Our last Beige Book was June 9th and we liked that one. My comment to Members at that time was:

Wow, this is good stuff! Ben was not BS'ing – It's a slow, tedious recovery but a recovery nonetheless! On the whole, a pretty good report! Not enough to support $75 oil but a nice, not too inflationary recovery is in the works. It's no quick fix though, as it will take 2 good Qs before corporations will be willing to add staff so I bet not much until next spring unless the government steps in (and they'd better).

At the time, the S&P was at 1,055 and we flew up to 1,120 on June 21st before the next market flip-flop, which we have just flip-flopped back from and yesterday we tested 1,120 again and here we are, back at the Beige Book. So now, the market is about where it should have been based on the last BBook (and no government help so far). I thought yesterday was too early to pop through ahead of the data and it turns out it was. If anything, I'm a lot more worried that a deteriorating report tanks the markets this afternoon (2pm release).

We'll get a clue this morning as we see Durable Goods at 8:30 and those are expected to be up 1% from down 0.6% in May. Oil Inventories are reported at 10:30 and don't expect demand to be picking up and no one has even mentioned what a disaster this is during summer driving season (speculators are circling their tankers one more time as they pray for hurricanes to make their long bets pay off). If we do survive the BBook this afternoon, we have a 10% upgrade to Q2 GDP to look forward to tomorrow morning (to 3% from 2.7%) along with Chicago PMI at 9:45.

We know that Leading Economic Indicators turned down 0.2% since the last BBook, the Philly Fed has dropped from 21 in May to 8 in June to 5.1 in July, Construction Spending fell 0.2% with Commercial far worse than Residential, ISM fell almost 6% with a 10% drop in orders leading the downturn and a very deflationary prices paid, Factory Orders in general were off 1.4% (which does not bode well for today's Durable Goods), Auto Sales slumped 5%, Non-Farm Payrolls contined to decline, Consumer Credit continued to shrink, Industrial Production slipped and Retail Sales dipped another 0.5% – so GOOD LUCK getting a good Beige Book report this afternoon. What remains to be seen is, how the market will react to it.

Earnings continue to come in nicely but earnings are mostly reflective of April and May (when we got a nice June 9th BBook) and if things have slipped since, the impact on Q2 (being reported now) would be minimal as the quarter ended 3 weeks after the last report. Out of about 300 companies reporting so far this week, just 20 have raised guidance – adequate but not what you would call "robust". We're not getting a lot of lowered guidance either, which is why I called our S&P mid-point on Monday (1,113) "just right."

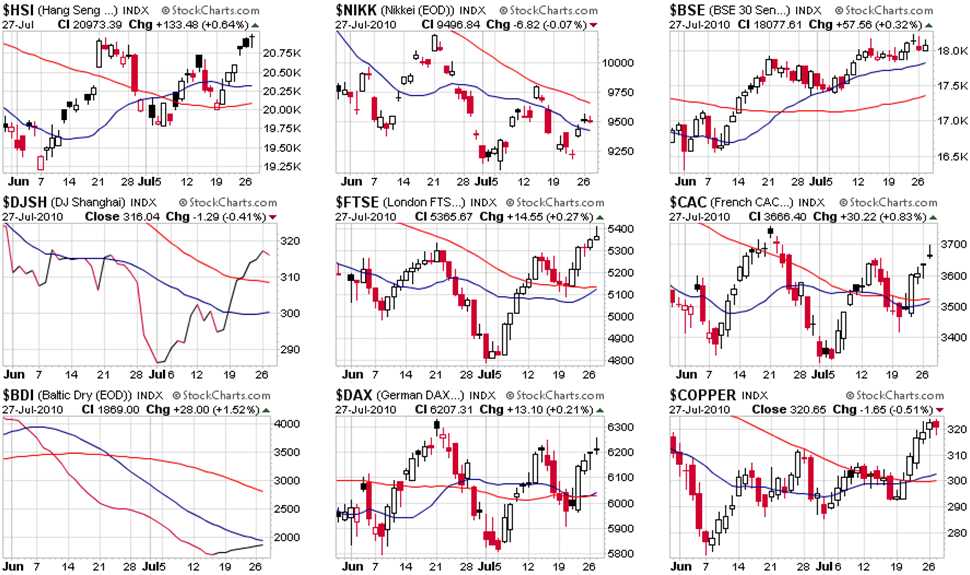

8:30 Update: Durable Good came in down 0.6% vs up 0.6% expected by people who don't read PSW (we went short on it yesterday in Member Chat) and now we'll see what kind of reaction that gives us. The futures turned down sharply and we are back to yesterday's market lows at 8:45, down from closer to yesterday's highs, which we were testing around 3am, as Asia was finishing off a nice session where the Nikkei popped 2.7% (good for yesterday's EWJ play) and the Shanghai added 2.26% and the Hang Seng added 0.6% but (and it's a Big But) the Bombay Sensex dropped 120 points and failed our super-critical 18,000 level so Danger, Will Robinson, danger, danger…

The charts do not reflect today's move but the EU is up down ahead of our open but they have been getting lower and lower since the open, indicating the mood changed as soon as Asia closed this morning. Our FOREX trade that (almost) never fails had another big day as the Yen bottomed out at 88.108 to the Dollar at the 4am Nikkei close and fell all the way to 87.50 just after 8am – a VERY profitable move in the currency trade. Copper is holding $3.20 so that's a pretty good sign and oil is hanging around our sweet spot at $77.50 with gold still stalled out at $1,159 – just above our $1,150 test goal. Nat gas continues higher at $4.71 so good for our UNG and they threw a nice sale on CHK yesterday, which is a great chance to establish a new position there.

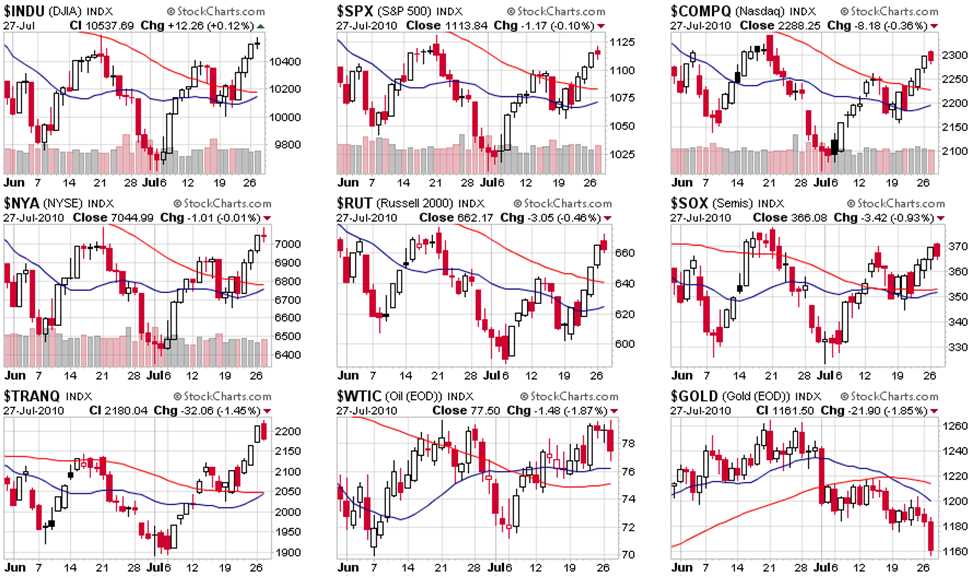

Look how pretty everything looks on the US charts. Gold going down while stocks go up is a good thing as it indicates that fear is leaving the markets but, as I said yesterday morning, we are clearly getting ahead of ourselves if we are going to start popping champagne corks over a 5-day run. Remember those "death crosses" everyone was freaking out about? Look how quickly they are turning into "golden crosses," where the 20 dma crosses over the 50 dma, which will hopefully lead to the 50 dmas crossing over the 200 dmas down the road.

Thanks to the wonders of high-frequency trading, trends that used to take months to develop now take about 2 weeks – so you have to be quick on your feet to stay on top of these crazy market moves. We have lots of lovely warning signs to go negative on. Yesterday I targeted Dow 10,700, S&P 1,155, Nas 2,300, NYSE 7,350 and Russell 666 as our next set of goals and the Nas and Russell toyed with those levels already so they are going to be our leaders or early warning system to the downside. Transports need to hold that 2,200 line and SOX should break over 380 if we are going to take the Nasdaq seriously. We DON'T want to see oil over $80 (hurts consumer) or gold over $1,200 (too much fear) in order to have a "healthy" rally.

Goldman Sachs has already figured out a way to circumvent the Volcker Rule,turning its risk-taking traders into asset managers. Goldman has moved about half of its prop stock-trading operations into its asset management division, where the traders can talk to clients and then place their market bets; the rest of Wall Street may soon follow so fear not, true believers – the boyz are back in business already!