Another week that flew by.

Unfortunately, this week didn't fly by in the "Oh wow, wasn't that just amazing" sort of way, this week flew by like a guy who snatched a gold chain off your neck while he drove by on a bicycle – kind of a painless mugging if there can be such a thing. We're right back where we started from after 4 days and pretty much right where we were 5 days before that and a month before that. The market went up, the market went down but when we zoom out to a more historical distance (say 5 years) all we really did is bounce off 11,000 and consolidate.

That's not really surprising considering the very conflicting signals we're getting from pretty much everywhere. Bespoke Investments put up a very interesting collection of headlines from various "trusted" sources telling us that yesterday's GDP report was everything from "healthy" (Washington Post) to "tepid" (NY Times) to "below estimates" (CNBC) to "fastest pace since Q3 2007" (Forbes). Come on fellas, it's the economy we're forecasting here, not an election – how about some certainty?

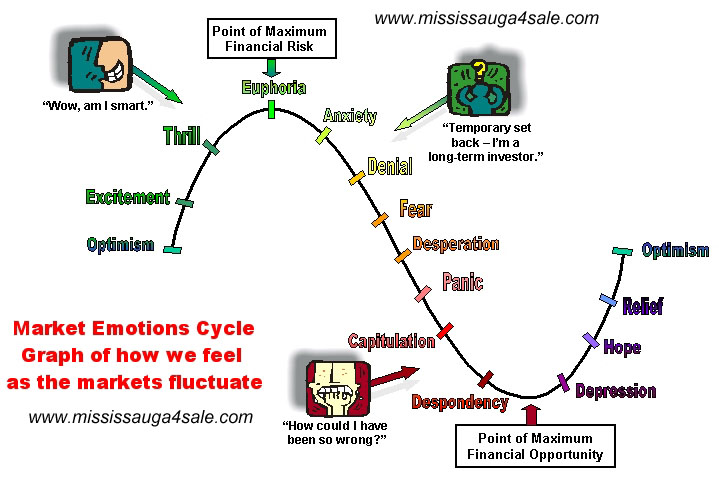

There is very little certainty on the stock market roller coaster we have all taken a ride on this month even though, in the end and just like a roller coaster, we didn't go anywhere! "Anger, fear, aggression. The dark side are they. Once you start down the dark path, forever will it dominate your destiny." – Yoda (who would have made a great trader) also said: "The fear of loss is a path to the dark side." Fear of loss is what the market hyenas prey on – you fear "the big loss" so you are more willing to take the immediate loss now, even though the future of your position remains uncertain.

Yesterday CNBC closed the day with Meredith Whitney, still dissing the banks despite the earnings coming out nowhere near her doom and gloom predictions and today they trotted out former Fed Chief turned bond pusher, Alan Greenspan to tell us (surprise) that "the US is nowhere near the bottom of the housing slump and is right on the brink of a recession." Greenspan's remarks came shortly after 3pm and knocked 150 points off the Dow in less than 60 minutes – the old boy's still got it!

It's Friday so it will be surprising to see a lot of capital committed ahead of the weekend. GM earnings are… are… errr, I simply cannot think of a word to describe how bad it is for a $11.07 company to lose $11.21 per share in a single quarter. Words simply fail to describe the sheer awfulness of this company. This is a $6Bn company that lost $15.5Bn in 3 months – THEY MUST BE STOPPED! It's not about the workers, there are 266,000 employees at GM and the company lost $56,390 PER EMPLOYEE or $18,796 a month PER EMPLOYEE – surely it would be smarter to just give them the money directly and stop pretending to run a car company, it's no longer even funny!

Sadly, GM is still a Dow component and somehow analysts (there are 13 "professional" analysts who follow GM for a living) "only" predicted a loss of $2.62 a share on the average with a range from -.72 to – $4.02. Does GM matter anymore? I certainly hope not and that's one of the reasons I can't take the Dow chart seriously. First of all, they switched MO and HON for CVX and BAC. CVX is down over 10% since the switch and BAC is off more than 20%, depsite the big comeback. GM is down 75% from last year and, of the other 27 Dow components, AIG, AXP, C, GE (1/2) and JPM are finacials (boo, hiss) and AA and XOM join CVX as commodity pushers.

BA has been slaughtered, CAT has taken a dive, GM needs Kervorkian, not Kirkorian, HD is in housing (boo, hiss), INTC is a semi (arrrg!), MRK and PFE are train wrecks unto themselves and MSFT is run by Steve Ballmer (say no more). Wow, what a motley crew to represent American industry in the 21st century! How about we scrap the whole thing and make a Dow that has no more than 4 companies from any given sector (Basic Materials, Conglomerates, Consumer Goods, Financial, Healthcare, Industrial Goods, Services, Technology, Utilities) and let's make sure those companies have been relevant in the past 5 years at least.

So stop watching the Dow and stop listening to people who are drawing Dow charts. Yes, we talk about the Dow all the time because it's big and in your face and it moves the markets but let's not lose site of what a very poor indicator of US economic health it is. The Dow is underperforming the Nasdaq and the Russell by 7% in the past 12 months, and is underperforming the NYSE and the S&P by 3%, which are also bloated with financials and energy stocks – the very things we NEED to rotate out of in order for us to build a better rally. Take a look at these earnings – this is not a catastrophe! Even guidance is generally flat. In-line guidance when everthing you are hearing from the MSM is panic is a sign of a bottom, not the top of Greenspan's slide.

To invest we need a premise and mine remains cautiously optimistic based on falling commodity prices (copper is still way too high at $365 and needs to break what looks like an uptrend to spook the metals markets), especially oil, which I've mentioned often enough is the key to everything. The dollar needs to recover (over 75) and housing has to bottom, which doesn't mean it can't go down further (prices still too high) but we're looking for some fresh money to come off the sidelines there as well. That's all we need to turn this market frown upside down – until we get it, we watch and wait.

To invest we need a premise and mine remains cautiously optimistic based on falling commodity prices (copper is still way too high at $365 and needs to break what looks like an uptrend to spook the metals markets), especially oil, which I've mentioned often enough is the key to everything. The dollar needs to recover (over 75) and housing has to bottom, which doesn't mean it can't go down further (prices still too high) but we're looking for some fresh money to come off the sidelines there as well. That's all we need to turn this market frown upside down – until we get it, we watch and wait.

They (whoever "they" are) have been assaulting us non-stop during the market's 20% slide with some of the worst-sounding economic forecasts in a generation but if you are old enough to remember the late 70s and early 80s, when 1 out of 4 people you knew were out of work and mortgage rates were in the teens, then you know that things are simply not that bad right now. The market rode out the recession from 1979 through 1987 with a 100% GAIN as Paul Volker RAISED rates over and over and over to get inflation under control for the first 4 years, then brought them back down for the second half of his term.

So let's not fear change, we need change because staying the course has been a bit of a disaster for the last 4 years. It's very easy to give up and walk away, that's what the chart above is telling us. "They" can't buy your stocks if you don't sell them so think about the company you own before you quit on it. You will hear analysts say they want to see capitulation, a big, dramatic sell-off and they are upset they are not getting it and I think trotting out Whitney and Greeenspan to tell us the world is about to end is their way of fomenting that bottom. Have you panicked? Have you capitulated? Are you despondent? If so, good, it's time to rally!

Jobless rates did hit a four-year high this morning with 51,000 more jobs lost in July, the seventh consecutive decline which pushed unemployment to 5.7%. This is NOT as bad as expected (as our expectations are soooooo bad) and we'll see how the markets take it but the weekend looms large and GM's earnings were a real catastrophe that more than offset what XOM made yesterday (and XOM was punished for that!). We have our own catastrophe as we attempted to bottom fish ELN this week only to find they have a whole new bottom as their second major drug (Tysabri) comes under fire in one week. Just this past weekend, the company reiterated they Tysabri had not had any negative side effects since the last scare – oops!

Asia was mostly down but China's president Hu Jintao lifted the Hang Seng and the Shanghai with a pledge to maintain economic growth "despite increasing challenges." China also increased the amount banks can lend by 5%, aiming to make credit more available to small businesses that have been hit hard by high energy costs. This is, unfortunately, supportive of high energy costs. Europe was way down but recovered on our jobs report, almost flat at 9 am.

So I'd love a nice rally today as it will put a stake in Greenspan's heart and we can finally shuffle him off to a home for the no longer relevant. Let's remember, it was Greenspan who blew this housing bubble in the first place and, rather than letting it deflate naturally, he gave the green light to ARM loans, turned a blind eye to bad bank practices and, when all that started falling apart, lowered rates almost to zero and created a commodity bubble all the while telling Congress that everything was under control. Now that he works for the bond-pushers at PIM(p)CO, he's telling you how screwed we are by bad government policies.

Damn, we are one gullible bunch of fools in this country!