We got our sell-off, now what?

We got our sell-off, now what?

Despite generally failing our levels yesterday (see Fibozachi review), the Dow held 10,250 and the SOX were green so we wrangled ourselves back to neutral into the close. Over and over again my best advice to bears in this rally has been to take profits off the table quickly as we rarely string more than 2 days in a row together of downward movement. With that in mind, we moved to lock in our bearish profits ahead of the 3pm stick save which, though disappointing yesterday, at least was predictable as ever.

We even went long on oil futures at $72.50 (after a failed attempt to go long at $73) and we came just short of our goal of $74 this morning at $73.88, which is close enough to take the money and run in the futures (pays $10 per penny per contract). So we’re looking for a small retrace today (up about 0.5%) to retest our levels and then we’ll see how we’re going to play into the afternoon depending on what holds up.

Meanwhile, I think it’s time to revisit the concept of hedging for disaster, something I advocated during another "recovery," in October of last year, where we made our cover plays to carry us through a worrisome holiday season and into Q1 earnings – "just in case." The idea of disaster hedges high return ETFs that will give you 3-5x returns in a major downturn. That way, 10% allocated of your virtual portfolio to protection can turn into 30-50% on a dip, giving you some much-needed cash right when there is a buying opportunity.

Meanwhile, I think it’s time to revisit the concept of hedging for disaster, something I advocated during another "recovery," in October of last year, where we made our cover plays to carry us through a worrisome holiday season and into Q1 earnings – "just in case." The idea of disaster hedges high return ETFs that will give you 3-5x returns in a major downturn. That way, 10% allocated of your virtual portfolio to protection can turn into 30-50% on a dip, giving you some much-needed cash right when there is a buying opportunity.

At the time, I advocated SKF Jan $100s at $19. SKF hit $300 around Thanksgiving and those calls made a profit of over $280 (1,400%), so putting just 5% of your virtual portfolio into that financial hedge would give you back 90% of your virtual portfolio when you cash out. Keep in mind these are INSURANCE plays – you expect to LOSE, not win but if you need to ride out a lot of bullish positions through an uncertain period, this is a pretty good way to go.

Another play we picked at the time was DXD Apr $55s at $14.20. DXD doubled that same month, went back down to $50 and was back at $90 in March. The nice thing about playing options rather than the stock is the Apr $55s were $65, up 350% rather than "just" the double for holding the ETF. SDS March $77 calls at $9.95 were my 3rd pick and SDS flew to $130 in November and then to $115 again in early March, a 500% profit on the calls. I would urge you to read the original post to get an idea of our mindset at the time, where I said:

As far as hedging goes, if you are 50% invested and 50% in cash and you are worried about losing 20% on the stock side in a major sell-off, then the logic of these hedges is to take 40% of your cash (20% of your total) and put it on something that may double while the other positions lose. If things go down, your gains on the hedge offset some of the losses on your longer positions. If things go up, you can stop out with a 25% loss, which will "only" be a 5% hit on your total virtual portfolio but it means we are breaking through resistance and your upside bets are safe and doing well. That is not a bad trade-off for insurance in this crazy market. Also, be aware that these are thinly traded contracts with wide bid/ask spreads and you need to use caution establishing and exiting positions.

As we are now, we were very keyed on watching our levels, which were at the time: Dow 10,650, S&P 1,135, Nasdaq 2,000, NYSE 7,400 and Russell 700 – all marks we are currently far short of other than the Nasdaq, who has been our leader this year. Today we are looking to retake ALL of our lower levels at Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,200 and Russell 600 and anything less than holding them into the close is going to put us back to bearish.

We had a very happy Thanksgiving because we were prepared for a nice correction and I want people to be able to enjoy Christmas and New Year’s the same way so that is the goal of our new protectors. Here’s a few ideas I have to ride out a possible downturn over the next few months:

We had a very happy Thanksgiving because we were prepared for a nice correction and I want people to be able to enjoy Christmas and New Year’s the same way so that is the goal of our new protectors. Here’s a few ideas I have to ride out a possible downturn over the next few months:

- DXD Apr $26 calls at $5.40, selling Apr $33 calls for $2.40. This is a net $3 entry on a $7 spread so your upside is limited to a 233% return but I like this play because DXD is currently $30.41 so you are starting out $4.41 in the money on your spread. If the Dow breaks over 10,500 and holds it, there’s a good chance you can kill this cover with a $1 loss (33%). Under 10,500 you stand an excellent chance of at least getting your money back, which makes this very cheap insurance!

- FAZ July $20 calls at $5.70, selling July $35 calls for $2.90 and selling July $14 puts for $2.10. This one is risky as you can end up owning FAZ for net $14.70 but it’s currently trading at $20.73 so that’s a 29% discount off the current price and FAZ is always a good hedge against your financial longs. The net entry on the $15 spread is .70 so it’s a phenomenal 2,000% return at $35. The premise of this trade is the financials may collapse again and, if not, we don’t think they are going to be rocketing up from here either.

When you are entering a trade like this, assume you will have FAZ put to you at $14.70 and allocate how much you are willing to own. Say that’s $30,000, which would be 2,000 shares and that means you can make this trade with 20 contracts at a net outlay of $1,400 and they will return $30,000 at $35 but even $22 would give you $4,000 back on your 20 July $20s. On the risk side, imagine FAZ falls 50% to $10 then you are assigned at $14.70 and have a $4.70 loss x 2,000 shares = $9,400. If that represents 10% of your virtual portfolio and you are fairly confident that your bullish financials will make at least $1,000 a month if the they finish flat to higher – this is a very cheap hedge.

- SDS March $38 at $3.20, selling March $50 calls for $1.10. Here we are in a $12 spread for net $2.10. This trade is out of the money and we would expect to lose the $2.10 but the payoff on a big drop is 6:1 so allocating 2% to a trade like this gives you 14% of your virtual portfolio in cash on a steep drop.

- SMN (ultra-short materials) Apr $11 calls at $1. This is a bet that the commodity bubble will collapse or the economy will slow and the materials sector will sell off. SMN was $82 last November (coming off $15 in June) so figure they can go up about 5x on a good run. Currently at $9.37, that gives us a max expected upside (in a disaster) of about $45 and, of course, we’d be thrilled to see half of it at $27, which would be a $1,600% pay-off on this play.

As with all of our protection plays, if we become more confident that the market will NOT collapse, then we simply take them off the table with a small loss and that makes us more bullish but having a few hedges like this in your virtual portfolio can do a lot to cushion the blows from any major market sell-offs. There are 6 more plays I’ll be reviewing for Members later this week as we focus on certain sector plays that can give us a very nice return – even if it’s only a little rotation!

As with all of our protection plays, if we become more confident that the market will NOT collapse, then we simply take them off the table with a small loss and that makes us more bullish but having a few hedges like this in your virtual portfolio can do a lot to cushion the blows from any major market sell-offs. There are 6 more plays I’ll be reviewing for Members later this week as we focus on certain sector plays that can give us a very nice return – even if it’s only a little rotation!

We didn’t do a lot of bottom fishing yesterday as we need to see that we have a bottom but we did grab a couple of gold longs as they bottomed out at $1,130 as our gold shorts are well in the money and need protection. Today we’ll be focusing on the 2.5% line (off last week’s highs) and their expected bounces at: Dow 10,285 (10,336) S&P 1,090 (1,095), Nas 2,158 (2,168), NYSE 7,095 (7,130) and RUT 590 (593). So it’s the bracketed retrace lines we’ll be watching this morning and if we fail to get over those levels, we likely have a 1.25% leg down coming today, giving us a very critical test of NYSE 7,000 and Russell 585. The Russell has saved us from many trading mistakes in this cycle and we’ll be taking it’s lead very seriously.

I expected a squeeze play in the dollar to form by now and it hasn’t, that’s what’s keeping me "bullish" on equities and commodities for the moment but Forex is very complicated and it’s possible we just need to be patient. $1.45 to the Euro and $1.60 to the Pound are our key watch levels. What’s been holding the dollar back has been a weakness against the Yen, which makes little sense as their government officials have taken to openly fighting about monetary policy as the GDP has been revised lower, down to 1.3% from the 4.8% reported last month. The revision, which was deeper than the predictions of all but one of the 17 economists surveyed by Bloomberg News, also showed that price declines accelerated.

“Investor sentiment is worsening because of the reignited uncertainty about credit,” said Naoteru Teraoka, who helps oversee $16 billion in Tokyo at Chuo Mitsui Asset Management Co. “There’s uncertainty about the future and companies are cautious.” The Nikkei pulled back another 135 points (1.34%) and finished right at the 10,000 line while the Hang Seng dropped 318 points (1.44%), after failing to hold the critical 22,000 mark and wound up at 21,741 and the Shanghai Composite also dropped 1.4%, failing to hold support at 390 and looking more like a double top here than an index that’s consolidating below 400.

![[Rising Worries]](http://s.wsj.net/public/resources/images/P1-AS827A_GREEC_NS_20091208191230.gif) Europe is holding on to small gains ahead of our open (8:30) as German Exports continue to do well and the UK declares they will keep their stimulus plans (and presumably, easy money policies) in place through 2010. No news coming out of Europe is going to impress us at the moment as the FTSE failed our 5,250 watch line and the DAX failed at 5,750 as well so those are bearish signals for the global economy. Certainly this is a reflection of default concerns from both Greece and Dubai, who have both had their ratings cut to near junk status this week. Russia’s finance minister added to the chorus of concerns Tuesday. He said Russia is "still a weak link" in the global economy and would be vulnerable in case of a reversal of the tide of money now flowing in, partly because of higher oil prices.

Europe is holding on to small gains ahead of our open (8:30) as German Exports continue to do well and the UK declares they will keep their stimulus plans (and presumably, easy money policies) in place through 2010. No news coming out of Europe is going to impress us at the moment as the FTSE failed our 5,250 watch line and the DAX failed at 5,750 as well so those are bearish signals for the global economy. Certainly this is a reflection of default concerns from both Greece and Dubai, who have both had their ratings cut to near junk status this week. Russia’s finance minister added to the chorus of concerns Tuesday. He said Russia is "still a weak link" in the global economy and would be vulnerable in case of a reversal of the tide of money now flowing in, partly because of higher oil prices.

Greece’s case could present the European Central Bank and the European Union with a dilemma: whether to bail out the country or possibly see a euro-zone member face a debt crisis. The first course could reduce the pressure for fiscal discipline, while the second could damage the credibility of Europe’s great single-currency experiment. The real danger here is triggering a rapid rise in interest rates before international banks have a chance to stabilize their balance sheets.

Mario Draghi, the governor of the Bank of Italy, highlighted the danger posed by a "huge wall" of corporate and public debt. He cited estimates of around $4 trillion in non investment-grade and commercial-real-estate-based debt coming due over the next five years, "trillions" of dollars of bank debt and public debt on top of all that. "We are actually seeing sovereign risks that materialize," Mr. Draghi noted, referring to Fitch’s downgrade of Greece’s sovereign debt Tuesday. "All of this will certainly increase the risk premium in an otherwise safe asset, and may bring in sometime higher interest rates," he added.

Mario Draghi, the governor of the Bank of Italy, highlighted the danger posed by a "huge wall" of corporate and public debt. He cited estimates of around $4 trillion in non investment-grade and commercial-real-estate-based debt coming due over the next five years, "trillions" of dollars of bank debt and public debt on top of all that. "We are actually seeing sovereign risks that materialize," Mr. Draghi noted, referring to Fitch’s downgrade of Greece’s sovereign debt Tuesday. "All of this will certainly increase the risk premium in an otherwise safe asset, and may bring in sometime higher interest rates," he added.

We’re already well short on CRE but that sector never ceases to amaze us by staying up despite all news to the contrary. At the moment, we are resigned to be patient until Jan earnings announcements give us a better look under the hood of these players and, until then – we have our disaster protection – just in case things go south faster than we thought they would.

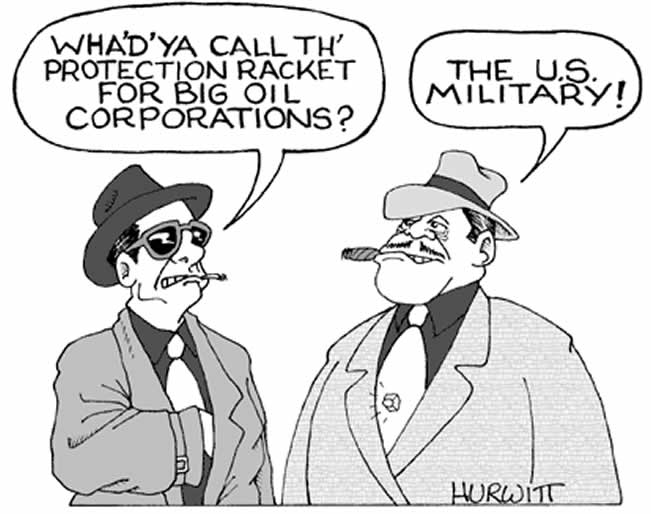

Keep in mind that this morning we are playing for our bounces but by no means bullish overall. Goldman’s market goose of the day is to announce that there will be no Fed hike until 2012 so all aboard the free money express. Of course, someone should tell GS that the money train left the station a long time ago and, unless the Fed is going to start paying us to borrow money, rates aren’t going any lower. Today is not a big data day with Wholesale Inventories at 10 and Oil Inventories at 10:30, where we may finally get a draw after 2 weeks of builds. Since a 2Mb build is being forceast by crooks in the pockets of Big Oil analysts, it will be very easy to beat and move oil higher.

High oil was a big factor in killing consumer confidence in last night’s poll with half of those polled saying they feel LESS financially secure than they did last year and just 1 in 3 people saying they think the economy will improve in the next 6 months. Mortgage Applications came in mixed but the numbers can easily be spun positively and that’s all that will count this morning on that report.

We’ll try to be agnostic and watch our levels but let’s all be careful out there, I’ll feel much better with a little more disaster protection depsite the fact that we are mostly cash and bearish since taking it off at the top over the past couple of weeks. As I said above, we were so bearish we had to sell DIA puts to lock in gains but we’ll be happy to buy them back if our lower levels start failing and we’re on the way to that 1.25% sell-off for the day.