Dow 26,000? Really???

Dow 26,000? Really???

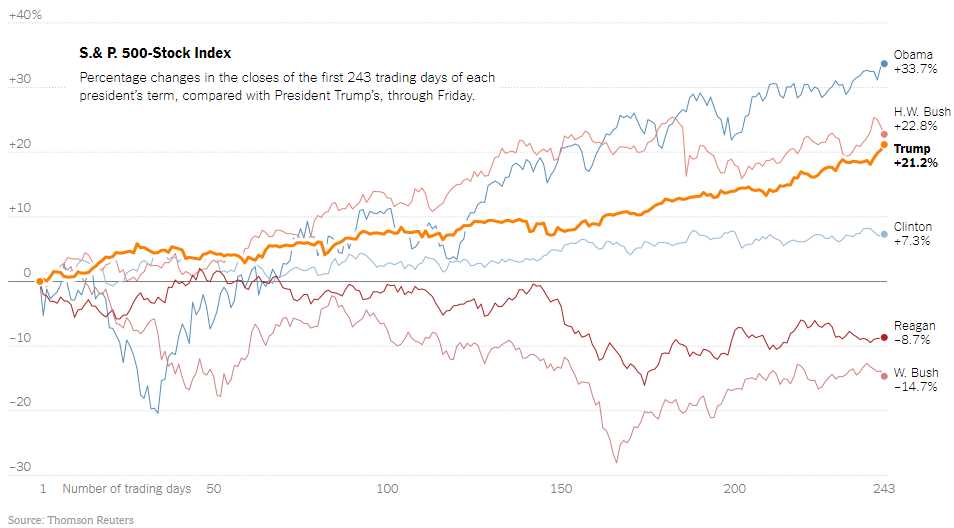

That's right, the Dow blasted 1% higher this morning to hit 26,000 and the S&P 500 hit 2,800 and the Nasdaq 100 hit 6,800 and the Russell hit 1,600 all record highs ahead of the Government shut-down on Friday (not really, they will extend it again). Meanwhile, this puts Donald Trump only 12% behind Obama for first-year market rallies and he only had to promise a $1.5Tn tax cut to get it. George Bush I also beat Trump – and that guy wasn't even trying!

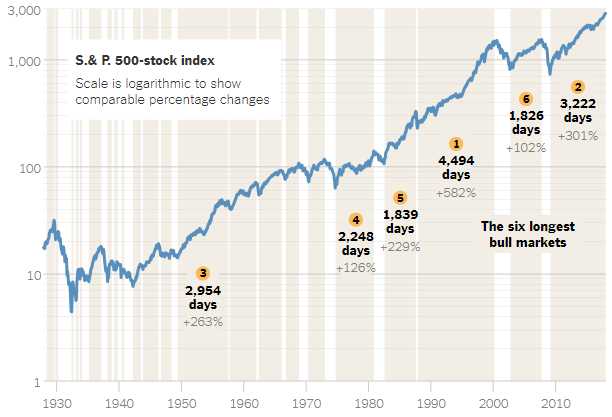

Obama's rally peaked out on Jan 19th, 2010 at 1,150 on the S&P and then we fell for a month – back to 1,050 (10%) but then we rallied to 1,200 (April) but then we fell to 1,050 again (July) in a very exciting second year. Of course, those consolidation waves set the base for the next 1,200 points and then Trump took over we're up another 600 but, of course, Trump is taking credit for the whole 3,222-day rally – even though he's only been President for 10% of it.

Notice the Clinton Rally lasted 4,494 days and was much, much bigger (582%) than our rally (301%) and yes, it was pure lunacy at the end of the dot.com boom but this is the no tax boom and crypto-idiocy boom and 2,000 lie boom – all rolled into one. Sure, in a few years, we'll look back at this rally and say "What were those idiots thinking?" and we'll forget "those idiots" were us and yes, I'm including myself because, despite warning you to be cautious, we put 20% of our CASH!!! back to work this month in our brand new Member Portfolios.

FOMO (Fear of Missing Out) is what drives the markets and, if we are on the way to a Clintonesque 100% additional gain from here (Dow 50,000?), then we'd feel like real idiots missing out on that rally, even if there is "no inflation" – according to the Fed. As you can see from the Relative Strength Indicator – since 1960, we have never been this "strong" in the market and forget the fact that all those peaks ended in disaster – just MAGA!

There is some really crazy stuff going on in the markets at this point. Coca-Colar (KO), for example, is trading at 45 times earnings and 36 times cash flow even though revenues dropped 14.6% year over year. Merk (MRK), another Dow Component and another S&P heavy-weight, is trading at 56 times earnings and 39 times cash flow despite 3-year average sales declines of 3.3% PER YEAR. McDonalds (MCD) is trading at almost 50x cash flow but "only" 25x earnings thanks to massive stock buybacks – something that is saving many companies these days. Sales at McDonalds are down 10.4% from the prior year and the stock has jumped over 50%, from $115 to $175 as "punishment".

This is just like looking back at the wild valuations of the Dot Com era and saying "how could people invest in those things" only this is happening now and those people are us, right? Now, these are not the stocks we are buying. We're buying stocks that are still decent values and, this morning, those of you who missed out on GE will have another chance as the stock drops back to $18 after a huge one-time write-off ($6.2Bn) and suspension of the dividend. This is something we expected as new CEO, John Flannery, cleans house AND takes advantage of higher tax rates to do a write-off. It's also a good excuse to increase job cuts to 12,000 over the next two years.

We reviewed our GE play on Friday and it should be back to our original price now – if you are brave enough to buy them when they are down. In theory, a rising tide should lift all ships, eventually but, if not, we'd sure rather hold onto companies that are earning 1/10th of their market cap each year than ones that are taking 30-40 years to return your per share investment.

This is the first week of earnings season and we'll finally get some indication of 2018 guidance as we close the door on 2017. We'll be most interested, at this stage, in taking close looks at stocks that miss expections and are unduly punished – that's one way you can find bargains – even in runaway bull markets.

As much as I don't trust the markets, we have to play along and, so far, our Long-Term Portfolio has been matching the market gains – despite the fact that we've used only 10% of our buying power. In fact, on Friday morning, we were at $521,755 – up 4.4% for the month and, at Friday's close, we were at $525,787 – up another $4,000 for the day. It will be interesting to see where we end up after today's rally but we only need to gain $5,000 to keep up with a 1% gain in the Dow – so no real rush to add more positions just yet – tempting though it may be to jump on the bandwagon.

If the market is really going to gain 1% per day and be up 200% by the end of the year – I think we'll be happy merely matching that and being up $1M on our $500,000 start BUT, if the market pulls back and corrects – THAT is when we can truly gain an advantage with a great opportunity to deploy our cash – while others are panicking. As I noted last week, you don't win in the long run by beating the rallies – it's holding onto your gains when the market corrects that makes you a great long-term investor!

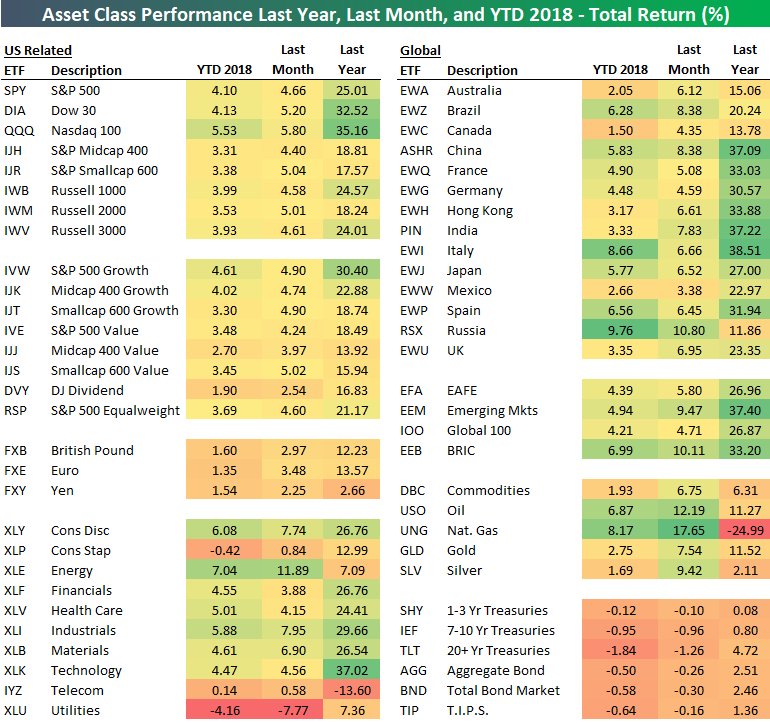

So far this year, the best-performing index is Russia's ETF (RSX), with a 9.76% gain:

That's right in line with our prediction from way back on October 11th, when I chose Brazil and Russia as my top two country ETFs for 2018. On Russia, I said:

Russia is being held back by the turmoil in the states (they are the subject of investigations in the House, the Senate, the FBI, CIA and, of course, the Meuller Investigation) so they are lagging the way a company under investigation tends to lag. Low oil prices have been hurting them but just this morning both Russia and Algeria stated they will work with OPEC to cut production and drive up oil prices to screw you at the pump – isn't that great?!? They've also given marching orders to Donald Trump, who is doing his part by removing mileage requirements from autos that Obama put in place, which drove the US fleet average from 20mpg to 35mpg over the past 10 years – lowering the overall demand for oil.

So why not back a winner and invest in Russia? At least we know the leadership there is stable – I don't see Putin having any Twitter wars with his staff or members of the Duma, do you? It's a shame we missed the dip in June but Russia is begining to usurp the US on the International stage, so why not place a small bet on Rex Tillerson's favorite country? Here's a nice spread for RSX:

- Sell 10 RSX 2019 $20 puts for $1.75 ($1,750)

- Buy 15 RSX 2019 $20 calls for $3.30 ($4,950)

- Sell 15 RSX 2019 $25 calls for $1.05 ($1,575)

Here we're laying out just $1,625 in cash on a spread that will return $7,500 if RSX is over $25 in Jan, 2019. That's a potential gain of $5,875 (361%) in 16 months and the risk is owning 1,000 shares of RSX at $20, plus the $1,625 cash if all is lost on the spread so net $21.08 is still $1.17 (5%) cheaper than it is now as your worst case.

It's been a bumpy start but now the $20 puts are down to 0.88 ($880) and the $20/25 spread is net $2.85 ($4,275) for net $3,395 and that's up $1,770 (108%) in 3 months (you're welcome) but only "on track" for the full $7,500 – so still a double to be had from here – even though we're past the intial uncertainty.

This is why we're not worried about missing anything by being cautious during this rally. Either we make it through ernings season and we get a bit more aggressive in our portfolios or we have a nice a pullback and we have a chance to go bottom-fishing on the pullback – either way we win!