The GOP tax plan, state and local taxes deductions – and you

Courtesy of Capri Cafaro, American University

The Capitol is lit up at dawn on Nov. 30, 2017 as Senate Republicans work to pass their sweeping tax bill. AP Photo/J. Scott Applewhite

While Washington is claiming victory, states are crying foul.

Late last week, the U.S. Senate passed its version of the tax reform package that cleared the House a few weeks earlier. Within the hundreds of pages of legislative language in each bill lay a number of provisions that have significant impact on state governments, including modifications to the state and local tax deduction.

Under current tax law, individuals who choose to itemize and deduct eligible expenses on their federal tax return are able to deduct state and local income, sales and property taxes. Both the House and Senate bills eliminate the so-called “SALT deduction” for state and local taxes while capping the property tax deduction at US$10,000.

As a former Ohio state senator, I served on the Senate Ways and Means Committee for a number of years. I also went through five state budget cycles over 10 years. Because of that experience, I believe the federal changes to the SALT deductions will be detrimental to American families and have long-term negative impacts on balancing state budgets.

An uncertain future

I am not alone in my concern.

The bipartisan National Conference of State Legislators issued a scathing statement on the proposed changes to the SALT deduction. The organization’s president, South Dakota State Senator Deb Peters, a Republican, expressed her opposition by saying, “SALT is one of the six original federal tax deductions and has been a staple of the federal tax code and the state-federal fiscal relationship for over 100 years. We will continue to fight for the more than 43 million Americans who claim this deduction every year.”

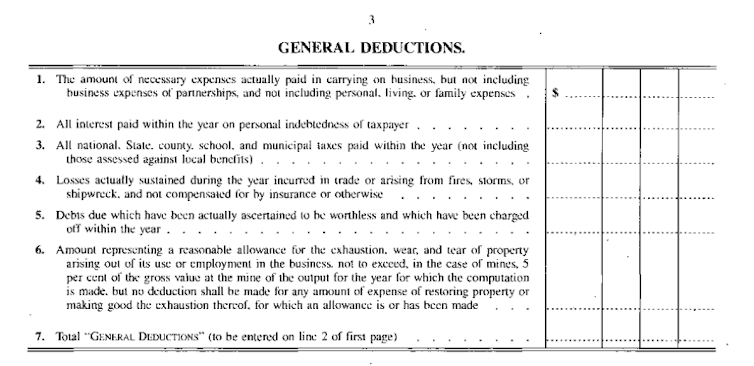

Page 3 of the 1913 1040 form, showing a deduction for state and local taxes.

State lawmakers have reason to be worried, as most state budgets rely on state income and sales tax as primary revenue streams for their operating budgets. According to the center left think tank Center for Budget and Policy Priorities, eliminating the SALT deduction could place strain on funding needed for critical programs and services provided at the state level such as education and infrastructure. Cities and towns usually benefit from property taxes. So the fact that the tax plan caps – rather than eliminates – the property tax deduction could help insulate local governments for now.

However, it has been my experience in Ohio that when the state cuts funds for essential services, the funding burden gets dropped to the local communities. During my time in the Ohio Senate, state government cut allocations to local governments. This caused local communities across my home state to cut safety forces and scale back infrastructure repairs. This is why the SALT deduction is so important. It essentially protects against double taxation and serves a bit like a subsidy to the state and local governments. If the SALT deduction goes away, state and local governments may try to lower taxes to offset the cost of higher federal taxes. What does this mean in real terms? According to modeling done by the Government Finance Officers Association, budget cuts caused by revenue shortfalls could result in cities and towns losing five police officers, 10 teachers and five public works employees.

The changes to the SALT deduction could hit Americans in two significant ways. First, citizens often carry the burden when states scale back their services. For example, when police and fire forces get cut, response time gets longer and community safety is jeopardized.

Second, individual Americans would also shoulder increased tax burdens should the proposed SALT deduction changes be signed into law. Elimination of the state and local income and sales tax deductions would result in a tax increase for those who itemize their deductions and deduct SALT. A report recently issued by the Government Finance Officers Association in partnership with seven other nonpartisan state and local government associations stated 30 percent of all taxpayers across all income levels use the SALT deductions, and 50 percent of those choosing to use SALT make under $200,000 per year. This means the SALT deduction is widely used by middle-income Americans. While the amount would vary by income, the Urban-Brookings Microsimulation Model estimates a roughly $2,000 increase in taxes on those taking the deduction.

Capping the property tax deduction at $10,000, while better than a full elimination, still falls short for a number of communities. California, Illinois, Texas, New York, New Jersey and most of the Northeast have the majority of property owners nationally that would exceed the $10,000 threshold. For example, in New Jersey the average property tax deduction is $9,500, meaning a fair number of property owners in the Garden State would fall above the $10,000 cap. In states with high numbers of properties that are above the $10,000 deduction, the cap threshold is not sufficient to offset the costs associated with the SALT deduction change.

![]() The data suggest that changes to the SALT deduction would result in higher taxes and fewer local services for a large number of middle-income Americans. Changes to SALT have passed both the House and the Senate. The bills must now come together in conference where the differences between the two versions are negotiated. While it is possible that changes could still be made, both versions of the bill have the same language. That makes it less likely to be modified. States and individuals alike will need to start planning for the changes on the horizon.

The data suggest that changes to the SALT deduction would result in higher taxes and fewer local services for a large number of middle-income Americans. Changes to SALT have passed both the House and the Senate. The bills must now come together in conference where the differences between the two versions are negotiated. While it is possible that changes could still be made, both versions of the bill have the same language. That makes it less likely to be modified. States and individuals alike will need to start planning for the changes on the horizon.

Capri Cafaro, Executive in Residence, American University

This article was originally published on The Conversation. Read the original article.