Our levels are holding so far.

We came right back to 1,000 on the S&P yesterday but it held like a champ and that gave us the confidence to take a bullish cover on our longer DIA protective puts, right at 3:04, ahead of the usual 50-point stick save but it was a move we initiated right at the bottom at 2:30, catching almost the dead bottom on our roll. Of course it's total nonsense but it's total nonsense we can count on with 8 stick saves of at least 50 points in the last 90 minutes coming in the last 10 market sessions accounting for 400 points of Dow gains or ALL of our gains since July 20th when we "broke out."

As illustrated in David Fry's SPY chart, the only exceptions to the stick save were the last two Fridays and I said to members in yesterday's chat, perhaps that is somehow significant that the collective we call "Mr. Stick", does not feel confident enough to make bullish plays into the weekend anymore. Today we should head right back to re-test 1,000 on the S&P but we are much more bearish overall, having taken profits yesterday and covered our unrealized gains in our $100KP – the plan we discussed in yesterday's morning post.

We got a re-test and a re-failure of the Russell at exactly our 574 target right at 11:15 and the the Qs never even mounted a serious threat on our 40 line so it wasn't a tough call for us in the morning. The other levels we are watching, Dow 9,297, S&P 1,000, Nasdq 2,017, NYSE 6,438, Russell 562 and SOX 308, are looking shaky and may not stand up to another test, especially if we get any bad news on our upcoming data with Wholesale Inventory and Productivity Reports on deck this morning. Our bearish additions were an ERY spread (3x Energy bear) and COF Sept $40 puts, which are already up 10% from our 12:17 pick. It wasn't all negative, we liked a couple of buy/write plays and we took a very bullish spread on FRE, which should do very well this morning. At 12:57 we had noticed FRE moving up and, in Member Chat, we were discussing the merits and my take was this:

FRE/Ifl – The float of FRE is just 650M shares and they are capable of earning $5Bn a year in a stable economy so that would be about $7.50 per share. If we ignore the fact that they lost $50Bn (10 year’s earnings) by virtue of the fact that it’s been swept under the rug by the government. Even if you think it would take them 10 years to pay Uncle same back you still paid $1 for a stock that will let you retire on $7.50 a year in earnings. FRE is not going away, the common stock may end up being liquidated or whatever but, on the off chance it’s not – we were buying them in the spring at .60 on this same premise. What the hell, you put down $1,000 bucks and maybe get $15,000 a year off it down the road – that’s worth a toss. Less so at $1.30 but now options come into play again so a world of possibilities like buying it here and selling the Jan $1 puts and calls for .95 for net .45/.73. You can also spread the Jan $1s with the Jan $2.50s for .34 with a $1.50 upside at $2.50 and in for the same $1.34 as it would cost to buy it now but with less downside delta.

Those $1s should be looking pretty good this morning as FRE reported earning $768M this Q ans said they do not need any more bailout money. Of course, this ignores the fact that the Fed is buying hundreds of Billions of Dollars of the company's debt at close to face value – THAT they do need to continue or this company will vanish in a puff of smoke so be aware of that before you start chasing them uphill! Still it should make for a fun short squeeze this morning and, like I said, what a payoff if it hits… EOG also caught our attention and we put a bearish backspread on them but the margin requirement was too much for the $5,000 Virtual Portfolio, which could use a good sell-off to push WHR and VNO below $59.

Of course the news isn't all bad. The Wall Street Journal is running a heart-warming story this morning about how cities like Nashville, Tampa and Ontario California are all part of a growing movement of cities who embrace the tent cities that lie on their outskirts as they clearly have no better idea of what to do with the rapidly growing population of homeless people. According the the WSJ: "After years of enforcing a tough anticamping law to break up homeless clusters, Sacramento recently formed a task force to look into designating homeless tracts because shelters are overflowing. One refuge in the California capital, St. John's Shelter for Women and Children, is turning away about 350 people a night, compared with 25 two years ago, said executive director Michele Steeb." See – it's a growing business! Who says this economy doesn't have any thriving sectors?

Of course the news isn't all bad. The Wall Street Journal is running a heart-warming story this morning about how cities like Nashville, Tampa and Ontario California are all part of a growing movement of cities who embrace the tent cities that lie on their outskirts as they clearly have no better idea of what to do with the rapidly growing population of homeless people. According the the WSJ: "After years of enforcing a tough anticamping law to break up homeless clusters, Sacramento recently formed a task force to look into designating homeless tracts because shelters are overflowing. One refuge in the California capital, St. John's Shelter for Women and Children, is turning away about 350 people a night, compared with 25 two years ago, said executive director Michele Steeb." See – it's a growing business! Who says this economy doesn't have any thriving sectors?

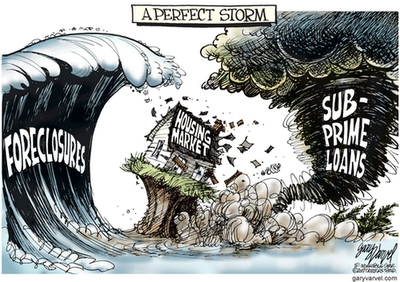

Actually, the homeless may be the fastest-growing segment of our economy with almost 25% of all US mortgage holders currently owing more money than their home is worth, a figure that is projected to rise to 30% by mid 2010. Wow, what's the name of the company that makes Gortex? “The negative-equity rate will rise and spin off more foreclosures,” Stan Humphries, Zillow’s chief economist, “I see a substantial downside risk to prices and don’t think we’ll see a bottom until the middle of next year.” A glut of unsold homes is also pushing down prices. The 3.8 million homes for sale in June would take 9.4 months to sell at the current pace of transactions, according to the National Association of Realtors. The inventory turnover rate averaged 4.5 months in the six years from 2000 to 2005. More than 18.7 million homes, including foreclosures, residences for sale and vacation homes, stood vacant in the U.S. during the second quarter.

So, let's do the math: There are 3.8M homes for sale and that is a glut of homes that is more than double the rate we had in the "healthy" economy we had in the first half of the decade. BUT, that does not include at least 14.9M VACANT homes that will, one assumes, either have to be sold by the banks or written completely off to the tune of (at the $186,000 national median) $2,771,400,000,000. These are real numbers folks, no matter how much you try to sugar-coat it, these numbers eventually come back to bite the economy in the assets. “We haven’t seen a bottom in home prices, and it could take into 2011 before we see equilibrium in the market,” said Michelle Meyer, an economist at Barclays Capital in New York.

So, let's do the math: There are 3.8M homes for sale and that is a glut of homes that is more than double the rate we had in the "healthy" economy we had in the first half of the decade. BUT, that does not include at least 14.9M VACANT homes that will, one assumes, either have to be sold by the banks or written completely off to the tune of (at the $186,000 national median) $2,771,400,000,000. These are real numbers folks, no matter how much you try to sugar-coat it, these numbers eventually come back to bite the economy in the assets. “We haven’t seen a bottom in home prices, and it could take into 2011 before we see equilibrium in the market,” said Michelle Meyer, an economist at Barclays Capital in New York.

I know – Ouch, ouch and ouch! You may say: Phil, how can you point to these things and not be reporting from a fallout shelter in the backwoods of Canada? Well, for one thing, I have faith that all this can be fixed over time – we simply lack the political will so far. I solved this housing crisis 2 years ago and some of my proposed measures have actually been implemented but not my biggie, where I last posted in February "How to Solve the housing crisis TOMORROW." Fortunately, I'm not the only problem solver in this country. Our friends at GM, just 3 years after gasoline first hit $2.50 per gallon, is ready to go to production with a car that gets 230 miles per gallon (city)! Automobiles use 40% of the world's fuel or 33M barrels of oil a day and most of that is city driving. Make no mistake about it, OPEC is terrified of this and they have now lowered their forecast for 2009 by 480,000 barrels a day, not based on the GM Volt, but on the already rapid trend of permanent demand destruction as global consumers just say no to conspicuous consumption in a jobless (and homeless) economy.

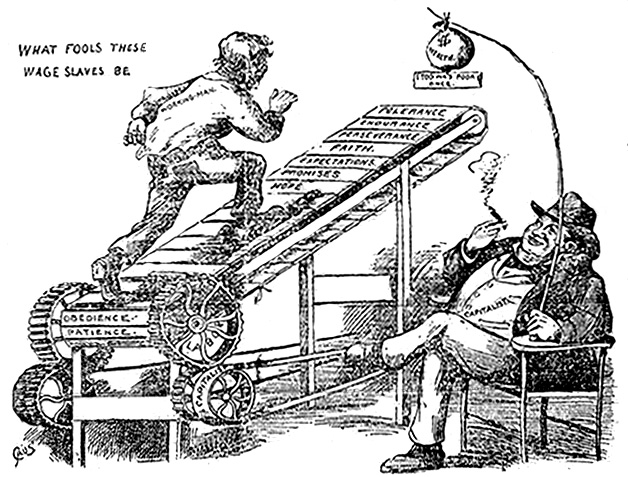

Another reason you have to love this country is we sure can pull it together when we have to. Productivity is up 6.4% in Q2 as a frightened worker turns out to be a highly motivated worker. This was up considerably from the 5.3% gain expected but, unfortunately, Q1 productivity was revised down by 81% from 1.6% to 0.3% so it kind of calls into question yet another set of vital government statistics. Hours worked dropped an average of 7.6%, something we discussed on the weekend as I had pointed out that the 150M people who do have jobs in this country are making 5-10% less for doing them and that is just like having another 15M people out of work. Oops, sorry – this was supposed to be the bullish counterpoint…

Well, sorry but, while we're on the subject – I must share. This was my favorite news item of yesterday as VLO is being sued for cutting their costs by cheating their workers out of millions of dollars in overtime wages and it is just the perfect microcosm of what's going on nationally in the Q2 profit picture. The class-action lawyer is a vertitable quote machine so I'll let him have the last word on this subject:

"To keep its gas pumps flowing, Valero virtually pumps the lifeblood out of its workers who are expected to be on call 24-7, but are only paid for a fraction of the time they spend working. This class action aims to turn off this oil Goliath’s unfair pay practices… When it comes to its employees," adds Mr. Wittels, "the only thing Valero has refined is how best to fleece its employees out of their wages."

So now I've gone on too long and run out of time but Asia was up half a point and nothing interesting happened there. The BOJ held rates at 0.1% but they won't give us home loans at that rate so what do we care? Europe is down half a point at 9am with Latvia's GDP falling 19.6%, keeping our premise alive that the Baltics may still sink the EU. The IMF was forced to lower Romaina's budget limits as well in order to keep that country running on life support and, of course, on a day when oil was testing $70 and OPEC lowered their forecast, it was inevitable that Rent-A-Rebel would come to the rescue and attack a pipeline in Nigeria. This time it was Shell's turn to knock off a day's production in order for NYMEX traders to have something to hang their hats on as they desperately attempt to talk up the price of oil before it falls off a cliff.

We're just waiting for the Fed tomorrow and then it's July Retail Sales on Thursday so nothing that happens today matters all that much but the Nasdaq already blew it's levels and we have some serious tests coming up on the rest. We're already bearish so it's the bull plays we'll be eyeing today, especially the ones we reviewed over the weekend but, as I said last week – watch the newsflow in the MSM. If it starts to get negative, look out below!