America is great again.

America is great again.

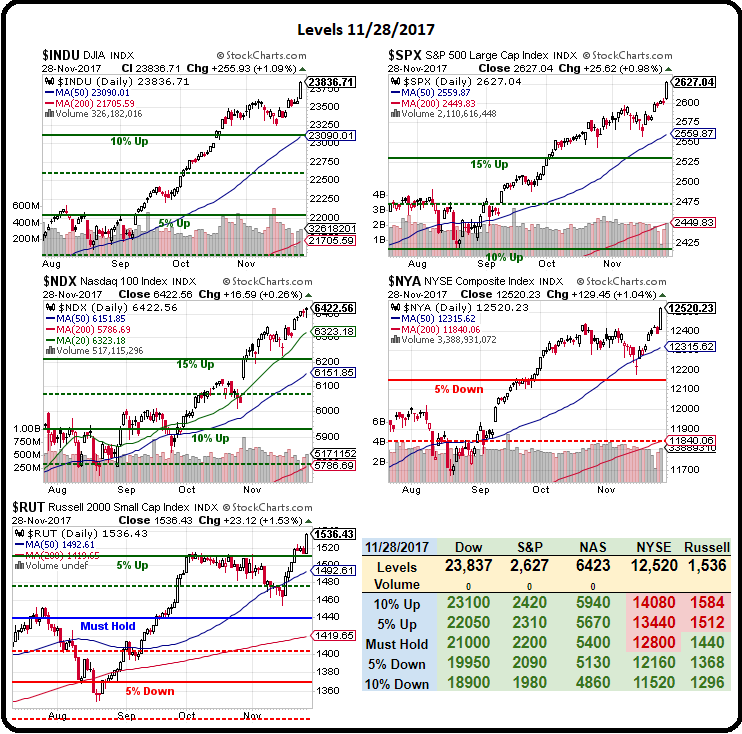

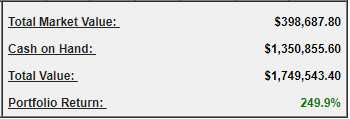

There's no denying it – from a stock market perspective, it doesn't get any greater than this. Forgive me for not believing but how can you deny how easy it is to make Millions in this market. It's the largest cash giveaway of all time – and all you have to do is play along. Out Long-Term Portfolio, for example, is just under 250% at $1.75M and we're being CONSERVATIVE – with 77% of our portfolio in CASH!!! (have I mentioned how much I like CASH!!! lately?) yet still, the EXACT SAME POSITIONS we just reviewed on Nov 17th at $1,698,372, are up another $51,171 (3%) in just 12 days.

At that rate of return (6%/month), we'll have $3.5M by the end of next year and why not – certainly we're working hard for it, right? Well, that's sort of the problem – we're not working for it at all and neither are the companies represented by these stocks – they are not growing profits or revenues to cover these gains – they are simply getting more and more expensive. Now, clearly a lot of the exhuberance in the market is about the forthcoming tax cuts but – even if we assume they are going through – how much of an impact will they really have when US Corporations only paid $444Bn in taxes last year?

That's on $3.5 TRILLION in profits so, on the whole, an effective tax rate of about 13% so how much will lowering the Corporate Tax Rate to 20% really accomplish? All it's going to do is lowe the rates for the companies that aren't already cheating by hiding their earnings overseas or funneling profits through partnerships so they can show losses to offset the gains. Will they effectively pay 10%? 9%? Even at 9%, they are only saving $130Bn yet the market is up TRILLIONS in anticipation of these cuts.

The ENTIRE market cap of the S&P 500 at the 2009 lows was $6Tn and today we are testing $24Tn with just 5 stocks; – FB, AAPL, AMZN, NFLX and GOOGL (FAANG), making up $1Tn. I'm old enough to remember when a Trillion Dollars was considered a lot of money, but not these days, with the S&P adding $1Tn (125 points) since October 1st.

The ENTIRE market cap of the S&P 500 at the 2009 lows was $6Tn and today we are testing $24Tn with just 5 stocks; – FB, AAPL, AMZN, NFLX and GOOGL (FAANG), making up $1Tn. I'm old enough to remember when a Trillion Dollars was considered a lot of money, but not these days, with the S&P adding $1Tn (125 points) since October 1st.

Where did this money come from? I don't know – what's the difference. The money is every bit as notional as the now $210Bn "value" of BitCoin, $180Bn of which was added this year – the year when money ceased to matter. That's how they will look back on 2017 – it's been a year when we lost our bearings and threw out rational valuation models and simply started paying WHATEVER for whatever struck our fancy at the moment. Someone just bought a picture for $500M, for God's sake!

We shouldn't complain about it – we should just take the money and run – just remember to get some off the table and have a few hedges – just in case. Having hedges gives us to confidence to keep playing the game and we don't need to be greedy when the market is spitting out 100% annualized returns. For example, back on Sept 20th, in our PSW Report, we published our fairly new Money Talk Portfolio which, at the time, was at $59,075 with just 4 positions:

Today, less than two months later, those same 4 UNTOUCHED (as I haven't been back on the show to make another call yet) positons are now worth $85,362 – a gain of $26,287 (44%) in just over 60 days. Come on folks – this is RIDICULOUS!!! I may be good but this is simply silly – you shouldn't be able to make money like this – it cannot end well!

It's even more ridiculous that I can go on TV and publically announce our trades and publish the portfolio and STILL it returns 44% in two months. I'm good but no one is that good – this is a broken system that is allowing already rich people (like us) to drastically increase our wealth and, if the lower classes aren't in the market – then they'll simply fall further and further behind which is great – because then they won't be competing for us for the things we like to buy, the land we want to acquire, the hotel rooms we like to vacation at.

Not only is the investor class able to double their wealth in a good year of trading (or 10x trading Bitcoins!) while paying just 20% tax rates on the gains (and 1/10th of what you pay for SS), but we'll be able to take it with us when we die now as the estate tax is eliminated. You poor people have no idea how completly F'd you are by this set-up as our children will own EVERYTHING in a couple of generations. America will truly be Great Again – the way it was when we had a monarchy!

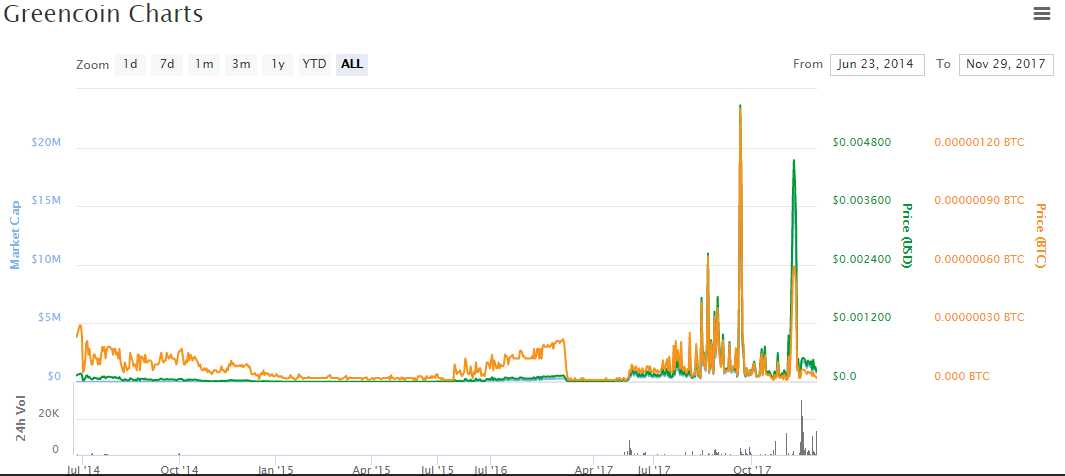

Speaking of GREAT – GreenCoins (GRE) have come down to 0.000220 which is still double where we told you we like them but 90% below the highs. I was going to wait to announce it but, while they are cheap, let's see if we can help make PSW greater by setting Annual Membership Prices at 0.00044 per GreenCoin so, if you want to get a 50% discount on any PSW Annual Membership (full-priced ones only – no additional discounts please!), we will put a floor in for the month of December and will accept payments in GreenCoin (via wallet transfer) at that rate.

In other words, a $1,495 Annual Top Trades Membership can be paid with "just" 3.4M GreenCoins or a $2,499 Trend-Watcher Membership can be paid with 5.7M GreenCoins, which are currently trading for $1,254. We are not doing this altruistically, our plan is to increase interest in GreenCoins while we accumulate them for ourselves. Greencoins are currently at about the level where BitCoin was when 10,000 of them were used to purchase a pizza – that would now be a $100M pizza!

There are many crypto currencies out there and we like GreenCoin because it has an environmentally-friendly kicker but it's just as likely to go worthless as any of them. On the whole, we think the BitCoin mania (almost $11,000 this morning) is out of control but, if it is ultimately accepted, we will see many crypto currencies getting a boost and it sure would be nice to have one of them in our wallets. See our "Crypto Corner" for all the latest news on the subject.

Crypto currencies are just another stealth way for the rich to get much, much richer in Trump's America as vast fortunes have already been made in what is now a $230Bn BitCoin market (up $20Bn since I started writing this post). Where does the $20Bn come from? Who cares, as long as we're getting it and not giving it, right? It sure didn't come from the economy, which grew just 3.3% according to this morning's GDP report.

Crypto currencies are just another stealth way for the rich to get much, much richer in Trump's America as vast fortunes have already been made in what is now a $230Bn BitCoin market (up $20Bn since I started writing this post). Where does the $20Bn come from? Who cares, as long as we're getting it and not giving it, right? It sure didn't come from the economy, which grew just 3.3% according to this morning's GDP report.

Economy up 3.3%, market up 30% – sounds bubbly to me but you've got to be in it to win it – so we'll keep playing.

Speaking of which, we officially announced our Trade of the Year on Hanes Brand (HBI) yesterday and we sent our a Top Trade Alert to our Members and published the trade for our Options Opportunity Portfolio over at Seeking Alpha and, this afternoon, I'd like to invite you to join us for a FREE Live Trading Webinar at 1pm, EST, where we'll talk about our Trade of the Year, crypto-currencies and other ways to keep up with the Trumps.

And, as I write this, BitCoin hits $11,200 – AMAZING!