A maelstrom is a powerful whilpool, once described by Edgar Allen Poe:

"Here the vast bed of the waters, seamed and scarred into a thousand conflicting channels, burst suddenly into phrensied convulsion – heaving, boiling, hissing – gyrating in gigantic and innumerable vortices, and all whirling and plunging on to the eastward with a rapidity which water never elsewhere assumes except in precipitous descents… These streaks, at length, spreading out to a great distance, and entering into combination, took unto themselves the gyratory motion of the subsided vortices, and seemed to form the germ of another more vast… The ordinary accounts of this vortex had by no means prepared me for what I saw… It appeared to me, in fact, a self-evident thing, that the largest ship of the line in existence, coming within the influence of that deadly attraction, could resist it as little as a feather the hurricane, and must disappear bodily and at once."

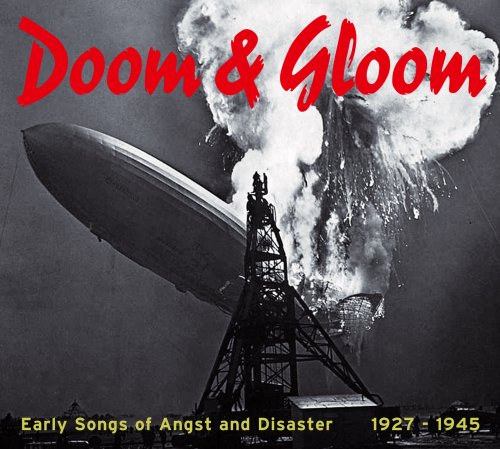

All in all, that's a pretty good description of the market action, especially in the financial sector where even the biggest "ships" are being pulled down to their doom. It's the same action we first noted back on December 1st, with the Dow still at 8,800, when I said: "In our roller coaster market model, the absence of stimulus (usually in the form of government money) can only lead to gravity taking it’s toll. As the picture on the right illustrates – is there enough money in the world to push our ships of state free of the relentless downward market spiral?" I noted that (and see the original post for the image) we were still in the very early stages of a REAL bear market and sadly we have since continued right on that track.

I'm not here to make a bull case or bear case – see my most recent article on media manipulation and the markets starring my "friend, buddy-pal"Jim Cramer for my views on that. Suffice to say we are deep in the throes of the maelstrom and one side of the ship sees nothing but oblivion while the other side of the ship sees calm seas to the horizon but Poe summed up the current situation very well saying: "It may appear strange, but now, when we were in the very jaws of the gulf, I felt more composed than when we were only approaching it. Having made up my mind to hope no more, I got rid of a great deal of that terror which unmanned me at first. I suppose it was despair that strung my nerves."

I'm not here to make a bull case or bear case – see my most recent article on media manipulation and the markets starring my "friend, buddy-pal"Jim Cramer for my views on that. Suffice to say we are deep in the throes of the maelstrom and one side of the ship sees nothing but oblivion while the other side of the ship sees calm seas to the horizon but Poe summed up the current situation very well saying: "It may appear strange, but now, when we were in the very jaws of the gulf, I felt more composed than when we were only approaching it. Having made up my mind to hope no more, I got rid of a great deal of that terror which unmanned me at first. I suppose it was despair that strung my nerves."

In short – Abandon all hope, ye who enter! It's a heck of an investing premise for the financials and I mentioned that in Friday's webcast regarding our SKF shorts – yes, the financials can go lower but we also do see clear skies on the horizon and the bears are betting on the rough seas lasting forever. Even a storm needs energy, while a hurricane may destroy your home, the very act of hitting your home weakens the storm – that is why you cannot have an endless bear market, there is a certain point, even in this nightmare, where value is created, whether is is the $100 home you buy at a foreclosure sale that will make you $10,000 or the highly skilled computer programmer your company is able to hire for $50,000, even a depression creates opportunity – for those who can force themselves to take action that is…

The bears were out in force in the media this weekend. As I mentioned in my prior post, we had Cramer, the Wall Street Journal, Bloomberg, Dick Shelby and John McCain all telling us we are DOOMED. The financials are DOOMED, the Dow is DOOMED, the economy is DOOMED. Even I told you last Monday that if we failed to retake 4,425 on the NYSE, 373 on the Russell, 1,340 on the Nasdaq we were DOOMED. Well, today we'll see if 6.500 can hold on the Dow along with 670 on the S&P and we can only HOPE (never a good strategy) to get back to our broken-down levels.

The bears were out in force in the media this weekend. As I mentioned in my prior post, we had Cramer, the Wall Street Journal, Bloomberg, Dick Shelby and John McCain all telling us we are DOOMED. The financials are DOOMED, the Dow is DOOMED, the economy is DOOMED. Even I told you last Monday that if we failed to retake 4,425 on the NYSE, 373 on the Russell, 1,340 on the Nasdaq we were DOOMED. Well, today we'll see if 6.500 can hold on the Dow along with 670 on the S&P and we can only HOPE (never a good strategy) to get back to our broken-down levels.

Asia was hit very hard this morning and the Hang Seng ran straight to the 5% rule, giving up 577 points to settle 65% off the 2007 highs at 11,344. The Shanghai fared little better, dropping 7 to 212 and the Nikkei "only" gave up a point to settle at 7,086 at 39% of their top. Japan recorded its first current account deficit in 13 years (-$1.8Bn) in January due to plunging exports and a big decrease in its overseas financial earnings. "The result was shocking. I'm afraid that Japan's current account will likely be in the red ink for months ahead," said Toshihiro Nagahama, a senior economist at Dai-ichi Life Research Institute. "Because we can't expect that the U.S. economy will hit a trough in the near term, Japan's exports will very likely remain very weak," he said. See – depression! His outlook for Japan is based on his poor outlook for the US and now we will lower our outlook based on the poor outlook for Japan and so on and so on…

As I mentioned in Friday's Big Chart Review, the FTSE was our last holdout at the 50% off line and today they slipped right near it (3,377) on the morning dip to 3,450, 100 points off what was, for a moment, a good open – much like our Friday was. HBC is hitting both Asian and European markets with a 24% drop as that bank is being sold of in bear raids as the bears are hoping they suffer the same fate as LYG, who may rise to 77% government ownership on this latest bailout. There are a lot of people hoping something positive will come from the G20 meeting but it's not until April 2nd and I don't know if they have that long!

As I mentioned in Friday's Big Chart Review, the FTSE was our last holdout at the 50% off line and today they slipped right near it (3,377) on the morning dip to 3,450, 100 points off what was, for a moment, a good open – much like our Friday was. HBC is hitting both Asian and European markets with a 24% drop as that bank is being sold of in bear raids as the bears are hoping they suffer the same fate as LYG, who may rise to 77% government ownership on this latest bailout. There are a lot of people hoping something positive will come from the G20 meeting but it's not until April 2nd and I don't know if they have that long!

We will be happy to get to our Friday upside targets any time this week at this point. We tested them first thing Friday morning and failed miserably. They were 6,765 Dow, 700 S&P, 1,350 Nasdaq, 4,400 NYSE and 360 on the Russell and they look pretty far away at the moment with the Dow showing a 60-point drop at the open as of 9 am. We did get what would normally be considered good news as MRK pulls the $41Bn trigger on a merger with SGP, a considerable premium to that company's $17.63 close on Friday. While the banks are not willing to finance deals, the companies themselves are getting creative although JPM is committing $8.5Bn in financing into the mix.

Piper Jaffray must have been watching my show on Friday as they came out with an upgrade on AMZN this morning with a Buy reccommendation and a $81 price target on the $62.26 stock. AMZN was the only stock I picked on Friday morning's dip… We'll be keeping our eye on the Nasdaq in general, we're done with our QID puts and waiting for confirmation that it's time to take the QLD longs. We're certainly not going to be excited about anything if we can't take back our levels but, as SGP shareholders can tell you – it does get to a point where some stocks just get too low to leave alone!