We have Case-Shiller at 8:30 but that’s not my main concern.

We have Case-Shiller at 8:30 but that’s not my main concern.

Inflation is much worse than it seems and Doug Kass made an excellent point in TheStreet.com: "Few economists or pundits have noticed that the BLS has increased the weighting of OER to 24.433% of CPI. It had been 23.158%. (Because it’s now declining?) And let’s not ignore the fact that Americans’ misery index in reality is far worse than the above official numbers indicate due to fraudulent U.S. economic statistical methodology. U.S. solons have relentlessly altered CPI, jobs data and GDP statistical methodology to obfuscate declining U.S. living standards. John Williams notes, "On the inflation front, the CPI-U annual inflation rate jumped to 2.7% (3.4% for the CPI-W)…. Adjusted to pre-Clinton (1990) methodology, annual CPI growth rose to 6.1% in December vs. 5.1% in November, while the SGS-Alternate Consumer Inflation Measure, which reverses gimmicked changes to official CPI reporting methodologies back to 1980, rose to about 9.7% (9.68% for those using the extra digit) in December vs. 8.8% in November." Plug in the pre-Clinton or the SGS-Alternate Consumer Inflation Measure as well as a more reasonable nominal income metric — U.S. solons greatly overstate jobs and income — and the American misery index would be more in line with the palpable ire in the U.S.A."

The whole article is a good read on CPI and the fallacy of the Owners Equivalent Rent calculation that has been keeping inflation "in check" for those fantasy consumers that are buying one of the 300,000 homes being sold in the US this year. We talked about it at length last year but it’s very nice to see it getting some attention in the MSM since we are still making policy decisions based on this nonsense. Nonsense won a victroy in California yesterday as Moody’s, S&P and Fitch won dismissal of a negligence and fraud lawsuit by two California investors who lost money on their A-rated bonds. U.S. Magistrate Judge Dale A. Drozd in Sacramento threw out the case in a ruling filed today, saying the investors’ complaint wasn’t specific enough about the alleged fraud.

Ronald Grassi, a retired California attorney, and Sally Grassi, a retired teacher, sued the New York-based companies in federal court in January 2009, claiming they gave high ratings to risky mortgage-backed bonds packaged and sold by Lehman Brothers to curry favor with the investment bank, which filed the biggest bankruptcy in U.S. history in September 2008. The Grassis said in court filings that they had sought safe investments and bought the bonds because they carried A ratings. The Grassis said they spent $40,000 on the bonds that turned out to be worthless. The ratings companies issued false opinions for profit, they alleged. The companies claimed credit ratings are statements of opinion protected by the Constitution’s First Amendment and that ratings providers can’t be sued for negligence because they had no direct dealings with investors.

Ronald Grassi, a retired California attorney, and Sally Grassi, a retired teacher, sued the New York-based companies in federal court in January 2009, claiming they gave high ratings to risky mortgage-backed bonds packaged and sold by Lehman Brothers to curry favor with the investment bank, which filed the biggest bankruptcy in U.S. history in September 2008. The Grassis said in court filings that they had sought safe investments and bought the bonds because they carried A ratings. The Grassis said they spent $40,000 on the bonds that turned out to be worthless. The ratings companies issued false opinions for profit, they alleged. The companies claimed credit ratings are statements of opinion protected by the Constitution’s First Amendment and that ratings providers can’t be sued for negligence because they had no direct dealings with investors.

The Grassis can re-file and say they will but the gist of this defense by the ratings agencies is very disturbing. Essentially, they are saying that an AAA or Bbb or Junk rating is nothing more than an opinion that they bear no responsibility for. Yet the international markets are moved daily by these sames ratings agencies’ pronouncement of the health of Greek, EU, Japan or even US ratings as well as various corporate ratings which, it turns out, are merely and exercise in free speech on behalf of the Big Three. Remember – it’s only a crime if you can prove it in court! Actually make that, it’s only a crime if you, the screwed consumer, can get past the technicalities and costs to get to court against some of the best law firms in America and then – IF the judge agrees to hear your case – THEN you have to prove beyond a shadow of a doubt that the party is guilty – using forensic evidence gathered at incredible expense during months of trials and THEN get a judgment that is more than a wrist-slap and THEN win the appeals and THEN you have justice!

The next crash in real estate looks like it will be coming from the commercial side as Elizabeth Warren forecasts that, by the end of 2010 (this year – for those of you keeping track), about HALF of all Commercail Real Estate mortgages will be underwater. “They are [mostly] concentrated in the mid-sized banks,” Warren told CNBC. “We now have 2,988 banks—mostly midsized, that have these dangerous concentrations in commercial real estate lending." As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

The next crash in real estate looks like it will be coming from the commercial side as Elizabeth Warren forecasts that, by the end of 2010 (this year – for those of you keeping track), about HALF of all Commercail Real Estate mortgages will be underwater. “They are [mostly] concentrated in the mid-sized banks,” Warren told CNBC. “We now have 2,988 banks—mostly midsized, that have these dangerous concentrations in commercial real estate lending." As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

An example of how fast things are falling apart on the CRE side is LNR Property Corp, who are managing $22Bn worth of distressed CRE loans which were obtained through the discounted purchase of CMBS’s. As a workout shop, LNR either negotiates with borrowers to make a loan current or forecloses on the property to extract as much cash as possible from the delinquent mortgage. And while LNR used to make a nice profit working out the occasional bad loans, now the company and its competitors face a flood of bad debt. "It’s tough going for everybody right now,” said Lisa Pendergast, managing director of CMBS strategy and risk at Jefferies & Co. and the incoming president of the Commercial Real Estate Finance Council. ``I don’t think anybody built these [workout] shops to see these huge volumes of loans going bad.”

By LNR’s estimate, the front is widening with no relief yet visible on the horizon. ``We’re seeing vacancy rates in most markets going up. We’re seeing rental rates in most markets going down,” Ronald Schrager, LNR’s chief operating officer, told a recent real estate conference in Miami Beach. “There’s still a lot more distress ahead of us.” This distress is not isolated in Florida either – Downtown Manhattan, which had, until recently, seemed immune to the CRE problems is about to lose its spot as the best-performing U.S. market. Vacancies may exceed 14 percent of the area’s 87 million square feet by late 2011, empty space that’s equivalent to four Empire State Buildings and the highest rate since 1997. “The amount of space that’s potentially going to come to the market will increase availabilities and put pressure on pricing,” said Kenneth McCarthy, Cushman’s head of New York- area research. “It will be quite awhile before it can be absorbed.”

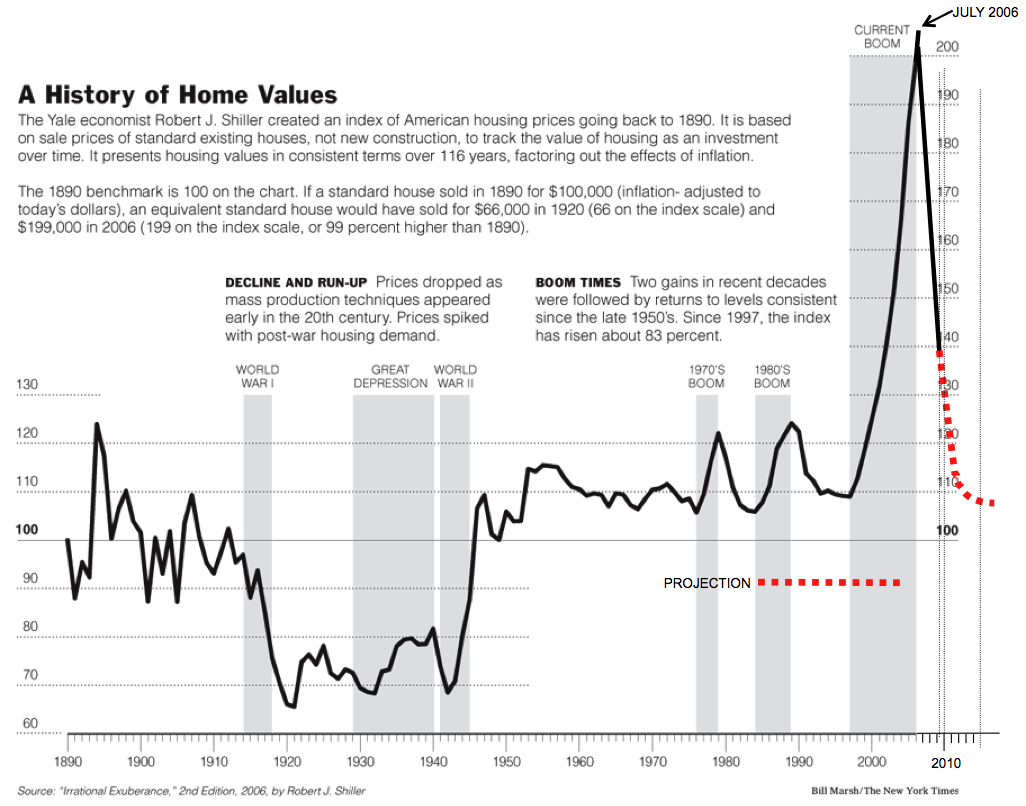

9:00 am Update: We’re getting a positive spin off the Case-Shiller Report, which shows "only" a 0.7% fall in housing prices since last January – that’s our smallest decrease in 2 years. This is kind of like when the family gathers around a terminally ill grandparent in the hospital and someone remarks how nicely they are breathing through their tube today… Cheaper homes, low borrowing costs and government incentives are combining to give life-support to the housing market, which still looks terminal. “While we continue to see improvements in the year-over- year data for all 20 cities, the rebound in housing prices seen last fall is fading,” David Blitzer, chairman of the index committee at S&P, said in a statement.

Japan ignored the 0.9% drop in Industrial Production this morning as the Nikkei went 1% the other way, all the way to 11,097 because, like the US market – bad news is good news as long as it keeps the government running the printing presses and handing out free money. If I hear one more analyst on TV tell us how great US earnings are going to be I think I’ll be sick. If we can’t put up good numbers with the US spending an average of $100Bn a month on stimulus projects. Since we’re buying Chinese goods with that money the Hang Seng was able to gain 0.65% this morning but the Shanghai was pretty much flat at 3,128 and the BSE gave up 0.7%.

Japan ignored the 0.9% drop in Industrial Production this morning as the Nikkei went 1% the other way, all the way to 11,097 because, like the US market – bad news is good news as long as it keeps the government running the printing presses and handing out free money. If I hear one more analyst on TV tell us how great US earnings are going to be I think I’ll be sick. If we can’t put up good numbers with the US spending an average of $100Bn a month on stimulus projects. Since we’re buying Chinese goods with that money the Hang Seng was able to gain 0.65% this morning but the Shanghai was pretty much flat at 3,128 and the BSE gave up 0.7%.

Europe is flat and not much is going on there either with France’s GDP up 0.6% in Q4 (down 2.2% for the year) and the UK coming in at up 0.4% (down 4.9% for the year). Britain’s Office of Fair Trading fines Royal Bank of Scotland (RBS) $42.8M for colluding with Barclays (BARC) on loan pricing and perhaps I should note that the earnings of the financials make up over 1/3 of the S&Ps total earnings so we’d better be nice to them or they may reverse their fake earnings again and then we’ll see the S&P’s p/e jump from 15 back to 45 overnight, like it did 2 years ago – the last time we were silly enough to question the Banksters.

Nope, better to just keep handing out the free money and keeping our mouths shut. We’re rallying in the pre-markets (of course) but I think it’s crap (of course) and don’t forget AAPL is 15% of the Nasdaq so a 2% move in AAPL adds 0.3% to the entire Nasdaq so let’s not be too impressed with their "leadership" on a day when it’s announced that the IPhone will be moving to other carriers. We’ll get consumer confidence at 10 and that could turn things down so – be careful out there.