TGIF! Its been a tough week for us here at The Oxen Report, but there is some light at the end of the tunnel. We were able to neutralize the losses that we are going to incur with our Play of the Week in National Semiconductor with a Buy Pick to Overnight Trade in Lululemon (LULU). NSM is expected to open down around 6.5% while Lululemon is expected to open 7.5% higher. I am going to exit both right out of the gates. Additionally, yesterday, we got involved with a new Medium Term Short Sale in Lennar Corp. (LEN). We got involved at 14.54, and the stock looks to open up about 1%. I am not too worried here because I like this one over an extended period to lose value.

TGIF! Its been a tough week for us here at The Oxen Report, but there is some light at the end of the tunnel. We were able to neutralize the losses that we are going to incur with our Play of the Week in National Semiconductor with a Buy Pick to Overnight Trade in Lululemon (LULU). NSM is expected to open down around 6.5% while Lululemon is expected to open 7.5% higher. I am going to exit both right out of the gates. Additionally, yesterday, we got involved with a new Medium Term Short Sale in Lennar Corp. (LEN). We got involved at 14.54, and the stock looks to open up about 1%. I am not too worried here because I like this one over an extended period to lose value.

This morning the market is looking like its poised to open a bit higher, but it is once again on basically nothing. My initial thoughts are that we are going to open a bit higher and pop a bit but dwindle throughout the day. Most of this will depend on the wholesale inventories report at 10 AM.

So what I have are two plays that we can line up for after the report. If it is good, then we can pick up a Buy. If it is bad, we will go a short route…

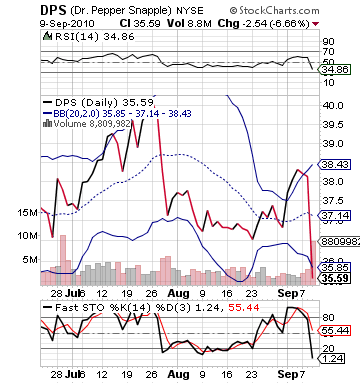

Buy Pick of the Day: Dr. Pepper Snapple Group (DPS)

Analysis: If wholesale inventories come out strong, then the market rally should at least for some time after the report continue upwards. I do not see a huge rally coming within the first thirty minutes. There is really nothing to go on for that to happen. A small gain or loss would not surprise me. One stock, though, that could be helped by a market lift would be Dr. Pepper Snapple (DPS). The company got hit in the face Wednesday and yesterday after a comment made by the  company’s CEO that he was not happy with where the consumer is at in terms of spending.

company’s CEO that he was not happy with where the consumer is at in terms of spending.

Since that comment and an FDA warning about wording on a Snapple Green Tea bottle, the stock has dropped just under 8% and has gone from being above its upper bollinger band all the way down to trading below its lower bollinger band. The stock is poised to open another 1.5% – 2% lower today. This huge drop, though, should be a bottom for the stock. The stock has not been this low since May before the company announced that they were guiding higher their FY 2010 estimates. Now, the stock is even with where it was before that announcement. The drop this morning will take it lower.

A good wholesale inventories reports helps all consumer products. Now, it will definitely be a very slight help to DPS or any other company, but a strong report will give the market something to really get the market moving on this Friday. With light volume, a good report could very well send the market much higher without a lot of supply and demand out there. If demand increases quickly, the whole market could rise. DPS is in a very prime buying spot here, and it definitely would get a nice boost out of the depths of darkness in which it currently is sitting.

A bad report, though, may do the opposite and keep DPS down further. The stock looks a strong candidate though for a possible medium term trade on a down day to pick up. We will keep that in mind.

The technicals, which have been slightly covered, tell the story further. The stock’s RSI has dropped from near 60 to below 35 in just two days. The company’s fast stochastics were butting with 100 and now are sitting in the middle of the chart, looking to go all the way to 20, and the stock has dropped well below its current moving average.

Definitely a buy if we can start a bigger rally today, however, as I will discuss more below. I will only buy DPS if the wholesale inventories are beaten and come out at 0.60% or higher. The market is already pricing in that inventories are better than one month ago wit this morning’s upwards movement. So, the inventories need to be even better to give it more push.

Entry: We will want to pick up shares of DPS per a positive wholesale inventories report.

Exit: We will be looking to gain 2-3% on top of entry.

Stop Loss: 3% on bottom.

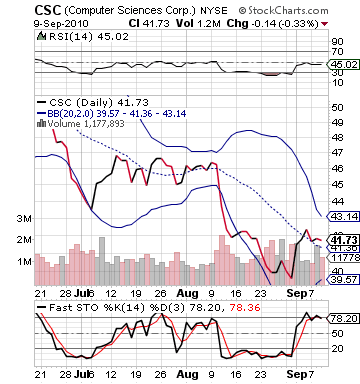

Short Sale of the Day: Computer Sciences Corp. (CSC)

Analysis: While I do hope we can rally, I am worried that a nice report is priced into the market’s gains. So, a match or even very slight beat won’t really do much, and we will sell off like we did yesterday. That is why having a short sale candidate ready to go is very important. That candidate would be Computer Sciences Corp. (CSC).

The company looks ready for a 2-3% sell off on a dipping market as it has become heavily overvalued. The stock gained 5% over the last week, and it is looking to add another 3% this morning after getting an upgrade to Buy from Jeffries. The company comments that the company has a new price target of $53. The stock is looking to open at $43.

company comments that the company has a new price target of $53. The stock is looking to open at $43.

They comment, "CSC‘s cash position and trough valuation have created one of the best LBO opportunities we have seen in several years, in our view. Using very conservative assumptions, we believe an LBO today of CSC could provide a five-year IRR of 25+% at a takeout price of $56."

This is all great financial analysis, and they do look strong moving forward. The problem is that the stock is about to open above its upper bollinger band that is in the 42.90 – 43.00 range. The stock could definitely see some slight gains on top of this, but if the market starts to sell off, CSC could be on a downward slope back down 2-3% as traders and investors would be happy with the company’s highest price in a month.

If we get a report at 0.50% or lower, I will definitely want to short sale CSC.

Entry: We will pick up shares of CSC per a negative wholesale inventories report.

Exit: We will be looking to cover after a 2-3% drop.

Stop Buy: 3% on top of entry.

Good Investing,

David Ristau