It's a race to the bottom!

While we may have thought we were flatlining yesterday near our breakout, Europe and Asia had a different view of our markets as we pulled back -0.5% to -1.73% when priced in other currencies. While you may not care what happens in other countries, there are 6.5Bn people who would disagree with you there and the US is not the World leader anymore (despite what the citizens of the US may think) – we can no longer afford to ignore things like how exchange rates affect us. Here's the chart for the Dow, S&P and Nasdaq priced in Dollars, Euros and Yen for the past two months:

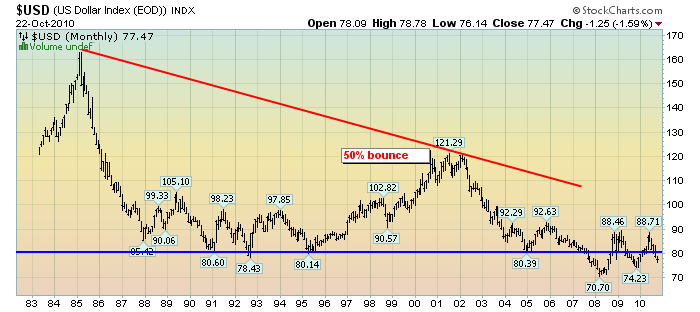

Fortunately for the bulls (especially the commodity ones), the dollar has resumed it's pathetic decline as Obama and The Bernank have combined to dilute our currency by another $2Tn over the next 48 months, from about $14Tn to $16Tn (+14%) plus, possibly, the $110Bn of new $100Bills the Treasury is trying to run off. This has sent the dollar back down from it's Thanksgiving high and now it's going to be all about whether or not we can hold that 78.5 line as our Congress finalizes their vote on the Obama Tax Cuts and another $1,000Bn of US debt taken by our citizens in order to hand another $650Bn to the top 1%.

When $100Bills are being printed faster than rolls of Charmin are being made, your currency is probably on it's way to a crisis. You reach a certain point at which it's cheaper to just wipe your butt with dollar bills than to go to the store and buy toilet paper and, of course, we've all seen pictures of Germans in the 1920's, fueling their fireplaces by burning bills, which were cheaper than wood. Of course stocks and commodities are going up when priced in dollars – they are making more dollars every day, even Disney now has cartoons trying to explain to kids why this is a bad idea.

When $100Bills are being printed faster than rolls of Charmin are being made, your currency is probably on it's way to a crisis. You reach a certain point at which it's cheaper to just wipe your butt with dollar bills than to go to the store and buy toilet paper and, of course, we've all seen pictures of Germans in the 1920's, fueling their fireplaces by burning bills, which were cheaper than wood. Of course stocks and commodities are going up when priced in dollars – they are making more dollars every day, even Disney now has cartoons trying to explain to kids why this is a bad idea.

On top of the relentless devaluation of our dollar-denominated assets, we also have wild rumors driving up demand for commodities by speculators, who are generally those same top 1% who are being handed money by our Government at a rate of $2Bn per day. If you had to put away $2Bn a day, where would you put it? Well they've made Treasuries very unattractive with historically low yields and low deposit rates and a declining dollar have made saving the money look like suicide. Bonds are getting crazy too so that leaves stocks and commodities and, since the top 1% are every bit as stupid as the bottom 99% – the best game in town is to start rumors to drive their money in and out of "the next big thing" like dot coms, oil, natural gas, housing, mortgage-backed securities and now oil (again), gold (again), copper (again) and silver.

At least sliver hasn't been used since the Hunt Brothers crashed the market back in 1979 but that was long enough ago that we have an entirely new generation of suckers who are willing to believe that JPM has been foolish enough to be short 3.3Bn ounces worth of silver ($99Bn) to the point where if everyone in America bought an ounce (300M ounces for $10Bn) it would bankrupt them. Aside from the fact that the math doesn't work in the first place (10% isn't going to blow out JPM), what are the odds you could get more than 2% of the people in this country to do something so stupid as to buy silver for about 100% above it's 5-year average based on some idiotic rumor.

Surely American's can't be that stupid again, can they? LOL, just kidding – of course they can! These are the same Americans that think oil can go back to $100/barrel without destroying the economy and plunging it back to $45, these are the same Americans that are buying NFLX for $200 (we shorted last week), PCLN for $412 (we will be shorting), CMG for $262 (we shorted already) along with $89 oil (our short entry) and $1,406 gold (our hedged long at the moment). Kid Dynamite did an excellent job of deconstructing silver and I really don't have time or space here for the rest but I would urge you to seriously consider all of your runaway investments in light of Kid's logic as there are people pushing all of these stocks and commodities at you every day – no different than silver except in scale.

Surely American's can't be that stupid again, can they? LOL, just kidding – of course they can! These are the same Americans that think oil can go back to $100/barrel without destroying the economy and plunging it back to $45, these are the same Americans that are buying NFLX for $200 (we shorted last week), PCLN for $412 (we will be shorting), CMG for $262 (we shorted already) along with $89 oil (our short entry) and $1,406 gold (our hedged long at the moment). Kid Dynamite did an excellent job of deconstructing silver and I really don't have time or space here for the rest but I would urge you to seriously consider all of your runaway investments in light of Kid's logic as there are people pushing all of these stocks and commodities at you every day – no different than silver except in scale.

Rather than listen to the blather of the MSM to tell us how great the economy is, we tend to rely on actual reports – like the very depressing December "Rail Time Indicators" report, which shows a very steep drop-off in the actual delivery of commodities (pg 2), indicating demand has NOTHING to do with prices right now. Average Weekly Carloads excluding coal and grain (pg 11) are closer to 2008 lows (+20K) than 2007,8 highs (-30K) with petroleum shipments (pg 12) similarly depressed while auto shipments (also on 12) have actually crossed below the lowest trends.

Another report we pay attention to is the PSW Holiday Shopping Survey where our Members, many of whom are or have been successful captains of industry themselves, head out to the Malls and report their ground level observations. Last year's survey led us to go short on the markets into January earnings and this year, we're already seeing a fairly sharp pullback since Black Friday's early excitement.

That has led us to stick to our guns on the above short plays as well as our repeated success on oil shorts. Just yesterday, in the morning post, I mentioned we'd be shorting oil at $89 (we did in the futures for a very nice .75 gain) as well as picking a USO put. It took only as long as 9:32 for my Morning Alert to go out to Members with a trade idea for the USO Dec $38 puts at .41. We took .60 and ran at 1:23 (up 46%) as well as a too early exit on those NFLX Jan $155 puts at $2.25 (up 40%) that I had mentioned we'd be getting back into in Friday morning's post, when they opened at $1.50.

Well, as my Dad always said: "You can lead a horse to water but you can't make him think." We choose every day to listen to one media source or another and I simply try to introduce a healthy level of skepticism that, on occasion, enables us to find nice investing opportunities – often as we play on the opposite side of "The Beautiful Sheeple." What's scary is I can tell 250,000 people that a trade's going to work in the morning and it still does – that is one MoFo of a rigged market when we can pile in the opposite side of a trade and it fails to affect the outcome!

Speaking of data – BBY missed by .07 with just .54 of Q3 EPS and that is in-line with our observations as we were simply not seeing a lot of big-ticket items going out the doors at the stores (watch out WHR!). ICSC Retail Sales were up 0.8% this week so that's trending up and November Retail Sales were also up a strong 0.8% but this one has a breakdown and, as you can see from the tables, it's pretty much all Gasoline sales, which are up 16.6% due to inflation and on-line sales, which are up 13.3%.

Meanwhile, we have a PPI report that, coincidentally, also shows a 0.8% increase, which is DOUBLE the last reading of 0.4% and, ex-autos (which are being heavily discounted to move inventory), the November PPI is up 1.2% vs 0.4% in October. We'll have to wait for tomorrow's CPI report but raise you hand if you think that the Producers will have trouble passing that 1.2% increase along to the unemployed masses (Best Buy sure did!).

You should be rooting for runaway inflation if you are a bull as we need that Dollar to die so we can keep pretending how great things are in the economy. UK inflation shot up to 3.3% in November, 65% over the BOE's 2% target rate and the EU, not wanting to be out-inflated by their island neighbor, is looking to increase their own bailout fund beyond it's current $1Tn level even while trying to tell bond investors that they will have no need of the first Trillion. As I said over the weekend, when you are peddling a fiat currency, trust is about the only thing you have going for you.

You should be rooting for runaway inflation if you are a bull as we need that Dollar to die so we can keep pretending how great things are in the economy. UK inflation shot up to 3.3% in November, 65% over the BOE's 2% target rate and the EU, not wanting to be out-inflated by their island neighbor, is looking to increase their own bailout fund beyond it's current $1Tn level even while trying to tell bond investors that they will have no need of the first Trillion. As I said over the weekend, when you are peddling a fiat currency, trust is about the only thing you have going for you.

Small businesses trust our government with a 1.5% increase in the NFIB Optimism Index since October but that's slowed considerably into the holiday's from October's 2.7-point increase and, let's not kid ourselves, we're still deeply into recessionary numbers. This is like when we get excited about home building going from 400,000 to 410,000 when the high was 2M.

As usual, you don't want to look too deeply into the data or you'll notice that Earning Trends had a -24% impact on the survey and Current Inventories also knocked 24% off the gains. So how could the index be going up? Well EXPECTATIONS are up 47% on the overall economy and up 29% on sales expectations with 24% of small business owners planning to increase inventories. That means the summary is, inventories are building out of control and the margins on things that are selling are contracting but The Bernank says things are getting better so I'm going to put on my 3D glasses and watch the cool charts on Fox news while I wait for customers to come through the door.

OK America – good luck with that plan. Meanwhile, we will wait to see if they can finally break 11,500 on the Dow and force us to get more bullish but, until then, it's a different kind of BS I'm worried about.