I was on TV last night and I predicted we had another 2.5% drop in us as yesterday's gains (such as they were) were entirely due to Boeings 16-point gain for the day, which accounted for 144 points to the Dow's 72-point gain so, on the whole, the Dow should have been down 72, not up 72 if BA hadn't had earnings yesterday.

Of course we played for bounces into the close with a Russell (/TF) long at 1,575 and and S&P long (/ES) at 2,820 in our Live Member Chat Room at 3:33 and those paid a quick $250 per contract on /TF and $200 per contract on /ES on top of the $200 we made in our Live Trading Webinar at 1pm but by the time I was on TV, at 7pm, the markets had gotten silly again and I called for shorts at Dow (/YM) 26,200, S&P 2,540, Nasdaq (/NQ) 6,985 and Russell 1,582.50 as well as a play on the Dollar (/DX) long at 88.75 – though my actual call there was that 88 would hold.

We also discussed our Money Talk Portfolio, which gained 74% for the year from picks I made live on the show in a $50,000 portfolio and we added trades on General Electric (GE), Barrick Gold (ABX) as well as a hedge using the Nasdaq Ultra-Short (SQQQ) just in case the FANG stocks mess up earnings tonight. The Futures shorts are way up this morning (8am) with the Dow down 86 points to 26,050 so up 150 at $5 per point is a gain of $750 per contract on that one and /ES is 2,822 (up $360 per contract), /NQ 6,942 (up $860 per contract) and /TF 1,575 (up $375 per contract) so, of course we're keeping tight stops on those gains in this crazy, crazy market as the Egg McMuffins are paid for and that's all we need from our breakfast trades.

Today is a heavy data day with Productivity at 8:30, Consumer Comfort and PMI at 9:45 along with ISM and Construction Spending at 10 and Auto Sales throughout the day but none of that really matters as Non-Farm Payroll is tomorrow morning (8:30) and we'd better be up from last month's terrible 146,000 jobs and that doesn't even matter because, tonight, we get earnings from Apple (AAPL), Amazon (AMZN), Alibaba (BABA) and Google (GOOGL) with Facebook (FB) already reporting slightly disappointing earnings last night.

We have plenty of longs and the thing that is most likely to wreck the market this week is diappointing FANG results so that Nasdaq (SQQQ) hedge (see: "Top Trades for Sun, 28 Jan 2018 19:53 – Money Talk Portfolio") or the Dow (DIA) hedge we dicussed in yesterday's report (see "Which Way Wednesday – Fed Edition") are good ways to protect yourself into earnings this evening and NFP tomorrow.

We have plenty of longs and the thing that is most likely to wreck the market this week is diappointing FANG results so that Nasdaq (SQQQ) hedge (see: "Top Trades for Sun, 28 Jan 2018 19:53 – Money Talk Portfolio") or the Dow (DIA) hedge we dicussed in yesterday's report (see "Which Way Wednesday – Fed Edition") are good ways to protect yourself into earnings this evening and NFP tomorrow.

As you can see from this Zachs chart, with 150 of the S&P 500 reporting so far, earnings are indeed pretty good, up 12% since last year, though a lot of that is Oil and Energy, which is up 185%. Without that sector, the rest are up 9% in earnings and 4.5% in revenues and that's really good – but is it good enought to pay 26% more for the stocks?

Call me old-fashioned but it seems to me we're overpaying by about 17% and, even if you assume this spectacular growth will continue, it's going to take two years of it to catch up to the current, sky-high valuations. We discussed this in yesterday's Live Member Chat Room:

I reach another conclusion that lower taxes will not have as big an impact as what is already priced in and the main benefits we're seeing are from repatriated funds, which are a one-time thing. So maybe we keep rallying this year (BA just said they are buying back $9Bn worth of stock, which is 5%) but that still doesn't mean I want to buy BA for $357, which is a $213Bn market cap for a company that made $5Bn last year (slightly less than the year's before).

If BA has $9Bn to throw around and if their business is going to grow to the point where they justify 40x earnings – then why aren't they hiring 15,000 people (+10%) and opening a new plant? TSLA spent $2.5Bn for a Giga factory so figure Boeing (BA) could spend that much and 15,000 $100,0000 people is "only" $1.5Bn so $4Bn, not $9Bn and they could produce 10% more planes on the way to the 100% more expected gains in production and profits that are baked into a p/e of 40.

They aren't doing that because they know it's a pop that doesn't last and they don't want to be sitting there in 5 years with empty factories and they have no viable competitors so why spend more money just to complete orders faster? But is that a reason to pay them 40x? Of course not – it's asinine! The problem Barry (and many others have) is they are wrong so long they feel the pressure to capitulate and rationalize the market but that's wrong because the market is behaving irrationally and, as Keynes noted:

"The market can remain irrational longer than you or I can remain solvent."

It will end when it ends and not a moment sooner.

That's our very simple premise for shorting the market at this level – we can't see a justification for the kinds of multiples that are being commanded by ordinary stocks and we are long overdue for a pullback of at least 5% – and even that is shallow compared to the run-up we've had – but it's a good start!

That's our very simple premise for shorting the market at this level – we can't see a justification for the kinds of multiples that are being commanded by ordinary stocks and we are long overdue for a pullback of at least 5% – and even that is shallow compared to the run-up we've had – but it's a good start!

Meanwhile, we're not there yet as the fall in the S&P from 2,870 to 2,820 is only 1.7% so, as Robert Frost said "Miles to go before I sleep." In fact, now it's 8:50 and the indexes have continued lower without a bounce so double those gains on our Futures shorts (you're welcome) and now the play is tight stops on 1/2 and looser stops (weak bounce lines) on the other half – in case we get a really nice sell-off today.

As I said to our Members on Tuesday as we hit Dow 26,000 – "another 600 points to go to complete this drop cycle". In fact, the Dow Futures (/YM) are just now crossing back below 26,000 (up $1,000 per contract on our shorts!) so a move down to 25,400 would make another $3,000 per contract if it happens so great for a new trade, right now, with tight stops above 26,000 means you risk losing $5 per point before you stop out vs potential $3,000 gains – THAT IS HOW YOU HEDGE WITH THE FUTURES!

As noted above, we were interrupted by the ridiculous over-reaction to Boeing's earnings (and they are buying back $9Bn worth of stock, which is 5% of the company) but, other than that, the market action was weak and we'll see how the next couple of days go but, so far, we've failed those weak bounce lines I laid out for you yesterday – and that's the bearish signal we've been looking for to indicate we've got another leg down to go from here.

Speaking of bearish signals, Q4 productivity dropped by 0.1%, missing estimates of leadning economorons of 1.4% by over 100% so nice job (as usual) boys! Las Q is revised down from 3% to 2.7% and Unit Labor Costs jumped from -0.1% to 2% – massive wage inflation kicking in with the low unemployment and what is Trump doing? He's stopping people from coming to this country and filling jobs – so of course wages will rise faster than productivity. That's why we call them Economorons – how is it they can't do this simple math?

On top of that minimum wages have been rising and Health Care costs are going up again as the GOP tries to strangle Obamacare and all these are factors that led us to assume Corporate Margins would begin to slip, leading investors (not idiot traders) to begin to rethink the ridiculous valuations they have been giving to stocks these days. Notice that, in the above chart, margins haven't improved at all, ex-energy, from Q3 (and only up 0.3% from last year) and those same improving margins for the Energy Sector are an added cost to everyone else. Again, that's why we call them Economorons – this is really basic, obvious stuff that they simply don't understand!

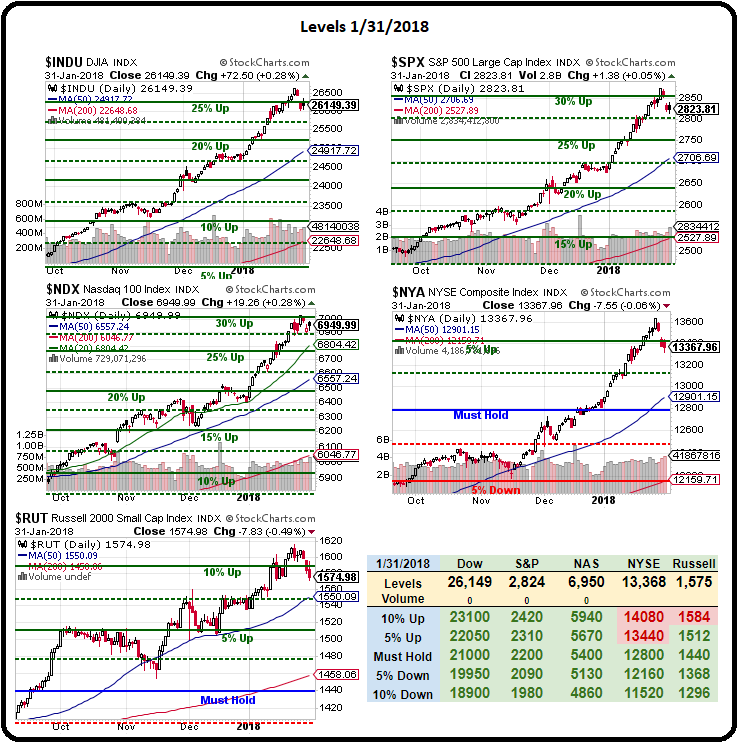

The indexes will pause into the open at 25,950, 2,810, 6,900 and 1,565 -those are the key supports but, if they break down without a quick, weak bounce (back over 26,000, 2,812.50, 6,912 and 1,567.50), it's better to look down than up to see where we're going:

Be careful out there!