Kondratieff Cycle Unhinged

Excerpt from Broken Mirrors, MarketShadows 9 23 2012

It is often proclaimed that, ‘History repeats itself.’ However, in cycles spanning less than cosmological time periods, this is untrue. Mark Twain was more precise: “History does not repeat itself, but it does rhyme.”

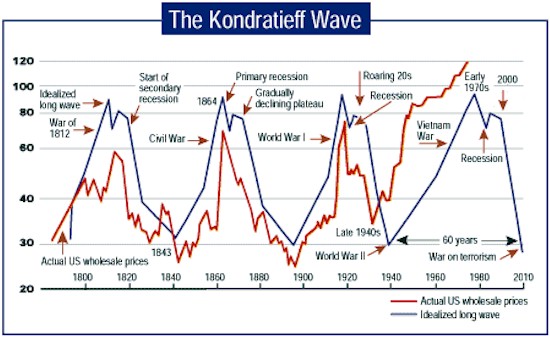

Cycles repeat, but new permutations can look different than prior ones. John Rubino wrote a fascinating piece on the Long Wave story. Examining the well-known Kondratieff Cycle, John explored this century’s added twist–the ability of central banks to create money out of thin air.

The Kondratieff pattern is on track to teach us the consequences of unlimited debt creation. While we cannot predict exactly how or when our lives might be turned upside down by the natural course of events, the times directly ahead are likely to rhyme with the age-old cycle. John Rubino describes the process in The Long Wave Versus the Printing Press: Central Banks Go All-In:

“The short version of the Long Wave story is that we’re emotional creatures with limited memories. For as long as there have been markets, we’ve been passing through the same sequence of mental states, beginning with anxious conservatism in the aftermath of hard times, followed by cautious optimism and finally – as the original “depression-era” generation is replaced by their clueless grandkids — let-it-all-hang-out financial excess. A horrendous debt-driven crash then resets the cycle.

“There are several variations of Long Wave theory, but the most famous is based on the work of Nicolai Kondratieff, a Russian economist who gave the various stages seasonal names, with summer and autumn denoting the peak of financial speculation and winter the aftermath of the resulting crash.

“The most recent cycle began after World War II and lasted until the tech stock crash of 2000, which means according to this theory we’ve already spent a decade in Kondratieff Winter. But the headline statistics published by the US and other major governments tell a different story, in which we have an anemic economy but not a depression.”

Did the cycle get suspended in midair? John argues that it did, because central banks have a new set of tools that allow them to prolong the cycle and postpone the inevitable. In past cycles, money was real, limited in supply. But not anymore. Now, the money at the base of the financial system can be printed into existence.

“Since the US broke the final link between national currencies and gold in 1971, everyone has been running fiat currencies that can be created in infinite quantities and depend for their value on the trust we place in the competence and honesty of our leaders.”

World governments acting in concert with central banks have been able to use unlimited credit to stem the flow of an inevitable debt implosion. The ever-lower interest rates and creative asset purchase plans have extended the Kondratieff cycle’s usual time-frame. As a result, the global economy continues to grow, anemically, and people are still hoping for a solution.

Meanwhile, unfunded liabilities, derivatives and “other exotica” continue piling up, but the Long Wave is still pressuring the global financial system. Without central bank life-support, John argues, the European, American and Japanese economies would rapidly implode.

“Over the past couple of weeks the European and US central banks have accepted this reality and announced open-ended asset purchase plans, implying that zero interest rates and unrestrained money printing will go on for as long as the markets keep accepting fiat currency.

“Does this mean the contest is over and the printing press has won? No, but it means that the analytical framework has to shift from linear to nonlinear systems… Double the size of a financial system and its chance of coming undone rises by ten times or more.

“By going all-in, the major central banks are committing to a progressive increase in the complexity of global financial markets. As more individuals and pension funds abandon cash and safe-but-low-yielding paper for higher-yielding but more-volatile stocks and junk bonds, the system grows ever-more fragile, making a crash both likely and more destructive…

“So here we are. The conditions for a global catastrophic failure are in place… There’s no way to know which dollar (or which external event) will start the avalanche, but without doubt something will.”

It might be a loss of confidence in the dollar, euro and yen, manifesting in hyperinflation. It might be the bond markets discovering they’re being conned, “pushing interest rates up in a spasm that’s too fast and widespread for central banks to counter…” We don’t know, we can only watch and try to prepare for the most salient risks. (Read the full The Long Wave Versus the Printing Press: Central Banks Go All-In)

John Rubino, is co-author, with GoldMoney’s James Turk, of The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998).