Wow, what a ride!

Wow, what a ride!

As I mentioned in yesterday’s post, we expected the Russell to lead us higher and we picked up both IWM and TNA out of the gate but, of course, we like our leverage so my 9:46 Alert to Members was:

Bottoms WERE: Dow 10,200, S&P 1,075, Nas 2,200, NYSE 6,800 and Russell 620. As I said yesterday, "don’t forget there’s a 5% drop to support below these levels).

For now, we’ll be watching the 2.5% lines at Dow 9,945, S&P 1,048, S&P 1,145, NYSE 6,630 and Russell 605.

My working theory is RUT is weakest because they are getting killed by cut-off of unemployment checks. That means that an upside play on the RUT could go very well in case they extend benefits today. I like TNA $37 calls for $3.20 and IWM $63 calls at $1.25. These are risky of course because if the extension is defeated we could go further down so take quick profits off the table on half to make a buffer and make sure you do have some disaster hedges.

We bounced right off those 2.5% lines and got our $3 copper signal at 10:24 so we knew we were good to go as we took those calls plus GOOG, BAC, GS, QQQQ, IBM, TXN, AAPL, WFR and BIIB. Other than BIIB, which is a long-term spread, all of our shopping was done by noon and the rest of the day we just said "Wheeeeeeeeeeeeeee!" as the market went up and up and up – and they haven’t even extended the unemployment benefits yet!

I have been saying we need to keep an eye on copper $3 during this whole market breakdown as $3 copper is NOT the right price for a Global Depression, which is what the market has been pricing in and at 10:24 as copper hit our bull target, I said to Members: "Copper $3! That’s like the little snapping sound when the bear takes the bait in the bear trap." Now we are back testing our "bottoms" which, as I said yesterday, are really the middles of our 5% Rule range but our view of earnings season so far is that we shouldn’t be in the lower end of the range and the recent action, as I summed it up in yesterday’s post, was silly.

Now things get serious as we need to hold our levels or it will be time to take the money and run on our short-term bullish plays (and boy, did we have our fun already – both the IWM and TNA calls went up 40% yesterday alone!) and look back at some disaster hedges – pretty much the same ones we’ve been using since the beginning of July.

Now things get serious as we need to hold our levels or it will be time to take the money and run on our short-term bullish plays (and boy, did we have our fun already – both the IWM and TNA calls went up 40% yesterday alone!) and look back at some disaster hedges – pretty much the same ones we’ve been using since the beginning of July.

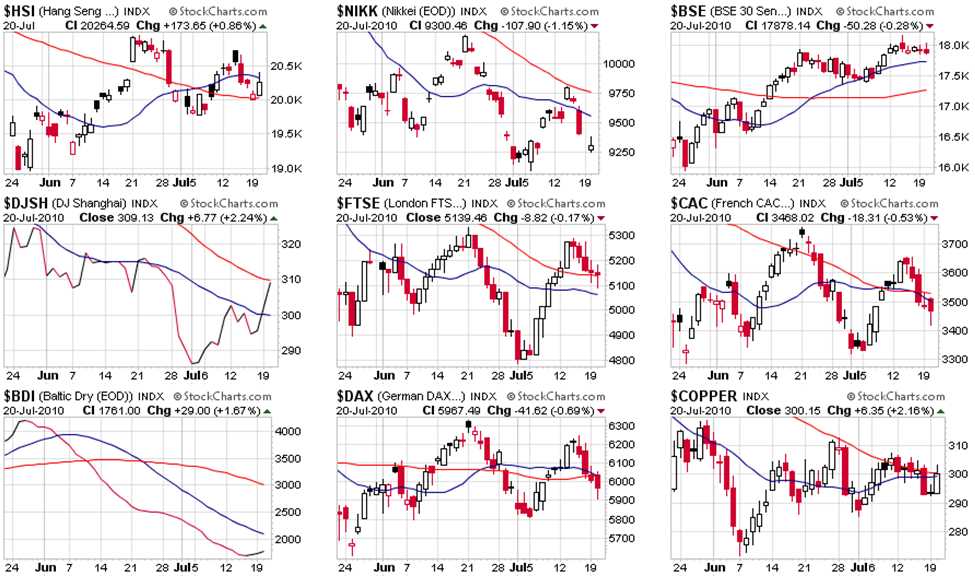

Asia was not sure how to take our finish yesterday but the Nikkei finally stopped falling at 9,278, almost 1,000 points below the Dow as the Yen barely held 87 to the dollar in overnight manipulations. The Hang Seng went up 1% (222 points) to 20,487, finishing at the day’s high and the Shanghai was more subdued with a 6.66-point gain, but they are the leader back at 2,535 already. The BSE continues to knock on the door of 18,000 – this is where we ran into trouble last time so we take everything with a grain of salt until we clear ourselves internationally.

Europe is off to the races this morning with 2% gains across the board as they are a lot less worried about the upcoming stress tests than the MSM alarmists in this country. FTSE 5,242 is just 8 points under goal, DAX is 51 over at 6,051 and the CAC is 40 over the line at 3,540 – nice recovery guys! Note today’s moves are NOT reflected in the charts below but you can see we’re looking pretty good all of a sudden – even the Baltic Dry Index found a bottom of some sort:

We are looking strong again pre-market and it’s going to be a dull day for us if we keep going up as we did all our shopping below 10,000 for the past few weeks and nothing looks very cheap to us once we’re over 10,200. As I keep having to remind people, I’m not bullish – I’m rangish so we tend to go long below 10,000 and go short above 10,500 and unless we get some really strong or really weak earnings, that’s not too likely to change. For now, we’d be thrilled to establish a base at our "bottoms" that sticks for a change and gives us confidence to do a little more stock picking.

So watching and waiting is our rule for the day. We get more earnings from the Financial sector plus the EU stress tests next week so we’ll have to wait and see how much our $3.7Tn taxpayer contribution ($27,000 per taxpayer – so far) to that sector has helped their bottom lines. Speaking of robbing from the poor to give to the rich – Brett Arends has an excellent article on income disparity, pointing out that the wealth gap in the US is, by far, the worst in the civilized world, far worst than Russia’s oligopoly and rising to a level that can only be compared to Zimbabwe, Argentina and El Salvador when comparing the lot of the average citizen to that of those in positions of power.

Bernanke gives his "Humphrey Hawkins" report to Congress at 2pm and there’s a warm-up hearing on TARP at 10:30. Mortgage Applications were up 7.6%, countering the negative housing news we’ve been hearing. MS had a huge beat as did WFC, HCBK and TXT and I hear APPL did OK too so let’s see what sticks today – there’s certainly no reason to be gloomy.