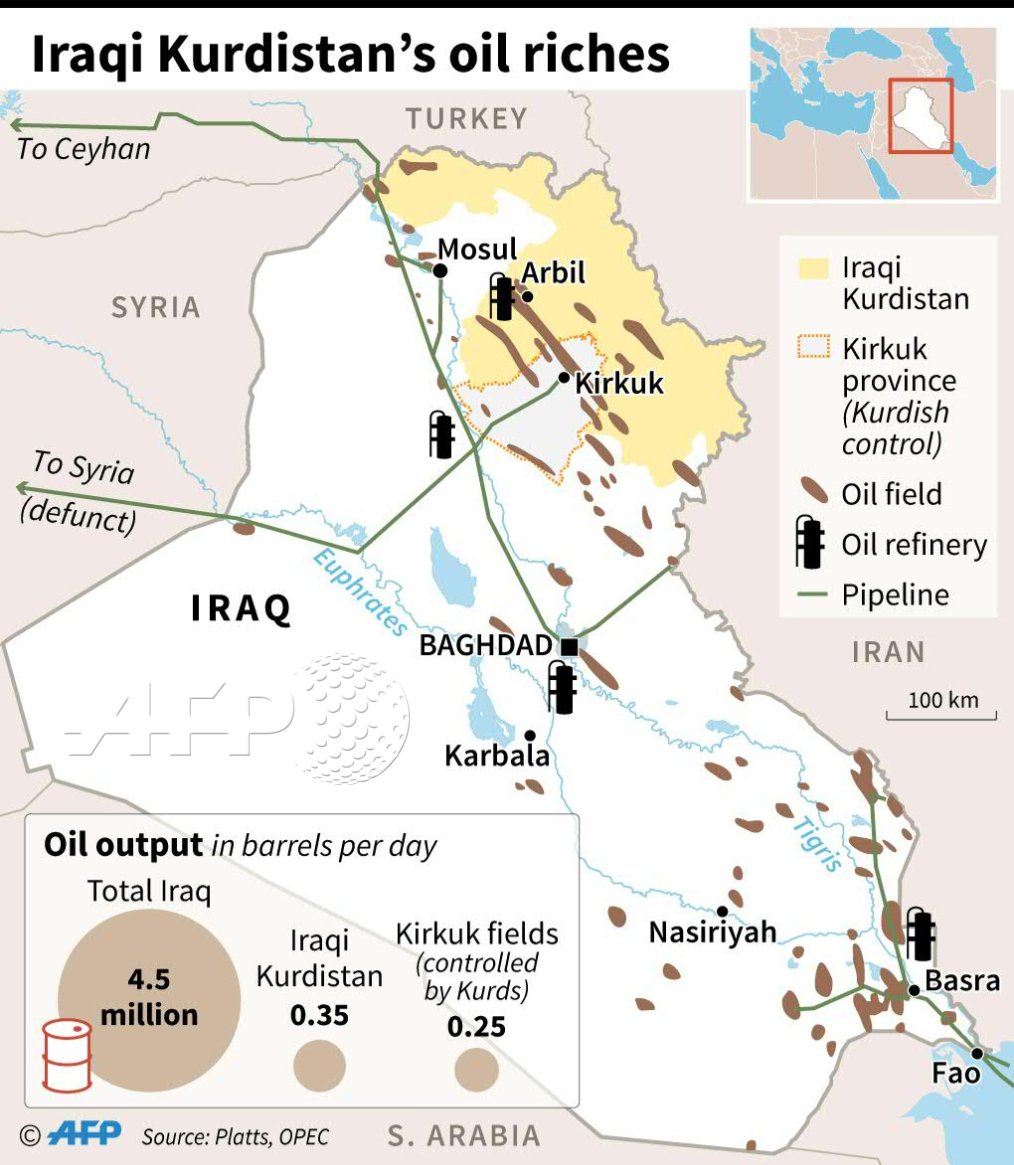

Speaking of Godless heritics, Oil (/CL) is spiking higher again today as Baghdad cranks up pressure on the Kurds following a controversial independence referendum, with a flight ban and a warning on oil exports, a vital source of income for Iraqi Kurdistan. Oil already spiked over $50 on news that Turkey was upset with the Kurds but now Iraq is another excuse to jam things up – $52.75 this morning and yes, we're still shorting!

Speaking of Godless heritics, Oil (/CL) is spiking higher again today as Baghdad cranks up pressure on the Kurds following a controversial independence referendum, with a flight ban and a warning on oil exports, a vital source of income for Iraqi Kurdistan. Oil already spiked over $50 on news that Turkey was upset with the Kurds but now Iraq is another excuse to jam things up – $52.75 this morning and yes, we're still shorting!

If you don't trade Futures, you can play the home game with the Ultra-Short ETF (SCO), which is down about $32.50 and we can assume things calm down in a month and go with a November spread like:

- Buy 10 SCO Nov $32 calls for $2.50 ($2,500)

- Sell 10 SCO Nov $37 calls for $1.50 ($1,500)

That's just $1,000 on the $5,000 spread and makes $4,000 (400%) if SCO is over $37 in mid-November and it was at $40 at the beginning of the month, when oil was $47.50 so we're looking for a 10% correction in oil between now and Nov 17th (option expiration day). For those of us who lose money on Oil Futures shorts, rather than stay on the roller-coaster, we can shoot to get even by playing with 1/4 of our loss, rather than letting the whole thing ride with all the current uncertainty.

The same goes for our Russell (/TF) shorts, which also burned us but we can play to get that back with another Ultra-Short spread (TZA) like this:

- Buy 50 TZA Nov $12 calls for $1.95 ($9,750)

- Sell 50 TZA Nov $14 calls for 0.70 ($3,500)

- Sell 5 AAPL 2020 $130 puts for $11.20 ($5,600)

That one is net $650 on the $10,0000 spread that's mostly in the money so the upside potential is $9,350 (1,438%) but you have to wait until 2020 to be clear of the obligation to buy AAPL for $130, which is a 16% discount to the current price. You can, of course, substitute a short put on any stock you REALLY want to own if it gets cheaper, we have a whole Watch List full of stocks we like when they are cheap in our Portfolio Section.

Gannett (GCI) is just starting to break higher, GE (GE) is still cheap and we put up a trade for them in yesterday's Report. Limited Brands (LB) is still in contention for our 2018 Trade of the Year but in danger of getting away from us before we officially announce. Macy's (M) is still cheap, Pitney Bowes (PB) is cheap again, though off the bottom already. Qualcome (QCOM) is down where we like them, Sealed Air (SEE) is a bargain, SuperValue (SVU) we've discussed as well.

So that's 7 of our 24 stocks still cheap enough to play while the rest have already blasted higher, like Aflac (AFL) who have done nothing but climb since we picked them on 2/17:

AFL (2/17) – I always forget to buy AFL. Super-solid company that trades in a channel good enough for the Butterfly Portfolio and should do better as rates tick up (insurance companies have huge reserves they have to keep in "safe" accounts). They have $102Bn in long-term investments (bonds) that are paying them nothing – a 1% rise in rates drops $1Bn to their bottom line ($2.50/share). You only have to pay $70.67 for a stock that threw off $6.45/share last year (p/e 11) and though they project flat – flat is just fine when you are returning 9% a year. They pay a 2.5% ($1.72) dividend while you wait but not worth owning the stock as we can sell the 2019 $65 puts for $5.50 and buy the $60 ($13.50)/70 ($7.10) bull call spread for $6.40 for net 0.90 on the $10 spread that's 100% in the money.

We're miles in the money on that one and already the 2019 $65 puts are down to $2.03 while the $60/70 spread is $8.75 for net $6.72 and up $5.82 (646%) but that's only on track for our expected $9.10 (1,011%) gain and we have no reason to feel we won't collect it. That means that, even just picking up the scraps from this trade that our Members already made 646% on since February, you (the cheapskate non-subscriber) can still invest $6.72 and make $3.28 (48.8%) in 16 months if AFL simply remains over $70. Who says trading is hard.

As we discussed in yesterday's Live Trading Webinar, these are the kind of long plays we are protecting with our index shorts and oil shorts. The shorts are INSURANCE to lock in the gains of our long positions and we expect to lose money on the shorts while our "boring" long-term plays mature.

AFL was the first trade on our buy list, the second was Bristol Meyers, which was added on 3/5:

BMY (3/5) – Last July, BMY took a huge hit because Opdivo (late-stage cancer) failed in trials and the stock collapsed. On Jan earnings, they missed estimates by 0.03 but earned 0.63 per $60 share so on track for $2.50 and a p/e of 24. There were, however, still extra expenses as they try to get Opdivo back on track (for wider acceptance – it's already being used for some cancers) and I think their guidance of $3/share will ultimately hold up. Too bad we missed them at $46, now $57.26 but volatility is good for put prices and we can sell 2019 $50 puts for $5.20 for a net $44.80 entry (below the lows) and that can be paired with the $50 ($11.50)/60 ($6.25) bull call spread at $5.25 so net 0.05 on the $10 spread and ALL BMY has to do to make a $9.95 return (up 19,900% return on you nickel!) is make it back over $60 in two years.

That one is right at our target and the 2019 $50 puts have dropped to $2.44 while the $50/60 spread is now $6.88 so net $4.44 is up $4.39 (8,780%) which means for each $50 cash you put into this trade, you got back $4,390 already and the good news for the non-Members is that you can still pick up more than a double playing with the scraps we are leaving you on this trade – enjoy!

We had 24 bullish trade ideas like those on our Watch List and many of them made it onto our Member Portflios and, in fact, Gilead (GILD), which we just went over on Tuesday, was such a slow-starter off our 2/17 pick that we used it as our first trade in our Nasdaq Portfolio on 4/27, which we discussed live that morning in my interview and subsequently went exactly as we planned it.

We had 24 bullish trade ideas like those on our Watch List and many of them made it onto our Member Portflios and, in fact, Gilead (GILD), which we just went over on Tuesday, was such a slow-starter off our 2/17 pick that we used it as our first trade in our Nasdaq Portfolio on 4/27, which we discussed live that morning in my interview and subsequently went exactly as we planned it.

The simple bull call spread required no margin and 10 units cost us $4,450 with no margin and already the net is at $7,650, which is up $3,200 (72%) with another $2,350 left to gain on what is now a deeply in the money trade. That's another one where you can pick up our Members' scraps and spend $7,650 for the spread now and still make up to $2,350 (30%) in 16 months. Of course, I can already see our Members rolling their eyes at "just" 2% monthly gains – it's probably time for us to close this one and find better use of $7,650 – but enjoy our leftovers!

8:30 Update: GDP came in stronger than we thought at 3.1%, which is up 0.1% from the previous estimate of Q2. It was my mistake thinking GDP would go down because it's not Q3, when we have the hurricanes, this is the third revision of Q2 and not the market-shaking report we still expect Q3 to be. It's not enough to move the needle on the real GDP for the year, which is still languishing at 2.2% and not at all likely to improve when Q3 preliminaries do come out:

So, between no bad economic news and promises of massive tax cuts for Corporations (which should boost earnings) – there's not much reason for the markets to sell off this week. Everyone has forgotten about Kim Jong Un already – that was so last weekend, right? As well-noted by Commonwealth's Brad McMillan:

“The proposal is very specific about the good stuff. It’s kind of nebulous about the bad. It’s a wonderful present to the market, but we’ve got to unwrap it to see what’s really in there.”

The Russell (which we're shorting) blasted up 200 points from 1,150 in November after the election on the assumption that tax cuts would be good for business and then they added 50 more points in December to 1,400 and they drifted back to 1,350 in August but yesterday they came just shy of 1,500 – up 30% since the election. That must be one MASSIVE tax cut, which is funny – as they only pay net 13% now. Some of the notes include:

- Corporate profits are way up, and corporate taxes are way down. In 1952, corporate profits were 5.5 percent of the economy, and corporate taxes were 5.9 percent. Today, corporate profits are 8.5 percent of the economy, and corporate taxes are just 1.9 percent of GDP.

- Corporations used to contribute $1 out of every $3 in federal revenue. Today, despite very high corporate profitability, it is $1 out of every $9.

- Many corporations pay an effective tax rate that is one-half (or less) of the official 35 percent tax rate.

- As of 2015, U.S. corporations had $2.4 trillion in untaxed profits offshore. Another study, looking at S&P 500 companies, found they held $2.1 trillion as of 2014. This roughly five-fold increase from $434 billion in 2005 stems largely from anticipation of a tax holiday.

- Corporations owe up to $695 billion in U.S. taxes on their $2.4 trillion in offshore profits. Having paid just 6 percent to 10 percent in taxes to foreign governments, they owe between 29 percent and 25 percent in U.S. taxes, based on a 35 percent tax rate with foreign tax credits.

To the extent that the GOP tax plan favors these large corporations over individual citizens, it will never fly. Trump and his minions are trying to wrap these massive tax cuts in the middle-class flag but that's because there's no actual plan yet for anyone to refute and the writing of such a plan will take months – and can't possibly be voted on in time to alter 2017 and even 2018 is an outside shot and, by next November – the GOP may not have the votes to get anything done.

In fact, you can't pass tax reform without a budget and our Government hasn't been able to agree on a budget since 2008. Since that time, we have been operating under a "continuing resolution", which means the 2008 budget is simply extended with 8% annual increases. That's the reality of what's going on so it's hard to imagine why the Russell is up 30% in less than a year. If the tax cuts don't return money to their customers – where are the earnings going to come from?