"The rich are less susceptible to the shame and fear-mongering used by the government and the mortgage banking industry to keep underwater homeowners from acting in their financial best interest." – Brent White

"The rich are less susceptible to the shame and fear-mongering used by the government and the mortgage banking industry to keep underwater homeowners from acting in their financial best interest." – Brent White

One in seven homeowners with loan over $1M are in default. That compares to 1 in 12 loans below the $1M mark. This is putting a huge amount of stress on the financial system as 23% of all luxury homes bought as investments are now 90 days or more overdue compared to just 9% of the smaller homes. Don't think of this as a 1:1 relationship either as the cut-off of $1M means that a single $10M unpaid mortgage above the line is worth 100 $100,000 loans (the national average) that are unpaid below the line so the distortion from a cash basis is close to a level of 100:1, which just so happens to be the difference in the income level between the top 1% and the bottom 99% as well!

Back in February, I detailed 3 ways that can save you $100,000 in payments on a $200,000 mortgage that could be accomplished without a default – so don't blame PSW Members for this annoying trend – we are part of the solution! Unfortunately, the same can't be said for our fellow investors: CoreLogic data suggest that many of the well-to-do are purposely dumping their financially draining properties, just as they would any sour investment.

“The rich are different: they are more ruthless,” said Sam Khater, CoreLogic’s senior economist. The CoreLogic data suggest that the rich do not seem to have concerns about the civic good uppermost in their mind, especially when it comes to investment and second homes. Nor do they appear to be particularly worried about being sued by their lender or frozen out of future loans by Fannie Mae, possible consequences of default.

“Those with high net worth have other resources to lean on if they get in trouble,” said Mr. Khater, CoreLogic's Senior Analyst. “If they’re going delinquent faster than anyone else, that tells me they are doing so willingly.” Willingly, but not necessarily publicly. The rapper Chamillionaire is a plain-talking exception. He recently walked away from a $2 million house he bought in Houston in 2006. “I just decided to let it go, give it back to the bank,” he told the celebrity gossip TV show “TMZ.” “I just didn’t feel like it was a good investment.”

As we discussed in the weekend post, this is just another mechanism to transfer wealth from the poor to the rich as Chamillionaire's fans end up bailing out the bank who partnered with the rapper on his bad investment and neither the bank or Chamillionaire suffer from the bad investment they made together. Instead, the government picks up the tab and bills the taxpayers, who become poorer and less able to afford homes of their own, enabling Rappers and Banksters to use their bailout money to scoop up some real bargains in round 2 of the Great American Land Grab.

You can trell round 2 is starting because "No Doc" or "Liar" loans are making a comeback. Forbes has learned that banks are quietly reestablishing the no-doc and low-doc mortgage market. In fact, low-doc loans accounted for 8% of newly originated loan pools as of this February. No Doc Loans are favored by wealthy real estate speculators, who like to dispense with the paperwork to shorten the loan process. Will the banks EVER learn? Why should they – it's not their problem when the loans turn bad, is it?

China (who turn out not to be currency manipulators after all in our land of make believe) is prepared for their own housing crisis as April home prices climbed 12.8% over last year while the banks claim they could withstand a 30-40 percent decline in home prices. Lei Hua, a senior analyst with the China Index Academy (CIA), said the non-performing mortgage loan ratio is not high and a30-40 percent price drop won't increase the ratio. "Sufficient funds hold back developers from reducing prices and house price cuts won't be seen soon," Lei said, adding the decline will be less than 30 percent. Oh good – everything will be fine then…

China (who turn out not to be currency manipulators after all in our land of make believe) is prepared for their own housing crisis as April home prices climbed 12.8% over last year while the banks claim they could withstand a 30-40 percent decline in home prices. Lei Hua, a senior analyst with the China Index Academy (CIA), said the non-performing mortgage loan ratio is not high and a30-40 percent price drop won't increase the ratio. "Sufficient funds hold back developers from reducing prices and house price cuts won't be seen soon," Lei said, adding the decline will be less than 30 percent. Oh good – everything will be fine then…

Don't forget we are ALL counting on China not to collapse on us but RTP's CEO says China's 9% growth rate is not sustainable and that their economy is more likely to grow at 6%, which is impressive but not impressive enough to pull the rest of the World out of the doldrums by themselves. That is leading the IMF to call for the ECB to provide more stimulus in order to offset local budget cuts (Greece just approved a massive pension overhaul) and that has been sending the Pound and Euro lower this morning, boosting the Dollar and the Yen (as if we are in better shape).

While the IMF stopped short of calling for the ECB to launch full quantitative easing (QE), it is clearly worried that the bank's passive policies have allowed credit to wilt and led to fresh strains in interbank lending markets and sovereign debt. "Downside risks to the recovery have risen sharply. Bank funding pressures may accelerate the ongoing deleveraging process. It is too early to tell if actual bank lending growth will worsen in the euro area, after recently stabilising at barely positive year-on-year rates," it said.

Jean-Claude Trichet, the ECB's president said yesterday that the need for fresh purchases was "progressively diminishing" but pledged that the bank would continue to provide lenders with unlimited liquidity for the time being. With German industry was booming, he said there is no risk of double-dip recession. "I see perhaps a tendency from the outside to be excessively pessimistic. The numbers we have are not confirming this pessimism," he said. The IMF's implicit criticism comes amid press reports that the US Federal Reserve is drawing up plans for fresh monetary stimulus in case recovery stalls, including more bond purchases. The news story has been widely seen as "kite-flying" by doves on the Fed Board to test the response to a fresh burst of QE.

Paul Krugman and I have been pushing for more stimulus and, frankly, I expect it because we need it and the administration doesn't have a lot of arrows left in their quiver other than to bite the bullet and take responsibility for actually doing something to help the struggling middle class. It might lose them the election, but it's the right thing to do. As Paul says:

The Obama administration is in a difficult spot. It’s now obvious that the stimulus was much too small; yet there’s virtually no chance of getting additional measures out of Congress. The administration has chosen to deal with this by trying to have it both ways — condemning Republicans, rightly, for obstructionism, while at the same time claiming, falsely, that we’re still on the right track. How did things end up this way? We’ll never know whether the administration could have passed a bigger plan; we do know that it didn’t try.

Something needs to be done this month in order to put people back to work next month. We are down 9M jobs in this recession and, over 3 years, another 3.6M new jobs should have been created to keep up with population growth so 12.6M jobs behind plus 100,000 jobs a month needed as a baseline to have growth is about 400,000 jobs a month for the next 4 years – just to get back to more or less full employment. The Federal Reserve has a dual mandate which includes promoting full employment – how are they doing on that front?

Asian markets were up nicely today with the Shanghai Composite jumping 2.3% to 2,470 – just under what would have to be considered a nice recovery at 2,500. The Hang Seng gained 328 points (1.6%) to 20,378 so now firmly above our 20,000 goal and the Nikkei is still pokey at 9,585, up just 49 points (0.5%) for the day yet the BSE keeps going up and up (1% today) as India is leaving the rest of the World in the dust. Thinks are so good in South Korea that the BOK raised rates to 2.25% as they shift to inflation-fighting mode. Korea is pretty much a "Company Country" with 1 in 10 people working for Samsung so I have to think this bodes well for electronics earnings this quarter.

Of course Samsung provides their own stimulus – investing $20.6Bn and hiring 45,000 workers as part of its expansion into solar, energy efficiency, light-emitting diodes and other green markets. Samsung has already said it wants to be number one in solar by 2015. Yes, that's right, while Obama celebrates wrangling $2Bn out of Congress to expand US solar projects – Samsung makes that their MONTHLY budget. Anyone want to take bets on who will be number one in solar by 2015? Anyone???

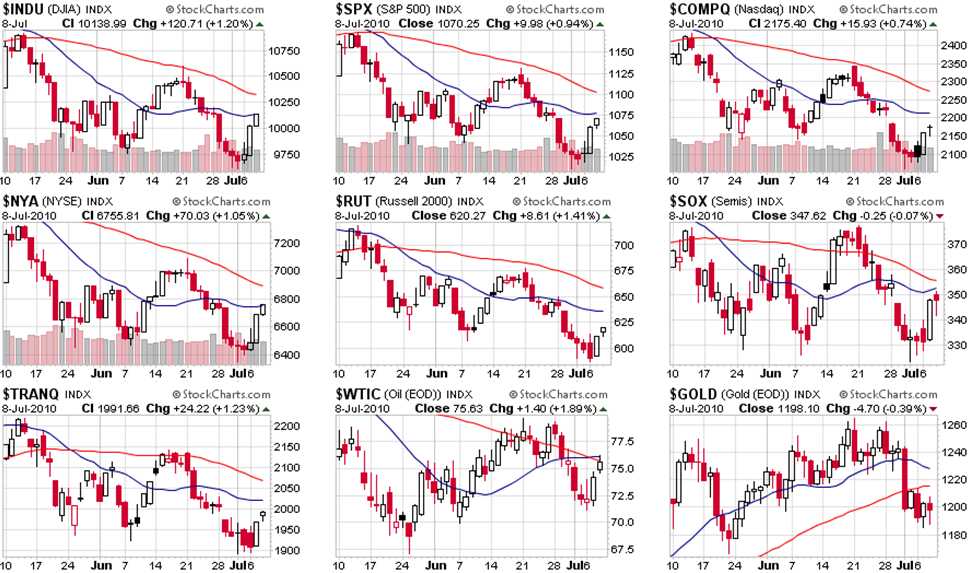

Oh well. We did get good news out of Asia as GOOG got their China license renewed so congrats to our Google bulls this morning as that's going to give us a nice (but expected) pop. What's really going to be interesting is to see what levels BIDU holds. Europe is up ANOTHER 1% this morning despite the currency worries as CDS swap rates fall for the third consecutive day as the global gloom and doom squad has to pull back and regroup after failing to cause a critical market break. Today is going to be a very big deal as we retest those broken trendlines – getting above them will put us in a nice position to set up for a short-term "Life Cross" or "Golden Cross" during earnings season as the blue 20 dmas cross back over the red 50 dmas (and notice the SOX are already there):

Have a great weekend,

– Phil