Thank goodness we still have our BitCoins!

Thank goodness we still have our BitCoins!

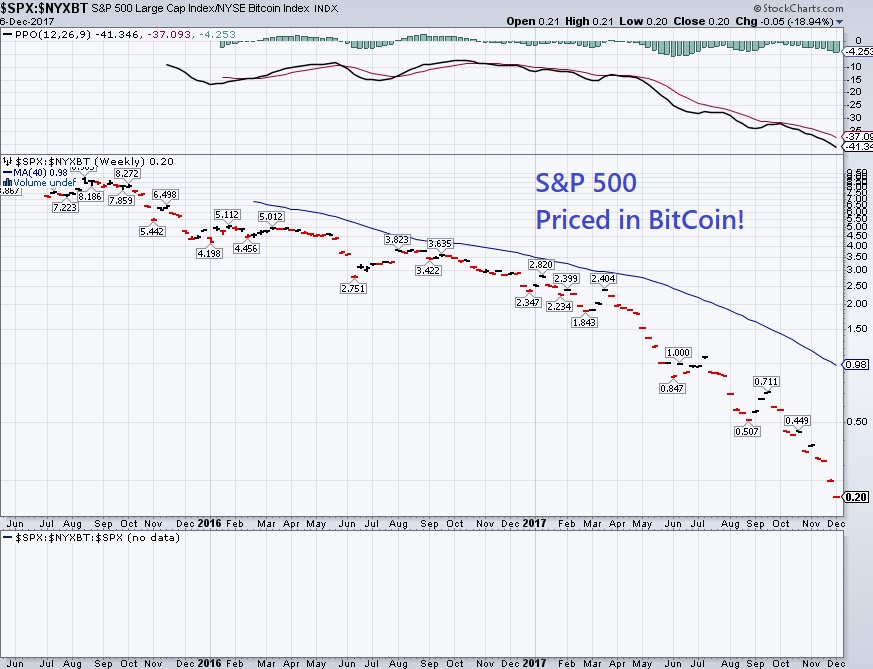

We may have cashed out of the market but you'll have to pry our BitCoins out of our cold, dead fingers. No, only kidding, this is silly too – we can't wait to sell – we're using tight stops now. PSW Investments bought their BitCoins for $600 each two years ago, so it's a nice gain and we should lock it in – the cash will make a nice Christmas gift for our partners. We still have our GreenCoins (GRE) though and we're accumulating more of those because each BitCoin's worth of those we bought is now worth $24,525 at 0.000327, so GreenCoins are doing 50% better for us than BitCoin – and they are far earlier in the run-up cycle.

Of course, in order to buy a GreenCoin you need a BitCoin and then you have to go to the CoinExchange (where it's ranked 93rd) and trade the BitCoins for Greencoins. 0.000327 is up 0.000107 (48.6%) since we discussed Greencoin LAST WEEK – how's that for a good tip? It's still below the 0.00044 that PSW is GUARANTEEING we will exchange them for as payment for Annual Memberships this month (see our weekend post). That's one of the reasons BitCoins are exploding in value – you can't buy any other CryptoCurrency without first buying a BitCoin so millions of speculators are holding BitCoins in their wallets (like us, frankly), simply because they were using them to buy other coins and ended up with some change.

That "change" is now worth a fortune – as BitCoin passes $250Bn in valuation. As we discussed in yesterday's Live Trading Webinar, BitCoin is sucking a lot of money out of commodities – as the same investors that were buying gold, silver, copper, etc. have plowed enough money into BitCoin to buy all but the top 12 stocks on the S&P 500.

That "change" is now worth a fortune – as BitCoin passes $250Bn in valuation. As we discussed in yesterday's Live Trading Webinar, BitCoin is sucking a lot of money out of commodities – as the same investors that were buying gold, silver, copper, etc. have plowed enough money into BitCoin to buy all but the top 12 stocks on the S&P 500.

We actually picked up some Silver Futures (/SI) as they fell back to $15.85 and that's down $2.15 (12%) since September and our 5% Rule™ says that's a 10% drop with a 20% overshoot and, while that's no guarantee of a bottom (real support comes at $15.50) – it's worth a poke down here as we don't expect the Dollar to pop 94 very easily and Gold (/YG) is testing $1,250, which is good support on the yellow side.

That's right, we're out of our stocks but that doesn't mean we aren't trading Futures and, in fact, just yesterday we sent out a BULLISH Top Trade Alert on the Ultra-Long Russell ETF (TNA) – just in case we're going to miss more of the rally (though we super-doubt it). My note to our Members was:

Speaking of hedges. TNA is the ultra-long Russell ETF at $67.87, well off the highs at $73.50. If you think you will regret going to CASH!!! then you can take an upside hedge using something like this, which will give you great gains if the rally continues (or Santa Clause comes to town).

Just like any play, a bull call spread will keep you from losing too much and the longer spreads have a lower net delta and that means you won't get too burned on the downside. So, for example, we are cashing in the OOP (the SA people voted yes too) at $300,000ish and usually we make about $10,000/month so, if we think we'll miss out $20,000 in gains during December and Jan, we can:

- Buy 20 TNA April $60 calls for $12 ($24,000)

- Sell 20 TNA April $70 calls for $6.50 ($13,000)

- Sell 3 TSLA April $330 calls for $19 ($5,700)

The net cost of the trade is $5,300 and it returns $20,000 if TNA is simply over $70 in April so you'll capture $14,700 (277%) in profits if all goes well. If not, unless TSLA has a major rally, you will only lose $5,300 at most but, more likely, you'll be able to salvage half of that by closing out the bull spread if the market is heading lower – as we expect it will.

You can, of course, use anything to offset the bull spread but I feel pretty good about shorting Tesla (TSLA), rally or no rally!

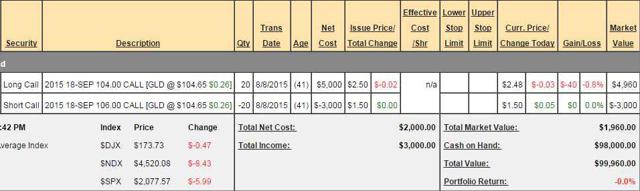

So all we need to do is take $5,300 (1.5%) of the $340,000 we're cashing in and, if we were wrong and the market goes higher, we'll still make $14,700. If not – we'll be thrilled that we took our $340,000 off the table, right? We're starting a brand new Options Opportunity Portfolio at Seeking Alpha on January 2nd with a $100,000 base – the same as we started back on Aug 8th, 2015 with the one we just cashed for $340,000 (up 240%).

I was just looking back at our very first trade in the OOP and, oddly enough, it was the Gold ETF (GLD) with the following trade idea:

GLD finished at $109.21 on Sept 18th, 2015 (expiration day) and that meant the $104 calls were worth $5.21 and we owed $3.21 back to the short $106 caller so we netted $2 per option contract and we had 20 blocks of 100 (2,000) for $4,000 back on our net $2,000 for a 100% gain on our first trade. That's always a good sign, right?

That's all we do over at PSW – we read the news, look at the macros, find undervalued positions and then construct a sensible options spread to leverage our CASH!!!, which we now have tons of on the sideline. Can't wait for next year!