Sorry about the lateness of my post. Let’s get right into the business then…

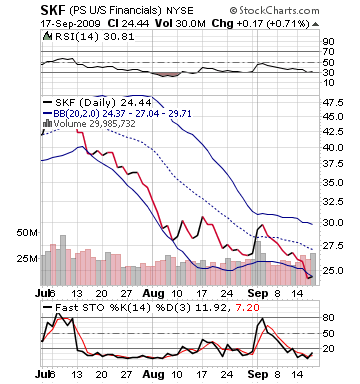

Buy Pick of the Day: Ultrashort Proshares Financials ETF (SKF)

Fridays are always slower days in the market, but today, we have absolutely no pertinent economic data, no pertinent earnings reporting, and very little interesting, market moving news.

So, what does that mean for the market?

So, what does that mean for the market?

Futures were mised earlier but have gained some gorunf as investors are trying to find a direction in the market. One part of the market that could help to bring the rest of it down is the oil market. Oil dropped below $72 per barrel in Asia today, and they are down in early trading on the NYMEX. A strong dollar, as well as, an oversupply of oil could bring the price per barrel back down.

"There is a supply overhang in both crude oil and products. Oil pricing at a $70 plus level is quite vulnerable given the weak fundamentals," Pervin and Gurtz oil analyst Victor Shum said.

The rally we have been on as of recent, if you remember back, was actually started by oil. The market is definitely overvalued and overbought as of right now, and so, what better market to pull things back into perspective than oil.

While oil may be the leader, I think the financials are where one could make some money. If the market starts to turn sour, Ultrashort Financial Proshares (SKF) should be a great play. The ETF has dropped a bit over 15% in the past two weeks. The ETF is way undervalued and it just dipped below its lower bollinger band. The charts are simply a technical guru’s fantasy.

What will be the catalyst though?

Well, the general market malaise I think will be seen in profit taking to start the session, which will compound with oil prices dropping. Further, Charles Schwab Corp. got a downgrade today from Goldman Sachs. That sort of financial downgrade cannot move the entire sector, but it can contribute. The technicals are screaming for a buy, and Huntington Bancshares and MB Financial offered $350 million in new stock, which dilutes the stock’s current value. The lack of news from the big guns also should mean profit taking.

dropping. Further, Charles Schwab Corp. got a downgrade today from Goldman Sachs. That sort of financial downgrade cannot move the entire sector, but it can contribute. The technicals are screaming for a buy, and Huntington Bancshares and MB Financial offered $350 million in new stock, which dilutes the stock’s current value. The lack of news from the big guns also should mean profit taking.

Entry: I think entering SKF in the 24.10 – 24.20 is a strong entry point.

Exit: Looking for 2-3% from that entry range.

Stop Loss: Set at 23.38.

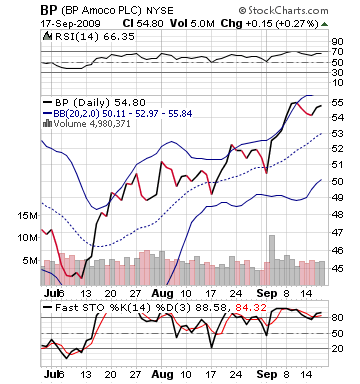

Short Sale of the Day: BP PLC

To follow the oil ideas, BP appears to be a really solid short sale for the day. Briefly, we have oil going down and perhaps a downwards facing market. The market will open higher, but BP is already in the red to start the day. This shows that the combination of lower oil prices and one of the most overvalued oil companies is leading to profit taking.

The stock is near its upper bollinger band, way overvalued, and ready for some investors to take profits after the stock has increased 10% over the past two weeks. Running out of time here, so I cannot give too much more. Basically, though, a lot of  the same ideas for the buy apply here. Picking BP over other major oil companies because it is way too overvalued.

the same ideas for the buy apply here. Picking BP over other major oil companies because it is way too overvalued.

Entry: Short sale it out of the gate because this one is on its way down.

Exit: 2-3% from opening price.

Stop Loss: 3% in reverse of opening price.

Good Investing,

David Ristau