After the Fed’s move Friday morning, we predicted financial troubles.

After the Fed’s move Friday morning, we predicted financial troubles.

Surprisingly it’s no particular lender in trouble (although the BAC/CFC seems iffy), the big story of the day is Federal prosecutors stepping up their investigation on sub-prime lenders in general. According to the Journal: "Prosecutors in the Eastern District of New York in Brooklyn have formed a task force of federal, state and local agencies that will involve as many as 15 law-enforcement agents and investigators. The U.S. attorney for the office, Benton J. Campbell, who supervises about 150 prosecutors, said the group will look into potential crimes ranging from mortgage fraud by brokers to securities fraud, insider trading and accounting fraud."

On top of this lovely bit of news we have Congress looking to pass legislation tightening liquidity and capital requirements for securities firms. “The Fed’s going to demand greater transparency into these balance sheets,” said Todd Petzel, CIO of Offit Capital Advisors LLC “You can’t have the Fed in a `trust-me’ mode.”

Major issues being debated include toughening the Basel II accord setting standards for how much capital banks must hold, Paulson’s plan to let insurance companies choose the federal government as their main regulator and calls from the financial- services industry to allow more flexibility on so-called fair value accounting rules. These standards oblige companies to estimate the worth of assets, including subprime mortgages, that don’t have readily available market prices.

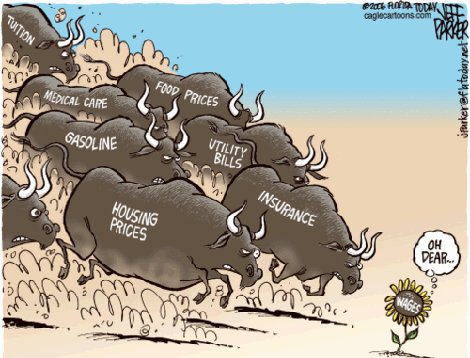

And, of course, the 800-pound gorilla that is growing globally at about 7% a year is – Inflation! The NY Times had this excellent chart (above) showing how inflation impacts each segment of consumer spending which is fascinating when you zoom in to view each individual item. It nicely highlight’s a gaping flaw in inflation data as "Owner’s Equivalent Rent" makes up 24% of the CPI but has NOTHING to do with what it costs a person who owns a home to live there. This is the fairy tale the government uses to excuse giving Social Security victims a 1.9% COLA adjustment when food and fuel are up 20% for the year.

Our own inflation is being fueled today by an alignment of EU politicians and the ECB who, unlike our Fed, are taking a strong stand on inflation. The ECB has refused to follow the U.S. Federal Reserve and Bank of England in lowering interest rates after inflation surged since August, to reach a 16-year high of 3.6 percent in March. The bank argues that rising prices are a bigger threat to economic growth than the increase in credit costs resulting from the collapse of U.S. subprime mortgages. The ECB meets Thursday to set rates and the dollar is already selling off in anticipation of the bankers holding rates steady this week.

Our own inflation is being fueled today by an alignment of EU politicians and the ECB who, unlike our Fed, are taking a strong stand on inflation. The ECB has refused to follow the U.S. Federal Reserve and Bank of England in lowering interest rates after inflation surged since August, to reach a 16-year high of 3.6 percent in March. The bank argues that rising prices are a bigger threat to economic growth than the increase in credit costs resulting from the collapse of U.S. subprime mortgages. The ECB meets Thursday to set rates and the dollar is already selling off in anticipation of the bankers holding rates steady this week.

Our bullish premise for the markets rests on a rebound in the dollar taking some of the air out of the commodity bubble, allowing it to soft land without bankrupting either consumers or speculators but. after a brief break last week, the hot money is flying right back into commodities at the smallest sign of trouble. This is a fear driven market, much like the panic buying in housing that we saw right at the top of that madness, where people would stand on lawns in Florida bidding against each other for the chance to pay $2M for a 3Br home that was built for $300K just 5 years earlier – they said that would never end either…

Just ask yourself, are the people who are buying up commodities intending to actually use them or are they "flipping" them by leveraging speculative dollars and hoping a "greater fool" comes along to take them off their hands at ever increasing prices?

Speaking of fools and their bubbles: The Yahoo bubble popped this weekend as the MSFT, the ONLY real buyer, walked away and the stock dropped over 20% in overnight trading. The winner here is going to be Google, as this makes it quite apparent that neither MSFT or YHOO have a clue as what to do to take on their competition. We’re also loving our TWX play as Ballmer has $40Bn burning a hole in his pocket and needs to do something to kick-start the company’s Web program and buying AOL may be just the sort of futile gesture MSFT needs to make to keep people off Steve’s back for another 12 months – isn’t that worth at least $10Bn?

Of course, since it’s Monday it’s time for another episode of "When Bond Pimps Attack" and this week it’s PIM(p)CO’s Bill Gross’ pet Fed Chief, Alan Greenspan again using his years of public trust to pronounce: "The U.S. has slipped into an awfully pale recession and may continue to languish for the rest of the year. We are clearly receding,” he said in an interview with Bloomberg. Warren Buffett disagrees and says he "sees investment opportunities in the U.S. stock markets, and that widespread financial turmoil from the credit crunch is behind us."

Bank losses "aren’t over by a long shot, but a lot of it has already been recognized," he said, adding that the depth of the housing crisis, unemployment and other economic factors would help determine how long the write-downs continue. "The idea of financial panic — that has been pretty much taken care of," Buffett said.

Bank losses "aren’t over by a long shot, but a lot of it has already been recognized," he said, adding that the depth of the housing crisis, unemployment and other economic factors would help determine how long the write-downs continue. "The idea of financial panic — that has been pretty much taken care of," Buffett said.

Given the choice between listening to the opinion of a man who built a $200Bn company from scratch and a guy who destroyed a $13Tn economy in order to get his back scratched, I think I’ll go with Buffet!

Asia was mixed today with metals and miners making a big comeback on news of more South African mine outages. The Nikkei was closed for a holiday that also has much of Europe closed so we can’t tell much from action over there. A cyclone has killed about 4,000 people in Myanmar and has left hundreds of thousands of people homeless. This has hit Myanmar worse than the 2004 Tsunami, which "only" killed about 500 people at the time and displaced several thousand. Also taking consumers off-line in Asia is a very deadly virus in China that has infected 6,300 people (that they admit to) and killed 26 children – not good just ahead of the Olympics! On top of all that, rice prices have now tripled for the year…

The markets in Europe that are open are trading down a bit as ECB President, Trichet ratchets up the inflation fighting rhetoric and energy traders have taken advantage of London’s trading being closed to bump Brent crude pricing up $4 on very thin volume. So far (9am) US traders aren’t biting but right on the button we have Rent-A-Rebel activity in Nigeria and Turkey disrupting piplines in order to support crude prices.

Our markets are opening low ahead of our big Cinqo de Mayo happy hour party on Wall Street, so don’t expect much action this afternoon as traders clear out early and head to the nearest Mexican restaurant. Keep in mind that option expire a week from Friday so don’t hold any May contracts you don’t really, really, REALLY love and even then you should sell them…