My thanks to Happy Trading for these charts:

Google has recently entered into a period of lower volatility, coupled with low volume.

Have people lost interest in Google or is the stock wound up like a coiled spring ready to explode?

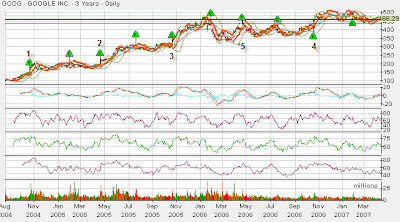

The long-range chart does indeed look interesting and a graph of the numbers bears out my logic, that this is an unusually low period of volatility for what we are used to thinking of as a very volatile stock:

|

|

|

|

|

|

|

Delta |

|

|

Date |

Open |

High |

Low |

Var |

Close |

Prior |

Avg Vol |

| Apr-07 | 458 | 474.3 | 452 | 22.13 | 466.29 | 8.13 | 3,843,900 |

| Mar-07 | 443 | 466 | 437 | 29 | 458.16 | 8.71 | 5,522,500 |

| Feb-07 | 506 | 506 | 443 | 62.97 | 449.45 | -52.05 | 6,418,200 |

| Jan-07 | 466 | 513 | 461 | 51.89 | 501.5 | 41.02 | 6,839,600 |

| Dec-07 | 486 | 492.4 | 452 | 40.06 | 460.48 | -24.33 | 4,711,100 |

| Nov-07 | 479 | 513 | 465 | 47.94 | 484.81 | 8.42 | 5,905,600 |

| Oct-07 | 402 | 492 | 398 | 93.77 | 476.39 | 74.49 | 7,490,800 |

| Sep-07 | 381 | 418.7 | 377 | 41.97 | 401.9 | 23.37 | 6,243,100 |

| Aug-07 | 385 | 390 | 363 | 26.64 | 378.53 | -8.07 | 4,779,600 |

| Jul-07 | 420 | 427.9 | 378 | 50.2 | 386.6 | -32.73 | 6,605,800 |

| Jun-07 | 374 | 419.3 | 372 | 47.73 | 419.33 | 47.51 | 6,756,300 |

| May-07 | 418 | 419.4 | 361 | 58.87 | 371.82 | -46.12 | 8,360,000 |

| Apr-07 | 390 | 450.7 | 388 | 62.79 | 417.94 | 27.94 | 10,143,900 |

| Mar-07 | 369 | 399 | 332 | 67.45 | 390 | 27.38 | 14,925,400 |

| Feb-07 | 389 | 406.5 | 338 | 68.67 | 362.62 | -70.04 | 17,734,800 |

| Jan-07 | 423 | 475.1 | 395 | 80.37 | 432.66 | 17.8 | 16,055,300 |

In the past 2 months, Google has moved a total of $37 on volume less than 1/3 of what it was at this time last year. We've been playing Google very well the past few months, working our Jun $490s and selling closer calls against them, often more than once a month. Now we are coming into earnings and, according to the above chart, we can expect an average of $40 during earnings months (bolded). Google does not need huge volume to make a big move, the stock jumped $74 last October and rose $41 in January (only to fall $70 from January's high to February's low)

At this point it might be worth mentioning that I am bullish on Google although that hardly matters around earnings as the results have little to do with whether Google makes or breaks their numbers. Happy tracks 5 instances since August '04 that Google has made significant jumps after earnings:

Pretty interesting pattern isn't it? Jump, skip, jump, skip, jump, skip, jump, skip (come on people, my toddler does these "guess what comes next" games!). I'm gonna have to go with jump here, partly to complete a 3 year pattern and partly because Google is expected to earn 44% more income with revenues tracking up over 60% and I just don't see what extra expenses they would have racked up (we're talking about $100M here) to offset what should have been a very merry holiday season.

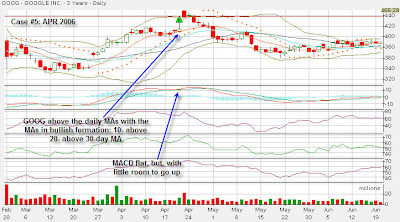

I think we are heading into a near mirror image of the pattern we had last April but I don' t know if we can get enough of a boost to break through $500 so I'm targeting $490, just above the upper edge of the current Bollinger band:

What we have going for us this quarter that we did not have in April '06 is that the MACD is not as "toppy", especially on the weekly view and the RSI is pegged around 50 vs. 64 at this point last year. With Google having recently pulled back 15% from its ATH and still just under 10% down on very low volume, an explosive breakout is a real possibility. Also, in the past three months, both the Nasdaq AND the S&P have left Google in the dust to the tune of 9%.

This means we need to abandon our existing strategy of selling current calls, tempting though it may be – and we may have a few pre-earnings spreads but, for now, let's just take some sensible covers. I'm hoping for a knee-jerk sell-off on the DoubleClick buyout to give me a good spot to take out my existing callers and pick up a few risky calls myself.

I'm going to use any up move to pick up some short-term puts to cover a catastrophe but I'll be hedging to the plus side and I'm willing to take my lumps if I'm wrong. We made a good dead bottom call with the bulk of our Julys on 2/27 but we picked up another 1/2 round on 3/30 and switched to the $500s for another half round on 4/3 based on my long-term fundamentals and the fact that I thought 4/3 was a great top to sell the Apr $470s and $490s into (and it was).

For these positions we'll be looking to buy back the $490s we sold pretty soon as they are already up 55% while the $470s we sold still carry a $12 premium so they will be the last to go. For every uncovered $5 of June call value, I will be taking $2.50s worth of May $430 puts (now $4.75) as a $30 drop should put me up to about $10 there while costing me perhaps $7 on the long end. If there's a $20 gain I should be able to recover $2 from the May puts and the June calls should go up about $7 so it's not a bad hedge on the whole.

As to possible new positions, bear in mind I'm hoping for a sell-off to perhaps the $460 level but pretty much any volume uptick should be the last we see of a Google sell-off barring a negative earnings surprise:

Safe(ish):

A) Buy the stock for $466 and sell the outrageously expensive May $470s for $16.35. This reduces your basis to $450. You can roll the calls if the stock trades down, or take advantage of dips to buy out the caller and resell as it moves up (this is what the big boys are doing to you!).

B) Play for the comeback of volatility ($40) by taking a spread of the May $510s for $2.30 and the May $410 puts for $2.18. Either one should be at least $8 if we get a $40 move within 30 days. If we get a fizzle, they should be 50% recoverable and we can also flip and sell Apr calls against them (risky but fun).

C) Make a tighter collar of the May $480s for $11.85 and the May $450 puts for $9.70. With absolutely no movement, the Apr $480s are $5.15 and the Apr $450 puts are $4.50 so this is probably your worst-case scenario post earnings bearing in mind a $14 move would be 1/2 the lowest move of any earnings month on our above chart.

Middle Play:

A) Assume they will have trouble breaking $500 and take the Sept $510s for $19.45 and sell the May $510s for $3.65. Again you can roll, or buy out on dips – Sept $540s are $10.85 so you lose $3 per $10 and you have July earnings in between to keep volatility up.

B) Take the Sept $520s for $16.15 and cover with the May $440 puts for $6.90. Sept $500s are $23.20 so a $20 move does it for you, leaving you with a very nice income producer for 4 months.

C) Split the June $500s for $9.80 with the June $440 puts at $10.10. You have 3 months in which a $40 move either way will put you in the money…

In a play like this, if I go in the money early, I like to reduce my holdings so I have just the profits remaining so either way I win.

Riskier:

I think Google may break up on earnings excitement , especially if we have a strong market next week, so I’m going to make a short-term play, even though I am likely to lose both ends of this bet. Keep in mind my wish would be for GOOG to tank tomorrow so I can bracket all these $10 or more closer:

A) Take the Apr $500s for $1.33 and the May $510s for $3.65 with the hope of selling the Aprils ASAP to reduce my basis on the Mays.

Can be covered with May $420 puts for $3.20 until you are comfortable with direction.

B) Take a 1/10 (of what you are willing to risk) position on the Apr $500s for $1.33. If that doesn’t work, by expiration, take a 2/10 position on the Mays that are $30 out of the money, followed by a 4/10 position in the Junes that are $30 out of the money at the close of May contracts. If the stock is still flat on June 15th, be glad you still have your 30% left and go get drunk!

The 30% is reserved for rolling your position when you get near the money; always, always take profits off the table!

The same trades can be done on the put side if you are bearish. Earnings are out Thursday night, and we can expect premiums to rise between now and then (minus time value, of course).

I am in no way suggesting it is a good idea to go right out and pay these prices, as my general practice is to wait for the stock to go the opposite direction and (as long as nothing new has happened to change my thinking), try to pick up a bargain in the opposite direction. We will keep on top of these in the member chat and I will be holding these picks private until at least Tuesday so we can get in position.

I will also be looking for daily volume to trend back towards 6m shares otherwise, we may not have enough fuel for the volatility we are looking for to make this trade happen. HappyTrading is also planning on providing updated charts on his site as we both look for trends to firm up during the week.

This should be fun!

Side note – Google's high valuation of DoubleClick should be a plus for their busines partner Yahoo as Eric Schmidt said about the DART system: "When we did a strategic review we realized the scale of the display advertising was much larger than we thought," said Google CEO Eric Schmidt on a conference call Friday. This is Yahoo's forte and it was not projected that Yahoo would continue on with DoubleClick as Panama was designed to take over those functions.

Also, look for big moves from VCLK and AQNT as the space is now "in play."