Hey Readers,

Hey Readers,

The market is looking like it wants to snap its major losing streak that occurred for most of last week, but I am not convinced. The futures on the market have continued to dwindle away as the trading day has begun, and there is one key economic indicator that I am looking at as a reason to definitely be worried.

Let’s get into the picks…

Buy Pick of the Day: Direxion Daily Real Estate 3x ETF (DRV)

Analysis: Today’s big story so far is that futures are up. Yet, I am not so convinced we are ready to just run up the market on pretty much no new developments. The market ran itself down on fears over Obama’s banking policy (right or not is up to you) and earnings that were subpar. This morning, we got a mixed bag of earnings from a couple of semi-pros. Halliburton, the biggest name out there, actually reported a 48% drop in earnings. The Asian market was down and the European markets are down even further. Nothing to me looks too bright. This is also why we have seen the futures on the market continue to dwindle away as more players become involved.

The big report for the day is Existing Home Sales at 10 AM. I am not bullish at all about this figure. At the beginning of

January, we saw that pending home sales were down 16%, when analysts were expecting a 2% decline in December. The decline from November to December was estimated to be about a 1% drop. It was actually a 15% drop. Analysts are nowexpecting nearly a 10% drop in existing home sales. Even if the number is close to the expected 5.95 million that is predicted. That drop is an eye sore, and I am pretty worried about the chances that the number will be met. The housing industry is really not in as good of shape as some think.

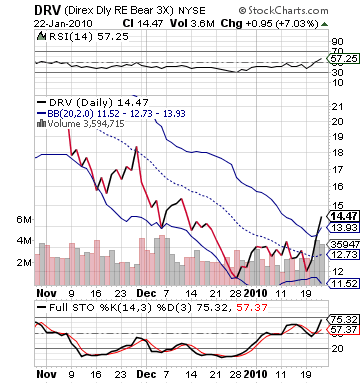

With the market not being as strong as some think and the housing report, a real estate ETF like Direxion’s Daily Real Estate 3x (DRV) looks to be a nice play. The ETF is already undervalued in pre-market due to the futures, and it presents a great value trade. While DRV does not look as closely at residential real estate, it does have some connection to it. Further, most investors associate DRV with housing data.

Technically, DRV is definitely an overvalued stock in the short term, which is part of the trade of which I am not terribly fond. Yet, I do still think the ETF presents a pretty interesting trade. We have adjusted down the entry point in order to help accommodate for the fact that the stock is right at its upper bollinger band. If the ETF does not reach this entry then I am not sure its a great trade. At the same time, the technicals are a bit deceiving. The stock traded in a one dollar range for almost one month after dropping nearly 50% in the two months prior. This had narrowed the bollinger bands, and the stock is breaking out of the narrow band.

Wait for our entry and good luck.

Entry: We are looking for an entry of 13.90 – 14.00.

Exit: Looking to gain 2-4%.

Stop Loss: 3% on bottom of entry.

Short Sale of the Day: Privatebancorp Inc. (PVTB)

Analysis: As has been stated before, I am not too keen on this market rallying. One major earnings beat today was from Privatebancorp Inc. The company went -0.30 vs. the expected -0.33. The stock, therefore has shot up 8% in pre-market trading, which is just way too much for this stock. Over the past two months, the stock has not changed any direction. It has been very flat in trading, and it is not a stock that makes 8% moves. That means that we are going to be seeing some MAJOR seller interest.

Investors are going to be looking to unload this bad boy fairly quickly in the market this morning, especially if things go sour. I still think it is a viable trade even if the market trades a bit up or neutral, but it may not have that movement we would like to see. We want to get involved early and get out.

Investors are going to be looking to unload this bad boy fairly quickly in the market this morning, especially if things go sour. I still think it is a viable trade even if the market trades a bit up or neutral, but it may not have that movement we would like to see. We want to get involved early and get out.

This type of trade is not one that we look at the company’s fundamentals and value. Rather, we are playing on market psychology. If a stock has not moved more than 1-2% in two months, and you were holding PVTB that entire time. You see 8% increase one day, what would you do? Sell! When are we going to get 8% again? With all that selling, the price is going to drop. Who wants to buy a stock that is going to move 2% in two months. Not me!

Check out the chart to see exactly what I mean.

Entry: We are looking for an entry of 10.85 – 10.95.

Exit: Looking to gain 2-4%.

Stop Buy: 3% on top to cover.

Good Investing,

David Ristau