What a wild week that was!

We got such a good sell-off last Friday that we went 1/2 covered into the weekend on our DIA puts (a little bearish) but we had already cleaned up on quick short plays on the Dow and USO and we were very much in cash but still making bullish plays at the time. I did a 3-part series on dividend-paying stocks over the weekend, elaborating on the 21 dividend payers we picked that Tuesday along with our $104,340 Virtual Portfolio (used to be $100,000) so we had no shortage of bullish ideas but it didn't take us long this week to turn pretty bearish.

Last Friday morning (22nd), ahead of the holiday weekend, with the Dow at 8,323, I sent out an early alert to members saying: "I’d go long on the Dow here but frankly I’m just not in the mood today. Still full covered on long DIA puts and still in the DDMs but just hanging out and watching today since you can’t take the action seriously anyway." Our plays that day ran the gamut: We sold BAC July $10 puts for $1 (now .66), took a TBT spread that has been a wild ride but right back where we started and an ICE bull call spread ($90/$100, selling $90 puts $2.33, now .57) that is right on track. All that came before 11:33 on Friday, where I rightly called a top at 8,342. We made nice profits on DIA puts and took an EXM and T hedges that are doing well. One of our best plays on Friday was the USO $32 puts at .80 we took into the weekend, those cashed out Monday morning at $1.05 (up 44%) – those USO trades were followed through in detail in our Members Only post: "Stupid Options Tricks – The Salvage Play."

As I mentioned, we have been mainly in cash for over 2 weeks now so mainly we're just taking small opportunities and having fun while we wait for the market to break one way or the other. One article I wrote over the holiday weekend was a timely update to "How To Vacation-Proof Your Virtual Portfolio," something anyone not in cash needs to take under strong advisement and DO NOT miss the very generous free video lesson from Sage's Market Tamers that is on that post. Our of 21 dividend plays we had discussed on Tuesday, the 19th, I went with LYG, who flatlined for the week, TNK, who gained 10%, PGH, who also gained 10%, KMP, who also gained 10% and CAT, who only gained 3% so LYG And CAT are still good for entries and, since we only need those stocks NOT to go down to make our targets – all are doing very well so far.

I'm still hoping we get our sell-off next week so we can make some more plays off our dividend list but we don't force the plays. The reason they worked is because we patiently waited from the 19th to the 26th before we executed 5 of our 21-stocks watch list. That's the benefit of cash on the side, we can patiently wait for the right deals to come along… Last Friday ended in a 100-point sell-off but and I called Tuesday's post "Atomic Testing Tuesday" as our pal, Kim Jong Il was up to his old tricks again and playing with nukes. Home pricing news was bad too along with lot's of other data. Nonetheless, we were skeptical of the pre-market sell-off and I said in the morning post: "So there you have it: A crazy guy has nukes, the terrorists are still out there, Europe and Asia’s economies are in shambles and no one is buying either durable goods or homes. Is it finally time to start buying stocks?" Then, at 10 am, a miracle occured and we got a HUGE 22% jump in Consumer Confidence causing me to send out an Alert to members at 10:01 saying: "Holy Cow – Consumer confidence 54.9 – MASSIVE beat! Run away bears!!!!!"

I'm still hoping we get our sell-off next week so we can make some more plays off our dividend list but we don't force the plays. The reason they worked is because we patiently waited from the 19th to the 26th before we executed 5 of our 21-stocks watch list. That's the benefit of cash on the side, we can patiently wait for the right deals to come along… Last Friday ended in a 100-point sell-off but and I called Tuesday's post "Atomic Testing Tuesday" as our pal, Kim Jong Il was up to his old tricks again and playing with nukes. Home pricing news was bad too along with lot's of other data. Nonetheless, we were skeptical of the pre-market sell-off and I said in the morning post: "So there you have it: A crazy guy has nukes, the terrorists are still out there, Europe and Asia’s economies are in shambles and no one is buying either durable goods or homes. Is it finally time to start buying stocks?" Then, at 10 am, a miracle occured and we got a HUGE 22% jump in Consumer Confidence causing me to send out an Alert to members at 10:01 saying: "Holy Cow – Consumer confidence 54.9 – MASSIVE beat! Run away bears!!!!!"

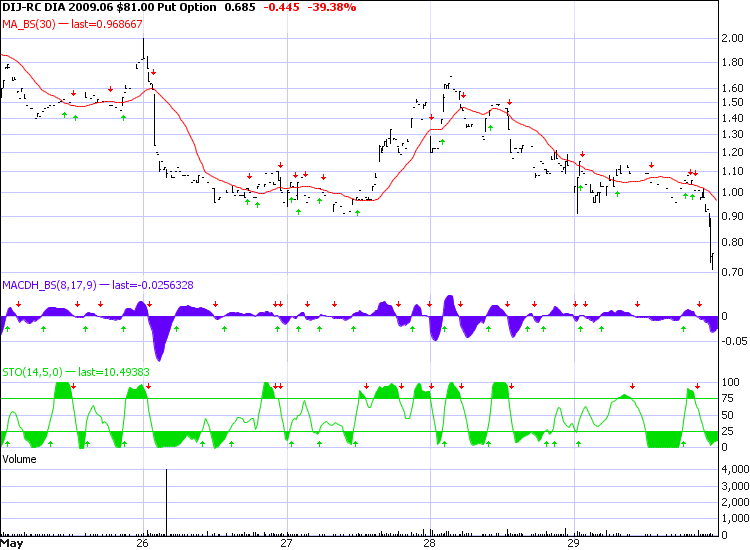

We sold some POT calls for a quick 28% profit, picked up some FAS $6 puts for .15 that are now .10 (down 33%). The move was so violent, though, that we flipped bearish around 11 and went back into the USO $32 puts for .70 avg and now .25 (down 64%) is the quick story without going into the other half dozen adjustments we've made since in what was, by far, our worst trade of the month of May. POT went up even further and we sold the $125 calls naked for $3.10, now $1.85 (up 40%) and at 12:18 we went naked on our long DIA puts with the Dow at 8,450, about 40 points early but it only took us 24 more hours to be extremely right about that one as we got a 200-point winner on the Wednesday drop. At 1:34, in fact, with the Dow at 8,475, we added the DIA $81 puts for just $1 which gained 60% by Thursday morning. We also picked up more FAZ at $5 and they were a quick 10% gainer the next day, where we covered up. That was our last trade of the day as we were pretty much 100% bearish and waiting for what seemed like an inevitable drop.

I explained our bearish rationale in Wednesday morning's post as confident consumers is nothing you should be basing a rally on. Against a strong looking pre-market I summed up my feelings, closing my morning commentary with: "So forgive us for sitting out yesterday’s rally but, with GM about to go bankrupt (the bondholders did not settle) and the global situation iffy at best, we felt it’s a little more fun to start establishing some short positions into this rally. If we do continue higher, then those shorts become our hedges as we begin to deploy more cash but, for now, cash remains king and we’ll take quick profits on the dips as we wait to see where things settle out." We patiently waited for the market to smarten up and I even said to members at 10:09 I even said to members: "On naked Sept DIA puts, patience is a virtue." Also, setting up for one of our best and most obvious trades of the week, in that same comment I said: "Wow, people are STILL buying GM. It’s up at $1.35 again. We should round all those people up and just take their money away…" We PATIENTLY waited for the right moment to strike on that one as well!

At 10:56 I posted 3 winning trade ideas in our new Channel Checkers section. That's 5 for 5 in 2 weeks there so that experiment is going very well and Ilene is tracking progress if you want to follow along. We had a simple UYG cover play and we added DIA $81 puts at .89 (still ahead of the run to $1.60) at 12:16, pretty much nailing the low of that drop to the penny. We looked at a C vertical, buying the 2011 $5s and selling the 2011 $7.50s for .31 (still just .34 for the $2.50 spread), looking to make $2.19 (706%) if C can get over $7.50 18 months from now and I still love that play. I also must have loved those DIA $81 puts because I picked them yet again at 1:37, even though they had already gained 17% to $1.04 – that's a good example of scaling in on the way up as our average was .89 + $1.17/2 or $1.03 with the stock at $1.17 at that point so still up 12.5% after adding another round! I do love it when a plan comes together and the Dow literally fell off a cliff from there:

As we were pretty bearish and things were going well, we took a bullish hedge with a 1/2 cover on our long DIA puts with the June $84 puts at $2.30 (now $1.46) and we took our POT money and ran as well because, as I said in the post, we were just looking to make some quick profits and get back to cash. It just doesn't pay to ride out positions in this market so we are very much turning into hit and run aritists for our non-hedged positions. We sold off so hard into the close that I called for adding another 1/2 sale DIA $84 puts at $2.65 (now $1.46) saying at 3:34: "I’m satisfied with this sell-off. As with yesterday – volume was low so it doesn’t mean much…"

I predicted a "Thrill-Ride Thursday" and that is certainly what we got with the Dow going down 130, up 100, down 75 and then finishing up 160 points from there – a crazy way to put in a 100-point gain on the day. I laid out my short oil premise in the morning post but it seems logic makes no impression on the energy market. As it was our only real losing trade of the week, we pressed our oil bets but it kept going up and up and up, which led to me having to write "Stupid Options Tricks – The Salvage Play" this weekend for members stuck in bad trades. There are still 3 weeks to expiration and I still think we're heading into a commodity retracement but I also thought oil would turn down "any minute" from $90 to $147 last year and, even though I was ultimately vindicated, we're not going to fall on that sword twice.

Durable goods was a much better than expected number Thursday Morning but there was a huge downward revision to March that, for some reason, everyone chose to ignore. GM hit $1.30 DESPITE the announcement they would be heading into bankruptcy on Monday so, in the most obvious play of the month, we shorted them at $1.30. They finished Friday at .75 (up 42%) and we got half out but hopefully we'll get a lot closer to zero on the other half. In another bad energy play we sold OIH $100 calls for and average of $6.90, now $8.45 (down 22%) and that will be another one we'll need to adjust if things don't turn next week. Other than adjusting USO and DIA, that's all we did on Thursday as we just watched the wild market swings ahead of the GDP. After hours we took a short play on the Qs that went nowhere on Friday but a GOOG spread is doing fine so far.

Friday morning I had been researching my oil premise and, as usual, found that most roads led back to Goldman Sachs and I did a mini-expose on the shenanigans. As I said in the post: "We remain mainly in cash but I will be scaling into yesterday’s oil shorts, painful though it may be. We expect a top at $70 (100% up from $35) and a 20% pullback to $63 so scaling in at $63 (yesterday), $66 (today) and $70 is the plan we are following." Sadly, it does look like they are determined to test $70 next week as we blew right through $66 oil on Friday!

Friday morning I had been researching my oil premise and, as usual, found that most roads led back to Goldman Sachs and I did a mini-expose on the shenanigans. As I said in the post: "We remain mainly in cash but I will be scaling into yesterday’s oil shorts, painful though it may be. We expect a top at $70 (100% up from $35) and a 20% pullback to $63 so scaling in at $63 (yesterday), $66 (today) and $70 is the plan we are following." Sadly, it does look like they are determined to test $70 next week as we blew right through $66 oil on Friday!

Things were not really looking all that bullish for the market or for oil until about 2:50, when the market began a 140-point romp into the close doubling the day's volume in the last hour of trading. We didn't trade much during the session other than adjustments. POT $100 puts were taken as weekend speculation at 11:43 and we went into the weekend short on USO, OIH and the Dow, adding June $81 puts at $1, which dropped a quick 20% into the crazy close, prompting Karl Denninger to write "What Was That?" where he points out:

Someone" who didn’t give a damn if they lost a sizable amount of money intentionally wanted to shove the cash market up through the 200DMA, a critical technical level. They were 1 minute late; they succeeded in doing so in the futures, but not the cash!

Steve Lendman was also moved by this insane market action to write "Manipulation, How Markets Really Work" over the weekend so I'm not going to waste any time here adding my own complaints as I got mine out of the way BEFORE all the very obvious BS started in the Friday morning post so, while I'm not surprised it happened, I'm still very annoyed as it does take a lot of the fun out of trading when blatant nonsense like this is allowed to go on. We get a lot of hard data Monday morning with Personal Income and Spending ahead of the bell, then Construction Spending and ISM at 10 am so we'll hold off on our complaints until and unless we REALLY have something to complain about.

Overall, we have lots of cash and lots of (now) protective puts so we're ready to rock and roll on long positions if the madness is going to continue next week. It's a big data week and we also have earnings of note from BOBE, HOV, LULU and SNDA on Tuesday evening; JOYG, TOL and WSM (all possible misses) Wednesday morning along with JOSB during the session and Thursday CIEN, TK and MTN in the morning followed by GES, FMCN and CINA after the bell. I think the builders earnings and outlook will be very telling as well as the LULU, WSM and GES, who all give us a clue as to what the upper middle class is spending (or not).

I'd love to put on a rally cap and BUYBUYBUY but not only haven't we made our 40% levels yet, but we aren't even at the May highs yet you would think that we had entered a grand era of global prosperity from what you read in the MSM this weekend – more about that tomorrow. Overall, it was an excellent week as long as you aren't worried about the fact that your stock gains were completely wiped out by currency losses or that the price of base commodities outpaced the gains in securities by 3:1 for the week making the average American far, far worse off than they were when the week (or the Month for that matter). How far can the madness go? Well the Dow went to 14,200, oil went to $147 a gallon and a 1 bedroom, 900 square foot condo in Manhattan was fetching $1M if you could race to the realtor fast enough to outbid 10 other people the first day it went on the market while they were still telling us things were a bargain on CNBC so DO NOT underestimate how irrational the markets can get.

I'd love to put on a rally cap and BUYBUYBUY but not only haven't we made our 40% levels yet, but we aren't even at the May highs yet you would think that we had entered a grand era of global prosperity from what you read in the MSM this weekend – more about that tomorrow. Overall, it was an excellent week as long as you aren't worried about the fact that your stock gains were completely wiped out by currency losses or that the price of base commodities outpaced the gains in securities by 3:1 for the week making the average American far, far worse off than they were when the week (or the Month for that matter). How far can the madness go? Well the Dow went to 14,200, oil went to $147 a gallon and a 1 bedroom, 900 square foot condo in Manhattan was fetching $1M if you could race to the realtor fast enough to outbid 10 other people the first day it went on the market while they were still telling us things were a bargain on CNBC so DO NOT underestimate how irrational the markets can get.

Keep in mind I am generally bullish – just not this bullish, this soon!