Well not today, it was the 19th but that's the closest Monday. Anyway, it was a Monday (a day like any other day) when the Dow fell 22.6% in a single day. That was only 508 points at the time (what inflation?) and it dropped to from 2,246 to 1,738. That happened pretty close to the anniversary of the original Black Monday of October 28th, 1929, which kicked off the great market crash and the Great Depression.

I don't know if this time is different but it's certainly not the same. The main difference here is that our market highs are not being caused by random market mania but by a fairly rational response to low interest rates and Trillions of Dollars worth of FREE MONEY being printed up and handed out to the Top 1% (Corporate Citizens included) in exchange for promising to trickle down on the poor – something, in fact, that the President himself supposedly was caught doing on a Russian video tape…

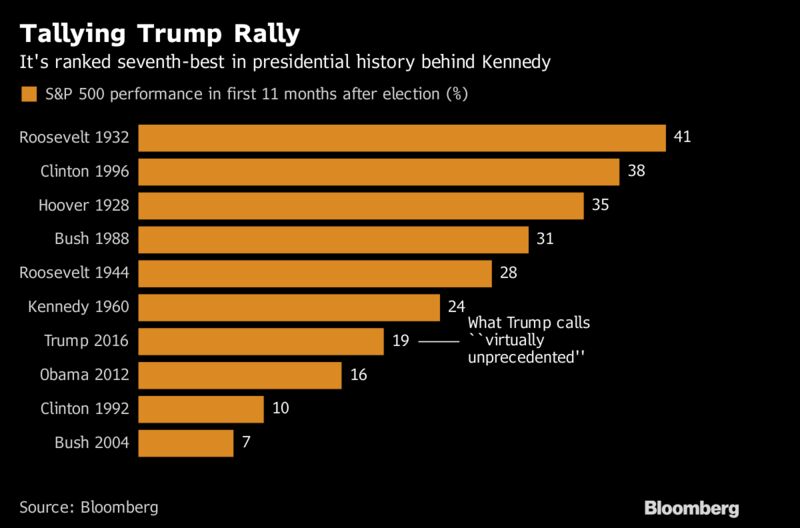

Trump, in fact, has more and more tied the "success" of his Presidency with the performance of the market, so there's another positive factor when the White House wakes up every day and says "How can we score more points on the Dow?" "It would be really nice if the Fake News Media would report the virtually unprecedented stock market growth since the election," Trump tweeted Wednesday. It's a much different tone than a year ago, when Trump warned America to beware of a "big fat bubble" in stocks. That was 4,000 Dow points ago! Though very impressive, the "Trump Rally" ranks 7th in Presidential rallies, only slightly ahead of Obama and miles behinkd Clinton and Roosevelt.

Trump, in fact, has more and more tied the "success" of his Presidency with the performance of the market, so there's another positive factor when the White House wakes up every day and says "How can we score more points on the Dow?" "It would be really nice if the Fake News Media would report the virtually unprecedented stock market growth since the election," Trump tweeted Wednesday. It's a much different tone than a year ago, when Trump warned America to beware of a "big fat bubble" in stocks. That was 4,000 Dow points ago! Though very impressive, the "Trump Rally" ranks 7th in Presidential rallies, only slightly ahead of Obama and miles behinkd Clinton and Roosevelt.

Only about half of America has any money at all in the stock market (52% of Americans, according to the latest data from the Federal Reserve, which does a comprehensive survey of everyone who has money in brokerage accounts, mutual funds, 401(k) plans, pensions, etc.). Most people with incomes below about $50,000 don't have money in stocks. They benefit little, if at all, from the market surge.

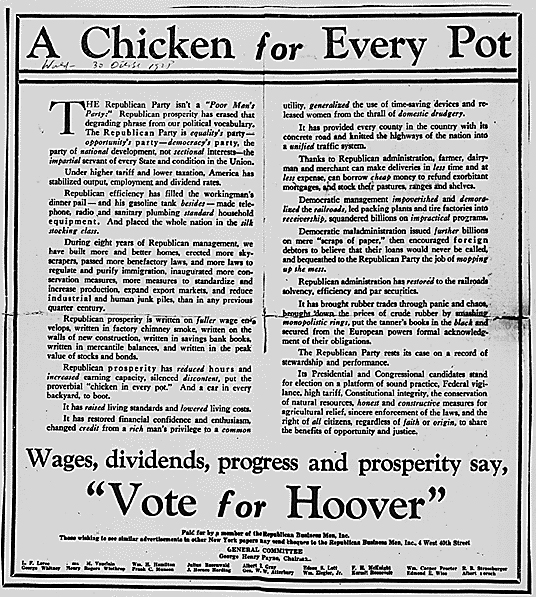

More apropos of comparison for Trump is Herbert Hoover, who, like Trump, famously promised "a chicken for every pot." In other words, he promised all things to all people and it was ALL BS and none of it was deliverable and the market rallied from Hoover's Nov 1928 election until October of 1929 – when it all began to unreavel in a spectacular fashion.

The economy SEEMED great in 1928 too. What people didn't realize was that it was only great for the Top 10% and tolerable for the next 10-20% but unbearable for the bottom 50% and, if course, none of US give a crap about THEM – until they stop shopping! While we have been having decent growth in top-line Retail Sales numbers recently – like 1929, people fail to put things in historical perspective and we discussed this a little in Friday's PSW Report so let's continue:

A headline gain of 3.1% (and it was only 1.6% in Friday's update) may seem nice but let's say we started at 100% in 2006 and gained 3.3% in 2007. That's 103.3 and then 0.6% in 2008 takes us to 103.92 and DOWN 3.6% in 2009 is back to 100.18 – no net progress at all in 3 years! 2010 was 3.1%, which took us back to 103.29 and 2011 (5%) gave us 108.45 and then (using the sequence you see above): 112.46, 116.06, 120.12, 123.85 and 127.68. First of all – it's a great example of how compound interest works and 2nd of all, we're only up 27.68% in 10 years.

The Dow, meanwhile, is up over 100% in the same period of time and one could possibly argue that companies have gotten more efficient but that's not enough to explain the difference. Neither is the fact that close to 25% of the S&P 500 stock has been repurchased by the companies – which lowers the number of shares among which their profits are distributed – giving them higher earnings per share ratios than they had previously on the same profits.

Last year alone, the S&P 500 companies alone spent $780Bn on buybacks. That's one thing that's very different between 1929 and today – in 1929, stock buybacks were illegal, because they were considered a form of stock market manipulation (they are). They were only legalized by the SEC in 1982 and, as Reuters wrote recently, “Stock buybacks enrich the bosses even when business sags.”

Last year alone, the S&P 500 companies alone spent $780Bn on buybacks. That's one thing that's very different between 1929 and today – in 1929, stock buybacks were illegal, because they were considered a form of stock market manipulation (they are). They were only legalized by the SEC in 1982 and, as Reuters wrote recently, “Stock buybacks enrich the bosses even when business sags.”

Another factor that makes this time different is our weak Dollar. The Dollar has fallen 10% since the start of the year, so there's your increase in Retail Sales as you simply need 10% more Dollars to buy the same thing you bought last year – including equities (see Friday's Report for charts and data on that subject). We've lost 20% of the Dollar's buying power since the start of the century (2000) and in 1985, before the 1987 crash, the Dollar index was way up at 160, 60% higher than it is today.

In 2006, Corporate Profits (net of losses claimed by other corporations and massive deductions, so not the whole story at all) were $1.4Tn and this year, after all the Dollar deflation, stock buybacks and Retail Sales gains – we're at $1.8Tn, which is up 28%. Assuming we have no missteps like we did in 2009, when Corporate Profits fell 50%, then we could justify a 28% increase in market prices but, unfortunately, even the 2007 market highs only took us to Dow 14,000 and 1,500 on the S&P and 2,800 on the Nasdaq. 28% more than those would be 17,920, 1,920 and 3,584.

In 2006, Corporate Profits (net of losses claimed by other corporations and massive deductions, so not the whole story at all) were $1.4Tn and this year, after all the Dollar deflation, stock buybacks and Retail Sales gains – we're at $1.8Tn, which is up 28%. Assuming we have no missteps like we did in 2009, when Corporate Profits fell 50%, then we could justify a 28% increase in market prices but, unfortunately, even the 2007 market highs only took us to Dow 14,000 and 1,500 on the S&P and 2,800 on the Nasdaq. 28% more than those would be 17,920, 1,920 and 3,584.

Needless to say, we are miles ahead of that at 22,900, 2,558 and 6,624 – and those are the HIGHS for the prior decade – we dropped more than 50% after that. So now we are higher than high on so-so sales increases and decent profit increases, propped up by the illusions of a lower share base and a lower Dollar base – what could possibly go wrong?

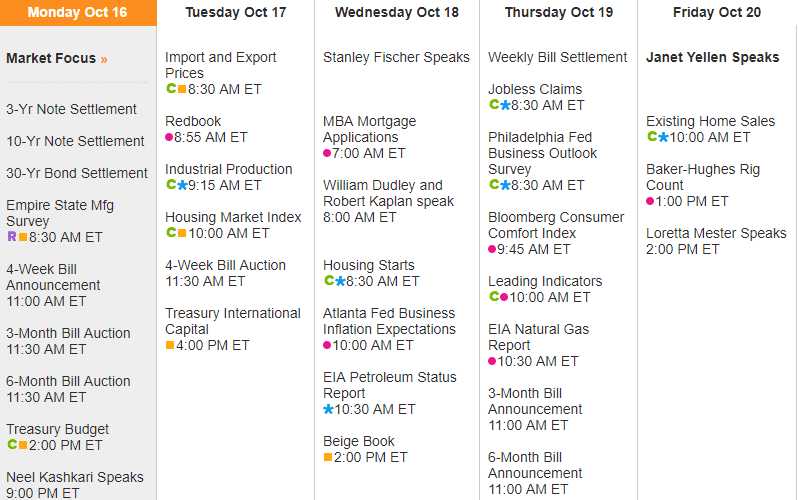

As you can see from the chart above, the profits the Corporations are now enjoying have come out of the pockets of the workers – how long can that keep up without the pendulum swinging the other way? Meanwhile, we'll see if this season's earnings and data live up to the market's lofty expectations:

Be careful out there.