GE (GE) dropped guidance by 33%.

GE (GE) dropped guidance by 33%.

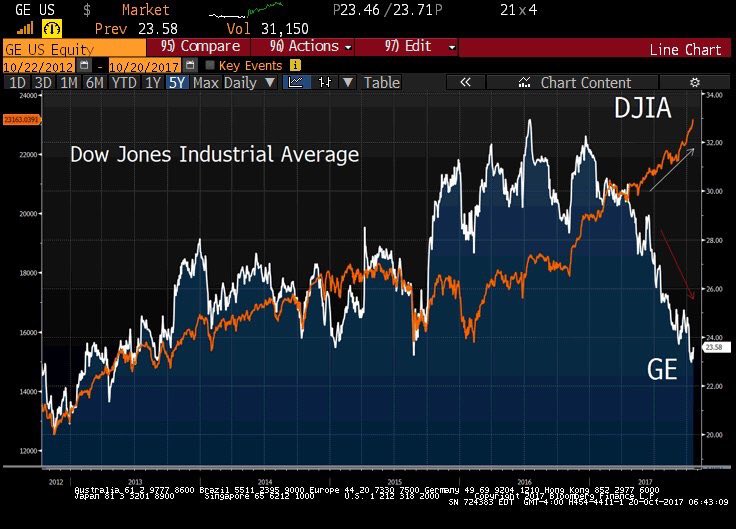

Not sure why I bother mentioning it, it's only a $200Bn leading industrial company so why shouldn't the Dow be up 100 points pre-market? Makes perfect sense, right? GE is a Dow component but it's stock is only at $23.50 so a 6.5% drop to $22 is only $1.50 and that's just 14 Dow points vs a 10% drop in IBM being $15 and adding 127 points the other day. Get it? No, nobody does, but it's still our leading market indicator so just play the game and don't ask too many questions.

We have been long on GE since June 27th and we have 2,000 shares at $27.40 in our Long-Term Portfolio but we sold the 2019 $25 calls for $3.75 and the $28 puts for $3.10 so our net entry on 2,000 shares was $20.55 but, if we get assigned another 2,000 at $28 (seems likely now), we'll have 4,000 shares at an average of $24.275. Of course, then we will sell another round of calls – the 2019 $23 calls are now $2.40 so hopefully we'll get more like $3.50 for the 2020s when they come out. That will keep our basis around $20 while we collect GE's fat 0.94 dividend so, as long as they don't cut it, we're happy to accumulate down here.

Either GE is going the wrong way or the Dow is and, this morning, we shorted the Dow Futures (/YM) in our Live Member Chat Room at 23,200. If it turns out the Dow SHOULD be up 28% for the year, then I have to believe GE will find a way to reverse their 20% decline over the same period. It's not just unusual that GE would diverge from the Dow by over 40% (almost 50% now) – it has NEVER happened, in the entire 121-year history (1896) of the Index (GE was one of the original 12 companies). Never is a long time, folks – this time sure is different, isn't it?

Either GE is going the wrong way or the Dow is and, this morning, we shorted the Dow Futures (/YM) in our Live Member Chat Room at 23,200. If it turns out the Dow SHOULD be up 28% for the year, then I have to believe GE will find a way to reverse their 20% decline over the same period. It's not just unusual that GE would diverge from the Dow by over 40% (almost 50% now) – it has NEVER happened, in the entire 121-year history (1896) of the Index (GE was one of the original 12 companies). Never is a long time, folks – this time sure is different, isn't it?

As we discussed in Wednesday's Live Trading Webinar – we're not "bearish" on the market, we're simply looking for a nice 5-10% correction that will make us feel better about picking up some longs but we don't have to wait when companies like GE go on sale – especially off an earnings report that shows $7Bn in cash flow, even after $1.8Bn in restructuring impairments. Revenues were also up 14% and, don't forget, GE just merged with Baker-Huges (BHI) and mergers often lead to rough quarters. Our theory is that the new CEO is "kitchen-sinking" the quarter – getting all the bad stuff out so he can appear to have a more positive impact going forward.

As to us going forward, let's never forget what a great long-term investment stocks tend to be. Here's a really good chart that illustrates the Dow's first 121 years and the events that shaped them:

Kind of makes you embarrassed to talk about our recent "crash" – especially to our Grandparents, who lived through the Great Depression – THAT was a crash! Is Donald Trump the 21st Century Herbert Hoover? Time will tell and we will ALWAYS have our hedges but there's no point in having hedges if we have nothing to hedge – so we'll always have our longs as well though, at the moment CASH!!! is King (have I mentioned how much I like CASH!!! lately?).

We don't need to use a lot of CASH!!! to make a lot of money. Our IBM earnings play was just net $750 on 10 contracts and already it's up to net $9,400 for a gain of $8,650 (1,153%) in 3 days and yesterday, in our Live Member Chat Room, we called an earnings play on Sketchers (SKX) as follows:

SKX/Lunar – Ah, an old favorite. They are certainly good for $1.50-$2/share so $24.25 is very reasonable. Q3 last year was slow (0.42) so they should be up from there but they missed last Q by 13%, which is scary.

I think they've already been punished enough and the way I would play them is to sell the 2020 $20 puts for $3.20 and buy the $25 ($6.25)/$35 ($3.25) bull call spread for $3 and that nets you in for 0.20 on the $10 spread and you should be HAPPY if they tank earnings and you get to put $2.50 in to roll them $5 lower and widen the spread but, if earnings go well – you'll be on track to make $9.80 on 0.20.

10 contracts there obligate you to own 1,000 shares of SKX at net $23 but that's unlikely to be an issue as they are up 27% this morning and passing $30 for what will certainly be another 1,000% gain on an earnings play. Two in one week is a good start to earnings season! Notice we make these plays using 2020 LONG-term positions, not short-term bets. The long-term positions, if properly structured, can be just as rewarding as short-term plays but with the added bonus of giving us plenty of time to recover if things go against us (like GE, so far).

If you would like to get these earnings calls live, during trading hours, you can join us by clicking HERE and selecting either the Trend-Watcher, Live Chat or Premium Membership levels.

As you can see from the earnings chart, next week is the height of earnings season, with 30% of the S&P 500 (150) companies reporting but there's still plenty of action for the whole month ahead. Remember though, we are not short-term traders – we are long-term FUNDAMENTAL investors who use options for hedging and leverage and we concentrate on buying undervalued companies that have a good chance of turning around in the near future. Earnings just happen to be one of those times when people do realize companies have become undervalued. We do, however, also make short-term trades while we wait for our trades to mature – especially in the the Futures.

Heck, you could have paid for your whole Membership with just yesterday's Morning Report call on Silver (/SI) with a long call on the Futures at $17. Silver contracts pay $50 per penny and /SI blasted up from our moning line all the way to $17.30 for gains of $1,500 per contract. Natural Gas (/NGV8) also made a nice move, jumping 0.02 for $200 per contract gains on the day.

Heck, you could have paid for your whole Membership with just yesterday's Morning Report call on Silver (/SI) with a long call on the Futures at $17. Silver contracts pay $50 per penny and /SI blasted up from our moning line all the way to $17.30 for gains of $1,500 per contract. Natural Gas (/NGV8) also made a nice move, jumping 0.02 for $200 per contract gains on the day.

This morning we have another chance to short the Russell (/TF) Futures at 1,510 but we need tight stops above as it's a crazy options expiration day. I mentioned above we are shorting Dow Futures (/YM) at 23,200 but also tight stops above as Trump is poised to announce a new Fed Chair (or maybe the same one) and anything could happen. We also got another short at shorting Gasoline (also from yesterday's report) at $1.65 (/RB) and that's a fun one over the weekend if you are brave (and rich enough to laugh off a potentially nasty loss).

The Senate passed Trump's budget last night with all 48 Democrats and Rand Paul voting against it. Trump's tax cuts are projected to add $1.5Tn to the deficit but those are just Trump's projections – outside auditors are warning the minimum danage will be $3Tn and closer to $6Tn more debt foisted on the working Americans in order to give more money to the Top 1%. Nonetheless, it's a market-booster – because little people don't own stocks (or not enough to matter).

Senate Democrats used this week’s budget process to force Republicans to take politically painful votes that highlight studies showing the tax framework unveiled so far would probably add Trillions to the deficit while mostly benefiting the wealthy. Republicans say the studies are incorrect because final tax brackets and credits haven’t been announced. In one vote, the Senate defeated 51-47 an amendment by Democratic Senator Heidi Heitkamp of North Dakota that would have barred tax increases for people earning less than $250,000 a year. Only 2 Republicans voted with the Democrats to prevent ordinary citizens from being victimized by the tax bill.

Senate Republicans signaled their intentions on dealing with contentious issues in a tax plan by rejecting Democratic amendments that would bar raising the deficit, prevent any middle-class tax increases, and block tax breaks for the top 1 percent. The votes indicated that Republicans will try to rewrite the tax code with mostly — if not exclusively — GOP votes. It’s a gamble that they’ll succeed where they failed on replacing Obamacare.

As noted earlier this week by Steve Mnuchin, if they don't get this done, the market is headed for a Hell of a correction.

Have a great weekend,

– Phil