After already spending enough money to make 8 Million Americans Millionaires (that's what $8Tn is!), the government is NOW looking to step in and buy up all the toxic assets Paulson said they were going to buy last year.

After already spending enough money to make 8 Million Americans Millionaires (that's what $8Tn is!), the government is NOW looking to step in and buy up all the toxic assets Paulson said they were going to buy last year.

This is called "leverage" – Paulson and Co. allow the situation to get so bad that you are forced to give him a blank check for $700Bn to "Fix It" and the Bush administration levers your cooperation into $8Tn of spending, NONE of which actually goes towards buying up any of the bad assets that we were told was critical to the system's recovery in the first place. So NOW we are going to be writing a $1Tn check (the opening, pre-levered estimate) to take the "bad assets" off the books of the surviving banks. Don't get me wrong, we did a similar thing with the Resolution Trust Corp and that worked but, knowing that history, wouldn't it have made sense to have done this first?

Had I known the government was willing to spend $100,000 times 80M households over just a 4 month period, I would have been more generous in my proposed program last April that solved the housing crisis by merely lending $100,000 to the then 4M homeowners at risk of foreclosure (a mere $400Bn stimulus) who could be saved by cutting their mortgage down with a principal reduction. In September, as the situation got worse, I pointed out that it would be much cheaper to just guarantee the mortgage payments on all 5M homes that faced foreclosure – a cost of "just" $5.8Bn a month that would effectively clean up all the balance sheets without necessitating taking possession of a Trillion dollars worth of properties and dislocating their owners.

I will make one final pitch for my idea, I won't rehash what is in the linked articles but, conceptually, if you offer $100,000 or more (since the government is 10x more generous than I proposed already) to reduce the average homeowner's mortgage payment by 50% to anyone who wants it (in exchange for $125,000 of equity in the home and 6% interest deferred to the eventual sale) you can allow the homeowner, with their government "partner" to refinance the remaining balance at 5% or less and save roughly $800 PER MONTH in payments. Now THAT is stimulus! The bank gets $100K in cash back against the principal on the home, the LTV ratio of the home drops by $100K (50% on most mortgages) and the consumers get $9,600 to spend in the economy on the things that make sense for them, rather than what the government chooses to subsidize.

Since the government can borrow money for 30 years at 4% easily, each $1Tn invested in US homes would cost $5.8Bn per month. The government is charging 6% interest on the money (payable on sale of the home) and is buying $125,000 worth of the homes value for $100,000 so this is, to a large extent, more of an investment than an expense. Keeping people in their homes helps support values and if home prices come back in the next 10 years this program would be a huge win for the government. Would you give up $125,000 of future equity in your home in exchange for a $100,000 mortgage reduction now – one that would allow you to refinance the balance at a more favorable rate? If it were an easy choice, we might be too generous but this is fair and would IMMEDIATELY reclassify the vast majority of the bad assets into performing loans and pump $1Tn in cash where it should go – back to the people who actually made the loans.

So send this to Congress, they are meeting today, and tell them to Fix It!

Speaking of fixes. OPEC wants US regulators to stop oil speculators, now that they are driving the prices DOWN. Abdalla el-Badri, secretary-general of the Organization of Petroleum Exporting Countries, is seeking rules to “limit the level of speculation” by investors who buy oil without planning to use it. “OPEC has repeatedly called for the need to reduce the role of excessive speculative activity in the market,” el-Badri, who will attend this week’s World Economic Forum in Davos, Switzerland, said in an e-mailed response to questions. “Today, it is impossible to know who is actually buying and selling oil futures.” Gosh I would laugh if I wasn't crying so hard! I was just saying to members yesterday that it is wrong to see oil at $40 as an indicator of economic troubles as IT NEVER SHOULD HAVE BEEN OVER $60 IN THE FIRST PLACE! When tulips in Holland went up 20 times in value and then collapsed, did that signal that the world economy had crashed or that tulip traders were idiots? The investing community has been making and popping bubbles for generations, using falling oil prices as evidence of a global slowdown is like using falling housing prices as evidence of a bad economy rather than an obviously necessary price correction. Oh wait, we're doing that too…

Speaking of fixes. OPEC wants US regulators to stop oil speculators, now that they are driving the prices DOWN. Abdalla el-Badri, secretary-general of the Organization of Petroleum Exporting Countries, is seeking rules to “limit the level of speculation” by investors who buy oil without planning to use it. “OPEC has repeatedly called for the need to reduce the role of excessive speculative activity in the market,” el-Badri, who will attend this week’s World Economic Forum in Davos, Switzerland, said in an e-mailed response to questions. “Today, it is impossible to know who is actually buying and selling oil futures.” Gosh I would laugh if I wasn't crying so hard! I was just saying to members yesterday that it is wrong to see oil at $40 as an indicator of economic troubles as IT NEVER SHOULD HAVE BEEN OVER $60 IN THE FIRST PLACE! When tulips in Holland went up 20 times in value and then collapsed, did that signal that the world economy had crashed or that tulip traders were idiots? The investing community has been making and popping bubbles for generations, using falling oil prices as evidence of a global slowdown is like using falling housing prices as evidence of a bad economy rather than an obviously necessary price correction. Oh wait, we're doing that too…

Not that there is NO connection but the fact is that a median home should not and can not cost 6 times the median income – that is simply unaffordable when the historical norm is closer to 3 times income. Either income has to go up or home prices have to come down but it doesn't take Einstein to realize the model is unsustainable when a 6% mortgage on a median $240,000 home costs the median $44,000 family $1,438 per month ($17,256 a year) which is more than 1/2 of their take-home pay. That leaves the family less than $16,000 ($1,333 a month) for food, fuel, property taxes, clothing, health care, etc. and then we wonder why $3 per gallon gas breaks the system? This was something we discussed in March of last year when I was a little bit early in predicting the collapse of the commodity bubble (but right on the money in hindsight – don't forget the Bush stimulus saved commodities April-July).

So oil shouldn't be $60 a barrel and homes shouldn't be more than 3 times a person's salary and I think it's GOOD that the commodity economy is collapsing. Unfortunately, the commodity economy (housing, mortgages, oil, metals, lumber, food) became our whole economy for the last few years and yes, there is a painful washing out period but it will be very nice when America can finally get back to business – hopefully a business that actually produces something other than trading commissions…

So oil shouldn't be $60 a barrel and homes shouldn't be more than 3 times a person's salary and I think it's GOOD that the commodity economy is collapsing. Unfortunately, the commodity economy (housing, mortgages, oil, metals, lumber, food) became our whole economy for the last few years and yes, there is a painful washing out period but it will be very nice when America can finally get back to business – hopefully a business that actually produces something other than trading commissions…

Today we are off to a rockin' start in pre-market trading as we are finally getting the move we expected since last week. Keep in mind that this is just another stimulated push up the roller coaster tracks and we are a very long way away from breaking out of our range (8,066 – 9,100) and we won't even take this seriously until we hit our mid-point at 8,650. We started the month at 9,000 so forgive me for not being impressed at 8,300 and we still have Friday to deal with when XOM, all by themselves, can send us back to 8,000 with a poor report. UBS downgraded them today but I laid out my bear case for members last night (maybe the analyst is a member) and we are hoping for another chance to short that train wreck at $80 today. We're also going to get a great chance to take out the DIA puts we sold and cheap rolls on our long index puts. They are just covers – we've been making bullish plays all week but, until we see some real sustained strength in this move, we're going to keep playing it cautiously now that our bullish plays are paying off.

China is still closed today and those FXI's we've been accumulating this week are primed for a very nice move. South Korea reopened this morning and jumped 6% out of the gate and Japan held their 5% gain from yesterday, adding another half a point and looking serious about holding 8,100 this time. Europe is also going strong this morning (and I'd be really worried if they weren't) and markets there are up nearly 3% across the board led by financials and the energy sector.

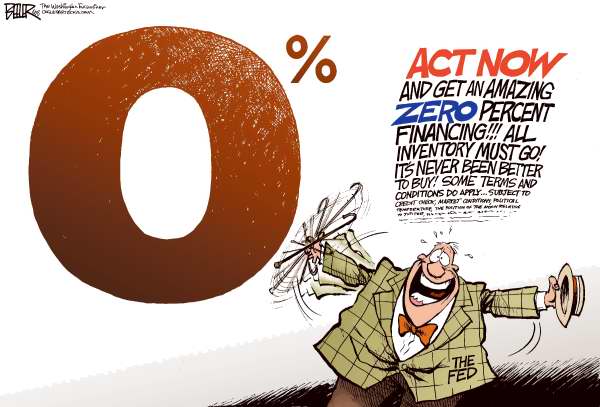

We have a Fed statement at 2:15 but what the heck can they do with the official rate already about zero other than say they will be holding it there for quite some time to nudge down the longer-term notes? Crude inventories are at 10:30 and we expect a net 5M build there. Last night we had pleasant surprises from YHOO, JAVA, SYK and GILD and this morning we are glossing over TERRIBLE reports from AAI, T, BA (due to strike), HES (danger XOM fans!), LM (lost 1/2 their share price this Q), USG, WLP and WFC – the last two who are both already being given a pass.

We have a Fed statement at 2:15 but what the heck can they do with the official rate already about zero other than say they will be holding it there for quite some time to nudge down the longer-term notes? Crude inventories are at 10:30 and we expect a net 5M build there. Last night we had pleasant surprises from YHOO, JAVA, SYK and GILD and this morning we are glossing over TERRIBLE reports from AAI, T, BA (due to strike), HES (danger XOM fans!), LM (lost 1/2 their share price this Q), USG, WLP and WFC – the last two who are both already being given a pass.

It's going to be an exciting session but lets keep our heads, we've made a ton of bullish plays the past two weeks expecting this move, now is the time to get a little skeptical and see if it sticks. If we can get past Friday without a retrace, I will start looking higher but GDP is Friday along with XOM earnings and that's going to be one major hump to get over!