Here’s an article by Yves Smith at Naked Capitalism on Robert Rubin and accountability, citing a WSJ article "Rubin, Under Fire, Defends His Role at Citi" (subscription required).

Mirabile Dictu! Rubin Takedown by the Wall Street Journal!

Excerpt: "This ought to be a celebratory event, the scrutiny of a powerful player in the financial system who heretofore seemed immune to criticism. And what is interesting about the spotlight on Citigroup consigliere and board member Robert Rubin is that, unlike Greenspan, the reassessment is starting while he would still appear to have his hands on the reins of power. After all, he is still on Citi’s board; his protege Timothy Geithner is slotted to become Treasury Secretary, his buddy Larry Summer is head-of-the-National-Economic-Council-in-waiting.

Yet if the reaction in New York is any indication, the outrage about the speed and size of the second Citigroup rescue is considerable, and a recent Wall Street Journal piece fingered Rubin as a moving force behind Citi’s disastrous strategy to take on more risk in debt markets in pursuit of profit and better competitive rankings. And the only consequences to Rubin will be (hopefully) lasting damage to his reputation. But he gets to keep his cash and prizes.

Rubin refuses to take an iota of responsibility for the bank’s tsuris (and that also comes from the Goldman playbook. The firm always circles the wagons and admits nothing). Get a load of this:

Robert Rubin said its problems were due to the buckling financial system, not its own mistakes, and that his role was peripheral to the bank’s main operations even though he was one of its highest-paid officials.

"Nobody was prepared for this," Mr. Rubin said in an interview. He cited former Federal Reserve Chairman Alan Greenspan as another example of someone whose reputation has been unfairly damaged by the crisis.

Yves here. Unfairly damaged? Is this what leadership amount to in America? You have the power, you get the perks, but you only take credit for the good stuff?

A very simple psychological construct places people on a spectrum of internalizing versus externalizing:

When something goes wrong, we look for answers as to why-what caused this? How we deal with setbacks has enormous implications for how we feel about ourselves during these difficult times. Some people take the responsibility onto themselves-"it must have been because of something I did or didn’t do." We can call these people internalizers because they internalize the responsibility. This can lead to feelings of depression if one’s self-esteem takes too much of a beating. However, sometimes there is also the promise of a brighter future-"maybe I can do this differently next time so it turns out better." Other people are more likely to place the controlling factor outside of themselves-"it must have been someone else." We can call these people externalizers. In some cases, they will act out in anger over a bad situation. Externalizing frees them of any feelings of self-criticism or guilt, but it also leaves them powerless over the situation unless circumstances change. So, the price they pay is that they don’t learn anything new…

Back to the Journal:

Its [Citi’s] troubles have put the former Treasury secretary in the awkward position of having to justify $115 million in pay since 1999…

Yves again. Please, his pay should have been questioned long before now. He did not have his name on any deals, and he claims not to have gotten his hands dirty. Indeed, he contends the problem was not the strategy, but the execution, and by implication he had nothing to do with that.

Are we expected to buy that?…

Back to the Journal:

Mr. Rubin said his pay was justified and that there were higher-paying opportunities available to him. "I bet there’s not a single year where I couldn’t have gone somewhere else and made more," he said…..

Yves again. Yes, and I could make a lot more money dealing drugs, or better yet, providing financing to terrorists (one of my buddies says they make an absolute fortune). The issue is did you deliver value to Citi that bore any relationship to what you were paid? What you could have made elsewhere doing something different is a distraction from the question at hand.

To Rubin again:

Mr. Rubin said it is a company’s risk-management executives who are responsible for avoiding problems like the ones Citigroup faces. "The board can’t run the risk book of a company," he said. "The board as a whole is not going to have a granular knowledge" of operations…..

They do at Sandater, in fact, they consider that to be the board’s most important responsibility…

Back to the Journal:

The decision has been blamed in part for Citigroup’s problems, including the growth of its CDO holdings amid signs the mortgage market was unraveling. Mr. Rubin doubts that’s true. "It was not an inflection point," he said, but "I just don’t know what would have happened" if the decision had been different…

Yves again. So he denies that the CDOs or the assumption of more risk had anything to do with Citi’s near death experience, despite the evidence in the form of huge writewdown on recent positions…

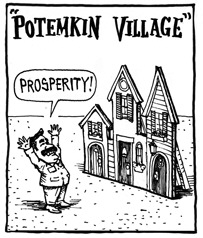

There is much more in this article, but it illustrates a pathology operative in our society. Why have we gravitated to leaders and advisors who built Potemkin villages and tell us that is progress, and then deny that they have any responsibility?..

Read the entire article, if you have the stomach for it."

Yves’s full article here.