Here we go again!

Here we go again!

Just when you thought the market couldn't get more pumped up – this morning CIT has been "rescued" and GS is raising their price target on the S&P to 1,060 (up 13%) by the year end. Kudos to our government for not bailing out CIT – it turns out they DID have alternatives to having their bones picked clean by GS and JPM although perhaps this only puts off the inevitable, we'll have to see. I see CIT trading at $1.50 pre- market and they make a tempting short here as not actually filing for bankruptcy doesn't means your have "saved" your company and what's good for the bondholders is often not what's good for common stockholders….

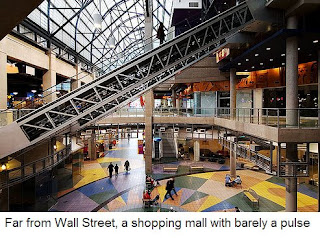

Does this mean the stimulus is kind of working? Bondholders have $3Bn to give CIT and structure a deal that does not require government intervention. The free market triumphs – maybe. There is certainly no shortage of companies in loan trouble as U.S. banks have been charging off soured commercial mortgages at the fastest pace in nearly 20 years, according to an analysis by The Wall Street Journal. At that rate, losses on loans used to finance offices, shopping malls, hotels, apartments and other commercial property could reach about $30 billion by the end of 2009.

The commercial real-estate market, valued at about $6.7 trillion, represents 13% of the U.S.'s gross domestic product. But the recession and scarce credit are pushing more commercial developers and investors into default. Meanwhile, property values continue to decline, and banks are required to record a loss on any troubled real-estate loans where the appraised value falls below the amount owed. Delinquencies on commercial mortgages held by banks more than doubled to about 4.3% in the second quarter from a year earlier. In contrast to home loans, the majority of which were made by about 10 lenders, thousands of U.S. banks, especially regional and community banks, loaded up on commercial-property debt. "Net charge-offs to date have been highly inadequate," said Richard Parkus, head of commercial mortgage-backed securities research at Deutsche Bank. "This is clearly a problem that is being pushed out into the future."

The commercial real-estate market, valued at about $6.7 trillion, represents 13% of the U.S.'s gross domestic product. But the recession and scarce credit are pushing more commercial developers and investors into default. Meanwhile, property values continue to decline, and banks are required to record a loss on any troubled real-estate loans where the appraised value falls below the amount owed. Delinquencies on commercial mortgages held by banks more than doubled to about 4.3% in the second quarter from a year earlier. In contrast to home loans, the majority of which were made by about 10 lenders, thousands of U.S. banks, especially regional and community banks, loaded up on commercial-property debt. "Net charge-offs to date have been highly inadequate," said Richard Parkus, head of commercial mortgage-backed securities research at Deutsche Bank. "This is clearly a problem that is being pushed out into the future."

Yes, I know – as I said in the weekend wrap-up, we have committed the great sin of being skeptical based on fundamentals and we may have cashed out too early by taking things off the table on Friday and, judging by the pre-market (8am), it looks like we were also wrong not to fully cover our long DIA puts, leaving us with a slightly bearish bias over the weekend. Oil flew up to $66 in early EU trading and gold broke $950 and our markets punched up about half a point so everything MUST be great, right? The dollar has lost over 1% (back below 80) of it's value since Friday's close so if your stocks AREN'T up 1% this morning, you are losing ground. We'll be watching $1.425 to the Euro closely this morning as well as the magic 95 Yen line, which would really cheer up the Nikkei but over $1.65 to the Pound is just insulting. Are we really in worse shape than England now? REALLY???

Asia was not in the least bit skeptical this morning with the Hang Seng adding 3.7% to their already impressive rally and running right back over the 40% off line (19,200) to finish at 19,500. The Shanghai hit the 2.5% rule, running up to 3,266 and inching towards that 100% gain for the year while India added 3% and the Baltic Dry Index moved 1.2% but couldn't close the deal at 3,500. The Nikkei was closed for a holiday and they flatlined at 9,395, remaining our lagging global index in the race to get back over our 40% (off the top) lines we've been watching all year. Goldman's global partner in crime, MS, got the rally going in Asia this morning by raising their outlook on Korea's KOSPI by 23%.

All our majors are green there except the S&P, who need to take out 946 and the NYSE, who need to top 6,232. It is NOT a good rally sign when our two broadest (and hardest to manipulate) indexes can't take out levels that the comic-book indexes blow through so we'll be keeping a very close eye on those two, as well as the Russell, who are on the fence at 519, with their 40% line at 514. We have lots of earnings and little data this week and it's going to be up to the 130 S&P reporting companies to make or break us on that 40% line.

All our majors are green there except the S&P, who need to take out 946 and the NYSE, who need to top 6,232. It is NOT a good rally sign when our two broadest (and hardest to manipulate) indexes can't take out levels that the comic-book indexes blow through so we'll be keeping a very close eye on those two, as well as the Russell, who are on the fence at 519, with their 40% line at 514. We have lots of earnings and little data this week and it's going to be up to the 130 S&P reporting companies to make or break us on that 40% line.

EU markets picked up Asia's hot hand and ran with it, gaining about 1.5% ahead of the US open (8:30) and that rally is being led by banks, who are being led by our beloved LYG (who just paid a fat dividend) on news they will turn a profit in the first half of 2009! Energy and mining stocks, of course, are on fire but, with just 66,000 outstanding Aug NYMEX contracts left – they can pretty much make oil any price they want (250,000 transactions on Friday) by churning them one way or the other so it remains to be seen whether we have a new tolerance for the same $65 oil that brought the market to it's knees just two weeks ago. But hey, 2 weeks is a long time and traders hate history so we'll just pretend this is the first time we've seen oil hit $65 and we'll pretend it won't affect consumer spending on other things, like the retailer stores who occupy the commercial buildings that are near default and threaten to bring down the entire financial system again. Yes, la di dah – move along – nothing to see here…

Of course, it's understandable that MS and GS are upgrading THEIR economic outloooks. The average GS employee is getting a $700,000 bonus this year, I'd be optimistc about the second half too knowing that was going to be my Christmas bonus. Perhaps they think everyone in America will be getting one of these checks. After all, weren't we all eligible for bailout funding?

Of course, it's understandable that MS and GS are upgrading THEIR economic outloooks. The average GS employee is getting a $700,000 bonus this year, I'd be optimistc about the second half too knowing that was going to be my Christmas bonus. Perhaps they think everyone in America will be getting one of these checks. After all, weren't we all eligible for bailout funding?

With MS and GS initiating a global market putsch this morning, all we can do is stand back and see how far they can push things. One would expect with a 13% upgrade in S&P outlook by GS that we should be able to take out the highs we made Mid-june, when GS's S&P target was 15% lower (and their target for oil was raised to $85 and look where those suckers bullish investors ended up!). If anything, we'll be rolling our put plays to higher strikes and playing the upside momentum but it's easy to watch for breakouts. In addition to our 40% lines, we'll be looking for closes (not spikes) over Dow 8,800, S&P 946 (the reason we were bearish on top was because they never broke it), Nasdaq is already above 1,860 and needs to hold it, NYSE 6,200 (32 more for the 40% line) and Russell 530.

We're close enough that we can keep making bearish plays and be ready to flip if we see the S&P and NYSE break higher but today is a day to watch and wait as tomorrow is earningspalooza and all the market upgrades in the world won't whitewash poor reports (see GE on Friday). There are still bears to squeeze and MS and GS still control the trading machines so DO NOT imagine they can't jam this market 5% higher. That's why they did the upgrades and they wouldn't pulll that trigger if they weren't prepared to back it up with a buy program so we are expecing an upswing – the question is though, how far can "THEY" take it? That is going to depend very much on earnings.