How long, can this keep going on?

"Well, your friends with their fancy persuasion

Don't admit that it's part of a scheme

But I can't help but have my suspicion

'Cause I ain't quite as dumb as I seem

And you said you was never intending

To break up our scene in this way

But there ain't any use in pretending

It could happen to us any day" – Ace

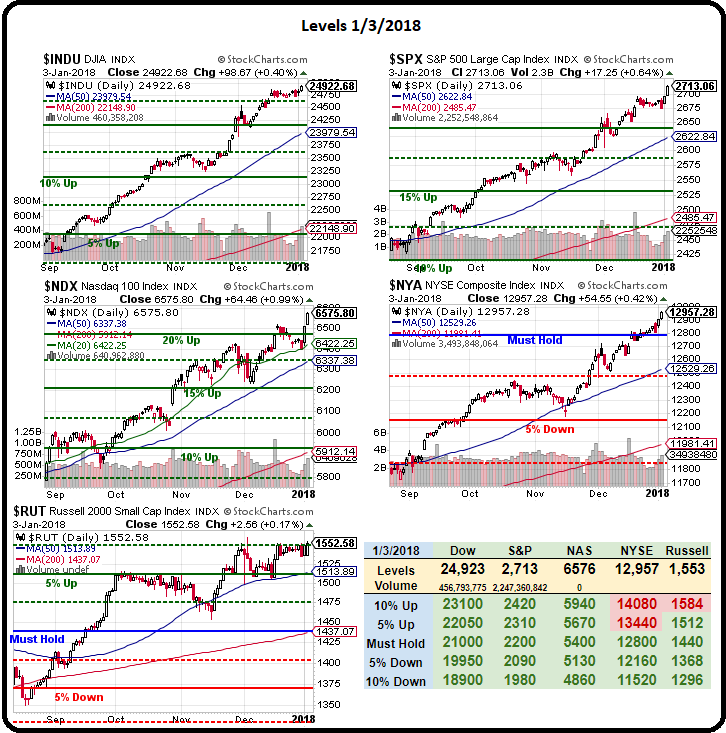

So far, 2018 is looking like 2017, with the indexes climbing up and up and, as I noted to our Members this morning, there's some good economic notes backing up the positivity including 18 states that raised the minimum wage on January 1st, which puts a bit more disposable income into the hands of 4.5M affected workers while putting upward wage pressure on 50M more. Those effects take time to roll in but rising wages is a trend we should be able to rely on.

Clearly the markets are loving it as we made fresh record highs and this morning the Futures are making even fresher, higher records but, as noted above, how long can this keep going on? What has actually changed to justify today's record high?

Clearly the markets are loving it as we made fresh record highs and this morning the Futures are making even fresher, higher records but, as noted above, how long can this keep going on? What has actually changed to justify today's record high?

You can't just keep rewarding the market for doing the same thing it always does otherwise, as I warned back on November 29th, we will all be Billionaires. While I'm sure you want to be a Billionaire, what's the point of it if everyone is a Billionaire? If that happens, you're going to be nothing if you aren't a Trillionaire – that's what happened in Zimbabwe, where they were printing $100,000,000,000 bank notes in 2009, right before their currency completely collapsed.

The US Dollar has collapsed by 4% since November and the S&P is up 6% but it's priced in Dollars so really only 2% gains priced in steady currency – but it looks pretty on the chart and people don't understand that stocks are priced in Dollars and there are two variables you need to look at to get the actual picture. None of that matters, what matters is hitting 25,000 on the Dow but then what?

Will the Dollar fall another 5%, below 90, which would be 12% down from 103 since Trump was elected? Is this how we're going to make America great again, by making a much smaller measuring stick? The S&P 500, priced in Gold, is just 0.3% higher than it was in December of 2016 (and down significantly against oil or Euros, which are up 15%) – the entire year of gains is essentially an illusion created by a weak currency and higher multiples paid by gullible investors – but that won't stop it from going higher – just something you should be aware of while you are playing the game.

Jeremy Grantham of GMO put out a note saying the market may melt up from here, before crashing hard, saying:

“I recognize on one hand that this is one of the highest-priced markets in U.S. history. On the other hand, as a historian of the great equity bubbles, I also recognize that we are currently showing signs of entering the blow-off or melt-up phase of this very long bull market.” – Grantham

Bubble factors cited by Grantham include increasing concentration on certain stock market “winners,” the outperformance of quality and low-beta stocks in a rapidly rising market, “extreme overvaluation” and the role of the Federal Reserve who, just yesterday, released minutes that show they are indeed concerned that the market is overheating and will almost certainly hike rates 4 times this year.

Here’s Grantham’s summary:

Here’s Grantham’s summary:

- A melt-up or end-phase of a bubble within the next six months to two years is likely, i.e., over 50%.

- If there is a melt-up, then the odds of a subsequent bubble break or meltdown are very, very high, i.e., over 90%.

- If there is a market decline following a melt-up, it is quite likely to be a decline of some 50%.

- If such a decline takes place, I believe the market is very likely (over 2:1) to bounce back up way over the pre-1998 level of 15x, but likely a bit below the average trend of the last 20 years, as the trend slowly works its way back toward the old normal on my ‘Not with a Bang but a Whimper’ flight path.

Grantham suggests putting money into Europe, Australia, India, China, not so much US equities, which he feels have run their course. Yesterday, we published our own Watch List (Members Only) with 8 trades added to our portfolios so far and another 14 we're keeping our eye on. If there is going to be a melt-up, we certainly don't want to miss out but we will begin adding some hedges along the way but, first, we will establish our longs.

I will continue to add new positions to the watch list this week and we'll review the new portfolios over the weekend. On the whole, we're still expecting a bit of a sell-off this month but, so far, there are no signs of it.