The bull is back!

Well, it never left but it paused for a day and that's something, right? As is often the case when the markets need a lift, Apple (AAPL) is getting a boost and, since it's in the Dow, the $10 run this month has added 85 of the Dow's 1,000 points but, in the S&P 500, AAPL is a whopping 4% of the S&P 500's weight so the 6.66% run from $150 to $160 adds 0.25% to the S&P, which is up 100 points (4%) over that time. In the Nasdaq, fuggedaboutit, as AAPL is closing in on 15% of the Nasdaq's total weight so adding 1% to the index all by itself from that run while the entire index is up 4% so 25% of the move comes from AAPL and probably another 25% from AAPL suppliers!

Boosting some of the key components in an index through upgrades, M&A rumors or straight-up buying of the stocks is a great way to mask selling by Fund Managers and Banksters when they don't want to scare off the Retail Investors while they move to CASH!!! (have I mentioned how much I love CASH!!! lately?). Yesterday, for example, the Nasdaq finished up but 1,514 stocks declined while only 1,370 advanced in the index. A falling Advance/Decline Line is one of the things we watch for if there's going to be a correction, so we'll be keeping an eye on it during earnings but nothing to worry about… yet.

Boosting some of the key components in an index through upgrades, M&A rumors or straight-up buying of the stocks is a great way to mask selling by Fund Managers and Banksters when they don't want to scare off the Retail Investors while they move to CASH!!! (have I mentioned how much I love CASH!!! lately?). Yesterday, for example, the Nasdaq finished up but 1,514 stocks declined while only 1,370 advanced in the index. A falling Advance/Decline Line is one of the things we watch for if there's going to be a correction, so we'll be keeping an eye on it during earnings but nothing to worry about… yet.

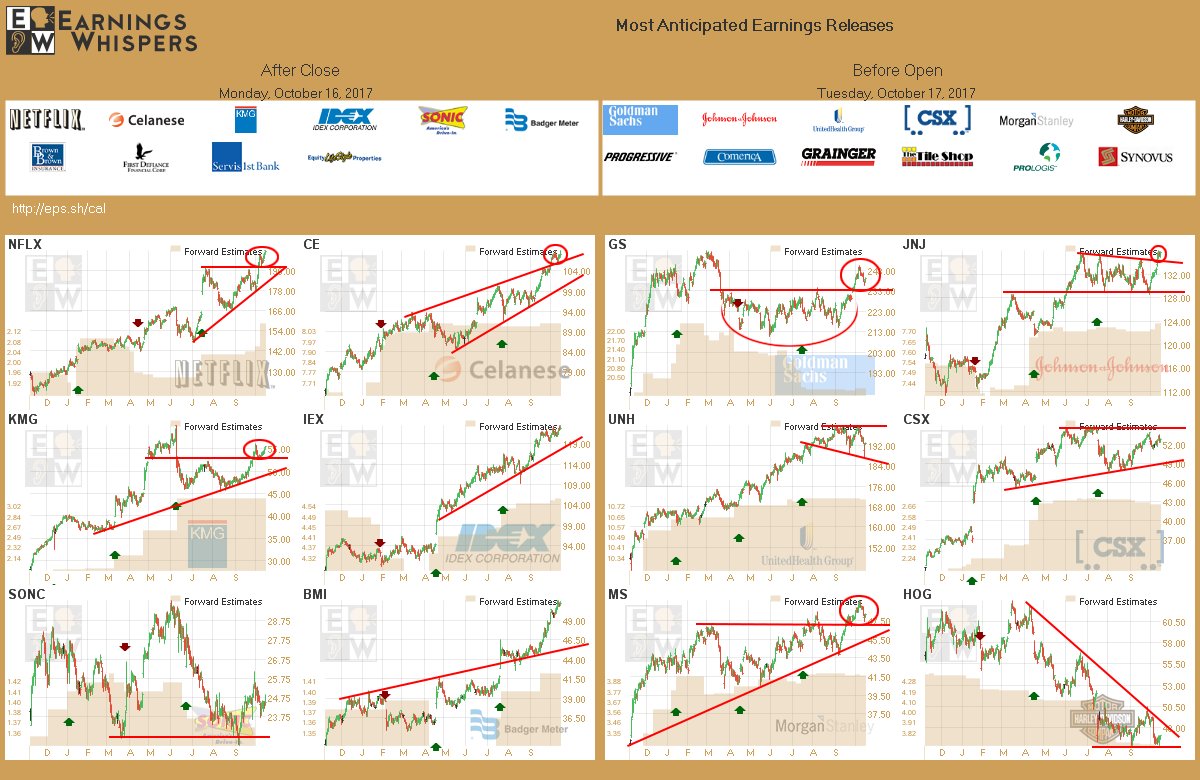

Meanwhile, it's earnings season and yesterday we got a beat from Schwab (SCHW) and SONC (SONC) although the latter blamed the hurricanes for any shortfalls. KMG (KMG) and Netflix (NFLX) missed but Netflix was immediately forgiven by rabid fans, who are happily paying the 10% rate hike which will, hopefully, compensate for their profligate spending. NFLX did add 4.5M new subscribers and, at $13/month, that's $702M/yr in new revenues added in just one quarter – not bad! Unfortunately, they have also increased content spending by $1Bn/yr ($8Bn now) – so we'll see how things go for them but the bottom line is they burned $465M in cash last Q – not good.

None of that stops the company from commanding a price ($203) that is 250 TIMES what they earn 0.80 – and even that is assuming all goes well. We think it may be time to short NFLX again because this is all the "good" news baked in and the price hike is here and 250 times earnings is a lot. Revenues were $8.8Bn last year and we've got the subscriber growth and the rate hike so let's go crazy and say $11Bn next year but their are buring over $2Bn in cash-flow for the year so $2Bn more revenues only stops the bleeding – if everything goes perfectly. We're thinking it might not.

It's tough to pick a top in a momentum stock but we'll see how it goes today and look for a simple put, perhaps the 2019 $170 put if we can pick it up for $10 as NFLX moves higher – that would be a fun one to hold through next Qs earnings. We don't actually need the stock to fall below $170, the puts have a delta of 0.25, so they gain 0.25 for each $1 NFLX drops so we make $2.50 (25%) on a $10 drop back to $193 and we can take that and run if we think $190 will hold – which will depend on why it's down (other than people not being idiots and paying 250x what a company earns – that ship has sailed!).

Speaking of sailing, back in July we told you we were playing the Cryptocurrency game with GreenCoin and, at the time, they were trading at 0.000000012 Bitcoins. Recently they hit 0.00000158 Bitcoins for a 10-bagger but have now calmed down back to a double at 0.00000025 and, as I reminded our Members in our Live Chat Room this morning:

We came in at 0.00000012 and it's been as high as 0.00000158, which is a 10-bagger so I REALLY hope people took half off the table with at least a double so they have a free ride from here. Even yesterday's settlement is still a double from where we started and that's the way you have to play these small coins – buy in a low channel and then sell half on a spike up so you no longer worry about the fluctuations.

It's actually a lot better in Dollars, of course, as BitCoins have doubled since July as well! If you want to learn more about GreenCoin and other Cryptocurrencies, follow the links from that July post. We also played GRNBF, which is the "bank" for GreenCoinX (no relation, oddly enough) and that one is another 10-bagger on the Penny Stock market (which we usually avoid but that's all there is in Crypto).

I don't advocate chasing either but we'll be hunting for the next new and exciting bargain as King Bitcoin tests the $6,000 mark and it's fun to think about how pissed off Jamie Dimon is every morning when he sees that in the papers! Dimon has a new ally though, Nobel Prize-Winning Economist Robert Shiller is calling BitCoin a "fad" and, by extension, the whole Cryptocurrency marketplace but he says he'll still play it "because I know I can sell it and get out of it" – that's our kind of investor!

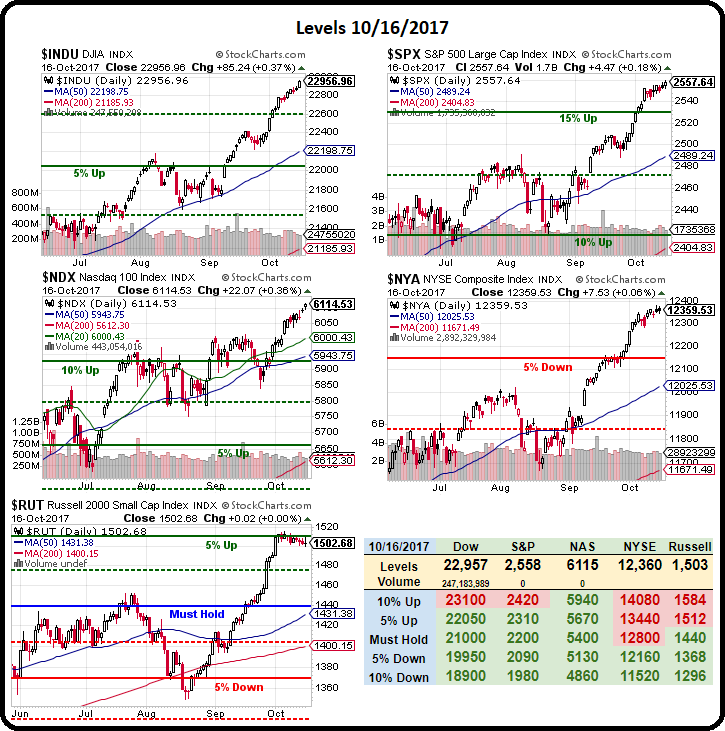

Notice every chart we have this morning is going up and up and up so it's bubbles, bubbles everywhere yet we reiterated our Russell (/TF) shorts just under 1,515 in yesterday morning's Live Chat Room and we'll be sticking with those and this morning we added a short on Oil Futures (/CL) at the $52 line (with tight stops above). We'll see how earnings go this morning but Goldman Sachs (GS) already knocked it out of the park with a 25% beat that should send them up to $250 – and that's only 20 times their earnings!

It's a little early to make predictions but I love earnings season – it gives you a chance to read the tea leaves. For example, despite beat by GS and MS, both showed significant declines in trading revenues which means purer trading houses like SCHW and others are not likely to do as well when they report. The Big Banks are likely to put a top in the index (XLF) as they report early and then we may start seeing some misses which makes the Ultra-Short Financial ETF (FAZ) and interesting play at $13.80 and the November $13 calls are only 0.95 so just 0.15 in premium to take a stab at some misses from the Banks is a fun play to start us off.

It's going to be a very interesting earnings season because SOMETHING is wrong with this picture and either it's the US is over 50% ahead of itself or the rest of the World has a lot of catching up to do – we'll have to wait and see: