Ouch, ouch and ouch again!

Ouch, ouch and ouch again!

Oil moved higher for the first time since last Wednesday, moving up 1.5% to close at $114.53 a barrel. We noted the strength in the sector at 10:36, when I commented that OIH was holding up well against the drop, then we saw the airlines heading down at 11:18 along with travel stocks. The Ags started making a move along with gold stocks too and, as I commented at the time "not the groups we’re rooting for." At 11:45 we caught the front end of the rally when I said to members: "Oils making a comeback despite flat crude, I think a lot of people are betting on inventory tomorrow. Only 65M Sept barrels remaining to get dumped at the NYMEX." So the conditions were there for a rally and oil exploded up $1.50, just after that comment.

Talk about the writing being on the wall! One thing we missed was that the dollar had bounced off resistance at 77.50, which is just about the 5% rule above the 50 dma at 73.52 so the stars were properly aligned for a commodity comeback. Fed Governor Fisher was no help as he made comments in the morning that he "expects economic growth to “decelerate to a snail’s pace, if not completely grind to a halt” in the second half of this year, with a slowdown that may extend into 2009." Fisher is the Fed’s dissenter, who favors easing rates and is out "talkng his book" to the media but someone should put a muzzle on this guy as his ill-timed statements amount to nothing more than a temper tantrum, thrown by a kid who didn’t get the rate cut he wanted at the last meeting. Fisher did save himself by quoting my "manic-depressive" veiw of the markets and related the concept to the commodity markets, saying that we may still see valleys in pricing that were as dramatic as the peaks…

Anything that even smacks of a rate cut is death to the dollar so it’s going to be up to Bernanke to show us a strong hand and respond with some strong dollar comments. While this is a natural place for the dollar to pause and consolidate, as the rally was getting a little out of control and beginning to worry US exporters, it’s a very fine line between keeping US goods cheap and bleeding consumers for gas and food prices. As I said on the weekend, it’s up to the non-commodity 80% of the Fortune 500 to use their political influence to let the Fed and the administration know that there are voters and (more importantly) contributors out there who do want lower commodity prices and a strong dollar.

Anything that even smacks of a rate cut is death to the dollar so it’s going to be up to Bernanke to show us a strong hand and respond with some strong dollar comments. While this is a natural place for the dollar to pause and consolidate, as the rally was getting a little out of control and beginning to worry US exporters, it’s a very fine line between keeping US goods cheap and bleeding consumers for gas and food prices. As I said on the weekend, it’s up to the non-commodity 80% of the Fortune 500 to use their political influence to let the Fed and the administration know that there are voters and (more importantly) contributors out there who do want lower commodity prices and a strong dollar.

We didn’t totally miss out on the rally, we grabbed some BHP calls in that same 11:47 comment as we’ve been watching that one for days and were ready to pounce. Goldman Sachs was also ready to pounce and decided this afternoon would be a good time to downgrade LEH, MER, MS and JPM. This was the second analyst on Tuesday to issue a report warning of big losses at Lehman. JPMorgan analyst Kenneth Worthington said before the market opened in New York that he expects a $4 billion loss for Lehman during the current quarter. Do you really still think this is not a coordinated effort to bring down the financials?

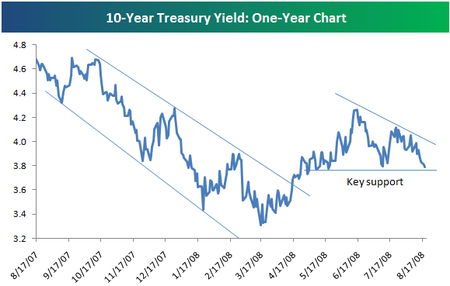

We did not hold our morning levels and oil did not break below $110. GOOG had another terrible day but AAPL held it together. HPQ had nice earnings and raised guidance, that might be good for something in the morning but the real test now comes on the financials as GS dropped the big one, usually marking the end of a round of hyena attacks. Meanwhile, all this nonsense about financial troubles is sending money flying into treasuries and the 10-year note is back at a key support level of 3.8 (Bespoke chart).

Perhaps the Fed had an alternate goal in talking down the markets as money flying into treasuries reduces borrowing costs and allows the Fed to raise their lending rates without impacting consumer borrowing costs – if so, well played boys! While people were happy to give the government their money for 10 years in exchange for 3.8% interest, they were not so thrilled to give it to FRE, who had to pay 4.16% to investors who bought $3Bn worth of 5-year notes.

All in all, a rotten day but the volume was low, the VIX was rejected at 22, HPQ had nice earnings so maybe, maybe, maybe GS is the final attack on the financial sector and we can get back to business tomorrow, hopefully along with a disappointing inventory report for the energy bulls. Speaking of energy, we’re doing an experimental bullish play on Russia with the RSX $41s, which are still $1.07. It’s a good way to play oil up or an end to the Georgia conflict, not a bad risk/reward with 4+ weeks to expiration.