Anti-Claud is coming to town!

Anti-Claud is coming to town!

You’d better not print, you’d better not ease you’d better not contract or your wages will freeze – Jean Claude Trichet is coming to town… The EU’s Central Banker has a lunch meeting at the NY Economic Club and there is no one who knows better when Bernanke’s sleeping and when the recovery is fake, so we’d better pay attention, for the country’s sake! THIS is the most powerful banker in the World, not the hollow Bankster puppet we have setting US policy, and Trichet has fought easy money tooth and nail -even as the US embraced it this year.

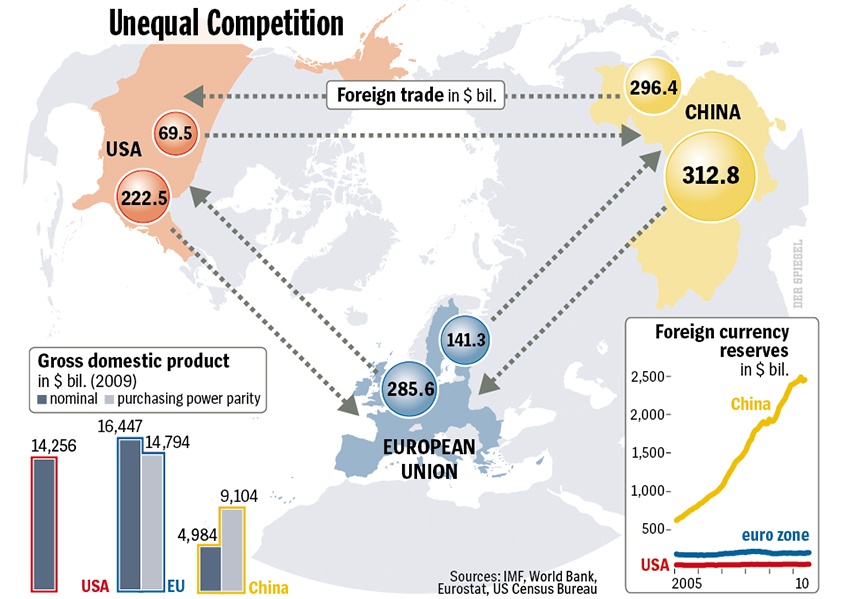

As you can see from the Chart on the right, Europe is a bigger (slightly) trading partner of China than the US and a MUCH bigger buyer of US goods than China by a factor of 3. The strong Euro lowers Europe’s trade imbalance as they have to send less Euros to both the US and our peg-partners in China for the same amount of goods they bought last year while the same goods they sold last year ship out in exchange for larger amounts of foreign notes.

With the Bank of Japan this week boosting its asset- purchase plan and the U.S. Federal Reserve mulling a similar shift, Trichet said last week that ECB policy makers are in the “same mood” as a month ago and for now remain committed to phasing out their unlimited lending program. That boosted the Euro back to $1.40 for the first time since February. The ECB and Fed compose “two different schools of thought,” said Jacques Cailloux, chief European economist at Royal Bank of Scotland Group Plc in London. “The ECB is looking at their own economy and seeing some signs of a revival. They’re very concerned about going down the line of the Fed.” Now Mr. Trichet will attempt to school us this afternoon – not coincidentally, on the same afternoon that the Fed Minutes will be released and QE2 mania is likely to peak out.

As noted yesterday by Zero Hedge, "While risk assets may hit all time highs courtesy of free liquidity, the economy, also known as the middle class, will be stuck exactly where it was before QE2… and QE1." The article does a great job of outlining my long-standing premise that money simply cannot be printed fast enough to overcome a drop in velocity and, as indicated by this chart, the drop is precipitous:

50% WORSE than the cumulative decline of the Great Depression! That would be BAD. Even worse, the idiotic policy of pumping free money into banks who don’t lend other than to corporations who don’t hire (and, in fact, have been using the money to buy each other out which leads to consolidation and more firings!) has grossly distorted the economy and the markets and, Dahling, in economics, it is NOT better to look good than to feel good…

According to the UK’s Telegraph: "A depression may have been averted, but nothing has been fixed. This is the depressingly downbeat message that came across loud and clear from last weekend’s annual meeting of the International Monetary Fund. The destructive trade and capital imbalances of the pre-crisis era are back, banking reform appears stuck in paralysing discord, public debt in many advanced economies remains firmly set on the road to ruin, and the spirit of international co-operation that saw nations come together to fight the crisis has largely disappeared."

Jeremy Warner sums it up, saying: "I don’t want to belittle the difficulties faced by some of the peripheral eurozone nations, but in the scale of things they are a sideshow alongside the malaise which has settled on the world’s largest economy. The house price collapse means people can’t sell and move to economically stronger parts of the country, as they’ve tended to in past downturns. High US unemployment – already at 9.7pc and getting on for double that on some wider measures – is becoming entrenched."

US Treasury forecasts, both for growth and the public finances, continue to be based on delusionally optimistic use of "the Zarnowitz rule", which posits that deep recessions are followed by steep recoveries. Regrettably, it’s not happening this time around. There’s no political appetite or will in the US for the long term entitlement reform and tax increases necessary to bring the deficit under control. Nobody believes US Treasury forecasts that public debt will be stabilised by 2014. Much more believable are IMF estimates which see gross US debt rising to well in excess of 110pc of GDP by 2015.

"So what’s left?" Warner asks. "The Fed can act, by pouring more money into the economy (QE2), but the Hill is paralysed. A second fiscal stimulus of any size is blocked by political division. More monetary stimulus is all very well, but it’s a blunt instrument which struggles to get through to the job creative bit of the economy – small and medium sized enterprises – and threatens new bubbles in emerging markets as abundent liquidity chases yield."

"So what’s left?" Warner asks. "The Fed can act, by pouring more money into the economy (QE2), but the Hill is paralysed. A second fiscal stimulus of any size is blocked by political division. More monetary stimulus is all very well, but it’s a blunt instrument which struggles to get through to the job creative bit of the economy – small and medium sized enterprises – and threatens new bubbles in emerging markets as abundent liquidity chases yield."

Nonetheless, the markets are in the throes of QE fever with commodities spiking up over 10% in the past month, driving Global Inflation out of control with UK CPI clocking in at 3.1%, forcing BOE Governor, Mervyn King, to write his 5th letter of the year explaining to Treasury why he can’t keep inflation under control – AGAIN! King is required to write an explanatory letter when consumer inflation misses the 2% target by a full percentage point in either direction, then once every three months that inflation remains outside the target by more than a point.

If only our own Fed were somehow held accountable to the people of this country – even symbolically…

Meanwhile we are left to read the tea leaves of todays Fed Minutes (2pm). The door was opened to QE2 at the last meeting and now traders will be looking to take the measure of the madness that is the Fed and Treasury’s policy of devaluing $30Tn held by US citizens (see yesterday’s post) by $3Tn, in order to borrow $1.5Tn more, most of which we ship overseas to fund our massive trade imbalances. This will come right on the heels of today’s $32Bn 3-year note auction, just a small fraction of what we’ll be needing to get by in October.

Meanwhile we are left to read the tea leaves of todays Fed Minutes (2pm). The door was opened to QE2 at the last meeting and now traders will be looking to take the measure of the madness that is the Fed and Treasury’s policy of devaluing $30Tn held by US citizens (see yesterday’s post) by $3Tn, in order to borrow $1.5Tn more, most of which we ship overseas to fund our massive trade imbalances. This will come right on the heels of today’s $32Bn 3-year note auction, just a small fraction of what we’ll be needing to get by in October.

Consumer Confidence is at 10 am along with the IBD Economic Optimism Survey and the Employment Trends Index so let’s watch that for some market direction this morning. We already had a reasonable ICSC Weekly Retail Sales Report (up 0.4%) and the Redbook Chain Store Sales Report declined only slightly at +2.5% vs last week’s +2.7% – a minor disappointment.

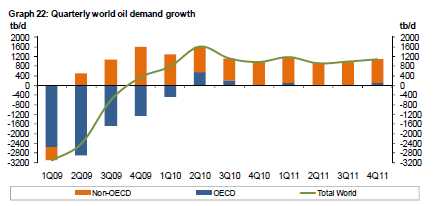

Tomorrow we have Morgage Applications (not good), Import/Export Prices (probably bad) and Crude Inventories. Despite record inventory builds in the US and Europe and prices that are up 15% since the end of summer driving season, OPEC has RAISED the demand forecast for 2011. The Global Cartel predicts 3.6% growth in global GDP in 2011 despite the fact that the US will slip from 2.6% to 2.3% and Japan will fall from 2.8% to 1.3% and Europe will slip from 1.2% down to 1% in 2011. Even China (9.5% to 8.6%) and India (8.2% to 7.7%) are forecast to decline so it’s a little hard to see where our Saudi Masters see +1Mbd of usage next year but it is good news in that this should keep them from calling for production cut-backs at their next meeting.

Like all runaway commodity assumptions, OPEC sees a never-ending flow of bailout money supporting flagging demand and rules out the possibility of a double-dip recession simply because the rulers of the West are far too wise to let anything like that happen. Notice the OECD demand goes to zero but never below – it is unthinkable to OPEC that we would cut back, even though – according to their own projections – we are a good 2 years away from even getting demand back to where it was in 2008.

Like all runaway commodity assumptions, OPEC sees a never-ending flow of bailout money supporting flagging demand and rules out the possibility of a double-dip recession simply because the rulers of the West are far too wise to let anything like that happen. Notice the OECD demand goes to zero but never below – it is unthinkable to OPEC that we would cut back, even though – according to their own projections – we are a good 2 years away from even getting demand back to where it was in 2008.

Never let it be said that lack of actual demand ever got in the way of a good commodity story. GS reversed what was looking like an ugly global pullback in metals this morning by raising their target on Gold to $1,650 12 months out. That turned Europe around from a very poor open and dropped the floor out from under the dollar, which rescued the US futures from what was looking like a very bad open with the Dow down to 10,875 at 4am on the futures. Don’t worry, everything is back to normal now and the Yen has bounced back from 82.35 to the Dollar last night all the way to 81.85 (it’s always 0.5) just ahead of the US open.

This move did not please the Nikkei, which fell 2.1% (200 points) back to 9,388 and the rest of Asia was down mildly except the Shanghai Composite, who are still catching up from their vacation. Copper was very happy as it lept from $3.72 to $3.78 and gold came of the $1,340 line back to $1,355 with oil jumping from $81 back to $82.25 so a very exciting morning already and tons of data to keep things lively through the day.

We’ll be testing our watch levels for real today and we’ll be looking to hold Dow 10,950, S&P 1,160, Nasdaq 2,400, NYSE 7,450 and Russell 690 if the markets are going to impress us. Below there are the 7.5% lines at Dow 10,965, S&P 1,146, Nas 2,365, NYSE 7,280 and Russell 672 and if those fail, it’s a quick ride back to 5%. Our morning plays yesterday were shorts on the DIA and the QQQQ weeklies and, at 12:09, I sent out a special Alert to Members outlining 4 very high-reward spreads on QID and FAZ heading into earnings so we are still expecting things to slip (we even cashed out last week’s aggressive SSO trade yesterday with a nice-enough 800% gain out of 4,000% possible (see this week’s Newsletter for details on the trade) – not bad for 3 days on a hedge we didn’t really believe in!