Good golly what a mess!

Good golly what a mess!

It looks like the administration's $800 chicken in every pot solution is not thrilling the rational part of the planet who both wonder how we will pay for this while also wondering how the hell this fixes anything at all.

I was going to write a post today about how our leaders can still save the markets but it may be too late. We had an emergency session on the member site today, which was supposed to be a day off but turned into a pretty sad death-watch on the global markets as one after another tumbled close to 20% off their summer highs.

To that end I'm going to run a special Big Chart that will give us levels to watch out for based on various possible retracement points we are expecting based on the 5% rule (and see today's comments for an extensive 5% rule discussion). The timing of this dip could not have been worse as I had chosen not to roll the majority of my callers last week, looking for a bounce this week, not a thud. It remains to be seen how far 250 naked DIA puts will take me in protecting the open positions but if we actually do open at 11,600 tomorrow, as the futures currently indicate, it's going to be one hell of an offset!

Usually in the big chart we don't use futures but I'm going to make an exception with the Dow, the Nasdaq and the S&P since I can see them on Bloomberg and we need to be prepared for tomorrow. This is some truly frightening stuff so look away if you have a weak stomach or haven't done much hedging! Don't forget the green you see is, for the most part off of levels that would represent a $13Tn destruction of global assets in 90 days!

| Fut. or | Drop | 25% | 20% | Feeling | 200 | |

| Index | Current | FromTop | Terror | Horror | Better | DMA |

| Dow | 11,592 | -2600 | 10,644 | 11,354 | 11,808 | 13,373 |

| Transports | 2,395 | -719 | 2,336 | 2,491 | 2,591 | 2,844 |

| S&P | 1,265 | -311 | 1,182 | 1,261 | 1,311 | 1,488 |

| NYSE | 8,794 | -1593 | 7,790 | 8,310 | 8,642 | 9,775 |

| Nasdaq | 2,294 | -567 | 2,146 | 2,289 | 2,380 | 2,614 |

| SOX | 349 | -210 | 419 | 447 | 465 | 472 |

| Russell | 673 | -183 | 642 | 684 | 712 | 800 |

| Hang Seng | 23,818 | -8182 | 24,000 | 25,600 | 26,624 | 24,364 |

| Nikkei | 13,325 | -4975 | 13,725 | 14,640 | 15,226 | 16,729 |

| BSE (India) | 17,605 | -3595 | 15,900 | 16,960 | 17,638 | 16,545 |

| DAX | 6,790 | -1327 | 6,088 | 6,494 | 6,753 | 7,704 |

| CAC 40 | 4,744 | -1424 | 4,626 | 4,934 | 5,132 | 5,752 |

| FTSE | 5,578 | -1176 | 5,066 | 5,403 | 5,619 | 6,435 |

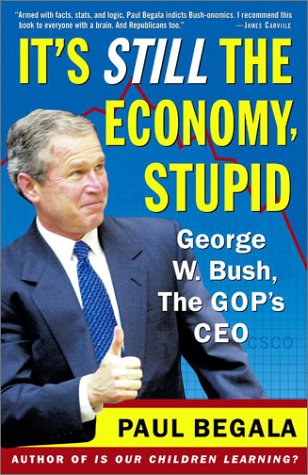

That's right, $1Tn a week since our October highs has disappeared from the virtual portfolios of global investors in what Bush, Paulson and Bernanke all called a "strong" economy just 2 weeks ago. I may not be as great an economist as those guys but perhaps the use of the word strong may have made them look just a tad wrong in their assessment. It takes confidence to keep an economy going and when the people lose faith in their leaders, they tend to pull back in their spending.

As Barry Ritholtz says in his post, "So Much for the Decouping..": "What is rather incredible about the past few years are the number of pinheads who so totally got this wrong. Not your run of the mill idiots who insisted Housing and Credit would have no broader impact; These hacks were merely blind incompetent cheerleaders. No, what really stunned me is the number of otherwise intelligent people who, once again, claimed "its different this time."

I highly recommend Barry's entire blog this weekend as he's summed up the issues quite nicely so I'm not going to bother rehashing them here. I will instead offer my solution to the problem. There is still time to get me on the ballot in Florida and I'll run as a Republican as I understand the field is wide open and nothing would be more fun than for me to get a spot in those debates – I have a thing or two to say to those guys!

Rather than toss money out of the proverbial helicopter and pray it finds its way back into the economy, I would propose targeting government spending to attack the actual problems we are facing. By the way, the administration's plan of giving $800 back to each taxpayer only applies to people who paid more than $800 in taxes, which eliminates the bottom 28% of our nation's households. One might think that a person who can barely afford to fill up the tank to drive to a $20,000 a year job so they can make their $1,200 monthly mortgage payment ($200K) which is properly deducted and leaves them with little or no tax bill MIGHT need the $800 more than the top 28% of the nation, who make $75,000+ a year.

Rather than toss money out of the proverbial helicopter and pray it finds its way back into the economy, I would propose targeting government spending to attack the actual problems we are facing. By the way, the administration's plan of giving $800 back to each taxpayer only applies to people who paid more than $800 in taxes, which eliminates the bottom 28% of our nation's households. One might think that a person who can barely afford to fill up the tank to drive to a $20,000 a year job so they can make their $1,200 monthly mortgage payment ($200K) which is properly deducted and leaves them with little or no tax bill MIGHT need the $800 more than the top 28% of the nation, who make $75,000+ a year.

The other part of "the Plan" is to allow business to make a large capital investment deduction in the hopes that this will encourage business spending but, just like the tax rebates, this is a trojan horse to send money to the rich as companies that were going to spend the money anyway suddenly find they get a fat new deduction while companies who are barely surviving can get themselves a brand new building for customers not to show up to and a fancy new phone system that will handle 30% less traffic with style!

My plan is targeted and simple:

- Freeze mortgage rates at current levels.

- Roll back rates to an 8% maximum.

-

Freeze foreclosures pending a review and allocate funding to put families back into homes.

- Aside from stopping 7,000 families a day from being thrown out of their homes destitute, it keeps them on the tax rolls and eases the housing surplus that is crippling the buiding industry and devaluing all homes in this country.

- With over 100,000 mortgage brokers out of work, we should be able to review 7,000 applications a day, even in a government agency…

Note that, so far I have spent no money but I have angered some bankers who were counting on charging people double the Fed funds rate but I'm even going to take care of them:

-

Guarantee the mortgage and bond markets.

- This is radical but, ultimately, the government is on the hook for it anyway if the whole thing falls apart and, by stepping up now, we can transform the loan virtual portfolios held by banks to AAA rated paper and they can refinance the virtual portfolios themselves at substantially lower rates.

- This directly and proportionately helps the companies who are suffering most and allows the financial communtiy to move most of the $120Bn worth of loans they have "written off" back on the books so they can SEND US money when they pay their taxes rather than skipping them through this advanced deduction program.

- Ambac performed this function as a $2Bn market cap company with just $18Bn in reserves, The US government will have no problem finding a favorable way to actualize the balance sheets on this project.

-

Invest back in America

-

I will offer up to $100,000 for a fair appraisal of every home in America with a 25% reduction (ie. we get $125K in value).

- This would reduce the average morgage of US homeowners who wish to participate by 40%, for most people, that works out to a MONTHLY reduction of a $250,000 mortgage of $666. The government will take an ownership interest in the home as an investment with with a 4% deferred interest against the sale price.

- The quick math on this is $2Tn if 20% of the US homes seek the aid, the 25% bonus should deter speculators (and it would be for owner-occupied only) and keep it from over-inflating home prices. Obviously the $2Tn can be financed which, at 4.5%, works out to $10.13Bn a month for 30 years (really, do the math!).

-

I will offer up to $100,000 for a fair appraisal of every home in America with a 25% reduction (ie. we get $125K in value).

Take our oil money back!

The US consumes 20M barrels of oil a day and at 42 gallons a barrel and $3 a gallon for refined products, that works out to $2.5Bn A DAY spent by US consumers on energy and NOT in other parts of the economy we are trying to stimulate. Since we send 60% of that money overseas where it disappears entirely, just $1 per gallon costs the US consumers $306Bn a year, double what the administration thinks would "stimulate" the economy.

Rather than go further into debt, the US can tap a small portion of the 1Bn barrel Strategic Petroleum Reserve by releasing just 3M barrels a week until prices come back to $60 (our 1/3 target). Since we will be selling this oil at the market price in competition with OPEC, we can simply put a buy order in at $60 to start replenishing the reserve. We can also enter into long-term purchase contracts meant to encourage increased domestic production.

Since 11Mb of oil a day are used by cars, it would seem obvious that raising the US fleets average mileage from 20 mpg should be a priority of a rational administration. Raising the average mileage of cars just 5 miles per gallon wold save us well over 2Mb a day of consumption. Getting our fleet average up to 35 mpg, currently the goal for 2022 can be achieved much faster with incentives.

Let the auto companies know what we intend and give them until 2009 to be fair but our auto companies already compete internationally, where 35 miles per gallon is the current GLOBAL AVERAGE – they save their gas guzzlers for the US market. Beginning in Jan 2009 we phase in a $1 per gallon gas tax over 4 years. This will generate $300Bn a year in revenues and add 30% to the price of gas. That 30% can be offset by any driver who wishes to purchase a higher mileage vehicle.

Establish 25 miles a gallon as a target price and offer $750 rebates per 2.5 mpg a new car exceeds them by. Charge a $750 per 2.5 mpg penalty for whatever shortfall a new car has. 16M cars are sold in this country a year, if we gave a $3,000 rebate to every single new owner for purchasing 35 mpg cars, it would cost the government just $48Bn (which would more than made up for by the new tax) but it would reduce 15% of the nation's fleet's fuel consumption by 75%, saving over 1Mb of fuel per day in our first year!

The incentives to buy new, fuel efficient vehicles would revitalize the auto industry and the lighter average vehicle weights would have the added benefit of reducing wear and tear on our highway infrastructure, saving tens of Billions more of federal money. Of course, a 75% reduction in fuel would also help out with that global warming thing, just in case that's real. It's a free market solution that even the conservatives can get behind!

This is why I still have faith in this country and our markets. We have suffered from years of terrible policy decisions but our problems are not too difficult to solve if we find people who are willing to lead. There are things that NEED to be done for the good of the nation but the nation needs to move past the political rhetoric and focus on solving problems and doing whatever it takes to make those solutions a reality.

Please send this to your Congresspeople, especially those who want to be President. They can debate me or they can steal this idea and pretend it's their own – I don't care as long as something gets done in this country. Send it to action committees and people who vote and tell them it's possible to have real dialogue and perhaps SOLVE some of our nation's problems, rather than blame the other guy or brush it under the table.

You can find your Congresspeople's EMail HERE!

We’re going to be either very lucky or very unlucky our markets are closed today, the timing of this is incredible – almost as if it were planned to shut out US investors as 2 years’ worth of gains disappeared over a weekend. I wonder if Hank Paulson’s old firm will do well this quarter…