"We think the global (and overall European) outlook remains robust."

"We think the global (and overall European) outlook remains robust."

That’s the word from Goldman Sachs’ Erik Nielson this weekend, who also observes that he was "Possibly deluded by the wonderful vibrancy of California." Deluded indeed seems to be an excellent choice of words with a new report out showing that California leads the nation in a local government pension crisis that has a $3.5Tn hole to fill and will not be sufficient to pay benefits through 2020 along with 5 other states while another 20 states will run out of funding by 2025. Is Nielson just saying anything to herd more suckers into the market by telling the sidelined cash that it’s safe to go back in the water or is he cleverly employing an SEP Field to bamboozle the public?

An SEP (Somebody Else’s Problem) Field s an effect that causes people to ignore matters which are generally important to a group but may not seem specifically important to the individual. As Douglas Adams put it:

An SEP is something we can’t see, or don’t see, or our brain doesn’t let us see, because we think that it’s somebody else’s problem… The brain just edits it out, it’s like a blind spot. If you look at it directly you won’t see it unless you know precisely what it is. Your only hope is to catch it by surprise out of the corner of your eye. It relies on people’s natural predisposition not to see anything they don’t want to, were not expecting, or can’t explain.

SEP’s are commonly used by politicians to justify ridiculous policies like kicking crises down the road, ignoring pension and other unfunded obligations (that’s going to be your children’s problem), massive deficits (grandchildren’s problem), unemployment (lazy people’s problem), global warming (someone living south of you’s problem) and, of course unfair tax policies (poor people’s problem). They are also used by analysts, CEOs, their lobbyists and journalists (especially TV ones) to distract the "beautiful sheeple" from focusing on what’s really happening.

Not at all our problem is the price of vegetables in China and that’s a good thing for us because they have risen 20% in 30 days. Officially, China’s inflation rate was 4.4% in October but even that is expected to jump 14% to 5% in November. "Many see China’s monetary tightening as a pre-emptive tap on the brakes, a warning shot across the proverbial economic bows. We see it as a potentially more malevolent reactive day of reckoning," said Tim Ash, RBS’s emerging markets chief. The Communist Party learned from Tiananmen in 1989 how surging prices can seed dissent. "Inflation is a redistributive mechanism in favour of the few that can protect living standards, against the large majority who cannot. The political leadership cannot, will not, take risks in that regard," said Mr Ash.

Not at all our problem is the price of vegetables in China and that’s a good thing for us because they have risen 20% in 30 days. Officially, China’s inflation rate was 4.4% in October but even that is expected to jump 14% to 5% in November. "Many see China’s monetary tightening as a pre-emptive tap on the brakes, a warning shot across the proverbial economic bows. We see it as a potentially more malevolent reactive day of reckoning," said Tim Ash, RBS’s emerging markets chief. The Communist Party learned from Tiananmen in 1989 how surging prices can seed dissent. "Inflation is a redistributive mechanism in favour of the few that can protect living standards, against the large majority who cannot. The political leadership cannot, will not, take risks in that regard," said Mr Ash.

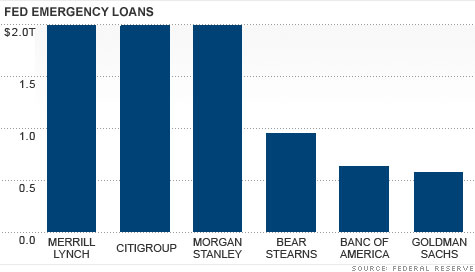

Oh no! Mr. Ash accidentally said something that is true – quick, hide the children! Inflation protects the rich by screwing the poor?!? Well, I am just shocked to hear that, aren’t you? Certainly The Bernanke doesn’t know about this or he would never put so much effort into devaluing the dollar while making $9Tn worth of near zero-interest loans to his banker buddies, would he? The Bernanke was on 60 Minutes last night and he said he is "100 percent" confident that, when necessary, the central banks can control inflation and reverse accommodative monetary policy. No, I’m not kidding – he actually said that! I know, what a friggin’ tool…

In The Bernank’s defense, I think he meant to say that inflation is AT 100% when you look at things like Oil, which has risen from $45 in April of 2009 back to $90 a barrel in 2010 despite an additional 5M people losing their jobs and an additional 2M people losing their homes. I went into the BS oil numbers in This Weekend’s Post, where we also discussed Natural Gas (up 100%), Health Care (up 20%) and the Manipulation of the Silver Market (up 150%), which is a must read for all speculators. I also discussed my outlook for the rest of the year while Stock World Weekly did a fine job of looking at The Bernank’s continued POMOs – which have been driving much of the market action in the past few weeks.

In The Bernank’s defense, I think he meant to say that inflation is AT 100% when you look at things like Oil, which has risen from $45 in April of 2009 back to $90 a barrel in 2010 despite an additional 5M people losing their jobs and an additional 2M people losing their homes. I went into the BS oil numbers in This Weekend’s Post, where we also discussed Natural Gas (up 100%), Health Care (up 20%) and the Manipulation of the Silver Market (up 150%), which is a must read for all speculators. I also discussed my outlook for the rest of the year while Stock World Weekly did a fine job of looking at The Bernank’s continued POMOs – which have been driving much of the market action in the past few weeks.

The Fed continues to have POMO Fever this week but it’s a milder case, with "just" $20Bn worth of FREE MONEY to be handed out this week, although the schedule ends on Thursday so it’s possible the next schedule begins on Friday with another $10Bn so let’s not count Ben out just yet. If you want to watch The Bernanke debase, defraud, distract, deflect and prevaricate – check out his performance here but, frankly, I’d rather wait for the cartoon bears to give us their take on this nonsense. I do love the fact, though, in part 2, that the Chairman of the Federal Reserve said he realized that unemployment was still a problem just last week, when he spoke to people in his old home town and they told him people are, in fact, still unemployed – that man REALLY needs to get out more!

Also cheer-leading the markets this weekend was Bloomberg, who did all but call the bears (market bears, not cartoon ones) losers, who missed the market rally while worrying about silly things like "falling home sales, record European budget deficits and the debasement of the U.S. dollar." That’s not just a direct quote – that’s how they LEAD off the article! As Bloomberg points out, the Bulls were looking like losers in July but they "were vindicated by the rebound that added $2.6 trillion in value." I think that is just brilliant logic – especially in light of the fact that net cash inflows to the market have been less than $100Bn in 2010 so we are getting a fantastic 26:1 leverage of market value increase for every dollar that is actually put into the market – what can possibly go wrong with that model?

Also cheer-leading the markets this weekend was Bloomberg, who did all but call the bears (market bears, not cartoon ones) losers, who missed the market rally while worrying about silly things like "falling home sales, record European budget deficits and the debasement of the U.S. dollar." That’s not just a direct quote – that’s how they LEAD off the article! As Bloomberg points out, the Bulls were looking like losers in July but they "were vindicated by the rebound that added $2.6 trillion in value." I think that is just brilliant logic – especially in light of the fact that net cash inflows to the market have been less than $100Bn in 2010 so we are getting a fantastic 26:1 leverage of market value increase for every dollar that is actually put into the market – what can possibly go wrong with that model?

This isn’t sour grapes, we were the contrarians at the bottom on June 26th, when we jumped in full blast with a 20-stock Buy List for Members and we liked the market so much on July 7th that we added "9 Fabulous Dow Plays Plus a Chip Shot" which was followed on July 26th with a still very bullish "Turning $10K to $50K by Jan 21st" virtual Portfolio (up 160% so far). By our August 26th virtual portfolio, we had gotten a bit less bullish and went with "Defending Your Virtual Portfolio with Dividends" but we decided we could do better and, on September 3rd we went with what became a wildly successful "September’s Dozen," which we kept in play until we decided to cash out at what we thought was a top a month later when we switched bearish for the first time with "October’s Overbought Eight." Because THOSE trades ended up being a mixed bag and because we still thought the market was overbought – we pretty much spent the month of November in cash, only just recently restarting the $10K to $50K Virtual Portfolio on November 27th to see if we can catch a wave and double up again to hit our $50K goal.

So we are not Bloomberg’s angry bears (or even the much more popular "angry birds") here, just sideline observers waiting for all the BS posturing to end but – if you do have your money in the market – don’t you think you should consider the very coincidental onslaught of positive spin that is being applied to the markets and, even more importantly – shouldn’t you be concerned about the LACK of real effect it’s having? The Bernank went on national television to tell you how great things are, Goldman Sachs put out a weekend memo saying "don’t worry, be happy," Bloomberg has a special article telling you what a sucker you were if you missed the rally and Cramer is foaming at the mouth telling you to BUYBUYBUY anything that isn’t nailed down. Still, we are not breaking Aprils highs yet. That has me concerned…

So we are not Bloomberg’s angry bears (or even the much more popular "angry birds") here, just sideline observers waiting for all the BS posturing to end but – if you do have your money in the market – don’t you think you should consider the very coincidental onslaught of positive spin that is being applied to the markets and, even more importantly – shouldn’t you be concerned about the LACK of real effect it’s having? The Bernank went on national television to tell you how great things are, Goldman Sachs put out a weekend memo saying "don’t worry, be happy," Bloomberg has a special article telling you what a sucker you were if you missed the rally and Cramer is foaming at the mouth telling you to BUYBUYBUY anything that isn’t nailed down. Still, we are not breaking Aprils highs yet. That has me concerned…

Nothing is "safe" until the EU resolves it’s Ireland issue and that is subject to an Irish vote tomorrow. As we discussed in Member Chat this weekend, the passage is far from certain and, even if it is passed, the government is going to be thrown out on their asses very shortly and the new government will likely run on the promise of overturning the decision and telling the EU to shove it. Already this morning, Germany’s Chancellor Merkel has said she sees on need for an increase of the size of the current financial safety net – quite the opposite of the rumors that boosted the markets (and dumped the dollar last week). Before that even happened, Moody’s downgraded Hungary by two notches with a negative outlook (to junk) on "fiscal-sustainability concerns."

Copper is testing $4 this morning and that’s got to be exciting to JPM, who bought "50-80%" of the LME’s copper supply for $1.5Bn and sent spot copper pricing back to it’s 2008 pre-crash highs. Traders noted that there was no physical shortage of copper in the markets but that fears of a squeeze have persisted ever since a raft of investment banks announced their intention to launch ETFs this autumn.

Last month metal traders wrote to the Financial Services Authority (FSA) claiming that licensing the funds, which are also likely to be launched by BlackRock, Goldman Sachs and Deutsche Bank, may amount to "approving the next financial bubble." No folks, this is not manipulation. Technically, this is a legitimate action that can be undertaken by an investment bank, that borrows billions of dollar from the Federal Reserve for free, uses it to corner the global copper market, driving the price up over 33% and then sets up an ETF so they can sell their supply off to suckers investors at top dollar while pointing to the recent run-up, THAT THEY CAUSED, in the prospectus as evidence of copper’s strong recent performance.

So you’ll have to excuse us if we sit out this "rally" just a little bit longer.