"What are they doing here? They're selling Mortimer – God help us, We've got to get to Wilson and tell him to sell… Wilson, you idiot, get back in there at once and sell, sell, sell!"

"What are they doing here? They're selling Mortimer – God help us, We've got to get to Wilson and tell him to sell… Wilson, you idiot, get back in there at once and sell, sell, sell!"

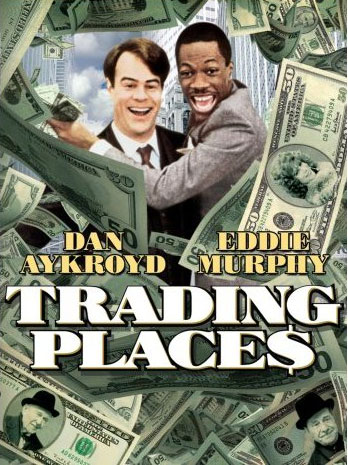

That's from my favorite movie scene in Trading Places and yesterday reminded me of that as blind panic once again took over the markets. Eddie Murphy's trading advice from earlier in the movie (2:40 on video) was very appropriate as we went bottom fishing during the carnage today. In a similar trading session he said: "It's Christmas time. Everybody's uptight. Pork belly prices have been dropping all morning. So everybody's waiting for them to hit rock bottom so they can buy cheap. The people with pork belly contracts are thinking, 'Hey, we're losing all our money and Christmas is coming. 'I won't be able to buy my son the GI Joe with the Kung Fu grip. 'And my wife won't make love to me cos I ain't got no money.' They're panicking, screaming, 'Sell, sell.' They don't want to lose all their money. They are panicking right now. I can feel it. Look at them…. I'd wait till you get to about 64, then I'd buy. You'll have cleared out all the suckers by then."

We're still not sure whether we cleared out the suckers or whether we were the suckers at a falling knife sale, but we maintained our 50/50 bias despite the carnage today and picked up upside plays on QLD, UYG, GOOG, LVS, DRYS, CAL, ABX, XOM, USO, JPM, UWM, LDK and CMI all bold (generally recommended) trade ideas and that's a lot in one day. Granted some were very well hedged entries but we're going for it on GOOG and the ETFs as I felt the market overshot to the downside yesterday much the same as I thought it overshot to the upside last week.

DRYS is a good example of what I mean by well hedged. At 3:17, in member chat, I put up a trade idea on DRYS at $15.67, buying the stock and selling the Dec $17.50 calls and puts for a combined $7.20. That reduces your entry point to $8.47 with a 106% profit on Dec 19th if called away at $17.50 and an average basis of $12.99 if the stock is put to you below $17.50 on that date. Even getting "stuck" with DRYS at $12.99 is a 23% discount off the current price, which is already down 80% for the year. We don't just make these trades on random stocks of course but we would LOVE to own DRYS at $12.99 long-term but, on the other hand, we won't cry too hard if we get called away with a 106% gain in 6 weeks either.

DRYS is a good example of what I mean by well hedged. At 3:17, in member chat, I put up a trade idea on DRYS at $15.67, buying the stock and selling the Dec $17.50 calls and puts for a combined $7.20. That reduces your entry point to $8.47 with a 106% profit on Dec 19th if called away at $17.50 and an average basis of $12.99 if the stock is put to you below $17.50 on that date. Even getting "stuck" with DRYS at $12.99 is a 23% discount off the current price, which is already down 80% for the year. We don't just make these trades on random stocks of course but we would LOVE to own DRYS at $12.99 long-term but, on the other hand, we won't cry too hard if we get called away with a 106% gain in 6 weeks either.

By entering a trade this way, we have established a break-even point on the trade of $12.99. Whenever we are entering a stock position for the first time, we need to look at the possibility of using options to give ourselves a discount up front. The caveat is, of course, that you must buy at least 100 shares and you must be willing to own 200 shares if they are put to you so it's not as useful a strategy for AAPL or GOOG for most traders and, of course, we prefer to pursue this play with stocks we feel are near rock bottom. In our XOM trade, we had a differenct strategy, we don't really like XOM but I felt that selling the Dec $65 puts at $4.05 was worthwhile as, much as I dislike them, I still don't mind owning XOM at net $60.95.

The same goes for USO, where we were able to sell the $40 puts for $1 on the premise that oil would not slip below $50 within 2 weeks. On USO, we also speculated to the upside with the $46 calls at $6 as we have observed a pretty reliable trend of oil rising into the weekend (the trade terminates tomorrow) and, if not, we felt that $60 would be a reliable floor for 48 hours. Balancing our risk/reward profile on each trade is key to building a strong portflio as is virtual portfolio balance in general.

Jordan made a comment in member chat today that I'm very proud of: "I just want to say thank you to Phil and the many well informed members here. The thank you is not about making lots of money (because I really do not). The thank you is about teaching me to have a virtual portfolio that is not bleeding cash even on days lke these. I used to routinely have 30% down days whenever the market tanked by 5%. Now on such days my virtual portfolio is much more stable (level). I think this is a great place to be in." That's just great, being able to stay even in a volatile market is the key to being a long-term investor. There are always solid opportunities as long as you can keep yourself in the game and that's what we're trying to stress with all the work we've been doing on balancing our virtual portfolios the past month.

Whenever we enter a position, we are "Trading Places" with somebody who's selling and with options, as they tend to have wide bid/ask spreads, it is critical to try to time your entries and exits to tops and bottoms as trying to buy and sell when the momentum goes against your bid will cost you an average of 5% on each end of the trade. That's why we pick up a lot of trades on our inflection points, even when the stock is going against our direction – once they turn up, we no longer can get the prices we want. The 10% rule allowed us to begin picking up speculative upside plays as we fell 8.5% off the top as we felt safe that, at the very least, if we continued down to 10%, we'd still get a bounce back to 8%. I laid out that logic for members at 12:25, as we crossed 8,800 on the Dow and we did indeed continue down to 8,600 (10% off the top) so now we expect at least a bounce back to 8,800. As I said later in the afternoon, if we fail that – THEN it's time to kill or cover the long positions but our goal now is to find a bottom and go 70% bullish.

We've come quite a way down from Monday's close, when we last ran the Big Chart. We were keying off the NYSE 6,232 level at the time and that gave us a great buy and sell signal on Tuesday and Wednesday. Now we're hoping to hold 5,600 (10% down) as our current hope is that we hold a 50% retrace of our probably ill-gotten gains leading up to election day (see yesterday's post re. the Plunge Protection Team).

|

|

|

3-Day |

2007 |

% |

Must |

40% |

50 |

25% |

|

Index |

Current |

Move |

High |

Loss |

Hold |

Down |

DMA |

Down |

| Dow | 8,695 | -618 | 14,021 | 38% | 9,000 | 8,413 | 10,089 | 10,516 |

| Transports | 1,802 | -120 | 3,114 | 42% | 1,750 | 1,868 | 2,032 | 2,336 |

| S&P | 904 | -62 | 1,576 | 43% | 925 | 946 | 1,085 | 1,182 |

| NYSE | 5,667 | -387 | 10,387 | 45% | 5,750 | 6,232 | 6,950 | 7,790 |

| Nasdaq | 1,608 | -118 | 2,861 | 44% | 1,650 | 1,717 | 1,953 | 2,146 |

| SOX | 219 | -18 | 549 | 60% | 222 | 329 | 281 | 412 |

| Russell | 495 | -43 | 856 | 42% | 500 | 514 | 617 | 642 |

| Hang Seng | 14,243 | -141 | 32,000 | 55% | 13,000 | 19,200 | 17,245 | 24,000 |

| Shanghai | 178 | 6 | 588 | 70% | 176 | 353 | 214 | 441 |

| Nikkei | 8,523 | -591 | 18,300 | 53% | 8,400 | 10,980 | 10,696 | 13,725 |

| BSE (India) | 9,964 | -667 | 21,200 | 53% | 9,750 | 12,720 | 12,328 | 15,900 |

| DAX | 4,858 | -262 | 8,151 | 40% | 4,600 | 4,891 | 5,509 | 6,113 |

| CAC 40 | 3,420 | -192 | 6,168 | 45% | 3,350 | 3,701 | 3,829 | 4,626 |

| FTSE | 4,357 | -179 | 6,754 | 35% | 4,200 | 4,052 | 4,746 | 5,066 |

I added a "Must Hold" column and those are appoximately the 50% retraces of the pre-election rally. As I said yesterday, I'm thinking the lows we had 2 weeks ago were clearly oversold so we should be able to hold the line at those levels going into the weekend. It would take a negative event, like a major bank failure or a country failure, to send us below the lows as terrible things are already priced in at those levels. Europe is bouncing ahead of the US open and took back those levels across the board but Asia followed the US down so it is up to American markets now to set the tone for the weekend. Hopefully, expectations for the Payroll report are already bad enough that they won't send us lower…

We don't get "bullish" (meaning not so bearish) until we either break above our 40% levels or spike back down to our lows in a volume capitulation move (maybe caused by the jobs report) and hold those so we're back to our favorite fence-sitting posture for the moment. We'll be hearing from President-elect Obama on Friday but I doubt he will be able to wave his wand and make the markets all better but a good speech can provide some much-needed backbone to the buyers who are out there, but are very, very nervous!