![[RETAIL]](http://s.wsj.net/public/resources/images/MK-BA300_RETAIL_NS_20091227192259.gif) Well, I was wrong.

Well, I was wrong.

According to MasterCard's SpendingPulse, a combination of last minute shoppers and an extra shopping day between Thanksgiving and Christmas boosted retail sales 3.6% over last year's horrific total. I had thought we'd be lucky to hit 1% and I'm not going to hide behind the extra shopping day (which added 3%) as an excuse – I simply underestimated the determination of the US consumer to spend money. We knew E-Commerce was doing well and the other results are very much in line with my more bullish 2010 Economic Outlook, with Electronics and Jewelry doing well while Department and Clothing stores taking a hit.

I've been playing for a big, sharp sell-off that just doesn't look like it's going to happen now as it was going to be retail that I expected to take us down, with imminent store closings finally deflating the REIT sector. Now what? I have some serious rethinking to do and it looks like we are going to track more in-line with the bullish side of the economy (the success of the top 10%) and ignoring the suffering of the masses for as long as we can get away with it (the French managed for an entire decade before the people finally began taxing the rich on a per head basis). The seeds of the French revolution were sown in their support for the American revolution (because it hurt England) and other "necessary" wars which put the country deeply into debt and drove up commodity prices causing the poor bulk of the population to downgrade their lifestyle even as the rich prospered and flaunted their wealth – a TOTALLY different situation, so why worry?

Speaking of massive government debt, our Treasury Department has removed the $200Bn (each) caps on aid to FRE and FNM for THE NEXT THREE YEARS, effectively paying whatever it takes to push off the problem of having to foreclose on non-payers and selling off the growing inventory of defaulted homes until AFTER the next Presidential election, when the bill will come in. Foreclosure filings exceeded 300,000 in November for a ninth consecutive month, RealtyTrac Inc. reported Dec. 10. The firm said filings will reach a record 3.9 million for the year.

The Treasury also relaxed its timeline for Fannie Mae and Freddie Mac to shrink their virtual portfolios of mortgage assets. Previously, the companies were instructed to reduce their virtual portfolios at a rate of 10 percent a year. Now, they will be required to keep the value of their virtual portfolios below a maximum limit, currently $900 billion, that will go down by 10 percent a year. This means they won’t need to take immediate action to trim their holdings and could allow them to rise. Fannie Mae’s virtual portfolio ended October at $771.5 billion and Freddie Mac’s holdings at the end of November were $761.8 billion, according to the latest figures released by the companies.

The Treasury and Federal Housing Finance Agency seized control of the mortgage-finance companies almost 16 months ago amid fears the two were at risk of failing. The government- sponsored enterprises, or GSEs, own or guarantee about $5.5 trillion of the $11.7 trillion in U.S. residential mortgage debt. Officials set up the Treasury lifelines, which were expanded in May, to keep the companies solvent. If the two firms exhaust that backstop, regulators will be required to place them into receivership. Washington-based Fannie Mae has lost $120.5 billion over the past nine quarters and McLean, Virginia-based Freddie Mac has recorded $67.9 billion in cumulative losses over the past nine quarters amid a three-year housing slump.

The Treasury and Federal Housing Finance Agency seized control of the mortgage-finance companies almost 16 months ago amid fears the two were at risk of failing. The government- sponsored enterprises, or GSEs, own or guarantee about $5.5 trillion of the $11.7 trillion in U.S. residential mortgage debt. Officials set up the Treasury lifelines, which were expanded in May, to keep the companies solvent. If the two firms exhaust that backstop, regulators will be required to place them into receivership. Washington-based Fannie Mae has lost $120.5 billion over the past nine quarters and McLean, Virginia-based Freddie Mac has recorded $67.9 billion in cumulative losses over the past nine quarters amid a three-year housing slump.

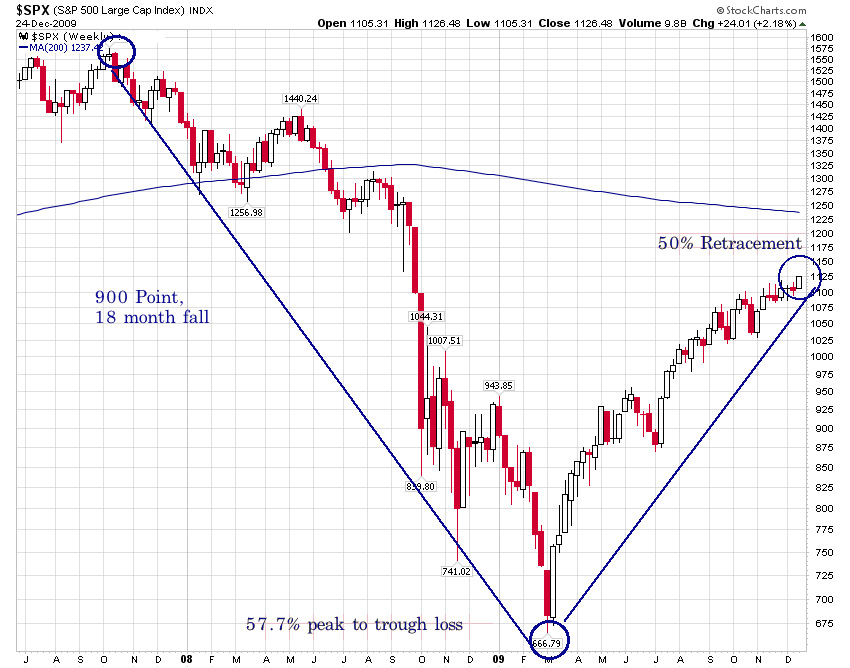

So yay, I guess. Both FRE and FNM should do well on that news, spurring a move up in housing on the news that the government is going to go far more in debt so we can keep pretending everything is going well and that may allow the S&P to stay over 1,116, which is our 50% retrace mark of the 900-point drop from 1,566 way back in October of 2007. It took us 18 months to drop 900 points and Jan 9th will be month 10 of our recovery – truly in incredible stock market rally if you assume that the drop to 666 wasn't an aberration. If, on the other hand, we were to say that 866 was the proper drop (700 points) and the rest was a silly panic that quickly reversed itself, then we have only retraced 37% of the real drop and the number to watch would be 1,216, which would be the true 50% retrace on the S&P.

I'll be looking to rework our Big Chart with that in mind this week as I believe we can all now admit that the March panic was a mistake and not an event that should be taken seriously by chartists. If we throw out that sharp "V" pattern and flatten out those lines on our various indexes, I think we'll get a truer picture of what's in store for our indexes in 2010 from a technical standpoint.

We're seeing a nice breakout from the Nikkei, who were our bullish choice for Jan gains with the $10 calls for just .10, which should do very nicely today. The Nikkei flew over the 10,500 mark today and finished up 1.3% at 10,634 on news of rising Industrial Production, a strong dollar and a statement from China that they will not be letting the Yuan rise, which is also supportive of the dollar. This allowed Asian investors to ignore a 25% tanker glut that is getting more serious as concerns are being raised that as much as 1/3 of the 168 tankers that are being used to store crude products will cause an even greater glut if the energy market dips and sends those tankers running to port.

Europe is in a fine mood this morning an up about 1/2 a point as they return from their holidays with the DAX finally topping 6,000 so we'll see if they can hold that as a very bullish global indicator for the day.

We still have our concerns and we'll wait for a bit more data but we're not going to fight the tape and we will remain mainly in cash until next week, where we can see how much of this year-end rally we can hang onto but this morning we have upgrades on AAPL and AMZN, which should help the Nasdaq to keep leading us higher and oil is up to $79 thanks to some weekend terrorism (also helping gold stay over $1,100) so it's business as usual this week and business is usually good in thinly traded markets!