Bad news kids!

Bad news kids!

I just did a huge, long-promised write-up of the 5% rule for Members and we cast our bones over the indexes and the signs do not look that good. I do not want to be bearish, I want to turn off my brain and celebrate this amazing economic recovery – maybe we can rent out one of those empty shopping malls for a party and hire a lot of former manufacturing employees for minimum wage to serve drinks (if WMT doesn’t get them first!). Oh yes, we love a good party but you know what can happen when you rent a mall at an inopportune time… That’s right – ZOMBIES!

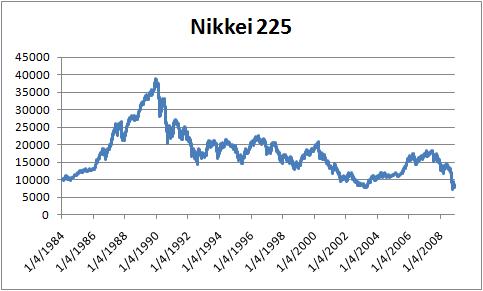

"Zombie" banks and other corporations that were propped up by the government were blamed for Japan’s "lost decade" (now in year 18), in which, according to Wikipedia, there was: "A massive wave of speculation by Japanese companies, banks and securities companies. A combination of exceptionally high land values and exceptionally low interest rates briefly led to a position in which credit was both easily available and extremely cheap. This led to massive borrowing, the proceeds of which were invested mostly in domestic and foreign stocks and securities. Recognizing that this bubble was unsustainable, the Finance Ministry sharply raised interest rates in late 1989. This abruptly terminated the bubble, leading to a massive crash in the stock market. It also led to a debt crisis; a large proportion of the debts that had been run up turned bad, which in turn led to a crisis in the banking sector, with many banks having to be bailed out by the government."

Gosh that sounds familiar! Well thank goodness we have wise leaders who study global history and learn the lessons of the past so that we do not make the same mistakes that other countries have (end sarcasm font). Michael Schuman of Time Magazine noted that banks kept injecting new funds into unprofitable "zombie firms" to keep them afloat, arguing that they were too big to fail. However, most of these companies were too debt-ridden to do much more than survive on further bailouts, which led to an economist describing Japan as a "loser’s paradise." This led to the phenomenon known as the "lost decade", when economic expansion came to a total halt in Japan during the 1990s. The impact on everyday life was muted, however, as the Japanese people tended to be savers, not borrowers. Unemployment ran reasonably high, but not at crisis levels and Japan just drifted along, well under 50% of their former highs, all the way down to 7,000 – which was, 80% off the 1989 high of 38,000.

Gosh that sounds familiar! Well thank goodness we have wise leaders who study global history and learn the lessons of the past so that we do not make the same mistakes that other countries have (end sarcasm font). Michael Schuman of Time Magazine noted that banks kept injecting new funds into unprofitable "zombie firms" to keep them afloat, arguing that they were too big to fail. However, most of these companies were too debt-ridden to do much more than survive on further bailouts, which led to an economist describing Japan as a "loser’s paradise." This led to the phenomenon known as the "lost decade", when economic expansion came to a total halt in Japan during the 1990s. The impact on everyday life was muted, however, as the Japanese people tended to be savers, not borrowers. Unemployment ran reasonably high, but not at crisis levels and Japan just drifted along, well under 50% of their former highs, all the way down to 7,000 – which was, 80% off the 1989 high of 38,000.

While you may want to think that this was unusual or exceptional, the sad fact is that it happens pretty often. The cycle we are now in WOULD BE exceptional if it DID NOT follow the pattern of the Nikkei bubble of 1989, the Nasdaq bubble of 1999 and the Dow bubble of 1929. Why will 2009 be different? Certainly not because the government is intervening – the government always intervenes:

Oh yes, very much in line with our 5% rule discussion, we’re right at that very critical 40% off the top level and we’re being led by the Nasdaq, which seems like a good thing but the Nasdaq is just completing their own 10-year crash cycle and should damn well be leading something as they are still 65% off the highs, actually underperforming both the Nikkei and the 1929 Dow 9.5 years after their crashes. As to this run up – the Nikkei made a splashy recovery from -50% to -30% (up 40%) but then entered a new cycle of misery that continues to this day. The S&P has gone from -55% to -40% (up 27%) and can go up another 21% from here (complex math) before really breaking the pattern.

We don’t intend to be bearish for the next 20% though, we are sitting in cash and will be thrilled to take a ride up if the S&P can break our long-standing 946 mark and the NYSE can take out 6,232, both 40% off the tops. Once we establish those lines, it will be a no-brainer (literally) to use those as stops for some very aggressive upside plays. In this particular case, the low VIX will allow us to turn leverage very much to our advantage, picking up leaps in solid companies for the run up.

We don’t intend to be bearish for the next 20% though, we are sitting in cash and will be thrilled to take a ride up if the S&P can break our long-standing 946 mark and the NYSE can take out 6,232, both 40% off the tops. Once we establish those lines, it will be a no-brainer (literally) to use those as stops for some very aggressive upside plays. In this particular case, the low VIX will allow us to turn leverage very much to our advantage, picking up leaps in solid companies for the run up.

BUT, FIRST, we have to get there! So far it’s been a frustrating June as we’ve sat on our hands in cash waiting for a break – one way or the other, we don’t care which – we’re happy to play either side. At the moment, as we are under what CNBC and now the whole MSM calls "an invisible ceiling" (which looks pretty darned visible to us) but it is easier for us to bet that the kid on the trampoline will break his neck slamming into the ceiling, than it is for us to assume he will just fly up to the next level. In what rational world do we watch markets fly up 35-50% in 3 months and then have the "experts" in the media act like they are baffled that we’ve hit resistance?

Certainly the markets were oversold, I was the one saying that in March. On March 6th, in fact, when Jim Cramer told everyone to sell and said the Dow would go to 5,320 – I was calling him an idiot, just like I’m calling him an idiot now when he tells you we’re going straight to 10,000. He was wrong then, he is wrong now. In fact, the Friday before Cramer was telling people to SELLSELLSELL at the bottom I was on TV telling people to BUYBUYBUY financials and SELLSELLSELL the SKF, which was topping out at about $270 (now $39). I did my show LIVE, while the market was crashing, WHILE people were panicking and I called it right. Cramer did his show at the end of the same day and came to a VERY different, very wrong conclusion.

I don’t bring this up to pick on Jim but he’s downright dangerous here and someone needs to say so. As I said, we’re all for being bullish IF the markets can prove themselves but (and I said this a lot on the way down in the Fall) IT IS NOT OUR JOB TO SAVE THE MARKETS! While Jim seems happy to use his sheeple as cannon fodder, I prefer to wait for more of a trend to develop before punching all the buttons. Meanwhile we are mostly in cash and picking up the occasional fun trades and yes, it’s dull but boredom is no reason to make random bets is it?

I don’t bring this up to pick on Jim but he’s downright dangerous here and someone needs to say so. As I said, we’re all for being bullish IF the markets can prove themselves but (and I said this a lot on the way down in the Fall) IT IS NOT OUR JOB TO SAVE THE MARKETS! While Jim seems happy to use his sheeple as cannon fodder, I prefer to wait for more of a trend to develop before punching all the buttons. Meanwhile we are mostly in cash and picking up the occasional fun trades and yes, it’s dull but boredom is no reason to make random bets is it?

Even if you’ve watched the March 6th video before, I would suggest watching the beginning of it (1st 30 mins) as the same reason we were long (and in pain) at the bottom is why we keep sniping at short positions at what we think is a top! There is great opportunity to being a contrarian IF you time it right. That’s been our pattern of trading this entire month, we keep jumping on little swells in the market as they turn up, hoping to eventually catch a big wave when it comes. This strategy remains valid unless we break over our top levels, just as our current strategy works unless we break over our tops. We will be very happy to change – when there is evidence to merit a change.

I’m bringing this up today because, in reviewing the week’s comments, I see the same fatigue on the part of the bears as the bulls had in that first week of March, when it looked like we’d never stop going down. Convictions or cash are your best alternatives (even though cash is losing value fast!), not the latest tonic sold to you by some television huckster. You can review what I wrote in the pre-bottom week HERE and the post-bottom week HERE and it’s interesting to compare as our man Jim has been calling me a "perma-bear" when, if anything, the only thing I have consistantly been is perma-opposite Cramer. We like to buy low and sell high, Jim likes his sheeple to buy high and sell low and thank goodness for them because someone had to sell us BAC for $2 and buy SKF from us for $270 but – if you are one of my people – try to stop being one of his!

I’m bringing this up today because, in reviewing the week’s comments, I see the same fatigue on the part of the bears as the bulls had in that first week of March, when it looked like we’d never stop going down. Convictions or cash are your best alternatives (even though cash is losing value fast!), not the latest tonic sold to you by some television huckster. You can review what I wrote in the pre-bottom week HERE and the post-bottom week HERE and it’s interesting to compare as our man Jim has been calling me a "perma-bear" when, if anything, the only thing I have consistantly been is perma-opposite Cramer. We like to buy low and sell high, Jim likes his sheeple to buy high and sell low and thank goodness for them because someone had to sell us BAC for $2 and buy SKF from us for $270 but – if you are one of my people – try to stop being one of his!

Better yet, don’t be anyone’s follower. Philstockworld.com is a community site, with many intelligent and diverse options. Read our opinions and then give us your own – it’s easy to be a sheep and hard to be a wolf but sheep get sheered over and over again – keep that in mind! We’ve updated our Strategy Section and we have our Virtual Portfolio Section which has our Buy List of stocks we generally like, our Dividend Plays and sample $100,000 Hedged Virtual Portfolio – all things well worth going over, especially IF we do break higher.

Last weekend I made a point of saying that high oil prices were likely to derail our recovery. I noted we had just come out of a manic/depressive week and it was not likely that behavior was going to change and I pointed out that that we had entered the "Triple Top Testing Zone," which left us pretty much left on the sidelines in cash, along with 11 Trillion other dollars it seems. Are we in the smart-money crowd or are we missing the train? It’s still to early to tell unfortunately….

Last weekend I made a point of saying that high oil prices were likely to derail our recovery. I noted we had just come out of a manic/depressive week and it was not likely that behavior was going to change and I pointed out that that we had entered the "Triple Top Testing Zone," which left us pretty much left on the sidelines in cash, along with 11 Trillion other dollars it seems. Are we in the smart-money crowd or are we missing the train? It’s still to early to tell unfortunately….

Monday started with a big sell-off, which was good as we had gone short into the weekend but we held the 8,650 line on the Dow and 925 on the S&P so there was nothing to be too bearish about. We made some quick DIA short money, took and XTO spread and sold COF July puts. We went in and out of USO over and over as the channel drifted higher each day, hoping to catch the big one when/if it finally breaks down. The Dow had a 150-point mother of a stick-save into the close but we added to DIA puts, turning a losing play into a winner the next day.

Tuesday we had a huge pre-market based on comments Paul Krugman had made in Hong Kong the day before and I put my foot down calling the move BS and asking, incredulously if we could get fooled, yet again, by the same BS. Apparently we could as we sold off into Wednesday afternoon but another huge stick save and two day’s of drift left us back as Tuesday’s pumped-up open for the week.

Tuesday we had a huge pre-market based on comments Paul Krugman had made in Hong Kong the day before and I put my foot down calling the move BS and asking, incredulously if we could get fooled, yet again, by the same BS. Apparently we could as we sold off into Wednesday afternoon but another huge stick save and two day’s of drift left us back as Tuesday’s pumped-up open for the week.

I said to Members in the Morning Level Alert "The only levels we need to watch today are S&P 946 and NYSE 6232 – the rest are over already by a good margin so it’s just a failure we’ll be looking for. Oil $70 is critical to get the OIH and XLE higher, gold is already over $960 and needs to hold that to stay bullish." That pretty much guided us for the week (and the S&P finished at 946 on the nose while the NYSE touched 6,232 on the nose on Thursday before being harshly rejected.).

From a trading perspective we spent Tuesday practicing our day-trading on oil and the Dow. Timing was good on oil too as I warned Members at 1:31: "OK, 1:30 was sell time for oil yesterday. Time to kill puts plays on crude if we don’t get something soon…." DB, one of our perma-bears, threw in the towel at 2:37 and I wasn’t joking when I said that the capitulation of the real bears was often the best signal that it was time to get bearish. Nonetheless, we watched and waited out the stick.

Wednesday was a Beige Book day and we expected a little of everything and we got it in spades! Our man Cramer had told his sheeple to BUYBUYBUY the night before, saying that we in the blogosphere were FOOLS for paying attention to "facts" and "news" and "fundamentals" when clearly the markets were going to go higher because they were going to go higher. I said we would be happy to join Cramer’s crazy train if he would only be so good as to at least show us the technicals before we start tossing our good money after his audiences Mad Money. I had already sent out a Morning Alert to Members listing our "Brain Shut-Off" targets, saying: "Aside from the not yet held 40% lines of 946 on the S&P and 6,232 on the NYSE, we really need to take out Friday’s tops of: Dow 8.750, S&P 950, Nas 1,865 (beat in yesterday’s high of 1,870), NYSE 6,160, Russell 536, SOX 285 (June 1st, Friday was 275), Transports 1,880 (also June 1, Fri 1,850)."

Not very surprisingly to us, rather than go UPUPUP, the markets went DOWNDOWNDOWN 200 points, right back to our 8,650 line on the Dow, yet again. We had shorted the Dow into the open and continued to mess around with oil puts but it was much like making small bets on horse races to keep things interesting while waiting for the big race to start. We put our foot down on FXP and sold the $12.50 puts for .93, thinking China seemed overdone. We also did a nice spread looking for a 100 point move in either direction on the Dow and, amazingly, got it both ways! UNG was added (naked July $13 puts for .70 and a bullish spread) and we exited our QID puts with a very nice win as we called almost the dead bottom by setting stops at 1:13. In fact, at 1:57, I said to Members: "Keep in mind we could fly 150 points so fast your head will spin in 5 mins so be careful! Take some off the table if you have profits.." That is pretty much exactly how many points we went up into the close. We shorted POT into the stick save but that was it for the day.

Thursday morning I wrote an article warning about hyperinflation, which is the only way to sustain a commodity rally but we continued to bet against it and upped our oil shorts once again into the morning pump. I pointed out in the morning post how suspicious it was that we kept closing at 8,750ish. We didn’t like the Beige Book, we didn’t like the Retail Sales report or the Unemployment numbers so we took another attempt at a breakout with a huge grain of salt.

Thursday morning I wrote an article warning about hyperinflation, which is the only way to sustain a commodity rally but we continued to bet against it and upped our oil shorts once again into the morning pump. I pointed out in the morning post how suspicious it was that we kept closing at 8,750ish. We didn’t like the Beige Book, we didn’t like the Retail Sales report or the Unemployment numbers so we took another attempt at a breakout with a huge grain of salt.

Our trade ideas for the day included DIA $87 puts at .69, another round of shorting the oil futures as they hit $72.50 (in and out many times), SPY $93 puts at .75 (avg), more oil shorts and a spread on OREX. Still mainly sidelined in cash on what was yet another crazy day.

Friday morning I wondered if it was finally the day we all fall down. It wasn’t and we pretty much flatlined into the close – not very impressive on the whole and still not hitting our levels. We continued to play with the oil futures on the short side, looked at some C longs, VLO naked puts (sold), and more oil shorts but we stayed light into the close as the Iran election news was hard to decipher and we were worried about a big run over the weekend.

All in all, the week went as we expected – almost exactly the same as the two before it. We are still naked on our long September DIA puts so still bearish overall but still in cash overall and looking for clearer signals than the ones we’ve been getting. We are willing to go bullish if we get the right signals but not willing to force the issue. Patience is a hard thing to master, especially when the media is telling us that we are missing out if we don’t BUYBUYBUY but, if this is going to be the rally of the century, then I think waiting for the NYSE to confirm a breakout 74 points away is not going to cause us to miss much.

Until then, the downside is the easier path to walk as we have such a clear stop line if things break higher.