This is starting to get funny.

This is starting to get funny.

The Beige Book was certainly no great shakes yesterday but we got our usual afternoon "stick save," with the indexes gaining 1% between 1:30 and the close to bring us to barely negative finish. By the time Asia opened, another half point had been added to the US futures and that allowed China to bounce back and we made yet another half point on Europe’s open around 3am. So here we are at 7:30, with our futures up almost a full point on no particular good news.

Of course, this is the same pattern we got in the days following the last Beige Book – a blow-off top into the cliff we fell off on the following Monday and we’ll have to see what we get this time. This is why I said in yesterday’s morning post: "We’re in "take the money and run" mode on our puts as we’ll be happy with a quick dip and a quick profit as we test our lower levels." You can’t press your luck in this market – especially if you are a bear! I screwed up because I thought the GDP was today but it’s not until tomorrow and that makes a very big difference and explains why the pumpers were able to come out in such force yesterday, as they already think they have the jobs nuber "in the bag."

I’m starting to think the GDP may be in the bag too as we have to pin this new round of market exuberance on our President, who managed to get himself quoted all over the planet saying "the Recession is Over." Now, what he actually said, in the proper context was:

I’m starting to think the GDP may be in the bag too as we have to pin this new round of market exuberance on our President, who managed to get himself quoted all over the planet saying "the Recession is Over." Now, what he actually said, in the proper context was:

Now, I don’t know if any of you noticed it. Maybe they’re selling Newsweeks by the check-out stand, but the latest cover of Newsweek says, quote, "The Recession is Over." Now, I bet you found this news a little startling. I know I did, because obviously people are going through a tough time all across the country.

This is a really good tactic for Obama to take. He gets to be quoted (like Nouriel Roubini last week) completely out of context but, if anyone comes back to question his wisdom later he can easily point to his statement and say "that’s not what I said at all." Unlike Roubini, don’t expect Obama to immediately demand for the MSM to clear up his statement – I’m pretty sure that being misquoted internationally was pretty much the game plan.

Recovery was the last thing we were thinking after reading the Beige Book yesterday, which included the zingers: "Commercial real estate sales volume remained low, even "non-existent" in some Districts" and "Most Districts indicated that labor markets were extremely soft, with minimal wage pressures, and cited the use of various methods of reducing compensation in addition to, or instead of, freezing or cutting wages."

Recovery was the last thing we were thinking after reading the Beige Book yesterday, which included the zingers: "Commercial real estate sales volume remained low, even "non-existent" in some Districts" and "Most Districts indicated that labor markets were extremely soft, with minimal wage pressures, and cited the use of various methods of reducing compensation in addition to, or instead of, freezing or cutting wages."

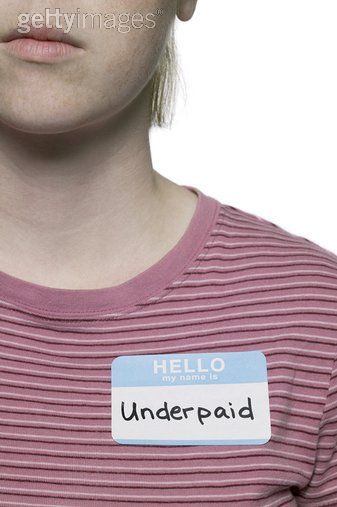

So we don’t just have unemployment, we also have the employed people making less money! If we’re worried about 15M people (9.5%) who don’t have jobs, what about 136M employed people getting paid 5% less? Isn’t that the same as losing another 6.8M jobs? We may be getting improved corporate earnings as companies cut costs, but the costs they are cutting are the spending power of 136M consumers…

Combine a 5% drop in wages with a 5% increase in spending and it’s hard to imagine how we’re going to have an upside surprise to the GDP report tomorrow. We’re waiting for jobs numbers but there would have to be a hell of a turnaround this week to make up for all the wages that are evaporating out of the paychecks of those lucky enough to still be getting one. Sure corporate profits are great and, eventually, they may even use some of those profits to hire someone again – IN INDIA! What we really can’t afford is a jobless recovery – we had one of those in the beginning of this decade, it didn’t stick.

8:30 Update: Great news – "Only" 584,000 people lost their jobs last week and the media is selling this as a big improvement as the 4-week moving average drops to the lowest level since Jan 24th with 6.197M continuing claims vs 6.250M last week. To some extent, the data is telling us that many people are giving up and accepting jobs with lower pay but, hey – at least they’re not unemployed anymore! This great news is pushing the futures to new highs and it seems certain we’ll be gapping up at the open above the previous highs.

So it’s going to be time stop worrying about all those silly fundamentals, switch off our brains and join the rally as our breakout levels become our hold levels. We’ll be looking for 9,100 to hold on the Dow, 980 on the S&P, 1,950 on the Nasdaq, 6,232 on the NYSE and 545 on the Russell. Those will be this week’s bullish hold points and they are generally 5% over our mid-point targets. As I said to Members in this morning’s alert, I will be surprised if this isn’t a blow-off top but being surprised and acting like a deer caught in headlights are two different things.

So it’s going to be time stop worrying about all those silly fundamentals, switch off our brains and join the rally as our breakout levels become our hold levels. We’ll be looking for 9,100 to hold on the Dow, 980 on the S&P, 1,950 on the Nasdaq, 6,232 on the NYSE and 545 on the Russell. Those will be this week’s bullish hold points and they are generally 5% over our mid-point targets. As I said to Members in this morning’s alert, I will be surprised if this isn’t a blow-off top but being surprised and acting like a deer caught in headlights are two different things.

Our play on the Dow yesterday was DIA was to grab the $92 calls for $1.05 and we got some $88 puts for the same as a spread looking for a big move one way or the other on the Dow. We’ll see how far it goes today but I’ll be inclined to cash the calls if we get a big win and let the puts ride but we’re going to watch our levels – NO THINKING!!! Thinking already got us into trouble into the close as we added some QQQQ $40 puts at $1.29 and QID $27 calls at $1.30 as we looked to protect the gains on our longs. At the moment, it seems that our long plays didn’t need any protection at all!

XOM missed but no one seems to care and GS kept the plates spinning with an upgrade to GE that countered XOM’s drag on the Dow nicely. Mega Global corporations: Nintendo, SNE, Mitsubishi and Mazda all reported significant revenue slumps and, over in Europe, Shell also had bad news as did SI, Telefonica (Europe’s largest telcom), BASF, National Express and ALU but those markets are flying on what the WSJ calls "Strong Earnings in Europe." International air travel is down 30% from last year but the EU markets are up over 1% so our bullish premise is that no bearish news seems to matter – kind of an "everybody’s doing it" sort of logic…

We are ready to switch off our brains and BUYBUYBUY but first, please, let’s see our breakout levels hold for more than a day – then we’ll be happy to join so we can party like it’s 1999.