This is spooky.

Yesterday, in my 9:53 am Alert to Members I said: "I will be looking for this to reverse tomorrow unless they come up with something to back up this rally but today we can get back, like Europe, to Wednesday’s lows – which is Dow 9,800, S&P 1,060, Nas 2,130, NYSE 6,970 and RUT 615 – that’s where we’ll be looking for possible shorts." So where did we finish for the day? Dow 9,789, S&P 1,063, Nas 2,131, NYSE 6,940 and RUT 613 – I was off a grand total of 47 points on 20,536 points worth of indexes – that's 0.2% off, not bad for an opening forecast!

So the question for today is: Did they come up with something to back up this rally? Well we have the FDIC proposing banks pre-pay them 3 years of assessments ($36Bn) to keep them from having a negative balance sheet. No, that's not it – in fact, that makes me kind of nervous as they sound desperate. The SEC is holding hearings to restrict short selling. Nope, we tried that last year and that was also desperate. Japan's CPI fell 2.4% in August. No, I'm pretty sure that's a bad thing. No, nothing concrete has been done to justify yesterday's excitement so I'm going to listen to the guy who was off by 0.2% yesterday and plan for a reversal a volume picks up.

We did go into the close yesterday naked on our long DIA puts and we bought back our short Sept DIA puts that we sold to cover for a very nice 75% profit and we held our Oct $98 puts so we did follow the morning plan of shorting into the rally. Now we have to see whether Retail Sales (8:15), Case Shiller (9:00), the CEO Survey (9:35), Fed Gov Fisher (10:00), Consumer Confidence (10:00) and the Investor Confidence Survey (10:00) will be enough to get us over those levels (at which point we kill our shorts) or don't do enough to keep us aloft.

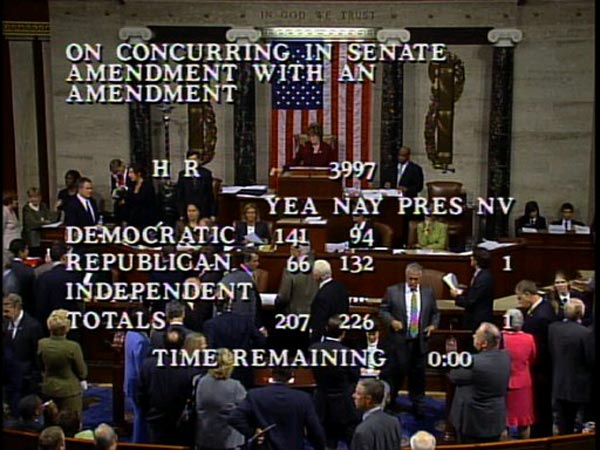

Today is, of course, the 1-year anniversary of the Dow's 777-point drop. I was just reviewing our Weekend Wrap-Up from the day before the crash as well as our Crash Day post, which I called "Too Little, Too Late" as I was very skeptical that the bailout package would solve anything anyway. It isn't really as exciting a read as you may think because we were prepared for the fall and had bet accordingly but we were still shocked when the Republicans voted the bailout packaged down and put a nail in the coffin on the markets. Still, that was the drama for the day and we watched it the way you watch a Nascar crash in slow motion – with sort of a detached sense of interest as it unfolds.

There is no danger of repeating that performance today and the people who are bringing it up with that in mind are just silly. We were in a massive crisis then and our leadership was in disarray and investors and consumers had zero confidence in the system so people were willing to dump stocks for 10 and 20% losses, just to get back to cash (or gold, which was flying) and into treasuries (which were diving). That is how money flew out of the markets last fall – the question we now have to examine is what will it take to get it to come back?

There is no danger of repeating that performance today and the people who are bringing it up with that in mind are just silly. We were in a massive crisis then and our leadership was in disarray and investors and consumers had zero confidence in the system so people were willing to dump stocks for 10 and 20% losses, just to get back to cash (or gold, which was flying) and into treasuries (which were diving). That is how money flew out of the markets last fall – the question we now have to examine is what will it take to get it to come back?

Americans are currently sitting on $3.5Tn in cash (which is insured by $87.42 of FDIC funds remaining) and that is equal to 73% of the S&P 500s net assets at 1,030. At the very peak of the bull market, that figure was 62%. It's not apples to apples of course but it seems to me that this would indicate that the MOST the markets are likely to go up from here, if investors become 100% confident in the market and feel there is not a problem in sight, is 15%. That would be S&P 1,184 and Dow 11,270 – just about 20% off the dead top. OK, I'll buy that as a possibility as a goal for the next 12 months – but not this year! That's kind of silly don't you think?

Last year we had a crisis of confidence, which wrecked our financial system (as it is based on confidence in a fiat-based monetary system) but it also destroyed REAL wealth in this nation. When the S&P was at 1,500 that 62% of sideline cash was $4.4Tn so investors are still down 25% in available cash and it will take, we assume, 1/3 of the remaining cash to get the market back to it's old highs. That would leave cash on the side at 50% of the S&Ps value and this is the EXACT SAME PROBLEM we had last year. If everyone want to sell their "$6Tn worth of stock," they're going to have a very hard time doing so with just $2.5Tn of cash available – even if you want to assume all those cash holders are dying to take the stock off your hand at peak prices.

Last year we had a crisis of confidence, which wrecked our financial system (as it is based on confidence in a fiat-based monetary system) but it also destroyed REAL wealth in this nation. When the S&P was at 1,500 that 62% of sideline cash was $4.4Tn so investors are still down 25% in available cash and it will take, we assume, 1/3 of the remaining cash to get the market back to it's old highs. That would leave cash on the side at 50% of the S&Ps value and this is the EXACT SAME PROBLEM we had last year. If everyone want to sell their "$6Tn worth of stock," they're going to have a very hard time doing so with just $2.5Tn of cash available – even if you want to assume all those cash holders are dying to take the stock off your hand at peak prices.

That's right, we are rapidly getting back to the same completely insane market valuation model we had in 2007, only this time we've already destroyed about 25% of the Nation's wealth so the closer we get to "recovery" the more dangerous reality can become if it rears it's ugly head and causes people to want to sell stocks again. Having the market rise too quickly, without allowing wages and capital gains to build up the supply of sideline money creates a very dangerous bubble with very little real support. I have explained this to members in the past using the analogy of a car lot:

Let's say that the market is represented by 100 cars on a car lot and those cars have a "value" of $100,000, or $1,000 per car. Now let's say that the people, your customer base, has $100,000 to spend. You can, at first, sell all 100 cars for $1,000 and, in theory, everyone is happy. That was roughly where the market was in March, when the value of the market dropped to about $3.5Tn, just about equal to the amount of cash there was to buy it. Since that time, very little cash has moved off the side but the S&P has gone up 50% to about $4.7Tn.

If we look at that in our car model, let's say that 20 of the 100 cars were sold for $1,500. That gives the remaining cars on the market a "value" of 80 x $1,500 since "that's what people are buying them for" but that logic is fatally flawed as the consuming public used $30,000 of their $100,000 to buy those 20 cars and now they have just $70,000 of cash left on the side. While you may think the remaining 80 cars are "worth" $120,000 based on the fact that the last car you sold went for $1,500, the fact is there isn't enough money in the world left to buy your remaining cars at that price. Should you wish to liquidate all 80 remaining cars now, not only would you not get $1,500 but, even if every single sideline buyer wanted to buy a car, there is only $875 per car left, representing a loss for all the "buy and hold" investors.

This is the great value fallacy of the market, especially one that rises quickly on low volume. We are creating wealth only on paper and, while that may make us feel better, the fact is that if the people who think they have money in their virtual portfolios actually try to convert their paper shares into hard currency – they will find that it's not quite as liquid as they think. The same nonsense is playing out in the commodity pits and we are building a real house of cards here as the markets have gotten way ahead of reality.

It is possible that, over time, the money on the sidelines will grow to accommodate the skyrocketing market and commodity prices. We will be looking for massive increases in Corporate Earnings and big increases in wages and savings that will show us that these levels may be sustainable as it is possible that investors are choosing to put new money straight to work in the markets and simply not bothering with cash – certainly that's the path the pundits are pushing this year. We're happy to go along for the ride but expect us to also be the first ones to sell if things get a little shaky.

It is possible that, over time, the money on the sidelines will grow to accommodate the skyrocketing market and commodity prices. We will be looking for massive increases in Corporate Earnings and big increases in wages and savings that will show us that these levels may be sustainable as it is possible that investors are choosing to put new money straight to work in the markets and simply not bothering with cash – certainly that's the path the pundits are pushing this year. We're happy to go along for the ride but expect us to also be the first ones to sell if things get a little shaky.

As we expected yesterday (our first pick of the day was FXI), China had a nice bounce overnight with a 450-point gain, right back to 21,000 (2%). The Nikkei gained a point, back to 10,100 but still 100 points below the danger zone even though they did get the Dollar back over 90 Yen, which sparked a huge relief rally in the export sector.

Europe has been trading flat ahead of our open and nothing is going on there as we all wait for the US data to come in today. Our futures got a quick boost from the Case-Shiller numbers, which shows just 2 of 20 metro areas still in decline (Las Vegas and Seattle). As of July, the index is down 33% from it's 2006 peak so yay, I guess…

As I said, let's watch our levels to see if they hold. We expect consumers, investors and CEOs to be confident at the top of a 50% market rally but the question is, as it was a year ago – Is it going to be too little, too late?