Let's see what we can deduce about the mood of the country:

The mood of the markets is clearly negative but the ISEE put/call indicator shows a rising moving average, showing there are 20% more bullish options bets placed now than there were in November. That's not necessarily a good thing but it's the most bullish options have been since June and we're coming off a low last March of 85 (85 calls to 100 puts) back to 120. There are, of course, other factors – like perhaps these are bull hedges on bearish positions. Similarly, the CBOE put/call ratio is declining (more calls) and has also been since November. I had trouble finding a lot of gloomy articles because blogger sentiment has turned 65% bullish, which is getting kind of extreme!

Can the bloggers be right? Well they were extremely bearish in September and that would have been worth paying attention to but they flipped bullish too early and haven't changed much since. Our best market runs usually come when sentiment is slightly more bearish, climbing that "wall of worry" that they no longer make fun of on CNBC because it turned out to be the writing on that wall of worry that people should have been paying attention to rather than the idiots on their channel that told us to buy oil at $100 and go long on housing and the financials when they were about 1,000% higher than they are now.

For background, let's look at my bearish outlook on the economy in March 2007, when I said "Are our economic sins finally starting to matter?" I was way too early on this but, to me, the end game was evident even then. By August of that year I saw signs (and, being an M&A consultant I was sensitive to this) that the brokers were in as much trouble as the home builders saying: "While I hate to go out on an early limb with the brokers, I have to think the same forces are at work in that sector as well. I was too far ahead of the curve last September when I said Amaranth was just the tip of a very large iceberg and that the real speculators in the commodities game were MS, GS, CSR, DB, C and JPM. I got killed in the fall shorting those guys because I forgot the words of the great John Maynard Keynes who said: “The market can remain irrational longer than you can remain solvent.” Longer than we can remain solvent perhaps – but not forever!"

In fact, in March of last year, with C down to $20 from $50 I wrote "Meredith Whitney's Out on a Limb With This Citi Bashing" and I made a passionate case for C being able to withstand this crisis saying: "So let’s say Citi does only earn $1.49 per share and can’t pay its dividend, and let’s say that its losses are so severe that they don’t recover until 2010 and, even then, earnings don’t get past $2 per share. How much should we pay for $2 per share forward earnings?" Well, it turns out that C LOST $4.60 per share, suspended the dividend and plans to lose $1.43 this year and will make just .58 (they hope) in 2010 so $5 a share, or 75% down from March is about right for them if the economy doesn't pick up more than they project. Of course I stand behind my premise that this crisis was caused by the lack of confidence in the system that led to the massive write-downs and collapsing asset values that led to spiraling unemployment etc but…. what can you do? We need to deal with the situation as is here.

Even with the write-downs, the price to book ratio of C is 0.27 compared to 1.33 for WFC, 0.70 for WFC, 0.74 for GS, 1.27 for GE and 3.13 for XOM. Maybe C is underpriced and maybe XOM is overpriced – who knows (I guess Meredith did) but that's what the market is willing to pay at the moment. I have used the run on the bank scene in "It's A Wonderful Life" on several occasions to illustrate that banks live and die on investor confidence, which is why so many banks are called 1st or Trust or National – things that sound safe for your money. That goes for stocks too and, right now, there is no confidence in financials or the markets in general and people are not willing to put their money in either so the "value" of those things declines. Time magazine has an excellent article explaining "Why Your Bank is Broke."

In last year's "Mid-Year Report" I said: "MSFT did not spur a tech rally with Vista and the SOX are not leading us out of trouble and our OPEC friends have not helped us get the price of oil down (I’ve given up even thinking that the administration will do anything) and, of course, there has been no turnaround in the financials (quite the opposite) due to a similar lack of action to address the foreclosure crisis, which marches on and on and on and on… It doesn’t sound at all good does it and, if I were a foreign investor, I wouldn’t touch this banana republic with a 10-foot pole." It was, in fact, all downhill from there and that's where we are now – all of our worst fears realized at the near bottom of what may be a bottomless pit. In other words – if you think this sucks – wait 'till you see how bad it can still get!

Notice in the crash of 1929, the Dow fell from 380 on Aug 30th to 200 on Nov 13th (47% in 3 months). This is not dissimilar to our recent dip from 14,000 to 8,000 (43%) over 12 months. The Dow made a recovery back to 300 (call it 50%) over the next 6 months but THEN fell all the way to 40, YES 40, in July of 1932 in a horrible, relentless destruction of 80% of the wealth of this nation. So when I say we are not out of the woods yet, I'm not talking about the path you took between the school and the soda shop – we're talking about being dropped in the middle of the Amazon jungle with no shoes or supplies and a paper clip as your only tool kind of woods and this is simply not likely to be the kind of thing you get out of quickly.

I was speaking to a venture capital firm this week and we were talking about what industries could lead this country out of a recession and we concluded that it's very unlikely that any of our existing industries can. Of the 5M people who have lost jobs the past 2 years, 1M were construction workers (about half) and another million were in the supporting mortgage/financial and real estate industry and a million of the people who are left in those industries are making half or less of what they were but are still considered employed. How are we going to bring that back? Of course 3M people losing their jobs entirely causes a 3% reduction in the workforce which means the other 97% of the people who are employed are 3% too many (2.91M) and presto, 5-6M people lose their jobs!

I was speaking to a venture capital firm this week and we were talking about what industries could lead this country out of a recession and we concluded that it's very unlikely that any of our existing industries can. Of the 5M people who have lost jobs the past 2 years, 1M were construction workers (about half) and another million were in the supporting mortgage/financial and real estate industry and a million of the people who are left in those industries are making half or less of what they were but are still considered employed. How are we going to bring that back? Of course 3M people losing their jobs entirely causes a 3% reduction in the workforce which means the other 97% of the people who are employed are 3% too many (2.91M) and presto, 5-6M people lose their jobs!

This is why it is so VITAL that we get people back to work as quickly as possible as the additional 3M people who lose their jobs due to decreased demand from the first 3M people who fell out of the consumer pool mean that another 2.82M people need to be cut (3% of the remaining 94M) and so on and so on until you get to the point where businesses can't function with less people (25% unemployed at the height of the Great Depression) and they start shutting down because there is no profitable way to function (see GM, F, FRE, FNM, AIG etc.).

So what can we do to re-employ 5M people (and we assume/hope that re-employing 5M people will reverse the under-employment of 10M more who have jobs that no longer pay what they did, the pre-unemployed)? This is where Obama's team is dead-on with their policy – We MUST create a whole new industry and what better than alternate energy since the US already spends (at just $50 per average barrel) $365Bn a year on oil and sends over 50% of that money out of the country. $180Bn is a $50,000 a year job for 3.6M people and, of course, $180Bn that stays in this country instead of going to Iran, Venezuela and other countries that hate us is a huge boost to our economy as the money is re-spent locally.

I don't care if it costs $1Tn to create a US-based energy industry that replaces half our oil consumption, the payback is absolutely there and, who knows, if we do a good enough job of creating affordable alternate energy solutions we may be able to export some to the rest of the world, who spend $1.5Tn of their own on oil each year. So Obama's "business plan" for the US is to spend whatever it takes to capture perhaps 20% of the worlds $2Tn annual energy expenditures (which I hear also has some long-term growth potential). At $100 per barrel those figures, of course, double – now isn't that a business the US should be investing in. When we spend money on NASA or other research they say "where's the return on investment" but that is not the issue here – the ROI is something any investor could get excited about.

David Leonhardt wrote an excellent article in the Times this weekend called "The Big Fix" and he goes into great detail about what it will take to get our economy back on track. "By any standard, the Obama administration faces an imposing economic to-do list. It will try to end the financial crisis and recession as quickly as possible, even as it starts work on an agenda that will inspire opposition from a murderers’ row of interest groups: Wall Street, Big Oil, Big Coal, the American Medical Association and teachers’ unions. Some items on the agenda will fail." David also points out that the same can be said about the New Deal so perhaps we need to gve Obama more than the 6 days Rush Limbaugh gave him before declaring the entire effort a failure…

David Leonhardt wrote an excellent article in the Times this weekend called "The Big Fix" and he goes into great detail about what it will take to get our economy back on track. "By any standard, the Obama administration faces an imposing economic to-do list. It will try to end the financial crisis and recession as quickly as possible, even as it starts work on an agenda that will inspire opposition from a murderers’ row of interest groups: Wall Street, Big Oil, Big Coal, the American Medical Association and teachers’ unions. Some items on the agenda will fail." David also points out that the same can be said about the New Deal so perhaps we need to gve Obama more than the 6 days Rush Limbaugh gave him before declaring the entire effort a failure…

Of course I'm thrilled that the Republicans have decided to play hard ball with Obama as we already have a poll showing 49% of the people approving of the Dems in Congress (38% disapprove) while only 26% now approve of the GOP so keep voting that party line guys – we'll move on without you in 2010! Only 39% of the voters surveyed were against the stimulus bill that was opposed by 100% of the House Republicans – tax breaks are not going to solve this crisis and Americans are waking up to that fact, even if the Grand Old Party has not. By the way, the latest Gallop poll shows just 10 "red" states left in America, so we should not speak ill of the dead…

Speaking of taxes, my readers will not find it surprising that the average tax rate paid by the 400 richest Americans (the top 0.0000013%) fell 17.2% under Bush by 2006 (the most recent year released), even as their average income doubled to $263M per year over the same period. So that's $105Bn in additional annual income for the top 400 who paid a grand total of $18.1Bn in taxes on that income in 2006 compared to the 32% paid by the average American wage earner. Of course, the average American wage earner also pays a SIGNIFICANT portion of their income in Social Security and taxes and property taxes etc. that are merely rounding errors on a day's interest for our nation's truly wealthy. And, of course, 400 is a very arbitrary cut-off as 3,300 Americans have been in that category over the past 15 years so multiply those number by 5 and you'll begin to get an idea of what happened to $3Tn that was sucked out the other 329,996.700 people's bank accounts in the first 6 Bush years.

On a global basis, the financial crisis has destoyed 40% of the World's wealth, and that was a topic of discussion at Davos last week as World leaders met to find out where their money went (most of them are not even in the top 0.0000013%!). Don't forget that, for Americans – at $140 a barrel we were simply burning $2.4Bn a day for a while – that is a very expensive habit! When you consider that oil is now $40 and we get the same output out of it that we did at $140 then clearly $2Bn a day was being burned up in smoke that did nothing to help our economy. Multiply that by 4 and keep it up for just a month and there went $240Bn a month out of global pocketbooks. With similar food inflation, another $240Bn a month was bled out of global consumers and transferred, in part, to the 0.0000013s. The impoverishment of the many to the benefit of the few – "let them eat cake" to the factor of 10!

On a global basis, the financial crisis has destoyed 40% of the World's wealth, and that was a topic of discussion at Davos last week as World leaders met to find out where their money went (most of them are not even in the top 0.0000013%!). Don't forget that, for Americans – at $140 a barrel we were simply burning $2.4Bn a day for a while – that is a very expensive habit! When you consider that oil is now $40 and we get the same output out of it that we did at $140 then clearly $2Bn a day was being burned up in smoke that did nothing to help our economy. Multiply that by 4 and keep it up for just a month and there went $240Bn a month out of global pocketbooks. With similar food inflation, another $240Bn a month was bled out of global consumers and transferred, in part, to the 0.0000013s. The impoverishment of the many to the benefit of the few – "let them eat cake" to the factor of 10!

Globally, the Kenesyans are in charge. Largely credited with rescuing the US from the Great Depression, the Keynesian formula is straightforward: First, you estimate how much the economy should be producing — given all the people and factories and offices. $15 trillion US GDP. Then you look at what the economy is actually producing, with a 5% drop in GDP that's about $14 trillion. According to Princeton economist Alan Blinder: "The government shouldn't have to spend the entire trillion-dollar shortfall. That's because of something called the "Keynesian multiplier." Every dollar the government spends produces more than a dollar in spending throughout the economy. If the government pays you to build a bridge, you spend your paycheck on rent and food and so on, and then your landlord and grocer have money. Using Keynesian math, you can figure out exactly how much the Obama administration should spend. That would lead you to conclude that you needed about $650 billion as a stimulus." Voila! That's the kind of number they're talking about right now. You see it in the newspapers every day, a number in that range.

There is also a multiplier effect to shorting this money so when Rush Limbaugh and Ken Blackwell try to rally support to take $200Bn of that $650Bn and divert it away from governemnt spending and into additional entitlements for the top 0.0000013%, what he's really trying to do is short the net recovery effect by $350Bn and doom it to failure so Rush can have another season of "I told you it wouldn't work" ahead of him and Blackwell can make sure there aren't more Democratic voters in Virgina. Again, this is a crisis of confidence as much as anything else and with 100% of the Republicans working against the recovery, the mood in the country remains sour, as evidenced by the market reaction to the rift on the stimulus package.

A sampling of 900,000 consumer accounts at Mint.com found that between August and December of 2008, the average consumer drained $5,700 from their bank account (50%), lost $10,250 (25%) in their investment accounts and borrowed $5,000 (10%) more dollars from banks or home equity lines. This is a population in great pain and the last thing they want to see is our "leaders" squabbling over which band-aid to apply! This must not go on – this CAN NOT go on…

Things have now gone past critical in Zimbabwe, where slumping donations from Global governments, who have their own problems, have forced the World Food Program to halve the rations for millions of starving people from 10Kg a month to 5Kg – about 600 calories a day or roughly 40% of what a human being is supposed to survive on. 7M people in Zimbabwe need $65M to survive another month, something that is in question as almost no funds have come in since December, a good thing to keep in mind as we debate the bonuses of Wall Street executives, which was $18.4Bn this year, enough to feed Zimbabwe for 23 years. Fortunately Forbes has made a nice photo essay of the World's 10 wealthiest CEOs for us to distract ourselves with…

Things have now gone past critical in Zimbabwe, where slumping donations from Global governments, who have their own problems, have forced the World Food Program to halve the rations for millions of starving people from 10Kg a month to 5Kg – about 600 calories a day or roughly 40% of what a human being is supposed to survive on. 7M people in Zimbabwe need $65M to survive another month, something that is in question as almost no funds have come in since December, a good thing to keep in mind as we debate the bonuses of Wall Street executives, which was $18.4Bn this year, enough to feed Zimbabwe for 23 years. Fortunately Forbes has made a nice photo essay of the World's 10 wealthiest CEOs for us to distract ourselves with…

Just in case those people in Zimbabwe get any ideas of coming to this country and finding compassion, I will point out that a homeless man was sentenced to 15 years in jail for stealing $100, which stands out to me as an AIG executive was only given 4 years for strealing $500M so the lesson to be learned here is – If you are going to go for it – go for it big!

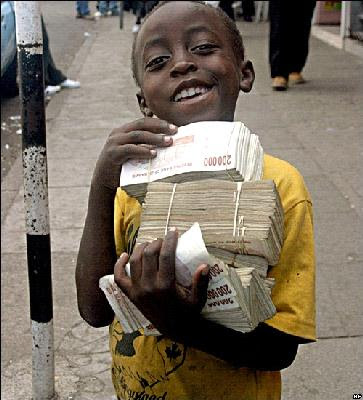

The Fed is going for it big time as they prepare to spend 1,200 times $500M to purchase long-term Treasury Notes in a scheme that sounds like it came from "The Honeymooners" in which Ralph writes a check to Norton who uses the check to lend Ralph the money to cover the check so he can write Norton another check which will be covered by another loan from Norton, who only has the money from the bad checks Ralph keeps writing – at least Madoff had the decency to PRETEND there was a third party involved! Fortunately, Zimbabwe has just started printing $1Tn bills and will be able to lend the Fed as much as they need (have I mentioned I like gold lately?).

So plenty of doom and gloom around but, after two days of reading, I have to say that I still think we have suffered enough. The fact that there is money out there to pay Wall Street executives 23 times what it costs to feed the nation of Zimbabwe for a year or half of California's budget shortfall indicates that what we have here is more of a mis-allocation of funds, rather than an actual lack of funds. For good or inflationary ill, the Fed has a virtually infinite supply of ammunition to fight this downturn and they are determined to use it. It was Archimedes who said of using leverage "give me a place to stand and I shall move the earth." Well I think if we give the new administration more than a week to get their footing and apply some economic leverage, we will be able to move the markets. Even Whitney and Roubini are down to forecasting the last $2.5Tn in losses for the banks...

Only $2.5Tn?!? That's what the kid in Zimbabwe is holding to go buy some milk at the grocery store!