GE is restructuring.

GE is restructuring.

We knew that already and discussed GE in depth (we're still bullish) in this weekend's 2018 Watch List Update, where we identified (so far) a dozen dividend-paying stocks we consider good buys at the current levels, which will become compelling buys if they pull back a bit more with the market.

And the market is pulling back with the Nikkei giving up 1.4% and Europe down almost a full point as Brexit Talks seem like they are failing and our Futures are, so far, down about a quarter point and indicating lower but it's Monday – so anything can happen and it won't mean anything if it does. I've only got 16 Mondays left until I quit in March (Mondays, not the whole week) so I'm enjoying my last ones before my 20% retirement party.

Over in Asia, despite still being 40% below their 2007 bubble highs, Chinese stocks are not doing the heavy-lifting required to catch up to the rest of the World, which is right back at the bubble highs. There was the strong rally of 2015 but that ended in disaster but China has spent many Trillions of Dollars on various stimulus packages over the past two years, and that hasn't helped either. China has now switched strategies and is ENCOURAGING foreign investors to buy Chinese stocks – that might not end well…

Speaking of things that aren't ending well: In addtion to Brexit Talks once again breaking down, Europe is a little concerned with "tens of thousands" of White Nationalists marching on Warsaw for the Independence Day Celebration. While the thousands of torches may have had a festive look and while "Fatherland" is certainly a catchy tune, the new battle cry of the Polish Fascists comes from Donald Trump's July Speech in Warsaw: "We want God," while calling for the extermination of Jews and Muslims.

Speaking of things that aren't ending well: In addtion to Brexit Talks once again breaking down, Europe is a little concerned with "tens of thousands" of White Nationalists marching on Warsaw for the Independence Day Celebration. While the thousands of torches may have had a festive look and while "Fatherland" is certainly a catchy tune, the new battle cry of the Polish Fascists comes from Donald Trump's July Speech in Warsaw: "We want God," while calling for the extermination of Jews and Muslims.

"They found new courage to face down their oppressors, and they found the words to declare that Poland would be Poland once again. As I stand here today before this incredible crowd, this faithful nation, we can still hear those voices that echo through history. Their message is as true today as ever. The people of Poland, the people of America, and the people of Europe still cry out “We want God.” – Trump

This is, of course, what happens when you declare one certain religion "right" and others "wrong" and most Presidents and rational World leaders have learned to keep the religion out of politics (as our Founding Fathers CLEARLY intended) but, unfortunately, America is now leading the World down that very dark path that leads us right back to Fascism and, eventually, right back to war.

Speaking of World War III, Russia will "retaliate" against the American Media this week after our Government ordered Russia's state broadcaster, RT, to register as a Foreign Agent after Twitter and Facebook have already banned the organization from buying ads on their platforms (so they were essentially cut off anyway). "If someone starts to fight dirty, perverting the law by using it as a tool to eradicate the TV station, every move aimed against the Russian media outlet would be repaid in kind," Foreign Ministry spokeswoman Maria Zakharova said.

Speaking of World War III, Russia will "retaliate" against the American Media this week after our Government ordered Russia's state broadcaster, RT, to register as a Foreign Agent after Twitter and Facebook have already banned the organization from buying ads on their platforms (so they were essentially cut off anyway). "If someone starts to fight dirty, perverting the law by using it as a tool to eradicate the TV station, every move aimed against the Russian media outlet would be repaid in kind," Foreign Ministry spokeswoman Maria Zakharova said.

This tit for tat attack could lead to the banning of US news outlets from Russia, which will then prevent US Citizens from getting anything other than State-Approved news out of Russia – something our Congress has given them the excuse to do by restricting RT. Somehow the First Amendment isn't as holy as the 2nd Amendment in the eyes of Trump's Congress and this whole thing somehow plays right into Putin's hands yet, somehow, no one can figure out what the connection might be – other than Congressman Eric Swalwell of California, who has a handy reference chart:

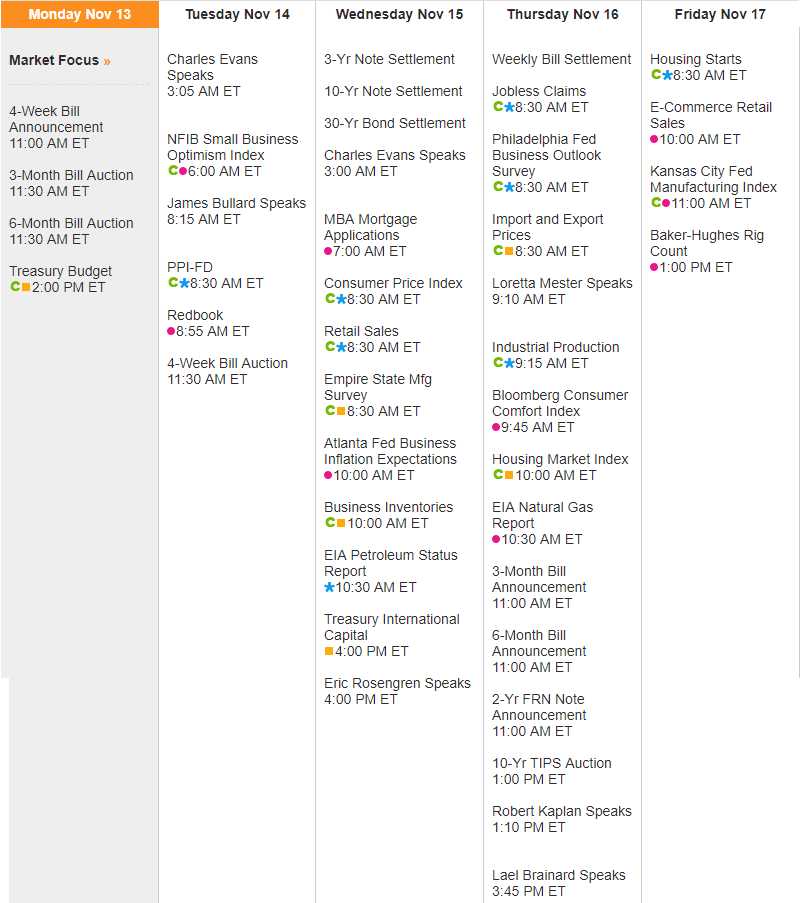

It's not a very heavy data week, with "only" 7 Fed speakers, two of which are Evans and PPI, CPI, Retail Sales, Industrial Production and E-Commerce Sales, which will be interesting into the holidays and after the hurricanes. Thursday's Consumer Comfort Index will be worth watching as we've gotten several declining reports recently on the consumer side – something we DON'T want to see into the holidays.

On the earnings side, there's still a lot of interesting stuff going on and we've been knocking them out of the park with our earnings calls so far. We went long HD and LOW into the huricanes and HD is this week with LOW on the 21st. Our call from Aug 28th's Morning Report on Low was:

Home Depot (HD) and Lowes (LOW) generally get a nice pop in business following damaging storms and LOW had a recent pullback to $72.50 from $85 so $17.50 is 20% which means we expect a weak bounce of at least $3.50 to $76 and likely a strong bounce to $79.50 thanks to the storm. The LOW Oct $75 calls are $1.70 and would pay at least $4.50 at $79.50 for a $2.80 (164%) potential gain.

As you can see, we went miles over our goal in Oct as the $75 calls were $7.50 in the money before expiring at $79.63, $4.63 in the money (up 172% in 2 months). That was an easy call – all we had to do is watch the news, see that a storm was coming and then think about who makes money on storm damage (autos were a good bet too). If the Administration is going to promote Global Warming – we may as well learn to profit from it as well, right?

The LOW trade was for our Members only and Target (TGT) is one of the trade ideas we had for our Members in this weekend's Watch List Update, which you can access if you JOIN HERE NOW but, if you don't, we'll be happy to tell you how we did on Thursday.