Courtesy of David at The Oxen Group

Note from David: The buy pick is made every evening at Midnight before the next day begins. The pick is for a single day-trade of a stock or ETF. The Oxen Group provides analysis, entry/exit points, resistance levels,… Picks are only single day trades.

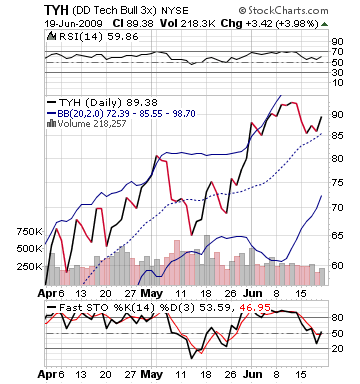

Buy Pick: TYH – Direxion Daily Technology Bull ETF

The Oxen Group believes this may be a strong week for technology. Coming out of the RIMM earnings, the tech sector is looking up after being beaten down for the past week or two. On Monday, especially, the market looks bullish.

The Oxen Group believes this may be a strong week for technology. Coming out of the RIMM earnings, the tech sector is looking up after being beaten down for the past week or two. On Monday, especially, the market looks bullish.

Over the weekend, we had some bullish news coming from Apple that Steve Jobs is ready to go, recovered from a liver transplant, and is healthy. This is bullish news for a company that many believe depend on Jobs for guidance. Further, Google announced that they will be releasing a new Android G2 Phone on T-Mobile in August. New version looks very intense and this puts more fuel to the Google fire. Additionally, Barron’s Online, for the week, is liking a recovery of tech, believing it has become undervalued, and they like Cisco and Microsoft, as well as, they did a special on how Yahoo! is turning things around.

Well, one ETF bundles all these companies into one package, the Direxion Daily Technology Bull ETF (TYH). The ETF looks poised for a strong run on Friday as the market will be bullish on little economic news to pull down as investors look towards the Fed meeting on Tuesday that sent Asian stocks skyrocketing. Further, Oracle Corp. may be creating some buzz as they are set to release earnings on Tuesday. Tech stocks were doing well throughout Asia and the Nasdaq is trading significantly positively. TYH has a lot of room for some upward growth and is sitting very nicely in a neither oversold or overbought postion. Get in at the beginning of the day and ride the stock up.

Entry: 10-25 minutes into day.

Exit: 2-5% increase from buy in.

Resistance: Upper 95.50