This is an example of an Iron Condor trade together with virtual portfolio insurance (in case the RUT moves steeply in either direction) which we put on three weeks ago.

Please note that based on your account size you can adjust the number of contracts you trade.

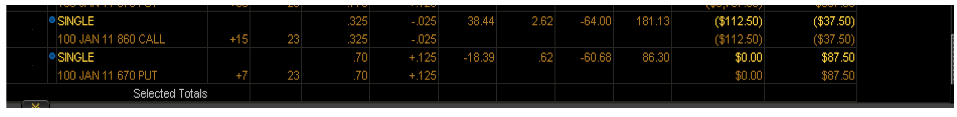

The above is the original trade and the execution prices. This is an Iron Condor position (established three weeks ago, from today 12/28/2010), with virtual portfolio insurance and all executed simultanueosly as one trade.

Sell RUT Jan 11 840 Call Quantity 55

Buy RUT Jan 11 850 Call Quantity 55

Sell RUT Jan 11 685 Put Quantity 55

Buy RUT Jan 11 675 Put Quantity 55

Gross premiums per contract is $1.20

Total Gross premiums taken in is $1.20 * 5500 = $ 6, 600

Virtual Portfolio Insurance

Buy RUT Jan 11 860 Call Quantity 15 gross cost $.40 * 1500 = $600

Buy RUT Jan 11 670 Put Quantity 7 gross cost $.70 * 700 = $ 490

Total Insurance Cost = $ 1,090

Net Gross Premiums = $6,600 – $1,090 = $5,510

Margin Maintainace Requirement $55,000

Net Return = 5,510/55,000 = 10.02% return

Position Performance as of today 12/28/2010

Virtual Portfolio insurance performance as of today 12/28/2010

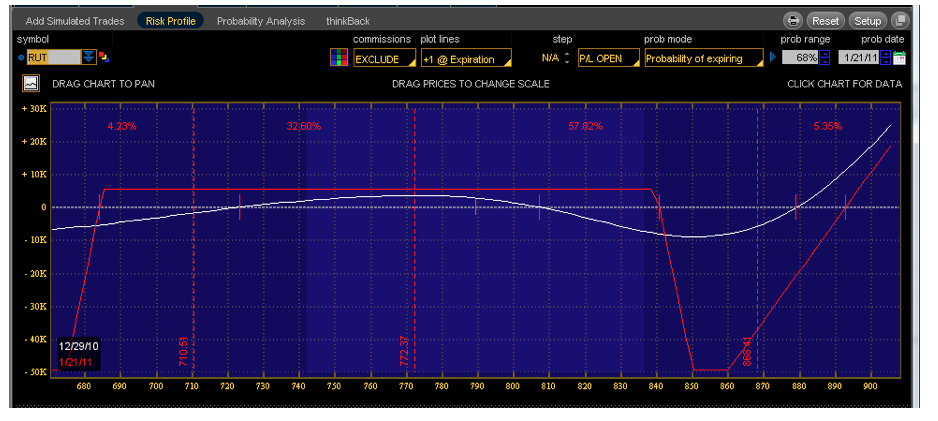

The graph above depicts our current position and the strike price range that we want the position to remain in for the duration of the trade. Our risk management parameter dictates that we try to maintain the position within the range (680 < or = Price = or < 840 ) depicted at all times till expiration. As the index price approaches either price point and based on how large the overall delta of the position gets , we will need to readjust the position to keep it within a new range that does not breach the strike prices.

The above is the overall Profit and loss for the position as of market close today 12/28/2010. It also gives all the Greeks of our positions, showing a positive Theta of 147.82 and negative Delta of -97.39.