Poor CNBC! They are never going to get those chocolates…

I joked with Members during yesterday's rally, after Fast Money's bullish "Half-Time Report": "Uh oh – All the Fast Money people said buy – make sure you have your disaster hedges in place!" Indeed the market fell off a cliff almost the second they said it but we got out of our TZA calls (a little early) and did a little bottom fishing yesterday with our own buys on LYG ($3.13), Short EUO ($25.30), VZ ($27), FRO ($30.50), RIG ($58.50) and PFE ($15.10). Maybe I'm just a paranoid conspiracy theorist but I said to Members at the close:

That was a sad little show at the end wasn’t it? Nas was beaten with a stick into the close. AAPL $243, BIDU $67.46, AMZN $123… Ugly stuff. Not at all sure what they were trying to accomplish if not a flush…

Gap/RMM – Yes (we will gap) up. I just didn’t see why we would sell off like that. It seems that someone wanted to paint un ugly picture, maybe they didn’t get a good fill on Tuesday morning? Maybe not gap up tomorrow, maybe another drop and THEN we take off but I’m thinking a fund that wants to make numbers on Friday would want to flush us today and buy the SPX overnight and pump us up for a big finish so they can get back to cash on Friday and book it.

Isn't it funny how that's pretty much exactly what's happening this morning? A huge gap up into the open that's erasing the previous day's losses when no one is trading – just like yesterday (when I get on my knees and pray – we won't get fooled again). Fast Money got fooled out of their bullish 1:50 positions by 5pm as suddenly they relized the market is controlled by evil computer programs – not exactly news to us and no reason to shake us out of our well-hedged positions. We ignored rumors on China (and we always ignore Steve Ballmer) in chat and those seemed to be the major rumors moving the market lower yesterday.

Isn't it funny how that's pretty much exactly what's happening this morning? A huge gap up into the open that's erasing the previous day's losses when no one is trading – just like yesterday (when I get on my knees and pray – we won't get fooled again). Fast Money got fooled out of their bullish 1:50 positions by 5pm as suddenly they relized the market is controlled by evil computer programs – not exactly news to us and no reason to shake us out of our well-hedged positions. We ignored rumors on China (and we always ignore Steve Ballmer) in chat and those seemed to be the major rumors moving the market lower yesterday.

Cramer kept the rumor mill grinding, saying: "The Chinese reportedly are debating whether or not to sell their European bonds, and that’s what killed our upward momentum." CNBC seems to have pulled the video so it's hard to tell the tone but Cramer put up a list of a dozen stocks to buy but said to wait for a 5% correction and concluded: "The next time you’re looking for stocks to buy after we get hammered off the euro, after the banking crisis in Spain or potential country defaults,” Cramer said, “take a look” at these stocks."

It's too bad Cramer doesn't understand how to use options or people could buy those stocks for a 20% discount right now. For example, with FDO ($40.87) we could simply sell the dreaded NAKED PUT, like the July $38 put for $1.25 and that puts us in the stock at net $36.75, a 10% discount right there but, of course, that's just a simple way to play, you can do much better by buying FDO as Cramer suggests AND selling the 2012 $40 calls for $7.50 and the 2012 $32.50 puts for $4 and that puts you in the stock for net $29.37 and you will either get called away at $40, with a 36% gain or you will have another round put to you at $32.50 for an average entry of $30.94, a nice 24% discount off today's price. If you are a long-term investor, wouldn't it be nice to take all your initial entries at a 20% discount?

Speaking of discounts – Kudos to David Ristau from the Oxen Group for putting Members into PAY in yesterday's "Overnight Trade of the Day." David's analysis of PAY was like getting the earnings report in advance! Keep in mind we ALWAYS sell into the initial excitement on these but what a great one-day ride! "Long-Term Investment of the Week", BIG also had good earnings this morning and hopefully we get a nice pop there as well – who says we don't trade straight stocks at PSW???

After taking a day off the fundamentals yesterday (since they weren't going to matter in a panic-driven market), we now get a BIG one with the Q1 GDP, which is expected to be revised up from 3.2% to 3.4%. Another 450,000 people probably lost their jobs last week (yawn) and we have the KC (11 am) and Chicago (Noon) Manufacturing Reports just ahead of the 1pm attempt by our government to find $31Bn worth of suckers to buy 7-year notes in exchange for just 2.8%, about 1/3 of what it was 10 years ago.

After taking a day off the fundamentals yesterday (since they weren't going to matter in a panic-driven market), we now get a BIG one with the Q1 GDP, which is expected to be revised up from 3.2% to 3.4%. Another 450,000 people probably lost their jobs last week (yawn) and we have the KC (11 am) and Chicago (Noon) Manufacturing Reports just ahead of the 1pm attempt by our government to find $31Bn worth of suckers to buy 7-year notes in exchange for just 2.8%, about 1/3 of what it was 10 years ago.

A good portion of this money is still going to bailing out banks, who apparently return the favor by lying to investors. According to the WSJ: "Bank of America Corp. and Citigroup Inc. incorrectly hid from investors billions of dollars of their debt, similar to what Lehman Brothers Holdings Inc. did to obscure its level of risk… In recent filings with regulators, the two big banks disclosed that over the past three years, they at times erroneously classified some short-term repurchase agreements, or "repos," as sales when they should have been classified as borrowings."

While the amounts concerned are "only" Billions (the two banks have over $4Tn on deposit), what I find disturbing is that, almost 2 full years into the banking crisis, STILL NO ONE IS AUDITING THEIR BOOKS?!? Come on Government, we are spending $1,500,000,000,000 more money than we take in – surely we can afford $100,000 for a guy to give the books a once-over! A bankruptcy-court examiner said Lehman had been doing the same thing to make its balance sheet look better before it filed for bankruptcy in September 2008, using a strategy dubbed "Repo 105" that helped the Wall Street firm move $50 billion in assets off its balance sheet.

![[REPOBANKSPROMO]](http://si.wsj.net/public/resources/images/OB-IQ006_REPOBA_D_20100526095010.jpg) Bank of America and Citigroup were among the banks cited in a page-one Wall Street Journal article on Wednesday detailing how financial firms temporarily shed repo debt at the ends of quarters, when they report their finances to investors. Since the financial crisis began, both banks often have reduced their quarter-end repo debt from their average borrowings for the same quarter. Repos are short-term loans that allow banks to take bigger risks on securities trades; classifying the transactions as sales instead of borrowings allows a firm to take assets off its balance sheet and thus reduces its reported leverage, or assets as a multiple of equity capital.

Bank of America and Citigroup were among the banks cited in a page-one Wall Street Journal article on Wednesday detailing how financial firms temporarily shed repo debt at the ends of quarters, when they report their finances to investors. Since the financial crisis began, both banks often have reduced their quarter-end repo debt from their average borrowings for the same quarter. Repos are short-term loans that allow banks to take bigger risks on securities trades; classifying the transactions as sales instead of borrowings allows a firm to take assets off its balance sheet and thus reduces its reported leverage, or assets as a multiple of equity capital.

8:30 Update: It turns out BAC and C are not the only ones inflating their figures. Q1 GDP was, in fact, revised DOWN 0.2% to 3%, not the up 0.2% expected. As we had originally expected (before the GDP "proved" us wrong), consumer spending was the weak spot and our high-commodity trade deficit was another big drag on the economy. 3% GDP is not going to be putting anyone to work – After the last severe recession in the early 1980s, GDP grew at rates of 7 to 9 percent for five straight quarters and the unemployment rate dropped from 10.8 to 7.2 percent in 18 months. Housing and commercial real-estate are major weak spots for the economy. Builders cut spending in each by double digits in the first quarter. One bright spot – Corporate profits were revised UP, from 8.2% to 9.7%.

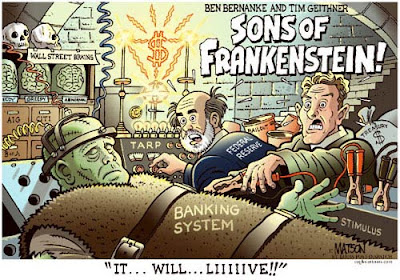

Of course we all know what this means…. MORE FREE MONEY!!! That's right, bad news is good news as slow news like this sends Benny and Timmy running right for the printing presses and I'm sure that Blanfein is on the phone to Obama now telling him he can "fix" this if Obama just gives him another $50Bn. Speaking of Blankfein – The tens of Millions of dollars the Banksters are spending to lobby Senators to ensure serious financial reform never sees the light of day are chump change considering what's at stake, Simon Johnson of the IMF says.

Not unexpectedly, China denies a report that it's reviewing its foreign exchange holdings of euro assets, calling the speculation groundless. "Europe has been, and will be one of the major markets for investing China's exchange reserves," said the State Administration of Foreign Exchange. The euro is not in danger, and a breakup of the eurozone is out of the question, former Bundesbank president Helmut Schlesinger says. The euro's (ETFs: FXE, EUO) 6-month, 20% plunge against the dollar is cause for concern, but its level "is by no means catastrophically low," he added.

Not unexpectedly, China denies a report that it's reviewing its foreign exchange holdings of euro assets, calling the speculation groundless. "Europe has been, and will be one of the major markets for investing China's exchange reserves," said the State Administration of Foreign Exchange. The euro is not in danger, and a breakup of the eurozone is out of the question, former Bundesbank president Helmut Schlesinger says. The euro's (ETFs: FXE, EUO) 6-month, 20% plunge against the dollar is cause for concern, but its level "is by no means catastrophically low," he added.

Europe is trading up around 2% just ahead of the US open and Asia was right around our 1.25% rule so technical bounces all around so far, which is pretty good considering the rotten signal sent out by that very fake US close. Maybe all of our international PSW readers are helping their fellow countrymen wise up to the shenanigans being pulled in the US markets – that would be nice!

They are lining up in Japan to get their hands on IPads, due to be released today while AAPL (among others) investigates a rash of suicides at one of their Chinese manufacturing plants. Japanese exports continue to hum along at a pace that's 40% over last year's indicating that fears of a global slowdown are probably a tad overdone. At home, oil is back at $73 (go USO!) as Obama suspends Arctic drilling until 2011.

We already have our buys in so today is more about whether we re-hedge to the downside or not. We've gotten so many great entries below Dow 10,000 now, it's going to be hard to buy more over 10,200 but let's not get ahead of ourselves – we aren't there yet!