Yesterday, we got into an Overnight Trade that does not appear to be working out for us. I recommended a play in Chiquita Brands Inc. (CQB). We got involved with the trade at 15.75, and we got hit with a solid 4.5% loss this morning when CQB opened. The company completely missed estimates and actually reported a loss when an expected profit around 0.24 as expected. It was a big miss for us, but we are hoping today’s plays can benefit us a bit more.

Let’s get into today’s plays.

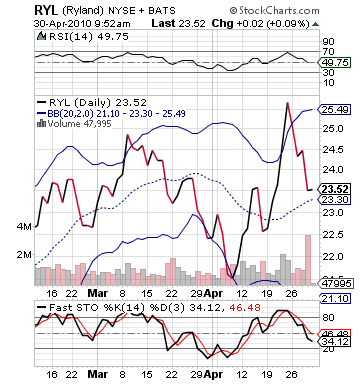

Buy Pick of the Day: Ryland Group Inc. (RYL)

Analysis: We are looking at Ryland Group as our Buy Pick of the Day because of some very solid earnings from DR Horton Inc. (DHI) that were released this morning. RYL released earnings on Tuesday evening that were better than expected, but the company had an order issue that brought the stock down on Wednesday. The stock has been declining over the past few session after breaking its upper bollinger band. In the past week, the stock has dropped near 8%, and it is in a perfect position to make a breakout.

Analysis: We are looking at Ryland Group as our Buy Pick of the Day because of some very solid earnings from DR Horton Inc. (DHI) that were released this morning. RYL released earnings on Tuesday evening that were better than expected, but the company had an order issue that brought the stock down on Wednesday. The stock has been declining over the past few session after breaking its upper bollinger band. In the past week, the stock has dropped near 8%, and it is in a perfect position to make a breakout.

This morning, DHI reported better than expected earnings, hitting an EPS of 0.04 vs. the expected -0.01. The expected loss beat by a profit has helped the company move up in pre-market around 5%. Additionally, it should help the rest of the residential home building market move up along with it. The market is looking at some worse than expected GDP numbers as the GDP came in at growth of 3.2% versus the expected 3.3% for the first quarter, but futures are showing that the market is not being brought down by the news with futures up slightly. Helping that is the fact that the employment cost index came back better than expected.

RYL is in the same sector as DHI and should be benefitting from an industry wide rise. Most of the other residential stocks, however, are already fairly overvalued and looking at some pre-market gains that are making me stray away. RYL, on the other hand, due to its fall over the past week, is looking fairly solid to have a large move to the upside. The company should be able to benefit from its undervaluation coupled with the news from DHI.

The technicals on RYL are very solid, as well. The company is looking at an RSI that is coming in right at 50, so it is not overvalued. The stock has moved right into the middle of its bollinger bands, as well. After a few straight session of losses, fast stochastics are showing an oversold movement, and we should be welcoming in an up day to buck the trend as momentum would suggest so.

Get in early and look for the DHI help. The Michigan Consumer Sentiment Index will help if it comes in better than expected.

Entry: We want to get involved with RYL in the range of 23.55 – 23.65.

Exit: We are looking to gain 2-3%

Stop Loss: 3% on bottom.

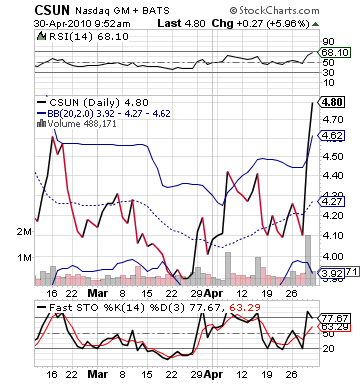

Short Sale of the Day: China Sunergy Co., Ltd. (CSUN)

Analysis: China Sunergy is one of our typical short sales on overexcitement. CSUN reported some very nice earnings this morning coming in with an EPS of 0.18 vs. the expected 0.10. The company is up over 11% in pre-market, though. The stock should see a major movement down from these gains as the stock has gotten much too far ahead of itself. CSUN, yesterday, was already above its upper bollinger band as the stock got a nice boost from some pre-earnings buzz and JA Solar’s good earnings and guidance, as well. The stock, however, is getting much too far haead of itself and selling will commence.

We want to wait for the stock to make a small pop to start the day before expecting a nice sell off to follow. CSUN has moved down a bit from its nearly 12% gains, but we should expect a small bounce especially since the market should open green. CSUN, while having great earnings, is just too overbought. The stock was outside of its range to start yesterday. Today, therefore, this movement puts the stock even farther outside its range. While solar is volatile, a 20% gain in two days has to stop. I think it will this morning.

Get in after the pop. Short sale and cover quickly.

Entry: We are looking to get involved in the 5.00 – 5.10 range.

Exit: We want to cover after 2-3% to the downside.

Stop Buy: 3% on top.

Good Investing,

David Ristau