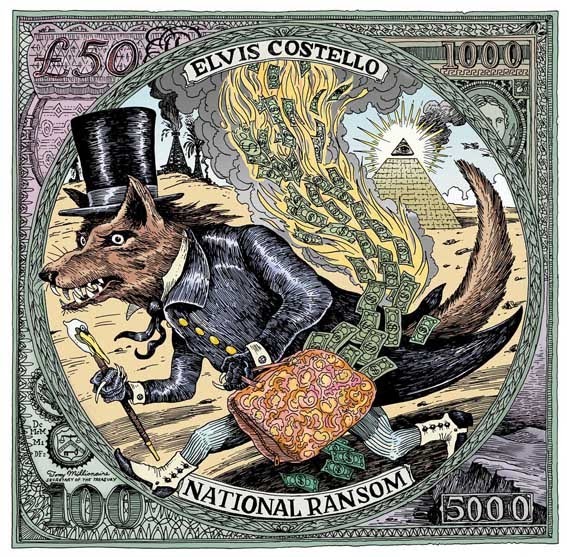

That's the title of the new Elvis Costello album and a fitting way to start the week as Elvis is an Irish bloke and it's the Emerald Isle that is kicking off the newest round of currency concerns with the Euro falling for the second day in a row as concerns mount about Ireland’s capacity to gain support for its budget and political uncertainty in Greece reduces the appeal of the region’s assets.

Europe’s currency weakened versus 11 of its 16 major counterparts before European Union Economic and Monetary Affairs Commissioner Olli Rehn arrives in Dublin today to look at Ireland’s budget plan. The euro also dropped as the extra yield that investors demand to hold Ireland’s debt rather than German bunds has more than doubled in the last three months. “The recent blow out in euro area peripheral country government bond spreads relative to bunds is starting to weigh on the euro,” said David Forrester, a currency economist at Barclays Capital in Singapore.

Meanwhile, Bloomberg notes that "Hedge Funds Raise Bullish Bets on Oil to Four-Year High." The funds and other large speculators increased wagers on rising crude prices by 8.6 percent in the seven days ended Nov. 2, according to the CFTC. Net long positions climbed to a record for the CFTC data available. The Dollar Index, which tracks the U.S. currency against those of six major trading partners, slipped 0.9 percent last week and is down 13 percent since this year’s June 7 peak. “It’s all about the dollar being debased,” said Mike Armbruster, “You’re going to see managed money take its cue from the dollar. If the dollar continues to weaken, you’ll see them continue to go long oil.” JPMorgan Chase & Co. and Bank of America Merrill Lynch last week forecast that oil may return to $100 a barrel for the first time since the 2008 financial crisis. “Whatever QE2 will or won’t do in the economy, it will cause the price of raw materials to rise,” said Jennifer Fan, virtual portfolio manager with Arrowhawk Commodity Strategies.

Oil did hit our magic $87.50 goal in overnight trading Sunday evening and is down $1 already so kudos to those who went with that trade. People like Jennifer Fan and pretty much everyone at JPM have no clue what the impact of $87.50 oil is on their limo drivers and thus they can make idiotic predictions like that AND get paid for it. There simply is not enough money in the World to support $100 oil. We have, Globally, over 10% LESS people working than we did last time oil was at $100 and this time people can't leverage their home equity lines to pay for gas. Also, $87.50 oil less 15% dollar devaluation = $74.38 and that works out to a 100% gain in oil off the '09 lows when priced in Euros or Yen so let's look for an eventual retest of $75, and that will come really fast if the dollar bounces.

You would think high oil prices would turn things around for Dubai but they get paid in dollars and home prices there are falling fast – down 6% in Q3 alone! “After a period of stable prices we are beginning to witness a shallow but lengthening slide in overall average prices,” said Ian Albert, regional director at Colliers. Prices had been hovering around the same values since the third quarter of 2009, he said in the report. “We are witnessing a slow but protracted decline in asset values,” Albert wrote. “This reflects the reality on the ground as occupancy rates fall to 80 percent and the market is unable to absorb the additional supply without a growth in the population or a slowdown in the release of stock.”

I am sorry. Every week I go into the weekend resolving to get more bullish but then I make the foolish mistake of actually reading a newspaper or talking to actual people who work in the global economy and I JUST CAN'T DO IT! Back on October 15th we charted the Beta 3 pattern that was being run by the bots and I said we are simply repeating the April run with a goal of taking us to 11,500 (as we came off a better base) in November with a failure right around Thanksgiving. Look how well this pattern is holding up in month #4.

The aberration is, of course, the Fed's QE3 announcement but, as I said to Members last week – getting to our target level early does not mean we are breaking through it, it just means the BS has been accelerating and no one piles it on quite like Uncle Ben and his nephew, Timmy. Unfortunately, we have to be patient and we do have to keep ourself open to the possibility that the market can keep going higher. Perhaps record numbers of Hedge Fund trades are not wrong this time, although they were in 2008 (when they set the old record), weren't they?

Reuters reports that it's beginning to look like Obama is heading to a G19 Meeting this weekend as the entire rest of the G20 has been unified by Geithner's betrayal (which I predicted would happen ahead of the last meeting as Timmy lied to and manipulated his fellow Ministers, Survivor-style). Officials from Germany, Brazil, China and South Africa were among those expressing concern that the Fed's money printing could weaken the dollar, drive up commodity prices and send uncontrollable waves of investor cash into emerging markets. If the G20 fails to defuse these global tensions, it may heighten investor concerns that policymakers are drifting further apart, leaving the world economy vulnerable to another bout of upheaval.

Reuters reports that it's beginning to look like Obama is heading to a G19 Meeting this weekend as the entire rest of the G20 has been unified by Geithner's betrayal (which I predicted would happen ahead of the last meeting as Timmy lied to and manipulated his fellow Ministers, Survivor-style). Officials from Germany, Brazil, China and South Africa were among those expressing concern that the Fed's money printing could weaken the dollar, drive up commodity prices and send uncontrollable waves of investor cash into emerging markets. If the G20 fails to defuse these global tensions, it may heighten investor concerns that policymakers are drifting further apart, leaving the world economy vulnerable to another bout of upheaval.

Since intervening in the currency market on Sept. 15 in its first attempt in six years to weaken the yen—in which the government sold 2.125 trillion yen ($26.19 billion at current rates) for dollars and pushed the yen briefly to 86 yen—the yen has stubbornly soared back to near-15-year highs. On Monday afternoon it was trading at 81.25 against the dollar. Now, the country's most powerful politicians are urging Japan Inc. to capitalize on yen strength by going on spending sprees abroad.

"We must work to prevent (a sustained rise in the yen), but in the meantime, there are advantages of yen rises," Yoshihiko Noda, Japan's finance minister, said Monday during a parliamentary session. "Moves such as purchasing foreign assets as well as foreign companies should be actively pursued," as gains in the Japanese currency make them cheaper, he said. The Nikkei rose 1.1% this morning but it was all pre-market pump based on the rhetoric out of the BOJ and Government. The Hang Seng gained 0.35% with a 200-point stick save that prevented a down 100 day and the Shanghai was more enthusiastic with a 1% gain on the day. The BSE dropped 0.7%.

"We must work to prevent (a sustained rise in the yen), but in the meantime, there are advantages of yen rises," Yoshihiko Noda, Japan's finance minister, said Monday during a parliamentary session. "Moves such as purchasing foreign assets as well as foreign companies should be actively pursued," as gains in the Japanese currency make them cheaper, he said. The Nikkei rose 1.1% this morning but it was all pre-market pump based on the rhetoric out of the BOJ and Government. The Hang Seng gained 0.35% with a 200-point stick save that prevented a down 100 day and the Shanghai was more enthusiastic with a 1% gain on the day. The BSE dropped 0.7%.

The EU is flat, waiting to see what we do and our open is looking flat as well as we wait for the week's data, including a new round of Fed auctions, starting with $32Bn worth of 3-year notes at about (ROFL) half a percent. So today we ask to borrow $32Bn US Dollars that we will toss down the deficit hole today in exchange for promising to pay back $32.5Bn in November of 2013. Had you taken this deal in 2007, you would be down about 25% today and able to buy roughly 1/2 as much gold now as you could then with your note (although a bigger house, of course).

It is all madness as we count down to reality but meanwhile, we can still party like it's 1999.

The Fed's Bullard will give a speech at 12:30 on "Monetary Policy and Inflation Outcomes" timed ahead of the auction so expect propping language there. Fisher speaks at 1:45 so it's bound to be a jawboning week as Treasury borrows another couple of hundred Billion for November.

Let's be careful out there!

Pic credit (lower two pictures): Thank you, William Banzai7