Advice For Aspiring Traders

Courtesy of Michael Batnick

A frequent question asked of podcast guests is, “What do you know now that you wish you knew twenty years ago?” Twenty years ago I was twelve, but five years ago I was buying stocks that were going down and shorting stocks that were going up. I wish I knew how foolish this was.

A frequent question asked of podcast guests is, “What do you know now that you wish you knew twenty years ago?” Twenty years ago I was twelve, but five years ago I was buying stocks that were going down and shorting stocks that were going up. I wish I knew how foolish this was.

I loathe talking to non-market people about investing because I don’t know anything about their favorite stock, and the “what do you think about the markets” is a question for which I lack a satisfying answer. The silver lining to these conversations is that I make it really awkward so they usually don’t happen twice.

I should clarify the previous statement. I dislike talking to people who have been investing for a few decades and still haven’t figured out that “experts” don’t know where the market is going. Talking with kids who want to learn about finance and trading on the other hand is something I quite enjoy.

I recently had this sort of talk with a college student who opened up a Robinhood account and wanted some advice. I found myself talking in circles, basically saying the same thing over and over, if you want to buy something that’s going to go up, buy something that’s already doing that! (H/t Jon Boorman)

When you open your first brokerage account, at least this was my experience, you try to find bargains. I attempted to buy low and sell high, which even if you know nothing about investing, you’ve heard this phrase before. But this is probably the worst advice you can give to an aspiring trader, because beginners can’t separate cheap from garbage, and they lack the patience necessary for something to turn around (which it usually doesn’t).

Buy what’s already rising is good advice, but like everything else, it’s easy to say and hard to implement. As an example, let’s look at one of the most beautiful trends in the world right now, semi-conductors.

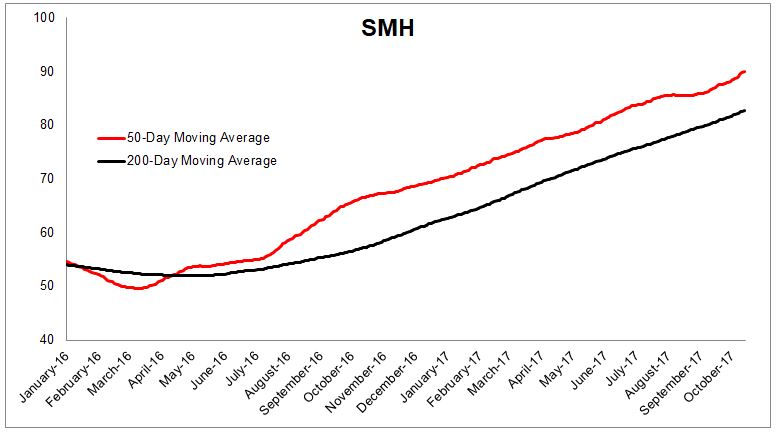

One of the easiest ways to determine a security’s primary trend is to look at a moving average. For SMH, the 200-day moving average has been higher for 357 consecutive days. Granted this is just one example, but it’s supportive of the fact that rising prices attract buyers.

The tricky thing, however, is that by the time these moving averages start looking like this, a big move has already been made. We can know that trends tend to persist, but that doesn’t make buying something that’s already up 50% any easier.

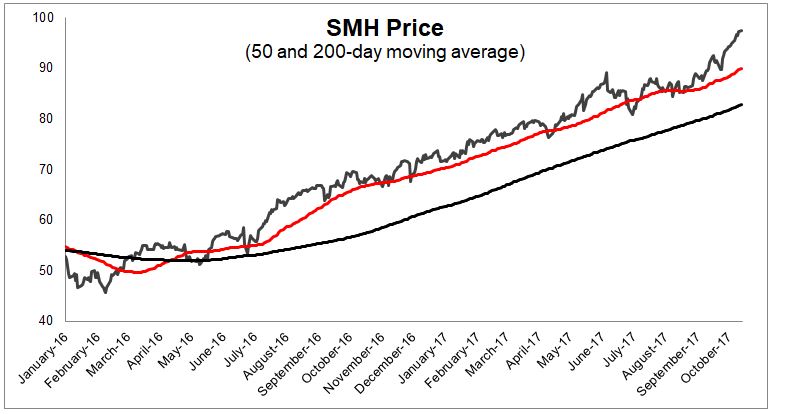

Another challenge with using long-term moving averages is that they don’t shield us from the day-to-day action. We don’t live in 200-day increments, we live in the real world, and it’s noisy as hell.

These long-term trends look like a layup with the benefit of hindsight, but riding them is very difficult in real time. Since last Spring, SMH has had thirty-seven -1% days, six -2% days, four -3% days, one -4% day and one -5% day. Each of these big negative moves was amplified one-hundred fold by the internet, because few things get people more excited than calling a top for an asset that’s been going up which they do not own.

Investors in SMH have experienced about as smooth a ride as possible- since last spring it’s up almost 100% and the max drawdown over this time is just -9.1%. But how many people do you think have stayed long this whole time? Investor’s tendency to sell winners and hang onto losers, or the disposition effect, is one of the behavioral biases that will never be eliminated. I tried for two years and fell victim to this more times than I can count. I couldn’t suppress the “buy low, sell high” humming in the back of my brain. Because this is the most common investing axiom, the idea of buying something after it’s already experienced a large advance is anathema to our trigger fingers.

I actually don’t wish I knew then what I know now, that fighting the primary trend is a money losing proposition. Because had I known that, well, how the hell could I have known that? I read Market Wizards and Reminiscences, but the thing they don’t teach you in these books is that you can’t learn how to invest or trade from reading books! Even if somebody grabbed me by the ears and screamed in my face to only buy stocks that are going up, I don’t know if I would have listened, and I don’t know that I have the genetic makeup to be a successful trader even if I did.

Buy things that are going up is good advice, but it’s also meaningless advice because some things can’t be taught. Nobody can tell you how to make money and how to lose it, or how to lose a little and stop playing. In trading and in life, there is no substitute for experience, so get going!